Credit for investments is a crucial part of agricultural financing in Brazil. This type of credit is used for purchasing machinery and equipment and for expanding the productive capacity of rural properties; it is also important for the implementation of sustainable technologies.[1] For the 2020/21 agricultural year, credit for investments totaled R$ 74 billion in Brazil, accounting for 30% of the total volume of rural credit by financial institutions.[2]

The Brazilian Development Bank (Banco Nacional de Desenvolvimento Econômico e Social – BNDES) is one of the main credit providers for investment in the agricultural sector. Over the last five agricultural years, 31% of the total volume of rural credit earmarked for investments originated from BNDES.[3]

THE KEY TAKEAWAYS OF THIS ANALYSIS INCLUDE:

• Between 1995 and 2020, BNDES disbursements to the rural sector almost quadrupled in real terms. This growth was associated with government initiatives to modernize and invigorate Brazil’s agricultural activities.

• The credit provided by BNDES is focused on crop activities, which historically make more intensive use of land than cattle production. Soy is the main agricultural product in terms of financing for the purchase of machinery and equipment.

• Purchases of harvesting equipment (32%) and tractors (28%) represent the largest portion of the credit volume.

• The largest volume of loans for machinery and equipment is concentrated in the Midwestern region, at 36% of all credit in 2018. Between 2005 and 2018, the Midwest increased its share by 10 percentage points, consistent with the expansion of the agricultural frontier in that period. Meanwhile, the Southern and Southeastern regions declined to 26% and 25% of the total credit for equipment, respectively.

• The main financial institutions that operate BNDES credit for agricultural machinery and equipment purchases are banks owned by machine manufacturers and private commercial banks (55% and 35% of the total loaned in 2018, respectively). This is in contrast with the rest of rural credit in Brazil, which is mostly operated by public banks – with Banco do Brasil being a prominent player.

This work is the result of a partnership between researchers from the Climate Policy Initiative/Pontifical Catholic University of Rio de Janeiro (CPI/PUC-Rio) and BNDES. The study presents an analysis of BNDES performance and evolution in terms of rural credit, as well as the characteristics of credit granted by the bank for the purchase of agricultural machinery and equipment. This document is part of a broader study, which includes a BNDES Report on Effectiveness Evaluation.[4] This analysis will also be supplemented by a second publication that presents the impacts of BNDES’s rural credit on economic activity, land use, and deforestation.

BNDES offers varying rates and conditions in its rural credit operations. Credit with BNDES funds can be borrowed directly or indirectly. The indirect modality – when funds are transferred to financial agents – is the predominant type of loan provided to the rural sector (99% of the credit volume in 2020). Loans can also be granted by means of different products (BNDES FINAME, BNDES Automático and BNDES FINEM) and Lines/Programs (MODERFROTA, MODERAGRO, INOVAGRO, etc.). Box 1 shows the BNDES credit structure for the agricultural sector.

BOX 1. THE BNDES SYSTEM AND RURAL CREDIT

Where Do BNDES’s Funds Come From?

BNDES has a wide variety of funding sources to finance investments across all economic sectors. Historically, the two most relevant sources have been the Workers’ Assistance Fund (Fundo de Amparo ao Trabalhador – FAT) and the National Treasury. These sources accounted for 43% and 26% of the bank’s funds (respectively) on December 31, 2020. In third and fourth places are the net equity of the development bank and repurchase agreements, accounting for 15% and 5.5% of the total funds on December 31, 2020. Other sources of financial resources for BNDES include external funding, other government funds, and financial bills.[5]

Rural Credit Operations

BNDES’s rural credit operations serve a variety of activities and offer widely different rates and conditions from one another. These operations can be classified by modality, product, and lines or programs.

Modality

The modality determines how the funds will be transferred and the financial institution responsible for the credit risk involved in the operation. There are two types of modalities: direct and indirect.

Figure 1 shows that loans in the indirect modality account for a large majority of rural credit (99% of the credit volume in 2020).

