The new leadership of the Indonesia Financial Service Authority (OJK) has officially been appointed. One of the key policies they immediately need to safeguard is sustainable finance.

In January 2021, OJK issued the Sustainable Finance Roadmap Phase II (SFR II) which outlines how the financial sector will move towards a more sustainable trajectory over the next few years (2021-2025), with Indonesia’s Green Taxonomy as a priority.

A green taxonomy is a list that classifies all business activities based on their contribution to environmental aims and thresholds. At its core, a green taxonomy is a crucial tool for financial institutions to expand their green credit portfolios and guide green finance with efficiency and integrity.

Launched in January 2022, Indonesia’s Green Taxonomy 1.0 has been designed mainly as a guidance, rather than a mandatory instrument. This, however, may expand in the future, for example, through mandatory disclosures of taxonomy-relevant investment portfolios.

Figure 1. Indonesia Green Taxonomy 1.0 extends POJK 51/2017 guideline on sustainable business activities

Latest progress of Indonesia’s Green Taxonomy 1.0

Indonesia Green Taxonomy 1.0 applies the traffic light system to represent activities from a view of sustainability:

- green is for activities with no significant harm, positive impacts on the environment, and that align with national environmental objectives

- yellow is for activities that are not significantly harmful to the environment, but are still transitioning to better alignment with national environmental objectives

- red is for environmentally harmful activities

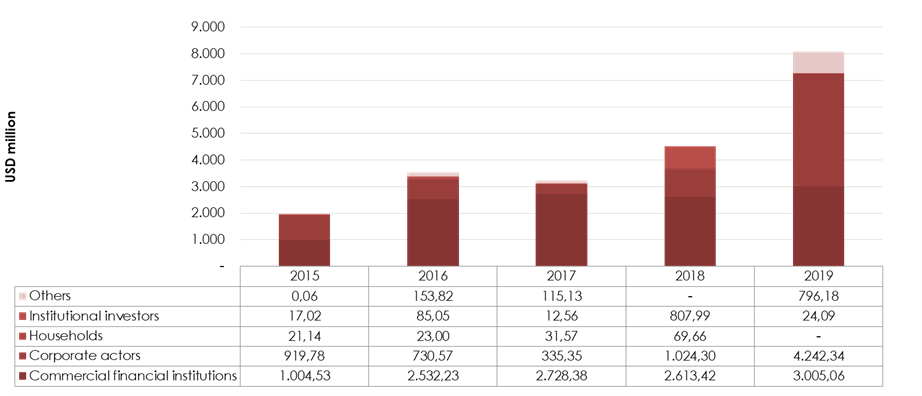

The classification system is designed to not only identify sustainable activities, but also to direct investments to fill Indonesia’s significant green financing gap. Indonesia will require investment of approximately USD 250 billion through 2030 to finance its climate goals. As of 2020, the government could only meet 34% of total investment needed to achieve its NDC targets.[1] With approximately 66% of funding gap to be filled by other sources, greater attention must be given towards improving private sector contribution at USD 21.3 billion over the period of 2015 to 2019 or merely around 9% (Figure 2).

Figure 2. Indonesia private climate finance over the period of 2015 to 2019

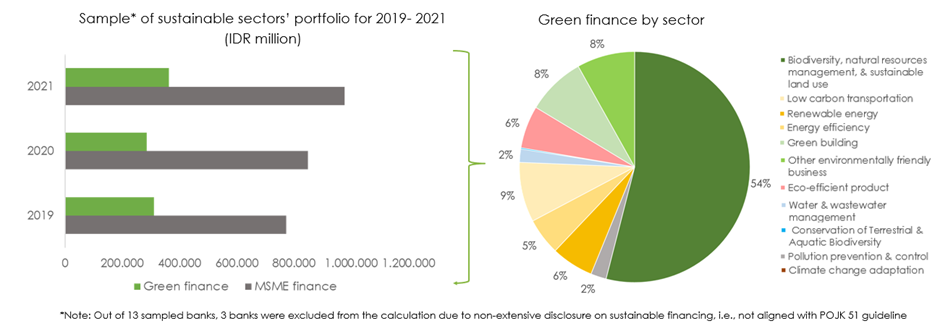

Indicators are emerging that Indonesia’s sustainable finance policy efforts are starting to align private-sector interests with impact investing, apparent from the upward trend in banks’ green portfolios over the past three years (Figure 3).

