The 2021 edition of Climate Policy Initiative’s Global Landscape of Climate Finance again provides the most comprehensive overview of global climate-related primary investment. We use two-year averages (2019 and 2020) to smooth out annual fluctuations in data.

Key Findings

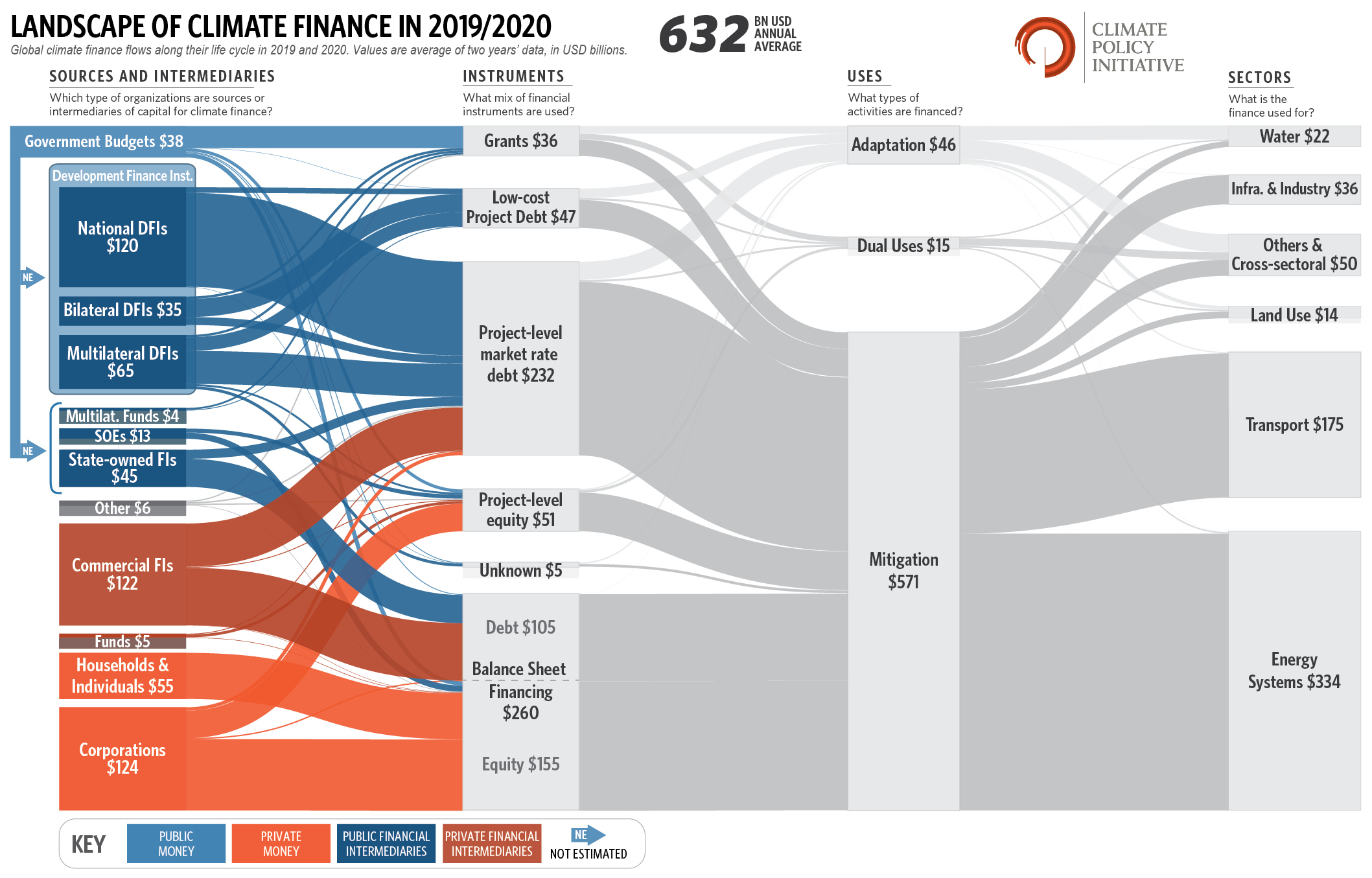

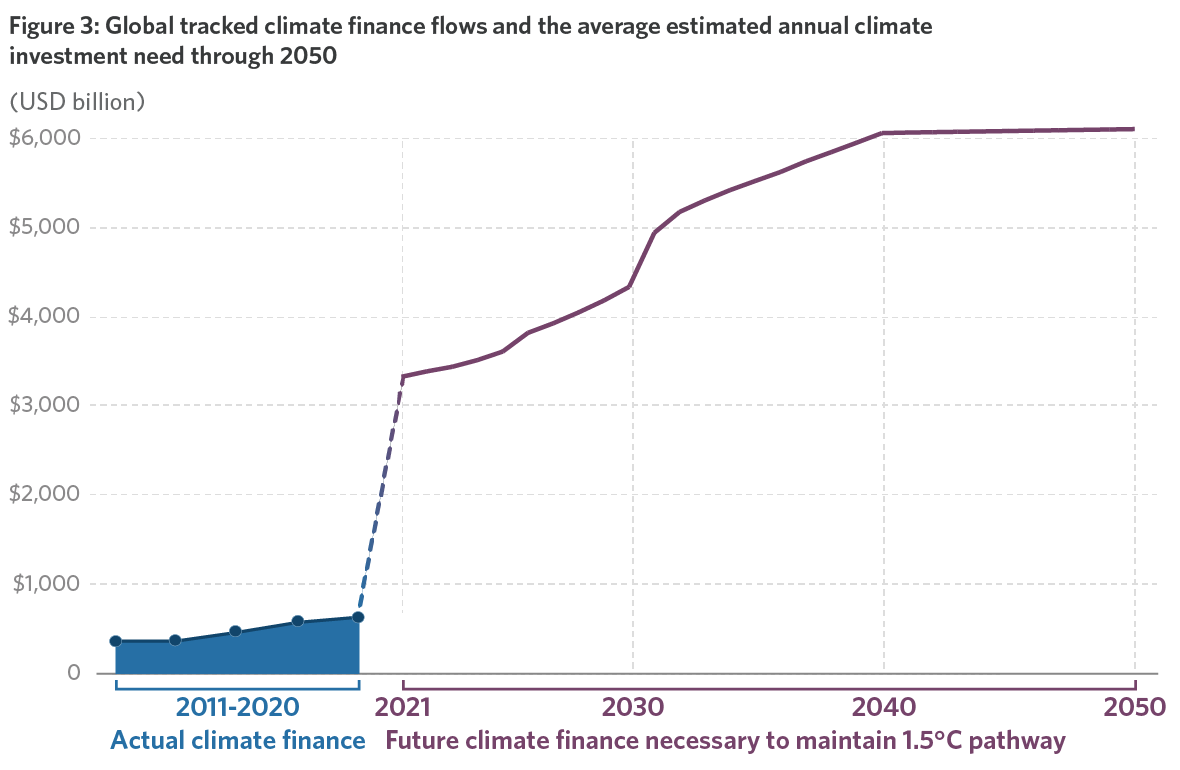

Total climate finance has steadily increased over the last decade, reaching USD 632 billion in 2019/2020, but flows have slowed in the last few years. This is a worrying trend given that COVID-19’s impact on climate finance is yet to be fully observed. The increase in annual climate finance flows between 2017/2018 and 2019/2020 was only 10% compared to previous periods, when it grew more than 24%.

An increase of at least 590% in annual climate finance is required to meet internationally agreed climate objectives by 2030 and to avoid the most dangerous impacts of climate change.

Adaptation finance continues to lag. Finance for adaptation increased by 53% reaching USD 46 billion in 2019/2020 compared to USD 30 billion in 2017/2018. Despite this positive trend, total adaptation finance remains far below the scale necessary to respond to existing and future climate change. UNEP’s Adaptation Gap Report (UNEP, 2021) estimates that annual adaptation costs in developing economies will be in the range of USD 155 to USD 330 billion by 2030. The public sector continues to provide almost all adaptation financing, with adaptation increasingly being prioritized in development finance climate portfolios, yet adaptation finance represented just 14% of total public finance. Moreover, data on adaptation finance from the private sector is still largely missing.

Sources and Intermediaries

Public climate finance increased by 7% from 2017/2018, remaining largely stable at 51% (USD 321 billion) of the total. Development Finance Institutions (DFIs) continued to deliver the majority of public finance, contributing 68% (USD 219 billion). State-owned financial institutions’ share increased to 14% in 2019/2020, partly due to improved data on the flows in East Asia & Pacific, as well as an uptake of renewable energy financing in the region. Direct finance flows (domestic and international) from governments increased by 17% in 2019/2020, accounting for 12% of public flows (USD 38 billion) driven by low-carbon transport and delivered primarily through grants.

