Introduction

Rural producers are subject to various risks that can lead to significant losses. In addition to natural hazards such as pests, droughts, and floods, there are market risks such as price fluctuations of inputs and outputs as well as exchange rate volatility. Improving the risk coverage system for producers can accelerate the modernization and sustainability of Brazil’s agriculture. Risk management tools also gain additional relevance in the context of climate change and increasingly frequent extreme events.[1]

Market failures in rural insurance lead to underinvestment, low agricultural productivity, and adverse impacts on land use. Without adequate risk coverage, producers might make ineffective production decisions, including a failure to implement crop specialization and to use more modern technologies. In addition, massive losses may prompt government assistance, hence putting pressure on public resources.

Two major programs in Brazil aim to mitigate risk in agriculture: the Agricultural Activity Guarantee Program (Programa de Garantia da Atividade Agropecuária – PROAGRO), which exempts beneficiaries from fulfilling financial obligations in rural costing credit operations and reimburses producers when they use their own funds for operating expenses, in case of losses arising from weather events; and the Rural Insurance Premium Subsidy Program (Programa de Subvenção ao Prêmio do Seguro Rural – PSR), in which the government provides an economic subsidy to the rural insurance premium, thus reducing the cost of insurance policies for producers.

Public spending on rural insurance programs must be efficient and support positive changes to Brazil’s agriculture, such as stimulating modernization, innovation, and sustainability efforts in the sector. The design of these programs can be improved so that resources can be earmarked for small producers, as well as for those engaged in more sustainable agricultural practices.

In this report, researchers from the Climate Policy Initiative/Pontifical Catholic University of Rio de Janeiro (CPI/PUC-Rio) analyze the inner workings of both PROAGRO and the PSR and unveil how the design of each program generates different incentives for producers, insurance claims adjusters, and financial agents, with an impact on the effectiveness of public spending.

In the PSR, the government provides subsidies to the premium, but the responsibility for the payment of claims lies with the insurers, who bear the risk. In the case of PROAGRO, financial institutions are in charge of operating the program, but the central government bears the risks, thus reducing the incentive for these institutions to monitor producers properly as well as for producers to strive to avoid crop losses.

These incentives affect the volume of claims under the programs. Claims were granted for more than 28% of PROAGRO’s policies between 2019 and 2021, against 19% for the PSR. In terms of value, granted claims accounted for 22% and 18% of the values insured under PROAGRO MAIS and PROAGRO TRADICIONAL and only 5.4% under the PSR. Furthermore, in recent years there has been a significant increase in PROAGRO’s demand for National Treasury resources. Between 2017 and 2021, expenses with compensations under the program grew four-fold, from R$ 1.3 billion to R$ 5.8 billion.

Understanding the incentives generated by the programs’ operating rules and their consequences is critical to developing a more effective government action on agricultural risk management.

MAIN RESULTS

1. The PSR has grown significantly, while PROAGRO has lost space

• Rural insurance policies subsidized by the PSR jumped from 102,600 to 213,800 between 2013 and 2021, with an increase in the insured value from R$ 22 billion to R$ 67 billion. The number of PROAGRO contracts fell from 466,900 to 284,300 over the same period, but the insured value remained relatively stable at around R$ 17 billion.[2]

• In 2021, PSR for the first time reached a greater number of municipalities than PROAGRO (3,311 and 3,352 municipalities, respectively). Differences in their geographic distribution imply a stronger PSR presence in the Central-West Region and a stronger PROAGRO presence in Northeast Region.

• The two programs are highly concentrated in soybean, corn, and wheat, which account for about 80% of the insured value in both programs.

2. Problems caused by information asymmetries are more severe in PROAGRO

• Since the federal government bears the risks under PROAGRO, producers have fewer incentives to strive, claims adjusters attest to more losses, and insurers overestimate claims.

• Under the PSR, the risk is borne by insurers, generating incentives for these institutions to select producers and monitor their activities.

3. Distortions in incentives are associated with more claims in PROAGRO

• Claims were granted for more than 28% of PROAGRO policies between 2019 and 2021, against 19% of PSR policies. In terms of value, paid-out claims accounted for 22%, 18%, and 5.4% of the values insured under PROAGRO MAIS, PROAGRO, and the PSR, respectively.

• The actual insurance coverage – i.e., the ratio of the compensation value over the insured value of the paid-out claims – is 68% under PROAGRO MAIS, 61% under PROAGRO, and 32% under the PSR.

4. Higher value claims entail higher costs for the government

• In the case of PROAGRO, increased demand for National Treasury resources for the payment of compensations outweighs the increase in the program’s revenue. Between 2017 and 2021, spending on compensations increased four-fold – from R$ 1.3 billion to R$ 5.8 billion.