Figure 1. Volume of BNDES Credit for Agriculture by Modality, 2020

• Direct: The credit operation is carried out directly between BNDES and the borrower. Direct operations usually entail higher amounts. In general, loans are only eligible for the direct modality if they exceed R$ 40 million (or R$ 20 million under a few conditions).

• Indirect: BNDES transfers the funds to banks and other financial institutions. These financial institutions, in turn, lend the funds to borrowers and bear the risk of non-payment.

Source: CPI/PUC-Rio with data from BNDES, 2021

Product

The product sets the general rules for credit, such as the purpose of the funds, activity, size of the borrower, rates, terms, and other conditions. Most loans to the agricultural sector are provided by means of the following products: BNDES FINAME, BNDES Automático, and BNDES FINEM.

Considering the volume of BNDES credit for agriculture in 2020, BNDES FINAME and BNDES Automático are the two most relevant products, accounting for 57% and 41% of the total amount loaned, respectively (Figure 2).

Figure 2. Volume of BNDES Credit for Agriculture by Product, 2020

• BNDES FINAME: This product finances production and purchases of domestic machinery and equipment.

• BNDES Automático: This product is associated with investment projects (which may include various financeable items, such as equipment or civil construction costs).

• BNDES FINEM: This product is associated with medium and large investment projects. In accordance with these rules, the operations linked to this product are in the direct modality.

Source: CPI/PUC-Rio with data from BNDES, 2021

Lines/Programs

Loans are also linked to a line or program. In addition to the product rules, the conditions established by the line or program must also be met. In general, programs are geared towards specific demands or sectors.

The most relevant lines/programs for BNDES in terms of credit volume are: MODERFROTA, PRONAF, INOVAGRO, BNDES Rural Credit, ABC Program, Moderagro, PCA, Pronamp, and Moderinfra.

As shown in Figure 3, the three programs with the highest volumes in 2020 were MODERFROTA (44.6% of the total amount), PRONAF Investment (11.7%), and INOVAGRO (6.6%).

Figure 3. Volume of BNDES Credit for Agriculture by Line or Program, 2020

• MODERFROTA: MODERFROTA finances the acquisition of tractors, harvesting equipment, cutting platforms, and other agricultural equipment.

• PRONAF: PRONAF aims to finance and enhance the productivity of activities related to family farming, with a view to generate income for family farmers and those settled from the agrarian reform.

INOVAGRO: INOVAGRO finances technological innovations that increase productivity and improve farmers’ agricultural practices.

• BNDES Rural Credit: BNDES Rural Credit is a credit line designed to support agricultural activities – including fishing, aquaculture, and forestry production – and agro-industrial activities by providing credit for working capital and investment purposes. This program was created in 2020 to enable continuous assistance to the agricultural sector when resources run scarce in the Federal Government’s Agricultural Programs (Programas Agrícolas do Governo Federal – PAGFs).

• ABC Program: ABC Program supports investments that reduce the environmental impacts caused by agricultural activities – for example, by curbing greenhouse gas emissions or adopting sustainable practices to increase production.

• MODERAGRO: MODERAGRO focuses on improving productivity in agriculture by modernizing the agricultural sector and employing actions aimed at soil restoration.

• PCA: The Warehouse Construction and Expansion Program (Programa para Construção e Ampliação de Armazéns – PCA) supports investments to improve the storage capacity of rural producers and cooperatives.

• PRONAMP: PRONAMP aims to support the development of activities carried out by medium-sized rural producers to create jobs and increase rural income.

• MODERINFRA: MODERINFRA finances improvements in agricultural infrastructure, such as the development of sustainable irrigated agriculture and the protection of fruit crops from hail. In the 2021/22 Agricultural Plan (Plano Safra 2021/22), the Moderinfra program was renamed PROIRRIGA and its focus shifted to financing irrigated agriculture.

