Climate Finance Needs and Roadmaps

Despite annual climate finance having more than doubled between 2018 and 2023, at least a fourfold increase is required to reach the level of investment needed through 2030 under the 1.5°C scenario. A large and persistent climate investment gap remains particularly in emerging markets and developing economies. Accurately assessing the size of this global climate finance gap and understanding the role that different types of investors and capital can play in different markets, can enable decision-makers to mobilize finance effectively, quickly, and to where it is most needed.

CPI compiles and standardizes data on climate finance needs from a wide variety of sources to provide the most comprehensive overview of the size of the climate finance gap to date. Timely and accurate information on climate finance needs is key to creating awareness among public and private investors as well as policymakers and ensuring that climate investments are channeled toward those sectors and countries that display the largest funding gaps. We distinguish between two types of finance needs to keep global temperature rises within 1.5°C: top-down and bottom-up.

Top-down needs

Estimated investment needed to keep global temperature rises within 1.5°C, typically derived using predictive models.

Top-down climate finance needsBottom-up needs

Investment required by countries to reach their national climate targets, including both finance to be raised domestically and international support.

Bottom-up climate finance needsRoadmaps

To close the current investment gap, available capital needs to be deployed effectively such that the right type of finance can reach the right markets. While extensive literature exists on climate investment barriers and risks in underserved markets, there is a lack of research on the actors and actions required to close the identified finance gaps in different sectors and geographies. This limits the potential for coordinated action to increase the scale of climate investments quickly and ensure an effective use of public and private, domestic and international resources.

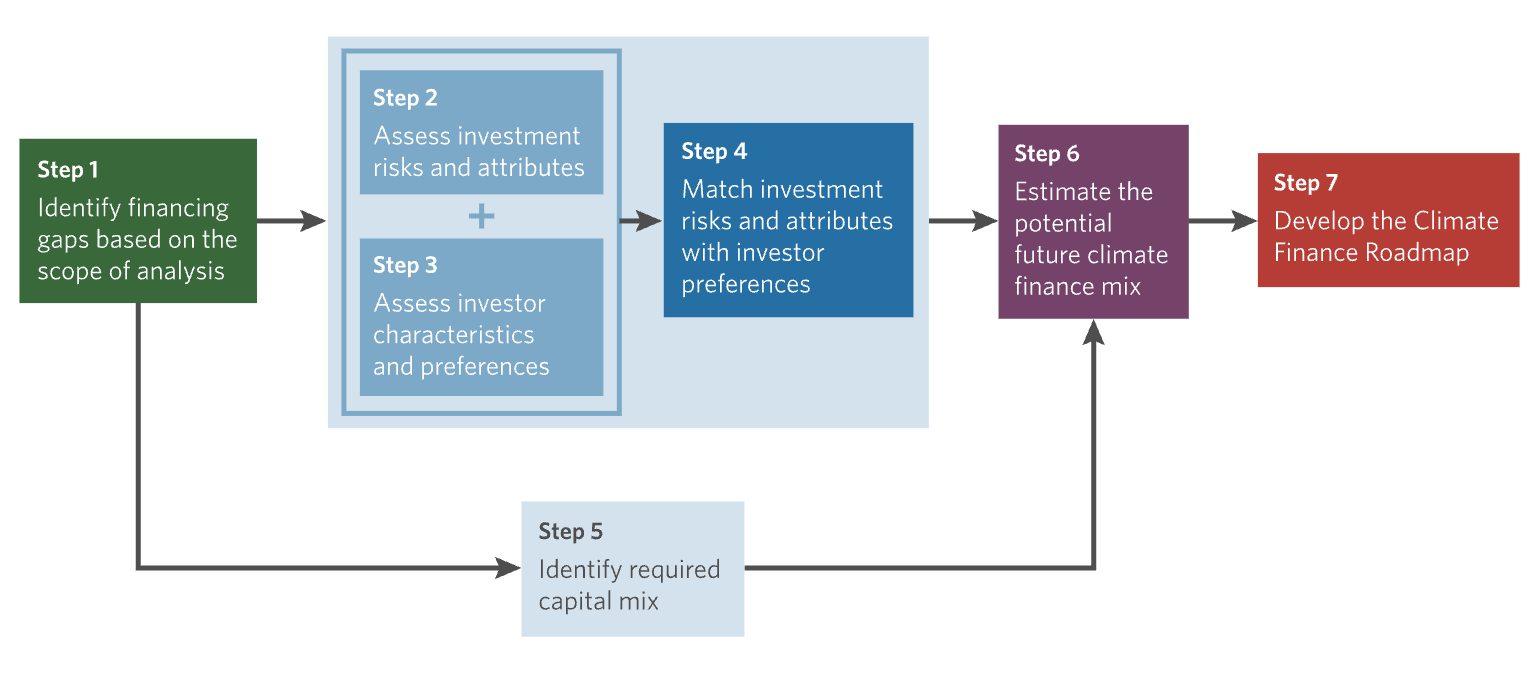

CPI’s Climate Finance Roadmaps aim to inform on which financial actors and what types of capital can best close the investment gap in different sectors and geographies. They can also help to identify and prioritize policy and regulatory interventions to overcome investment barriers and mobilize climate finance at scale.