• The rates charged from producers under PROAGRO and the PSR are not very different, ranging between one and two percentage points per crop. However, the premium paid relative to the insured area is higher in the PSR than in PROAGRO: R$ 170/hectare versus R$ 163 for PROAGRO MAIS and R$ 137 for PROAGRO TRADICIONAL.

• The PSR’s revenue has grown in recent years due to a more accelerated increase in policy volume relative to the government subsidy. The ratio of the total subsidy on the premium paid by producers dropped from 0.74 in 2017 to 0.38 in 2021.

5. The challenge for the PSR is to improve coverage for small producers

• The target audience of PROAGRO is composed of small and medium-sized rural producers, to whom the PSR is unable to cater on the same scale.

• A pilot PSR project for operations included in PRONAF in 2020 shows that the program can also attend to small producers.

POLICY RECOMMENDATIONS

• Investing in the training of claims adjusters and improving the inspection of claim events can reduce the irregular approval of compensation payments under PROAGRO. Parameterization (using satellite imagery and data on temperature and rainfall) can complement and facilitate the work of insurance claims adjusters.

• Production in accordance with the Agricultural Climate Risk Zoning (Zoneamento Agrícola de Risco Climático – ZARC) reduces the risks associated with the agricultural practices of insured producers. The ZARC can be improved to include management criteria, as informed by the latest Agricultural Plan (Plano Safra).

• Migration of PROAGRO’s resources to the PSR would not only be in line with the recent growth of the PSR but would also mitigate some of the public spending efficiency issues in PROAGRO. However, this migration should be accompanied by efforts to address current challenges facing the PSR.

• The PSR rules should allow the program to include a greater diversity of crops and reach municipalities in regions where its presence is weaker.

• The PSR should target resources to small producers who have greater difficulty in accessing risk management instruments and are mostly assisted by PROAGRO at the moment.

• Greater predictability in obtaining PSR subsidies for producers and more transparency regarding the order in which insurance policies are submitted to the Ministry of Agriculture, Livestock and Supply (Ministério da Agricultura, Pecuária e Abastecimento – MAPA) would stimulate demand for rural insurance.

• Because they use public resources, PROAGRO and the PSR should seek to foster the modernization of the Brazilian rural sector by incentivizing productivity gains and the adoption of new technologies and better agricultural practices to make agriculture more sustainable.

INFORMATION ASYMMETRIES IN RURAL INSURANCE

In economics, information asymmetry problems occur when two parties engaged in a transaction (in the case of rural insurance, a producer and an insurer) have different information, and one party has more or better information than the other. Literature shows that information asymmetries cause incentive problems in insurance markets. In the case of incomplete ex-ante information about policy applicants, insurers cannot clearly distinguish between producers engaged in riskier or less riskier practices. If there is no differentiation in policy prices by type of producer, the tendency is for producers with riskier practices to be more interested in getting insurance, as they are more likely to benefit from it. This constitutes an adverse selection problem.[3] To deal with adverse selection, insurers can offer a policy menu, thus prompting the insured party to disclose its likelihood of losses through a self-selection mechanism or by using a priori screening[4] methods, that is, when the less informed party uses means to acquire additional information or indicators about the more informed party – namely, the insured party.[5]

Moreover, when there is imperfect information about the insured’s actions after the insurance has been contracted, these actions cannot be perfectly monitored. In such cases, producers can put less effort into production under the assumption that they will be compensated in case of adverse events, thus increasing the risk of claim events. This leads to a moral hazard problem.[6] Parties can try to reduce moral hazard by monitoring activities during the production phase.[7]

When contracting rural insurance, producers also have private ex-post information on production, which insurers cannot easily observe. In this case, there is a problem of inspection of losses that can lead to fraud. A way to address this problem is to put in place an insurance policy structure that provides for production auditing, which would incur additional costs.[8] In the absence of these inspection mechanisms, producers may be incentivized to disclose false information about their production yields and losses incurred in order to receive compensation.

Parametric insurance, which depends only on observed parameters, is an alternative to reduce the problems tied to information asymmetry. This type of insurance uses pre-established values of an index as a reference when granting claims. For example, in the case of rain, producers are compensated if the rainfall value is higher (or lower, for droughts) than a parameter set in the insurance policy.[9] It is worth noting that even without significant production losses, producers may be compensated when the indicator reaches the stipulated value. The opposite is also true: producers who incur losses may not be entitled to compensation if the pre-established index threshold is not reached.[10]

Agricultural Risk Management Programs in Brazil

In Brazil, rural producers can access risk management instruments and rely on government insurance programs. However, these instruments and programs are limited in size and scope and do not offer the range of risk management options needed for producers to make decisions that lead to efficient agricultural practices.