Source: CPI/PUC-Rio with data from BNDES, 2021

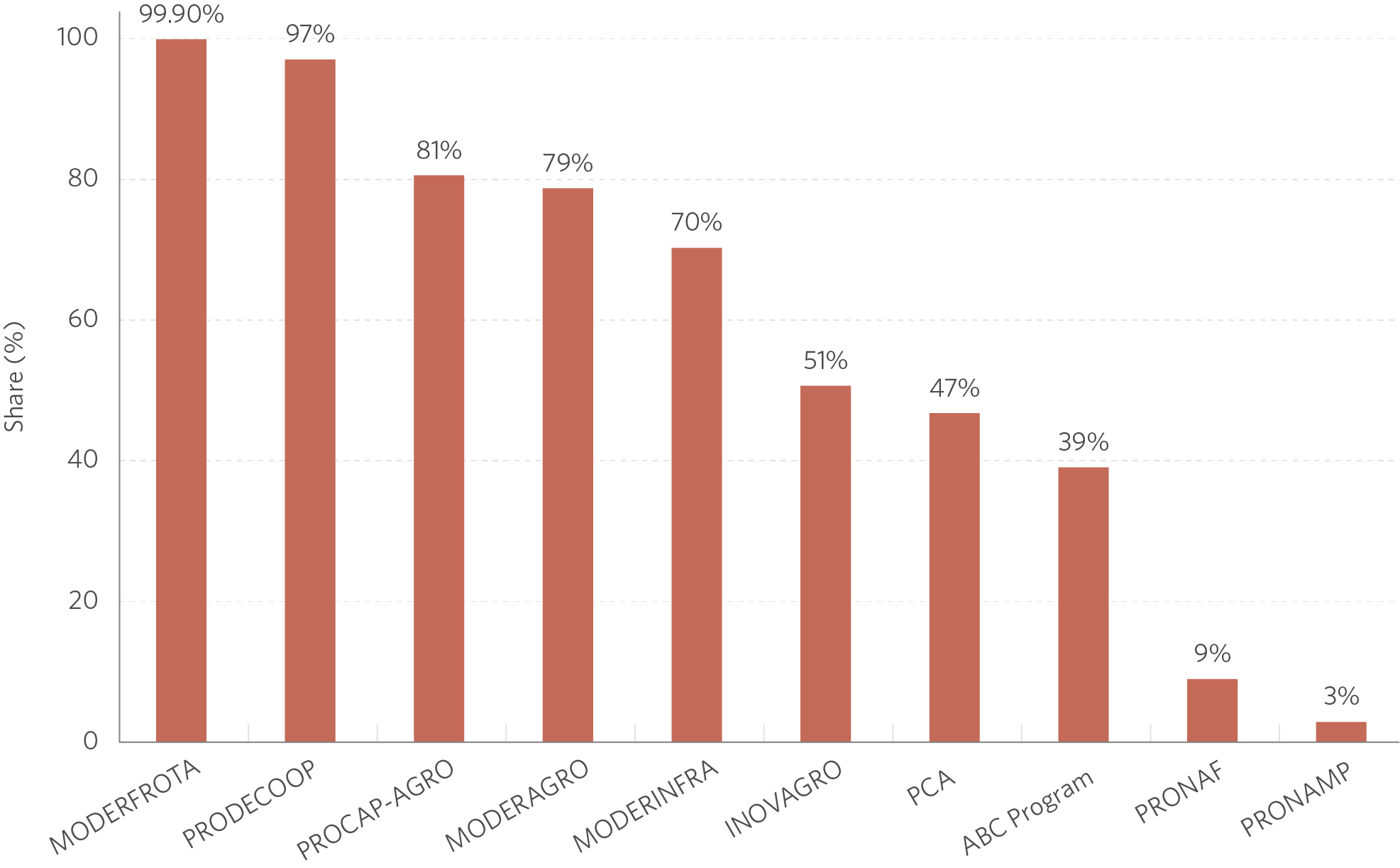

Figure 4 shows BNDES’s share as a source of funds in the amount borrowed under the different programs in 2020. BNDES was the main source of funding for six programs: MODERFROTA, PRODECOOP,[6] PROCAP-AGRO,[7] MODERAGRO, MODERINFRA, and INOVAGRO.

