Losses from natural catastrophes like floods and storms set a record in the first half of 2022, costing USD 75 billion, 22% above the 10-year average of the last decade (Swiss Re, 2022). 2022 saw Europe’s worst drought in 500 years and one of the most devastating floods in Pakistan. These floods and droughts have resulted in deaths and the destruction of critical infrastructure providing essential services for economic and human development, especially for vulnerable populations. Currently, almost 90% of global climate finance focuses only on climate mitigation, i.e. through renewable energy generation, low carbon transport, agriculture, and water management. As the impacts of climate change accelerate, investments in climate resilient infrastructure must be equally prioritized to prevent deaths, reduce the lock-in of climate vulnerability, and avoid economic losses in the decades to come.

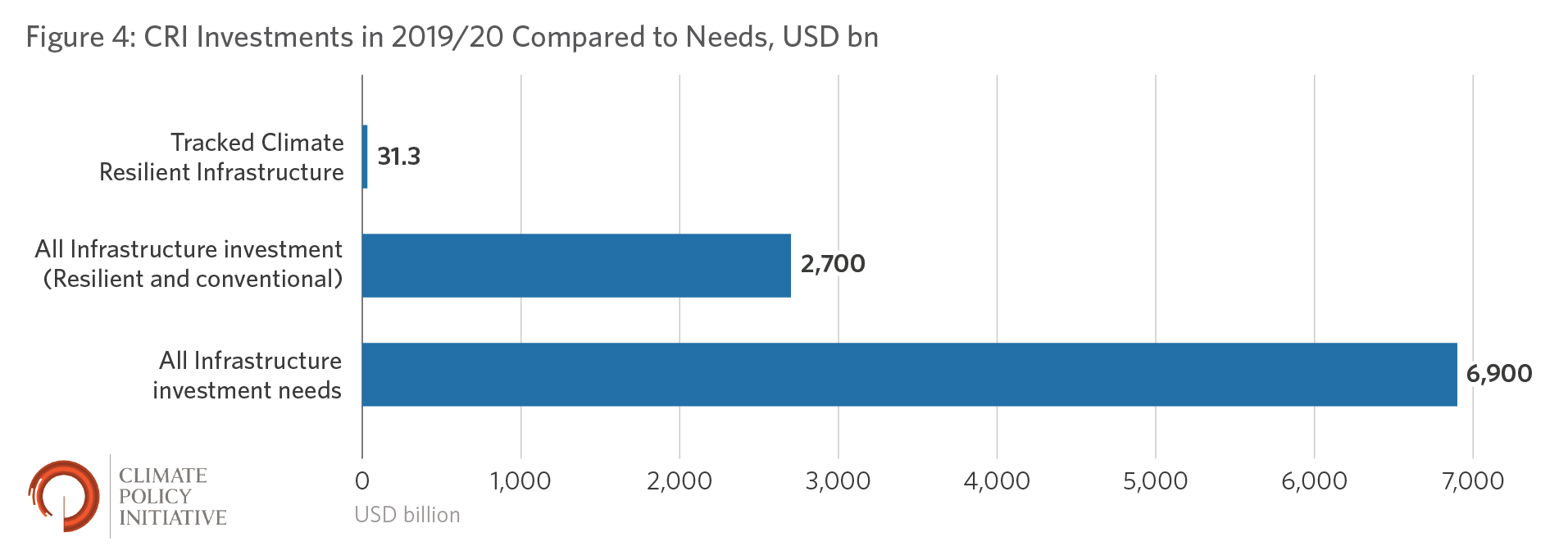

The proliferation of investments in climate resilient infrastructure, ‘CRI’ hereafter, is essential for delivering on the goals of the Paris Agreement, particularly Article 2.1b which aims to enhance adaptive capacity and strengthen climate resilience as well as Article 2.1c which states that all financial flows should be aligned with a low carbon and climate-resilient development pathway. Incremental investments in climate resilient infrastructure are no longer sufficient to meet the scale of this challenge (UNFCCC BA, 2020). The OECD estimates that USD 6.9 trillion worth of infrastructure investments would be needed annually by 2030 to meet the sustainable development goals (OECD, 2018). Innovative approaches are required to ensure that public and private investments in infrastructure are aligned with the resilience goals of the Paris Agreement (OECD, 2022).

Tracking and reporting on CRI investment is essential but challenging. Tracking CRI investments allows us to measure progress on the resilience goals of the Paris Agreement and understand investment gaps, barriers, and opportunities to further scale and channel finance into geographies and sectors that need it most. Assessing the landscape of CRI investment also helps build consensus on who can and should do what, and where and how it can be done most efficiently, thereby accelerating positive interventions in CRI.