Figure 1 shows the main risk mitigation instruments in Brazil in 2021. The total value of rural insurance premiums reported to the Superintendence of Private Insurance (Superintendência de Seguros Privados – SUSEP) in 2021 was R$ 9.7 billion. Of this amount, R$ 4.9 billion were for crops, cattle, or forestry insurance, which are categories potentially eligible for subsidies under the PSR. The amount of R$ 4.2 billion were actually subsidized by the program, which insured a production value of R$ 66.7 billion. The total amount of subsidies was R$ 1.2 billion. In the same year, PROAGRO’s premiums (known as “the additional amount paid by the producer”) totaled R$ 851.6 million, and the production value insured by the program was R$ 18.3 billion. The government transferred R$ 1.7 billion to PROAGRO in the fiscal year 2021, but by August 2022, the amount granted in claims for 2021 losses had already reached R$ 5.8 billion.[11] The Harvest Guarantee Program (Garantia-Safra), a program designed to support family farming activities affected by droughts or excess rainfall, paid out R$ 380 million in the 2020/21 crop year.[12]

Figure 1. Structure of Agricultural Risk Management Instruments in Brazil, 2021

Source: CPI/PUC-Rio with data from SUSEP, BCB, and MAPA, 2022

PROAGRO

PROAGRO was created in 1973 to protect low-income producers from risks associated with natural phenomena, pests, and diseases. It is a federal government program that exclusively subsidizes production costs by: (i) exempting producers from their financial obligations in rural costing credit operations; and/or (ii) compensating producers for the use of their own funds to cover operating expenses.

Program beneficiaries are rural producers and cooperatives with rural funding projects, who pay the premium called PROAGRO Additional to be enrolled in the program. PROAGRO coverage is of the multiple peril type, with protection against eight adverse events. The program used to operate with a single rate until 2017, when it began to differentiate rates by type of crop, but still without any rate distinction between the different regions of the country.

Producers must also comply with the ZARC[13] to benefit from PROAGRO. ZARC determines that producers should plant at the most suitable times for each crop and region and encourages the use of more efficient technologies, thus reducing the costs and risks involved in planting.

The program is divided into two modalities: PROAGRO TRADICIONAL and PROAGRO MAIS. PROAGRO TRADICIONAL is mandatory for rural costing projects of up to R$ 335,000 financed with controlled rural credit resources, for producers whose plantation is included in ZARC. Coverage involves the amount financed and the share of the producer’s own funds used in the project. PROAGRO MAIS, created in 2004, is aimed at small-scale producers. It is intended exclusively to finance agricultural costing under the National Family Farming Strengthening Program (Programa Nacional de Fortalecimento da Agricultura Familiar – PRONAF), whose threshold for costing operations is R$ 250,000 per producer. Under both modalities, the obligation to purchase is waived if the producer presents the policy of another rural insurance for that crop. The differences between PROAGRO TRADICIONAL and PROAGRO MAIS relate to their beneficiaries. In this sense, PROAGRO MAIS has lower rates and offers its beneficiaries the possibility to, in addition to costing coverage, include an investment credit portion and a minimum income guarantee.

The Central Bank of Brazil is responsible for managing the program’s resources, designing its rules, and enforcing compliance therewith, in addition to requesting central government resources and preparing reports. For the program to be present in rural regions, financial institutions operating rural credit play a central role in the provision of PROAGRO. Financial institutions have the role of structuring the operations involved in contracting the program, collecting the portion of the PROAGRO premium paid by beneficiaries, and transferring it to the Central Bank of Brazil. They also receive reports of beneficiaries’ loss claims in case of adverse events, contact the loss verification service, assess beneficiaries’ coverage requests, and calculate the coverage to be granted. Only then do financial institutions issue a request to the Central Bank of Brazil for reimbursement of payments to be made to the program. It should be noted that central government expenditures linked to PROAGRO are compulsory expenditures and, therefore, are not subject to budget restrictions.

Insured values for the 2020/21 crop year totaled R$ 12.1 billion under PROAGRO MAIS and R$ 3.7 billion under PROAGRO TRADICIONAL. Furthermore, over the same period, PROAGRO MAIS had 258,353 contracts, with an average insured value of R$ 46,984, while PROAGRO TRADICIONAL had only 30,657 contracts, with an average insured value of R$121,197.[14]

RURAL INSURANCE PREMIUM SuBSIDY PROGRAM

The PSR aims to assist rural producers in mitigating agricultural risks and ensuring financial recovery capacity in the case of adverse weather events. The program was created by Decree No. 5,121 of 2004 and began operations in 2006. The PSR is managed by MAPA and is a public-private partnership in which the federal government subsidizes part of the rural insurance policy premium charged by private insurers. By reducing policy costs for producers, the program aims to stimulate the development of the country’s rural insurance market. However, as the budget for subsidies is defined by decree, PSR resources may be subject to restrictions, which may jeopardize its implementation.