Figure 4. BNDES’s Share of Loan Volume by Program, 2020

Source: CPI/PUC-Rio with data from SICOR from Central Bank of Brazil, 2021

THE EVOLUTION OF BNDES CREDIT AND FINANCED ACTIVITIES

BNDES’s credit volume for agribusiness is quite significant. The bank’s disbursements for loans to the agricultural sector in 2020 were R$ 17 billion, which amounted to around 26% of the bank’s total disbursements that year.[8] Figure 5 shows the evolution of disbursements to the sector between 1995 and 2020. Even with strong annual fluctuations, there is an upward trend in the volume of funds over the period.

Figure 5. BNDES’s Disbursements of Credit for Agriculture, 1995-2020

Note: December 2020 constant prices (inflation adjusted by IPCA).

Source: CPI/PUC-Rio with data from BNDES, 2021

The expansion of BNDES’s operations in the rural sector relates to government initiatives meant to modernize and invigorate Brazil’s agriculture. A relevant milestone in this process was the creation of the MODERFROTA program in 2000 to finance the acquisition of tractors and agricultural equipment.[9] That year, the government sought to stimulate the productivity and competitiveness of the agricultural sector through a series of development measures grouped together in a program entitled “Programa Brasil Empreendedor Rural”. At the time, the low agriculture mechanization in Brazil was considered a problem that needed to be addressed. This led to the creation of MODERFROTA, with the goal of expanding and renewing the fleet of tractors and other agricultural equipment.[10] There was, in fact, substantial growth in fleet numbers, with a 50% increase in the number of tractors in rural properties between the 2006 and 2017 Agricultural Censuses.[11], [12]

In addition to MODERFROTA, BNDES currently operates several rural credit programs for purpose-specific investments, such as MODERINFRA (infrastructure improvement), MODERAGRO (soil recovery and productivity), INOVAGRO (technological innovation), and ABC Program (reduction of environmental impacts), among others (see Box 1).

Figure 6 shows BNDES’s share in rural credit for investment purposes between the 2002/03 and 2019/20 agricultural years. The bank’s share is greater in crop (an average of 52% during the period) than in cattle production (an average of 16%). Historically, crop has been more intensive than cattle production in Brazil. There are also differences between crop and cattle production in terms of investment profiles. A significant portion of cattle production investment is concentrated on breeding cattle, a modality not financed by BNDES.[13] Data from the Central Bank of Brazil (Banco Central do Brasil) show that, in 2020, 48% of all rural investment credit for cattle was used for purchasing livestock.[14]

Figure 6. BNDES’s Share in Rural Credit for Investment Purposes by Activity, 2002/03-2019/20

Source: CPI/PUC-Rio with data from RECOR and SICOR from Central Bank of Brazil, 2021

BNDES CREDIT FOR EQUIPMENT

This section focuses on BNDES credit operations specifically intended for the acquisition of agricultural machinery and equipment, as the data in these operations identify the types and quantities of financed equipment. Operations in the indirect modality and associated with the FINAME product, which are the most relevant as shown in Box 1 above, are considered here. Between 2005 and 2018, BNDES FINAME financing for the purchase of agricultural machinery and equipment – hereinafter referred to as “rural credit for equipment” – totaled approximately R$ 133 billion (in constant December 2018 prices).[15]

FINANCED EQUIPMENT

There is a wide variety of financed equipment. As shown in Figure 7, in 2018, 32% and 28% of the total volume of rural credit for equipment was allocated, respectively, for the purchase of harvesting equipment and tractors – accounting, therefore, for the largest share of the amount borrowed.

Figure 7. Volume of BNDES Rural Credit by Equipment Type, 2018

Source: CPI/PUC-Rio with data from BNDES, 2021

BNDES’s rural credit for equipment has been a significant contributor to the mechanization of Brazil’s countryside. Figure 8 shows the evolution of the number of tractors financed by BNDES and the total number of tractors sold in the country.[16] As such, it is imperative to assess the impacts of loans with resource funds from the development bank, in terms of agricultural production as well as land use and deforestation. This analysis will be the subject of the next report.