Climate finance roadmaps

Data dashboard

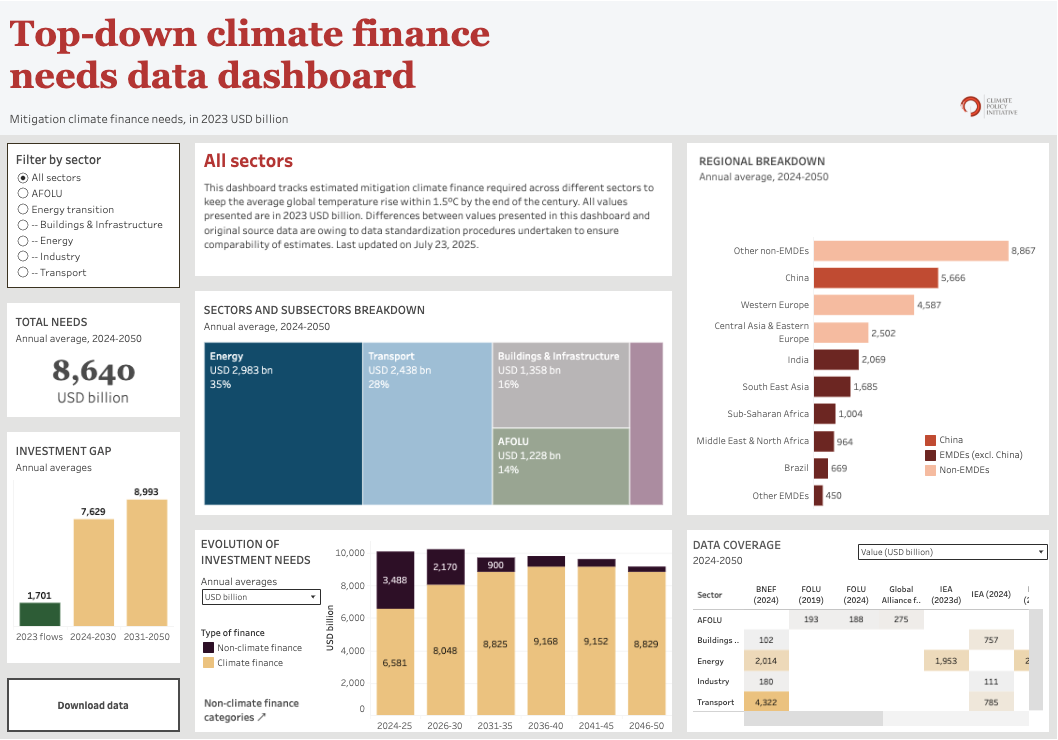

Top-down climate finance needs dashboard

Explore data covering mitigation climate finance required across different sectors to keep the average global temperature rise within 1.5°C by the end of this century.

Data Dashboard

Publications

Publication

Understanding the Quality of Climate Finance

As public resources face growing pressure, understanding not just climate finance flows but also how well they are delivered—is critical. This report offers a framework for assessing the quality of public climate finance, with clear pathways to deliver sustained, transformational change at the project, market, and system levels in EMDEs and beyond.

Publication

Scaling Up Green Guarantees: Recommendations by the Green Guarantee Group

Despite record growth in global climate investment, the finance gap remains vast, especially in emerging markets and developing economies. Guarantees are among the most effective tools to mobilize private capital for climate action but remain underused. This report by the Green Guarantee Group offers clear, practical recommendations to scale their deployment where they are needed most.

Publication

Forest Restoration in the Amazon: What is the Role of State-level Public Policies?

Researchers from CPI/PUC-RIO conducted a mapping and analysis of state legislation directly or indirectly related to forest restoration. This report identifies the main contributions, limitations, and opportunities of current state policies.

Selected Work

Publication

Global Landscape of Climate Finance 2025

The Global Landscape of Climate Finance offers the most comprehensive overview of global climate finance flows, providing crucial insights into the resources dedicated to addressing climate change.

Publication

Top-down Climate Finance Needs

CPI collects and standardizes data on climate finance needs from a wide variety of scenarios to provide a comprehensive and unique understanding of the scale of the climate finance gaps in different sectors.

Publication

Climate Finance Roadmaps

This report lays out CPI’s proposed approach to building Climate Finance Roadmaps, including methodological steps, assumptions made, data points required, and expected outputs.

Publication

Bottom-up Climate Finance Needs

CPI’s bottom-up climate finance needs analysis can help identify the largest gaps at the country level, track progress against climate targets, and better inform decision-makers and financial institutions on how to increase the speed, scale, and quality of climate finance.

Blog

The Cost of Inaction

This blog analyzes the cost of climate inaction based on findings from the Global Landscape of Climate Finance 2023.