Any producer – whether an individual or a corporation – who purchases rural insurance for crops, cattle, forestry, or aquaculture may be a beneficiary of the rural insurance premium subsidy. An insurer authorized by the PSR submits the policies to MAPA for analysis. MAPA, in turn, grants or denies the subsidy to producers depending on the availability of resources, the annual limits of subsidy use, and the registration status of the producer. Therefore, producers and insurers do not know, at the time the policy is sold, whether the subsidy will be granted. Since 2022, the subsidy has been limited to R$ 60,000 per activity group, producer, and year.[15] The total amount of a producer’s subsidies each year must not exceed R$ 120,000. Additionally, the percentage of subsidy over the total premium should not exceed 20% for activities related to soybean production and 40% for all other activities.

The PSR allows the government to transfer the responsibility for settling claims to insurers. Government spending on the program is limited to the initial amount stipulated for the payment of subsidies and, therefore, does not vary with weather events. Private companies set the price for the risk, develop and sell the products, pay the claims, and insure and reinsure operations. Thus, the government is protected from moral hazard or potential collusion between producers and insurers.

In the 2020/21 crop year, the value insured under the PSR was R$ 53.5 billion, corresponding to a total of 201,700 contracts, with an average insured value of R$ 265,500. The PSR has grown significantly in recent years, according to data from the Rural Insurance Atlas.[16] The number of insurance policies under the PSR increased from 21,800 in 2006 to nearly 214,000 in 2021, with a sharper increase between 2019 and 2021. However, the program is still restricted to certain crops and very much concentrated on soybeans. Despite covering crop, cattle, and forestry insurance, 98.3% of the policies covered by the program in the 2020/21 agricultural year were crop insurance contracts (with 47.6% of the policies for soybeans).

Comparing Programs

This section compares PROAGRO and the PSR regarding the number and value of policies, granted claims, distribution of financial resources by crop and geographic region, rates, and premiums.