Private climate investments increased by 13% from 2017/2018, to USD 310 billion. While corporations accounted for the largest share (40%) of private climate finance, commercial financial institutions made the biggest stride in growth, increasing their share from 18% to 39% (USD 122 billion). Household spending is the third largest share of annual private climate finance, driven largely by an annual consumer spending of USD 25 billion on electric vehicles in 2019/2020.

Instruments

The majority of climate finance — 61% (USD 384 billion) — was raised as debt, of which 12% (USD 47 billion) was low-cost or concessional debt. Equity investments, the next-largest instrument category after debt, came to 33% of total climate finance, up from 29% during the previous period. Grant finance was USD 36 billion or 6% of total flows (compared to 5% in 2017/2018).

Sectors

Solar PV and onshore wind continued to be the main recipient of renewable energy finance, attracting over 91% of all mitigation investment. Renewables were primarily financed through private capital, reflecting the sector’s growing commercial viability.

Low-carbon transport is the fastest-growing sector, with an average increase of 23% compared to 2017/2018. Investment tracked to private road transport (battery electric vehicles and chargers) accounted for 48% of low-carbon transport finance, building on multiple years of government subsidy policies and falling technology costs.

Mitigation investment in hard-to-decarbonize sectors remained low, partly attributed to limited data availability. Investments in the buildings & infrastructure sector and the industry sector totaled USD 27.7 billion and USD 6.7 billion on average in 2019/2020, respectively. Climate finance in industry is particularly hard to track as its processes are prone to confidentiality restrictions.

The largest share of adaptation investment went to ‘other & cross-sectoral’ activities, followed by water & wastewater projects. Given the cross-cutting nature of adaptation activities, the majority do not fit neatly into a single sectoral category, hence the predominance of cross-sectoral projects reported in 2019/2020 (USD 22 billion, 47%). Water and wastewater management activities followed at USD 17 billion (37%).