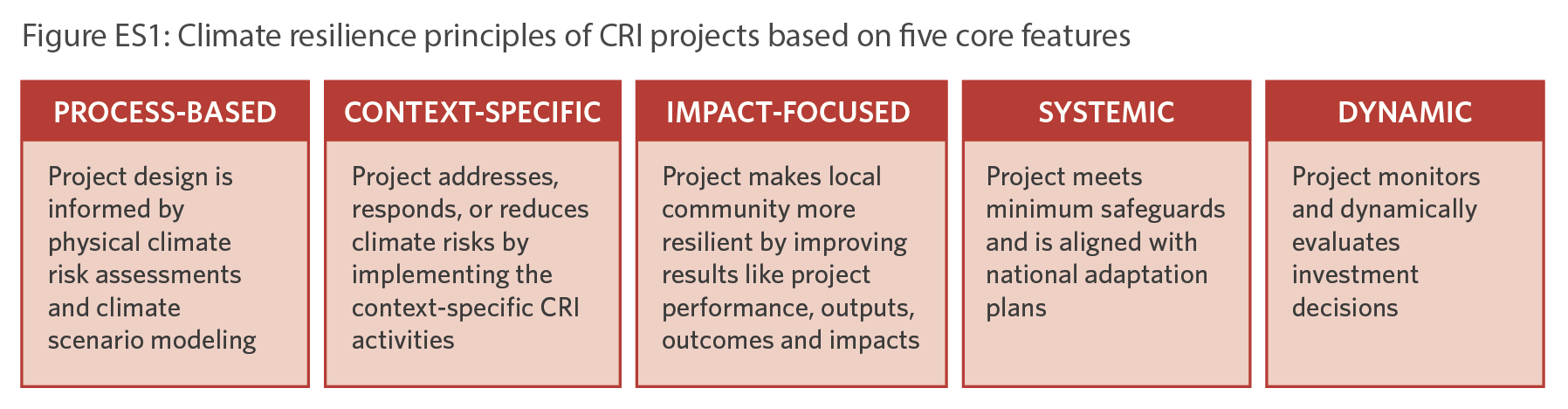

This study is a first-of-its-kind attempt to evaluate options for tracking CRI investments. The proposed methodology creates a more granular view of data gaps and methodological challenges in tracking CRI investments and ways to address them. We define “climate resilient infrastructure,” as infrastructure projects that align with five high-level climate resilience principles based on five core features of climate resilience, summarized in Figure ES1. These resilience principles are primarily adapted from the Framing Paper on Climate-resilient Finance and Investment (OECD, 2022), MDB Framework for Climate Resilience Metrics (IDB, 2019), and Joint MDB Assessment Framework for Paris Alignment (MDB, 2021). Together, these principles constitute the most comprehensive framework to conduct an accurate tracking of CRI investments.

This study is the first step in operationalizing these climate resilience principles for tracking CRI investments. Considering the limited availability of data, we could only operationalize three of the five climate resilient principles using a step-by-step approach, summarized in Table ES1. Detailed information on the approach is provided in Section 3.

The approach is piloted across four critical sectors: (i) water & wastewater; (ii) transport; (iii) energy; and (iv) agriculture, forestry, and other land use (AFOLU), as well as in cross-sectoral solutions. To simplify this initial effort, we focus on two water-related climate shocks—floods and droughts—but consider the potential to replicate the analysis for a variety of other shocks and stresses, such as heatwaves and sea-level rise. Future editions of this analysis can incorporate alignment with net zero transition scenarios.

Key findings

Piloting the methodology to create a first-of-its-kind global database of more than 4,000 CRI projects financed in 2019/20, we find that investments in CRI are only a fraction of total investments in critical infrastructure sectors.

For every USD 1 spent on CRI, USD 87 was spent on infrastructure projects which do not integrate climate resilience principles. This suggests that investing in CRI is still in its nascent stages. As global infrastructure investment needs are counted in trillions, there is an immediate need to integrate climate resilience principles in all infrastructure investment decisions. Failure to do so will result in locking-in climate risks in long-lived infrastructure assets and making businesses and communities vulnerable to increasing impacts of climate change. Despite the urgency, there is no common metric, incentives, nor concrete roadmaps to track progress.

In 2022, less than 30% of participating infrastructure entities in the GRESB Infrastructure Asset Assessment 2022 used physical scenarios for evaluating resilience strategies at the asset level. The majority (80%) of them are based in Europe or North America and fall in the energy, water, and transport sectors. Less than 60% of the reporting entities (USD 686 billion in asset value) systematically assessed material financial impacts of physical climate risks. Almost all of them (98%) flagged exposure to acute climate hazards such as floods, storm surges, and heat stress.

Climate-related disclosure standards for companies and investors are yet to integrate the double materiality aspects of physical climate risks which assess the impacts of infrastructure investments on systemic and community resilience. TCFD recommendations have had a positive impact on the climate risks disclosure ecosystem but the metrics and targets for physical climate risks are less evolved than that of transition risks and are accompanied by little effective guidance. Further development would be required to address these aspects.

Various stakeholders across the infrastructure lifecycle must be mobilized to overcome these knowledge gaps, data barriers, and methodological challenges to improve future tracking exercises at the asset-level. This study’s overarching recommendations for all stakeholders are to:

- Collectively agree upon common, comparable, and credible climate resilience principles which are applicable to both public and private infrastructure investors.

- Enable and incentivize the alignment of investments to the agreed climate resilience principles by setting standards, metrics, targets, and encouraging transparent disclosures.

- Make investments aligned with the agreed climate resilience principles.

- Monitor and evaluate progress to determine what further reporting is needed to inform assessments on how much more climate finance is needed to make investments resilient.