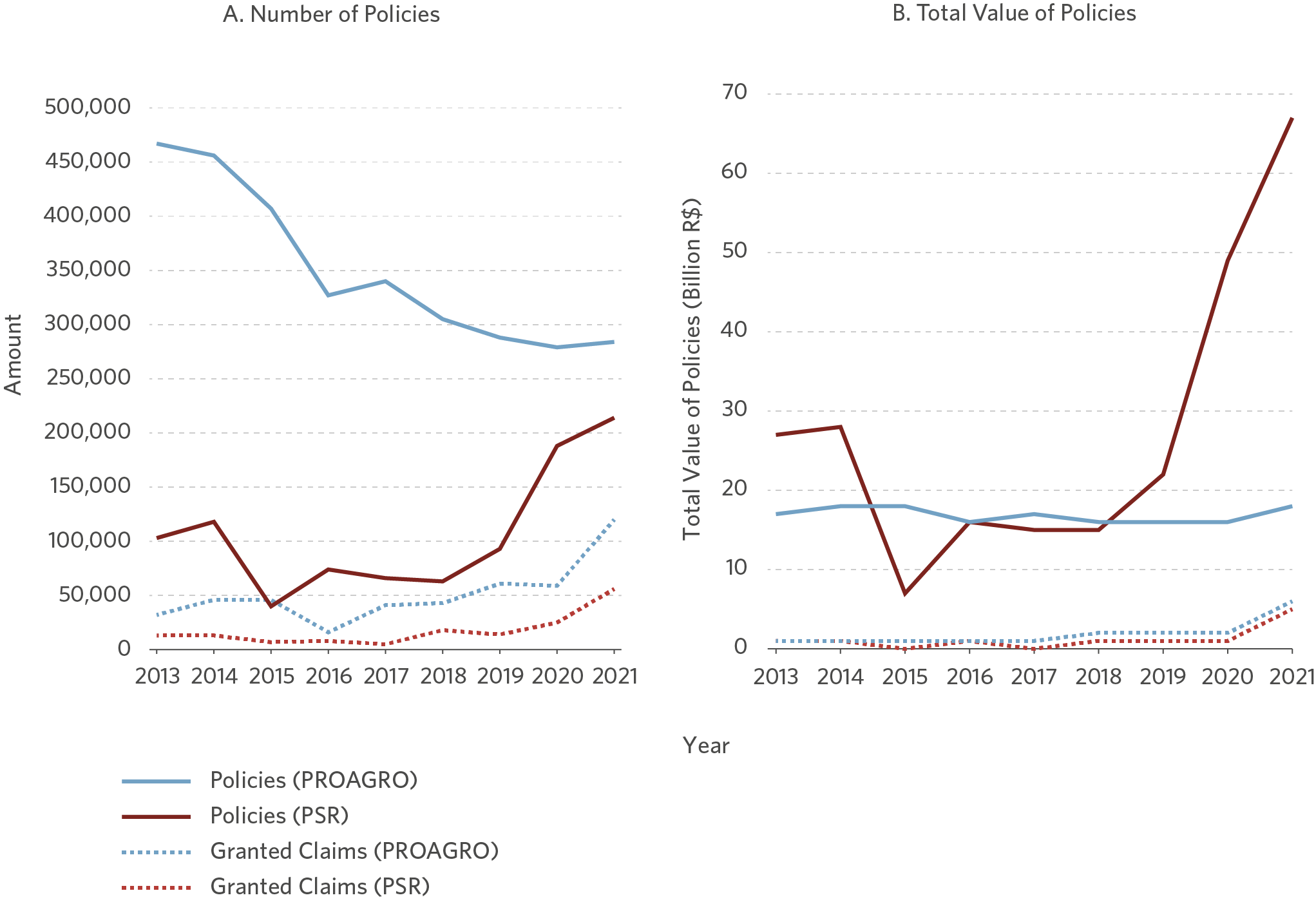

Figure 2a compares the number of policies and claims granted under PROAGRO and the PSR between 2013 and 2021. PROAGRO boasts a higher number of policies than the PSR. However, the two programs show opposite trends: while the number of PROAGRO policies fell from 467,000 in 2013 to 284,000 in 2021, the number of PSR policies grew from 103,000 to 214,000 over the same period.

Although the number of PROAGRO policies has declined, the number of contracts with paid claims under the program has nearly doubled between 2013 and 2020 (from 32,000 to 59,000). In the case of the PSR, the increase from 13,000 to 25,000 in the number of contracts with paid claims in the same period partly reflects the expansion of the program itself (from 103,000 to 188,000 policies). In 2021, the year in which there was a severe drought, both programs saw that number double again (120,000 for PROAGRO, 56,000 for PSR).

Figure 2b compares the evolution of the programs in terms of insured value. PROAGRO remained stable over the period, at around R$ 17 billion, indicating that the average value of the program’s contracts has increased. The PSR, in turn, experienced a steep growth in insured value, jumping from R$ 15 billion in 2018 to R$ 67 billion in 2021. Despite the significant increase in the insured amount, paid claims under the PSR remained at around R$ 1 billion in the period, with the exception of 2021. PROAGRO, in turn, saw the value of paid claims increase consistently in the period, jumping from R$ 900 million in 2013 to R$ 2.2 billion in 2020. In 2021/22, severe droughts were recorded in the Center-South of the country, which contributed to crop failures for soybeans and corn, two of the main crops insured. This explains the increase in paid claims in both programs to around R$ 5 billion in 2021.

Figure 2. Number and Value of Policies and Granted Claims per Program, 2013 – 2021

Note: Values at December 2021 prices (IPCA-adjusted inflation).

Source: CPI/PUC-Rio with data from the BCB (PROAGRO Data Matrix) and MAPA (Rural Insurance Atlas), 2022