Figure 8. Evolution of the Number of Financed and Sold Tractors, 2005-2018

Source: CPI/PUC-Rio with data from BNDES and ANFAVEA, 2021

FINANCED AGRICULTURAL PRODUCTS

The trajectory of rural credit for equipment has followed agricultural trends in Brazil. Soy is the main product financed and its credit share has remarkably increased. In 2008, around 30% of the total volume of rural credit for equipment was borrowed by soy producers. By 2018, the number had risen to 61% (Figure 9).

Figure 9. BNDES Rural Credit for Equipment by Agricultural Product, 2008-2018

Note: Version 2.0 of the National Classification of Economic Activities (Classificação Nacional de Atividades Econômicas – CNAE), in effect since 2007, was used for product.

Source: CPI/PUC-Rio with data from BNDES, 2021

BNDES CREDIT ACROSS BRAZILIAN REGIONS

Rural credit for equipment was provided in 4,790 municipalities of Brazil over the period under study, which shows the comprehensiveness of BNDES’s credit coverage. The shares of the different regions of Brazil in the total amounts loaned, however, varied significantly. Figure 10 shows the evolution of the composition of rural credit for equipment by region. Between 2005 and 2011, the Southern and Southeastern regions featured the highest loan volumes. The Midwestern region overtook the Southeastern region in 2012 and, as of 2015, became the region with the highest financing volume, reaching 36% of all rural credit for equipment in 2018. Between 2005 and 2018, the Southern and Southeastern regions each lost seven percentage points in their respective shares (accounting for, respectively, 26% and 25% of the total in 2018); in the same period, the Midwestern region showed an increase of 10 percentage points. This expansion towards the Midwestern region follows the expansion pattern of the country’s agricultural frontier. Finally, although the Northeast and North show a slight upward trend in the period, their share of total credit remains low (7% and 5%, respectively, in 2018).

Figure 10. Evolution of Brazilian Regions’ Shares in BNDES Rural Credit for Equipment, 2005-2018

Source: CPI/PUC-Rio with data from BNDES, 2021

FINANCIAL AGENTS

In the indirect modality – which corresponds to 99% of BNDES’s credit volume for agriculture – funds are transferred to banks and other financial institutions, which, in turn, make loans to borrowers and bear non-payment risks. Financial agents that operate BNDES credit can be private entities (private commercial banks, credit cooperatives, and banks owned by machine manufacturers) or public entities (public commercial banks and development banks).

Figure 11 illustrates the trajectory of financial agents and their roles in credit composition. As Figure 11a shows, private agents operate the largest share of rural credit for equipment and their participation has grown since 2013. Banks owned by machine manufacturers and private commercial banks are more relevant players in this segment (55% and 35% of the total loaned in 2018, respectively), but credit cooperatives have recently increased their share. Figure 11b shows the evolution of credit distribution by agents. Between 2005 and 2018, Bradesco operated the largest volume of rural credit for equipment (21% of the total), followed by Banco do Brasil (15%) and three banks owned by machine manufacturers: DLL (15%), John Deere (13%), and CNH (11%). These five institutions together accounted for over 70% of the total rural credit for equipment in the period. The predominance of private agents in the operation of BNDES credit contrasts with the rest of rural credit in Brazil. In 2018, 56% of the total volume of rural credit was operated by public banks; Banco do Brasil alone operated 45% of all credit.[17]

There is, however, considerable fluctuation over time in the participation of financial agents operating BNDES credit. Banco do Brasil, for example, accounted for approximately 25% of credit in 2013, but by 2018 its share had dropped to near zero. In general, public banks oscillated between expanding (from 2009 to 2013) and contracting (from 2013 onwards) their share.

Several factors explain the substantial variation in the volume loaned by financial agents. The annual volume of funds operated by a given agent depends, among other factors, on the amount of funds allocated by BNDES for agricultural programs, on the agent’s demand for this type of financing, on BNDES’s risk exposure limit to the agent, and on government guidelines on the operation of public banks regarding this type of rural financing.

