The report was revised on the 26th of January 2024 to reflect updated data from the IDB.

On-lending by multilateral development banks (MDBs) to national development banks (NDBs) could significantly accelerate global climate investment where it is needed most, by leveraging the institutional advantages that MDBs and NDBs each possess. New analysis identifies how MDBs and NDBs can work more effectively together to achieve climate goals.

Public financial institutions need to work together as a system, moving from project-based approaches to more coordinated country platforms with local financial institutions. However, the current state of engagement between MDBs and NDBs in emerging and developing economies (EMDEs), particularly regarding climate-related finance flows, is not comprehensively documented.

Simultaneously, MDBs and NDBs can take different approaches to aligning finance with the goals of the Paris Agreement. These approaches may depend on differences in, for example, their institutional structure, size, client base, mandate, and political context. Practically, this variability may in turn impact the quantity and quality of climate on-lending from MDBs to NDBs, particularly as MDBs begin to push for alignment among their counterparties.

CPI and E3G’s report advances the understanding of climate finance cooperation between MDBs and NDBs in EMDEs by:

- Developing a methodology to quantify and analyse climate finance flows between MDBs and NDBs.

- Assessing differences in Paris alignment approaches between MDBs and NDBs and the factors that underlie these.

Findings

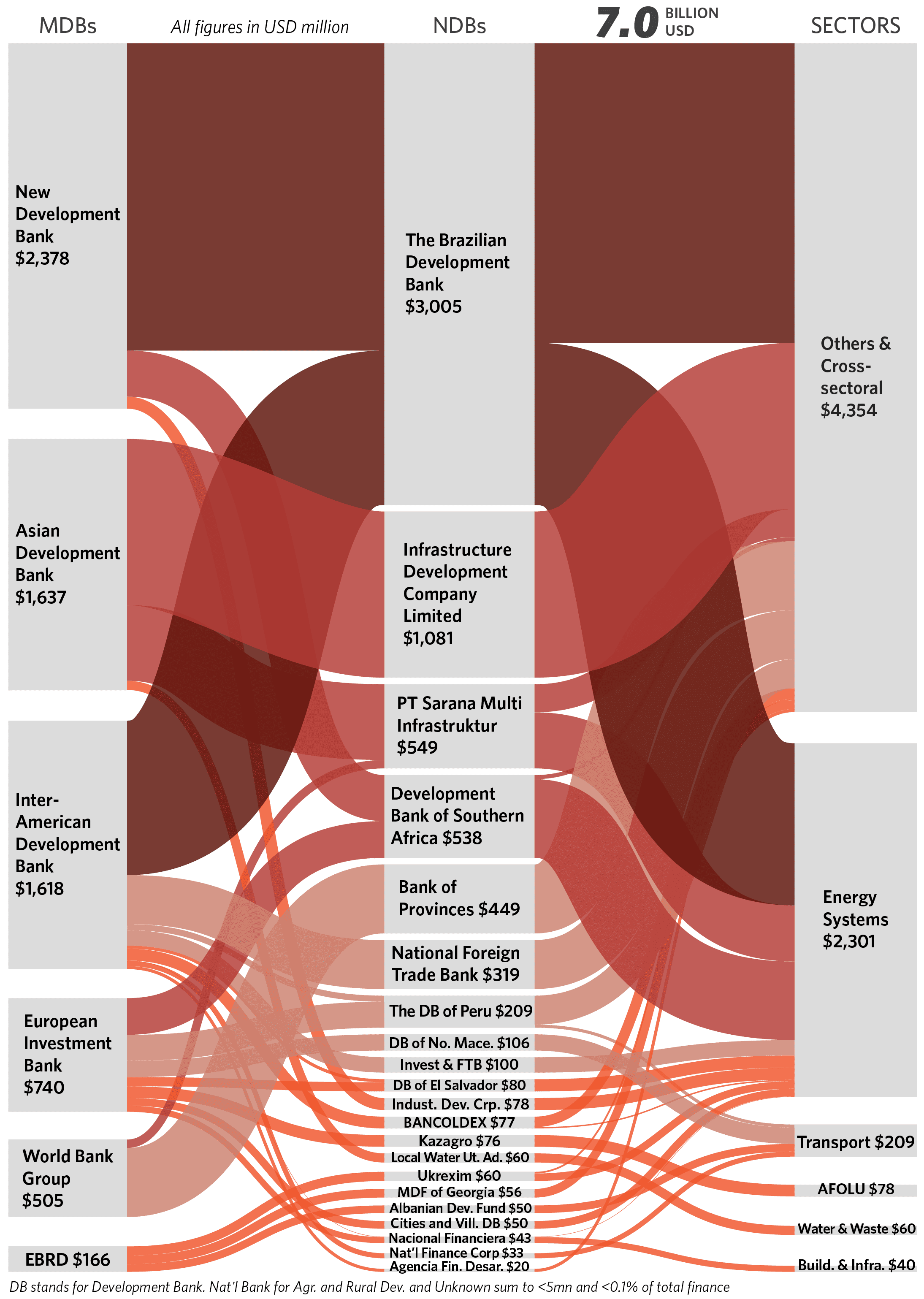

- The financial flows that can be tracked to date between MDBs and NDBs show limited climate cooperation. CPI constructed a sample of climate-related MDB-to-NDB financial flows across EMDEs between 2015 and 2022, by scraping data from project portals from MDBs’ joint reporting on climate finance. While this dataset likely underrepresents total MDB-to-NDB finance, it reveals only 52 direct transactions between MDBs and NDBs, totaling USD 7 billion.

- There are operational challenges to greater on-lending, particularly where misalignment between MDBs and NDBs creates transactional friction. Challenges include currency risks and domestic currency lending, general risk appetite, institutional capacity, and expertise. This is illustrated through the support and development of project pipelines, the role of NDBs as financial intermediators, and the procedures and approval policies that come with MDB loans. Additionally, there are macroeconomic political economy and governance risks.

- MDBs and NDBs diverge on their paths and progress towards Paris alignment. E3G assessed a sample of six MDBs and six NDBs across key dimensions based on an abbreviated version of the E3G Public Bank Climate Tracker Matrix. NDBs in the sample showed greater variability than MDBs in terms of accounting for and setting targets for climate finance, and on clarity of policies applied to financial intermediary financing. Moreover, NDBs are less likely than MDBs to have dedicated climate change strategies and adaptation goals. Rather, NDBs tend to incorporate climate into core strategic documents largely in the context of reaching NDCs. Unlike most MDBs examined, the NDBs do not have dedicated energy sector policies, although some are involved in just transition efforts.

Recommendations to strengthen MDB–NDB cooperation

Our recommendations target three key shared areas to increase both the volume of on-lending and the level of Paris alignment:

1. Political economy and governance

MDBs should optimize how they deliver climate finance through NDBs via on-lending to improve the scale, durability, and effectiveness of MDB–NDB collaboration. For example, by:

- Bringing concessional support into financial arrangements

- Supporting NDBs’ development of sectoral pipelines with clear climate criteria

- Promoting the development of local currency instruments.

2. Public finance mandates

MDBs and NDBs should clarify their mandates for climate action and leverage these as a framework for collaboration and development of institutional capacity.

3. Institutional capacity and expertise

MDBs and NDBs should share capacity for better collaboration on advancing institutional climate mainstreaming, scaling intermediated financing structures, and filling data gaps. Steps toward achieving this could include:

- Creating an MDB–NDB working group to share best practices

- Ensuring that MDB projects have a phased technical assistance approach

- Creating a public database of MDB–NDB financial engagements.