Geographies

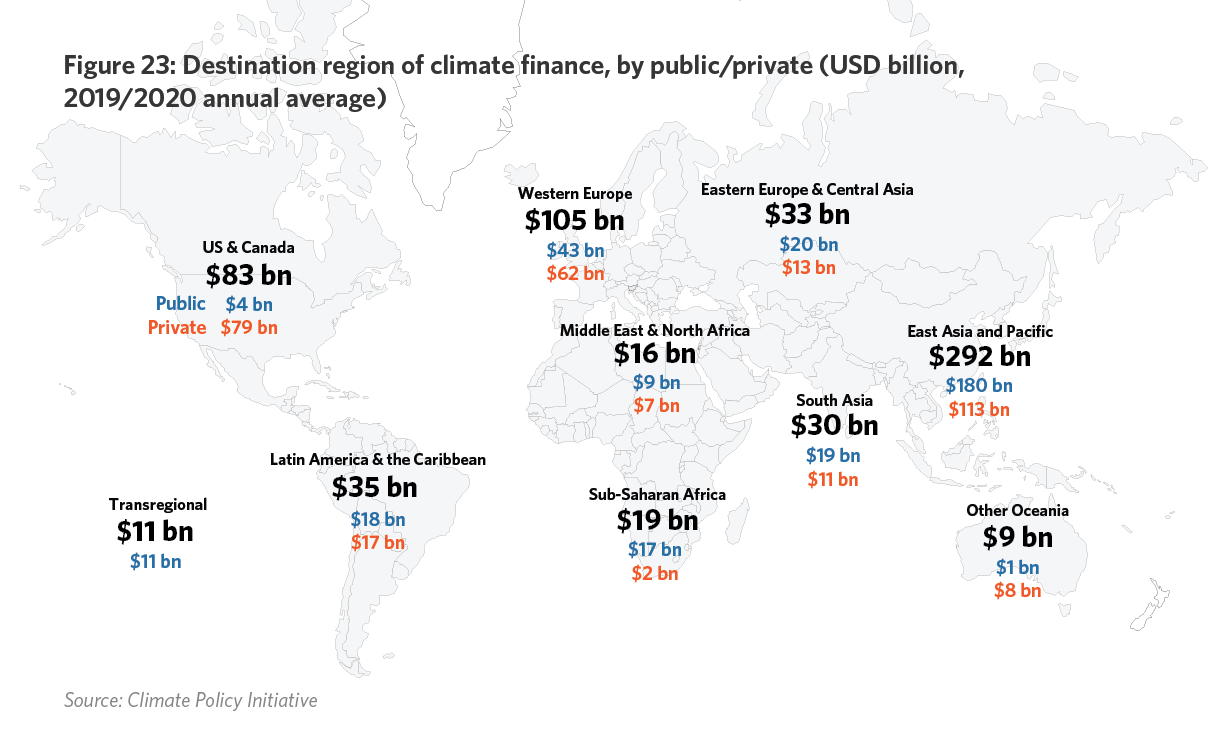

More than 75% of 2019/2020 tracked climate investments flowed domestically. Around USD 479 billion of climate investments was raised and spent within the same country, highlighting the continued importance of strengthening national policies, public finance systems, and domestic regulatory frameworks to encourage investments and address risk. International flows registered an increase of USD 13 billion from 2017/2018 to reach USD 153 billion, primarily driven by increased public investments from DFIs.

Three-quarters of global climate investments were concentrated in East Asia & Pacific, Western Europe, and North America, while the remaining regions received less than a quarter. East Asia & Pacific accounted for almost half (USD 292 billion) of 2019/2020 tracked global climate investments, up by USD 43 billion compared to 2017/18. An estimated 81% of the investments in the East Asia & Pacific region were concentrated in China.

Climate investment in the economically advanced regions of Western Europe, United States & Canada, and Oceania were primarily funded by private finance, while other regions sourced their climate investments mostly from public sources.

Recommendations

Climate finance flows are nowhere near estimated needs, conservatively estimated at USD 4.5 – 5 trillion annually. To achieve the transition to a sustainable, net zero emissions, and resilient world this decade, climate investment must increase drastically. High-emissions investments continue to flow in key sectors, curbing the impact of new finance towards climate mitigation and adaptation. Climate investment should count in the trillions, whereas fossil fuel investments, which exceed USD 850 billion annually, should dramatically decrease in this decade. Climate finance commitments also need to translate into action in the real economy, requiring all public and private actors to align their investments with Paris goals and net zero, sustainable pathways.

Filling the investment gap for adaptation is critical to achieving the goals of the Paris Agreement. Finance to adaptation, from both public and private actors, must be scaled by orders of magnitude to respond to current and oncoming climate risks. Information on investment in adaptation must also improve. The current limitations of adaptation finance tracking, especially of private sector finance, hinders tracking of progress towards a critical aspect of the Glasgow Climate Pact: increasing adaptation support for emerging and developing economies, especially those that are the most vulnerable to the impacts of climate change.

Improved and standardized definitions, methodologies, and data access are key to inform necessary climate investment decisions. Currently available disclosure initiatives fall short of providing standardized information on climate investments. In addition, information on investment levels in adaptation, data in agriculture, forestry, other land uses, and fisheries-related (AFOLU), buildings, and industrial sectors are scarce, particularly from the private sector, and lack science-based standards. More data is also required at the country level, including domestic public budget expenditures. This information is essential to measure progress against the need, avoid resource fragmentation and direct finance where it is needed to be most impactful.

We need credible and coordinated monitoring of commitments, with clear transition plans that include interim goals. Achieving net zero by 2050 will require all public and private actors to align not only investment, but also practices, business models, and portfolios with the goal of limiting global warming to 1.5°C and increasing resilience to a changing climate. To achieve real economy impact, we need better oversight to ensure that commitments are immediate, credible, and verifiable. As concluded in the Framework for Sustainable Finance Integrity (CPI, 2021a), coordination across public and private financial actors is also needed to ensure coherence and impact on resilience, net zero, and sustainability, with support from all sectors and aligned with the science.

Wider and better reporting on the interlinkages between climate finance and other sustainable development goals (SDGs) can help facilitate assessments of progress towards a just and sustainable transition. Climate finance offers synergies for attaining other SDGs simultaneously, however, currently the data is scarce. More granular reporting can help assess the landscape of synergistic climate finance, directing attention to the distribution of benefits across different beneficiaries (women, youth, rural and indigenous populations) as well as the efficacy of flows.