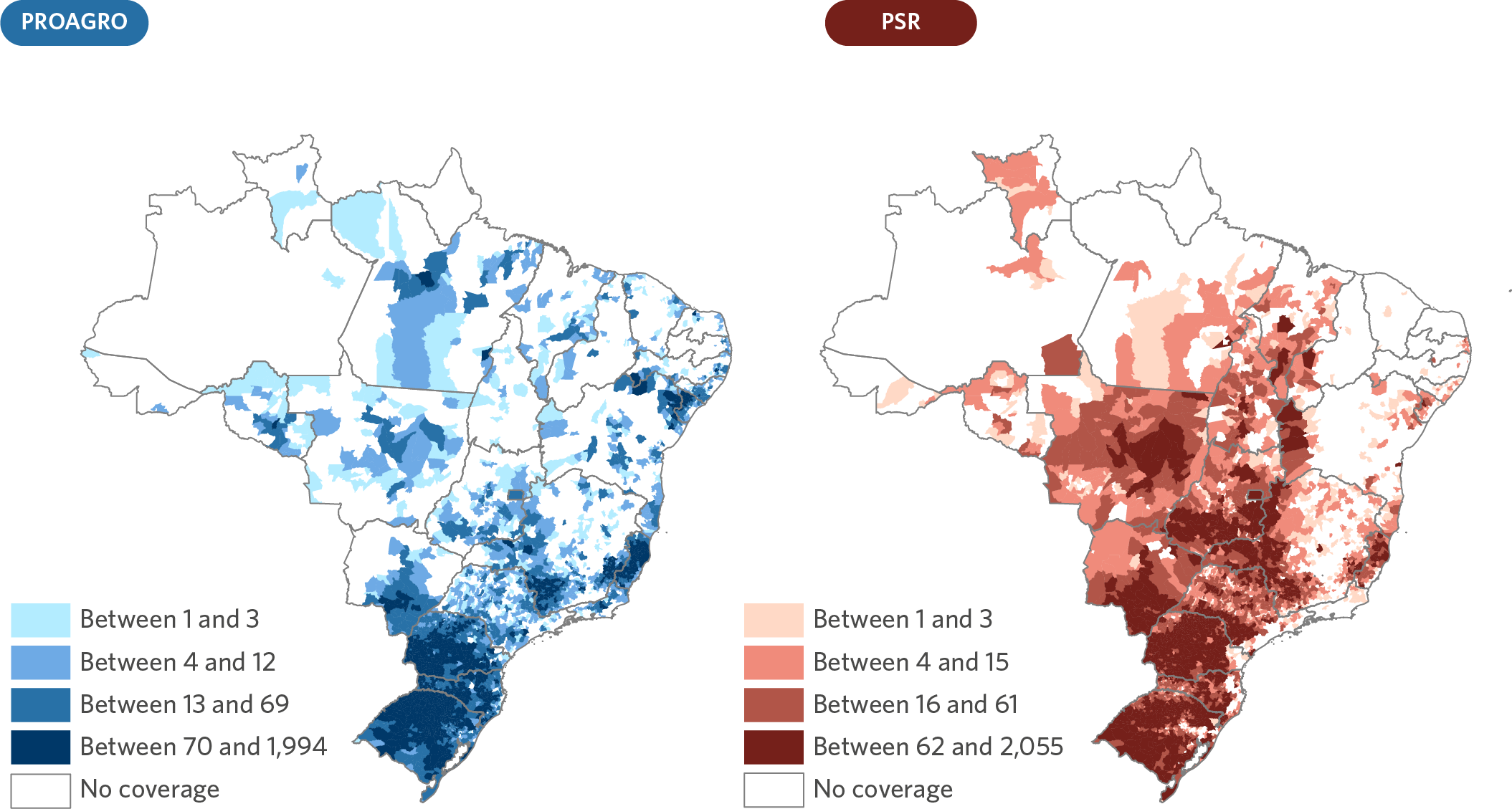

Currently, both programs cover a similar number of municipalities. In 2021, 3,252 Brazilian municipalities had PROAGRO contracts, while the PSR subsidized contracts in 3,311 municipalities. This similarity is a consequence of the significant growth of the PSR’s coverage in relation to 2018, when only 2,127 municipalities had contracts subsidized by the program.[17]

However, as shown in Figure 3, despite reaching a similar number of municipalities, the geographical distribution of the programs’ coverage varies across Brazilian regions. The PSR covers virtually all municipalities in the Central-West region. Both programs reach a few municipalities in the North and Northeast regions, although PROAGRO’s presence in the Northeast is almost twice that of the PSR. The two programs have a high concentration of insurance policies in the Southern region of Brazil and a large number of policies in the Southeast. Although the two programs reach a substantial number of municipalities, 1,409 Brazilian municipalities were not covered by either program in 2021.

Figure 3. Geographical Distribution of PROAGRO and PSR Policies across Brazilian Municipalities, 2021

Note: Quartiles of the number of PROAGRO and PSR agricultural insurance policies.

Source: CPI/PUC-Rio with data from the BCB (PROAGRO Data Matrix) and MAPA (Rural Insurance Atlas), 2022

