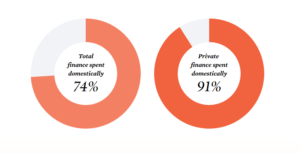

Around the world, 74% of total global climate finance and over 90% of total private climate finance is raised and spent in the same country. As low-carbon, climate-resilient assets become increasingly attractive to national actors compared to the alternatives, action on climate is largely happening within national contexts.

In fact, the domestic bias of climate finance is likely understated. CPI’s Global Landscape of Climate Finance reports have repeatedly highlighted substantial data gaps around domestic budgets in particular.

The majority of finance was raised and spent in the same country. Because domestic investment dominates, it is vital to get policies right. This requires robust national-level climate finance tracking.

Clearly, understanding how finance flows within countries is key to accelerating countries’ transitions toward low-carbon and climate-resilient economies.

CPI has worked with counterparts in Germany, Indonesia and most recently Côte d’Ivoire to track their climate finance and other organizations are also tracking climate finance at the national level. For example, Institute for Climate Economics (I4CE) used CPI’s approach as a foundation to conduct a similar exercises in France, Trinomics has done similar work in Belgium, and the United Nations Development Programme (UNDP) has worked with seven Asia-Pacific countries to understand climate-related public expenditures in their national budgets.

While these countries have made a start, more work is urgently needed as improved national tracking will critically inform countries’ efforts to implement their Nationally Determined Contributions (NDCs) submitted under the Paris Agreement. The International Energy Agency (IEA) has estimated that, to implement NDCs, energy efficiency and low-carbon technologies require$13.5 trillion in investment over the next 15 years. Ensuring that investment from a range of national and international sources is optimized will help ensure impact and value for money.

There are many benefits to improving national-level climate finance tracking systems

Identifying, tagging, and tracking budget allocations that respond to climate change challenges enhances governments’ ability to allocate appropriate resources at the national and local levels and ensure they are being spent as intended.

Increasing understanding of what different domestic and international, public and private actors are investing, in which climate-relevant activities, and what instruments they are using to deliver finance, can help identify blockages, and highlight opportunities to better coordinate spending and reallocate finance to areas where it will have more impact.

Extending the scope of tracking exercises beyond climate finance can reveal how much public money is flowing to support business-as-usual investments including in fossil fuels, and unsustainable land use. Understanding where public incentives are misaligned with climate goals can highlight opportunities to improve policies and ensure public spending is coherent.

CPI has designed related tools to inform decision makers thinking around this broader question and is applying them in the context of REDD+ related finance in Côte d’Ivoire to support the country’s work to develop a REDD+ strategy.

Ultimately, such tracking provides a basis for decision makers to ensure that limited domestic and international public resources are targeted where and how they are needed most to help countries achieve their goals. Effective tracking provides a starting point to inform discussions about what is happening, and informs the design of more cost-effective policies and financial instruments to mobilize investment.

CPI remains committed to improving understanding of climate finance flows at the national and local levels.

Since 2010, CPI has supported decision makers from the public and private sectors, at international, national and local levels, to define and track how climate finance is flowing from sources and actors, through a range of financial instruments, to recipients and end uses. Providing decision makers with robust and comprehensive information helps them to assess progress against real investment goals and needs. It also improves understanding of how public policy, finance and support interact with, and drive climate-relevant investment from diverse private actors, and where opportunities exist to achieve greater scale and impact.

This blog is part of a series on climate finance tracking challenges. Read more here.

Click here to sign up for updates on this and other aspects of our work.

If you would like our support tracking your climate finance flows, get in touch here.

This article first appeared on Public Finance International.