Figure 3. Green portfolio of commercial banks representing more than 60% market share in Indonesia, members of Indonesia Sustainable Finance Initiative, for the period of 2019 – 2021

While this is a positive trend, for the Green Taxonomy to have robust impact, two things are needed:

- Credibility and interoperability

- A transition plan

1. Taxonomy interoperability and credibility is key to scale up green finance

Many taxonomies are being developed across the world, both at the national and regional levels, as are the cases of the ASEAN Taxonomy and EU Taxonomy. At the same time, other countries apart from Indonesia are designing their own taxonomies, such as the UK, Canada, China, and other ASEAN Member States. Recognizing the importance of inclusivity, regional taxonomies acknowledge the implausibility of a one-size-fits-all approach and the need for certain differences between regional and national taxonomies. However, differences that are too stark will raise doubts as to (1) the credibility of each country-level taxonomy in classifying an activity as green or red, and (2) how it can be implemented in the context of the global economy. These doubts will, in turn, fail to generate trust and interest from green investors at the scale needed. The solution is to ensure that governments and communities across the globe, including Indonesia, adopt credible taxonomies that are interoperable across different actors and jurisdictions.

Interoperability means that the taxonomy can be used in consistent form across different stakeholders and jurisdictions, whilst allowing for local contextualization. For example, the EU Taxonomy is designed to improve transparency and disclosures across both government actors and broad financial market participants, improving its ability to be adopted across member states and aligned with other taxonomies. The ASEAN Taxonomy is structured into two tiers, a Foundation Framework and Plus Standards, to facilitate early adoption among ASEAN Member States while laying out a longer-term vision and facilitating an orderly transition to more rigorous standards.[2] The Foundation Framework is sector-agnostic and applicable to all economic activities regardless of economic characteristics of a country, thus interoperable across all ASEAN Member States. The Plus Standard is designed with metrics and thresholds for certain targeted sectors, allowing for interoperability among Member States with a more specific transition path.

Indonesia’s Green Taxonomy adopts the ASEAN taxonomy’s Foundation Framework: it classifies and color-codes the activities based on their contribution to climate change mitigation. However, Indonesia must also identify the extent its taxonomy is interoperable with other taxonomies, including but not limited to the ASEAN taxonomy. For example, Indonesia should develop clear metrics and thresholds for the yellow category and targeted sectors with remedial measures to transition, in order to operate under ASEAN’s Plus Standards.

Credibility requires that taxonomies are rooted in high standards, with clear universal principles that delineate activities which contribute or do not contribute to climate goals.

The EU Taxonomy applies performance criteria and a common classification system as the basis for determining which economic activities significantly contribute to regional climate goals. EU countries can now use the taxonomy as a transition guide towards a low-carbon economy, as it covers activities responsible for almost 80% of direct greenhouse gas emissions in Europe. An activity is in-scope, i.e., aligned with the green taxonomy and deemed to contribute to climate mitigation or adaptation, if it is included in a ‘Delegated Act with set of Technical Screening Criteria’. The Technical Screening Criteria (TSC) are developed in detail for specific economic activities — one of the central features of EU taxonomy. It also recognizes that international safeguards, such as social and human rights, should be a condition for economic activities to be qualified as environmentally sustainable.

The ASEAN Taxonomy, in contrast, applies a “traffic light system” of red, amber (yellow), and green. Under the ASEAN traffic light system, an activity is taxonomy-eligible if it passes a qualitative, sector-agnostic decision tree, i.e., a broad-based system that is universally applicable to all economic activities. The ASEAN Taxonomy also applies the concept of minimum safeguard, only requiring activities to comply with local environmental laws, acknowledging ASEAN’s economic diversity. Therefore, this first version of ASEAN Taxonomy serves as a comprehensive guide to complement national sustainability efforts to benefit all ASEAN members by providing a credible structure.