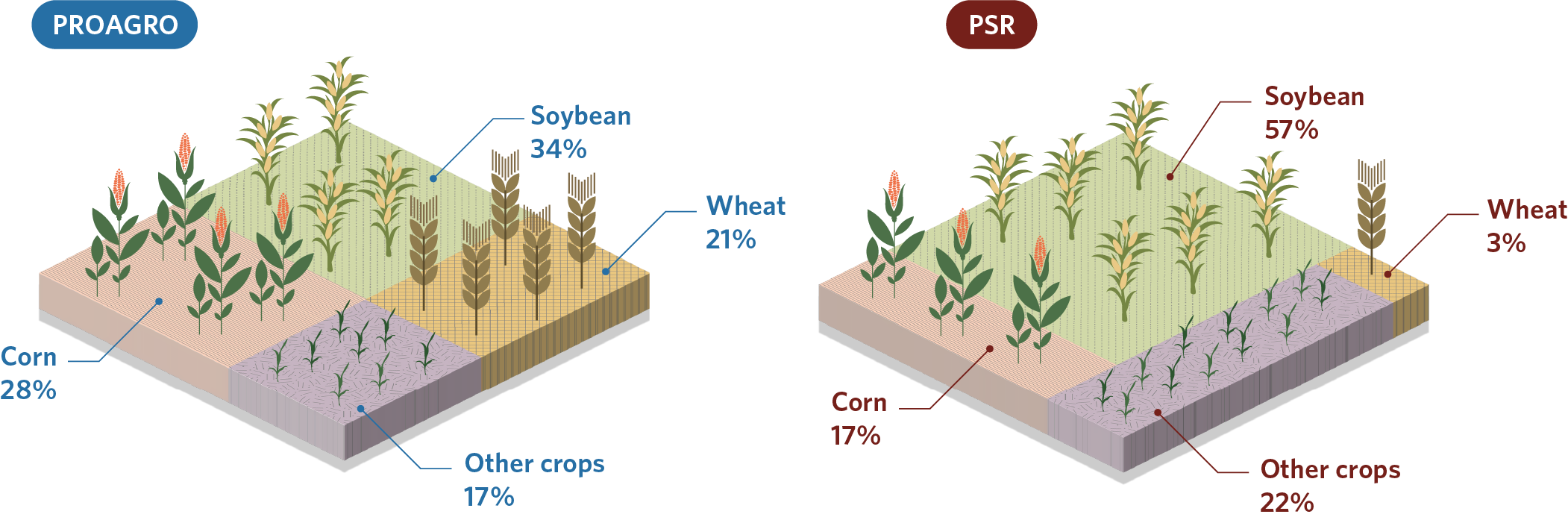

PROAGRO covers significantly higher crop diversity than the PSR in terms of insured products. In 2021, PROAGRO insured 126 crops and the PSR only 62. Nevertheless, the distribution of the insured values of the crops insured under both programs is highly concentrated in three products: soybean, corn, and wheat.

Figure 4 compares the distribution of the insured value of the main crops insured under each program between 2019 and 2021. Together, these three products represented more than 80% of the values insured by the programs in the period. Soybean is the dominant crop in both PROAGRO and the PSR, accounting for 34% and 57% of the insured value of these programs, respectively. The second most insured crop is corn, which corresponds to 28% of the value insured under PROAGRO and 17% of the value under the PSR, followed by wheat (21% under PROAGRO and 3% under the PSR). Thus, although PROAGRO insures twice as many crops as the PSR, in both programs the insured values are highly concentrated in the three dominant crops, so diversity is not relevant in either program.

Figure 4. Distribution of the Insured Value of the Main Crops Insured by Program, 2019 – 2021

Source: CPI/PUC-Rio with data from the BCB (PROAGRO Data Matrix) and MAPA (Rural Insurance Atlas), 2022