Figure 11. Evolution of the Share of Financial Agents Operating BNDES Credit, 2005-2018

11a. By Agent Type

Source: CPI/PUC-Rio with data from BNDES, 2021

11b. By Agent

Source: CPI/PUC-Rio with data from BNDES, 2021

CONCLUSION

BNDES plays an important role in financing investment in agricultural activities in Brazil.

The analysis of the role of the bank presented in this study complements previous work by the CPI/PUC-Rio on rural credit in Brazil by focusing on investment credit. Administrative data from BNDES enabled an in-depth analysis of loans for machinery and equipment purchases and showed that harvesting equipment and tractors are the main items financed in the rural sector. Regarding financed activities for investment, crop production has predominance over cattle.

Credit for equipment has similarities and differences with rural credit in general. As with other rural credit financing, funding concentrates around major crops (such as soy) and producers in the Midwestern, Southern, and Southeastern regions. On the other hand, the types of financial institutions operating credit for equipment are different. The predominant position of banks owned by machine manufacturers and private commercial banks as operators of BNDES funds contrasts with the dominance of public banks seen in other rural credit lines.

Given these peculiarities, it is essential to analyze the effects of BNDES credit when assessing and designing public policies related to agricultural investment. With this objective, the data analyzed here will be used in a study on the impact of BNDES rural credit on economic activity, land use and deforestation. This study will be published subsequently as a complement to this work.

[1] ABC Program is noteworthy in terms of sustainability, as it finances investments that contribute to the reduction of environmental impacts and the adoption of low-carbon technologies.

[2] Central Bank of Brazil. Sistema de Operações do Crédito Rural e do Proagro. bit.ly/3em1xNX.

[3] Central Bank of Brazil. Sistema de Operações do Crédito Rural e do Proagro. bit.ly/3em1xNX.

[4] Sant’Anna, André A., Luciano Machado and Priscila Souza. Avaliação de Efetividade dos Financiamentos do BNDES para Compra de Máquinas e Equipamentos Agrícolas. Relatório de Avaliação de Efetividade. Rio de Janeiro: BNDES, 2021.

[5] BNDES. Fontes de Recursos. 2021. bit.ly/32qsD3m.

[6] PRODECOOP promotes the modernization of production and trade systems, thereby making agricultural cooperatives in Brazil more competitive.

[7] PROCAP-AGRO supports the recovery or restructuring of assets belonging to agricultural, agro-industrial, aquaculture, and fishery cooperatives, financing the payment of shares and providing working capital.

[8] Banco Nacional de Desenvolvimento Econômico e Social. Estatísticas Operacionais do Sistema BNDES. bit.ly/3kjnkcA.

[9] Sant’Anna, André and Francisco Ferreira. Crédito Rural: da especulação à produção. Brasília: Secretaria de Assuntos Econômicos, 2006. bit.ly/3kY6IYd.

[10] Central Bank of Brazil. Ata do Conselho Monetário Nacional de 24 de fevereiro de 2000. bit.ly/3kgPgOb.

[11] IBGE. Agricultural Census. 2006. bit.ly/3Dz289v.

[12] IBGE. Agricultural Census. 2017. bit.ly/3oKt2ow.

[13] Breeding cattle are animals used for reproductive purposes to improve future generations and increase herd size.

[14] Central Bank of Brazil. Sistema de Operações do Crédito Rural e do Proagro. bit.ly/3em1xNX.

[15] Amount deflated by the Extended National Consumer Price Index (Índice Nacional de Preços ao Consumidor Amplo – IPCA).

[16] Associação Nacional dos Fabricantes de Veículos Automotores. Anuário da Indústria Automobilística Brasileira de 2020. bit.ly/3G7q9WR.

[17] Central Bank of Brazil. Sistema de Operações do Crédito Rural e do PROAGRO. bit.ly/3em1xNX.