Under the traffic light system, the yellow category takes on an important transition role. It is designed to reflect metrics and thresholds that evolve over time, meaning that today’s yellow activities could eventually turn into red activities. Therefore, the ASEAN Taxonomy includes more detailed screening, metrics, and thresholds for activities in each category, an important function currently missing in Indonesia’s taxonomy.

2. Yellow means transition

The Indonesia Green Taxonomy 1.0 covers 919 sectors and sub-sectors. CPI conducted an analysis of all 919 sub-sectors against the Green Taxonomy and assessed:

- green: 15 subsectors currently meet the green criteria

- yellow: 422 subsectors are in transition, avoiding significant harm but not yet fully aligned with the taxonomy’s green criteria

- red: 482, or more than 50%, of the subsectors covered by the taxonomy, are completely misaligned with Indonesia’s climate goals

The yellow category seeks to “avoid significant environmental harm,” but still includes carbon-intensive activities with negative climate impacts and stranded asset risks, such as existing fossil fuel projects and clean coal. It acknowledges the political and economic reality of fossil fuel being deeply embedded in Indonesia’s system. This is an acceptable part of the transition, but it lacks clear pathways detailing a credible transition. Without a clear transition pathway, there is a risk that carbon emissions from these “yellow” activities are locked-in for the long term. The sunk costs associated with established technologies, infrastructures, accumulated experience, and long-term financial arrangements create additional consequential challenges, making it more complex to opt for low-carbon alternatives.

Without critical detailed information such as clearer thresholds, tightened metrics and timelines for the ultimate shift from yellow to just red, investors and other stakeholders have no insight into what may change in future iterations of the taxonomy. Thresholds are ideally set based on relevant ministry regulations and policies. Economic activities must be assessed against relevant local environmental laws as a minimum safeguard, for instance, by obtaining a green or gold rating for Company Performance in Environmental Management (PROPER) and having pollution control mechanisms. However, the threshold in identifying level and magnitude of emission reduction remains unidentified in the current version of the Green Taxonomy 1.0.

Next Steps

Though challenging and time-consuming, the convergence of green taxonomies to the highest standards is pivotal in improving credibility. This will in turn better attract inflow of green foreign and domestic investments by providing policy predictability across the global economy and reducing the costs of verifications/due diligence.

OJK has purposefully designed the Indonesia Green Taxonomy Version 1.0 as a dynamic “living document,” to acknowledge the ongoing transition and accommodate new supporting sectors/sub-sectors. This is expected to further evolve, align with international benchmarks, and include multifaceted public inputs, such as the categorization of more than 2,000 additional business categories, feedback on 198 additional sub-sectors proposed by several ministries and other stakeholders, and more detailed screening criteria. The latter should include a narrower interpretation of the yellow category and better definition of thresholds.

Furthermore, if the taxonomy includes more categories as green, POJK 51/2017 as a key regulation that currently stipulates disclosure requirements of investment portfolios in 11 green business activities must be updated and synchronized with the taxonomy.

Regular evaluation and timely harmonization of Indonesia Green Taxonomy with relevant regional taxonomies are also critical. It is important to note that the ASEAN Taxonomy is envisioned to provide a common language for sustainable finance among all ten ASEAN Member States, comprising the fifth largest economy in the world, reducing friction, and creating greater economic opportunity within the region.

For the Green Taxonomy to effectively drive the transition, sub-sectors under the current Yellow category must develop robust strategies, action plans, timelines, and clear targets on their transition path. To better facilitate this transition, significant financial and policy supports are required. Investors are advised to keep up with the changes to the taxonomy, such as new sectors and thresholds for activities, that may be changed over time. Once common standards are streamlined, they will enable investors, companies, governments, and regulators to align their activities, identify opportunities, and make better-informed decisions along the transition towards a low-carbon future.

[1] Fiscal Policy Agency, Ministry of Finance of Indonesia. 2022. Pemerintah Semakin Fokus Kembangkan Green Sukuk Lewat G20. Available at: https://fiskal.kemenkeu.go.id/baca/2022/07/06/4353-pemerintah-semakin-fokus-kembangkan-green-sukuk-lewat-g20

[2] ASEAN Taxonomy Board, ASEAN Taxonomy for Sustainable Finance, 2021.