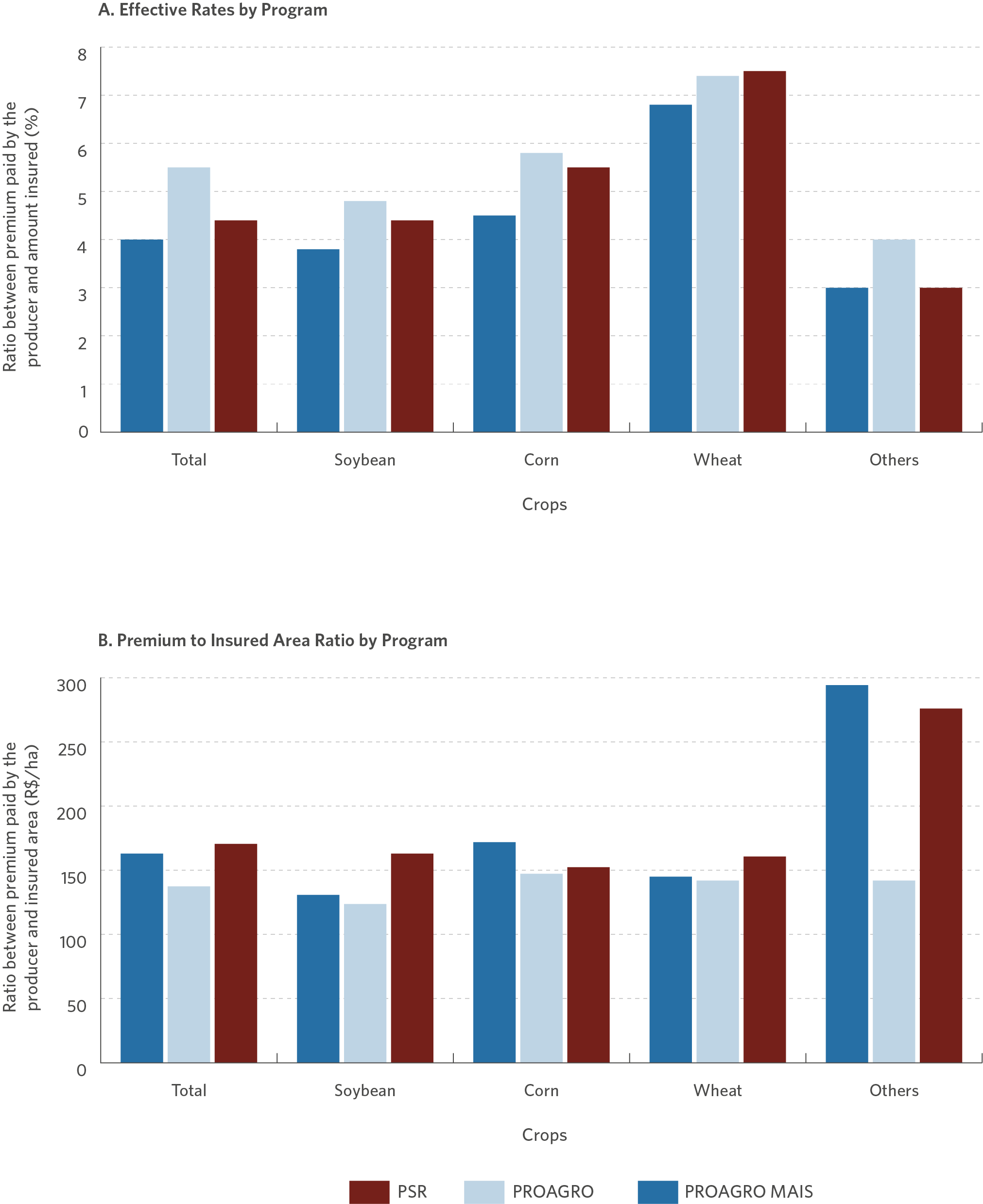

Figure 5a shows the effective rates, measured by the ratio between the premiums paid by producers (minus the subsidy) and the amount insured for the three years from 2019 to 2021. It is worth noting that in PROAGRO and PROAGRO MAIS, the rates are determined a priori in the Rural Credit Manual (Manual de Crédito Rural – MCR).[18] In the PSR, the rates are set by insurers and, therefore, are not established a priori. Additionally, the effective rate paid by producers depends on the restrictions imposed by MAPA’s Three-Year Rural Insurance Plan (Plano Trienal do Seguro Rural – PTSR),[19] which determines (i) the initial budget allocation for the program and (ii) subsidy limits per activity. The period from 2019 to 2021 is used to ensure the calculation of the effective rate reflects a single set of rules.

The effective average rate charged by the PSR was 4.4% in the period. In PROAGRO MAIS and PROAGRO, the premiums account for 4% and 5.5% of the total insured amount, respectively. For soybean and corn, the rates charged by the PSR are located at an intermediate point between PROAGRO and PROAGRO MAIS. As expected, PROAGRO MAIS, which is intended for small producers, has the lowest effective rates for all crops.

Figure 5b shows the premiums evaluated by insured area. The premium per hectare is higher in the PSR. Between 2019 and 2021, the premium per hectare was 170.5 in the PSR, a value 24% higher than the premium charged in PROAGRO and 4.7% higher than in PROAGRO MAIS.

Figure 5. Comparison of Effective Rates and Premiums by Insured Area between PROAGRO, PROAGRO MAIS and PSR, 2019 – 2021

Source: CPI/PUC-Rio with data from the BCB (PROAGRO Data Matrix) and MAPA (Rural Insurance Atlas), 2022

Revealing Incentives

INFORMATION ASYMMETRIES IN PROAGRO AND THE PSR

In this section, we show how information asymmetry problems appear in PROAGRO and the PSR according to the rules of each program.

The adverse selection problem occurs at the time of purchase for both insurance options because insurers do not have all the information about producers. In the case of PROAGRO, because it is mandatory for PRONAF’s costing credit and for loans of up to R$ 335,000 involving controlled resources, the distinction between high- and low-risk producers occurs when the financial agent decides to grant the rural credit. Producers with riskier profiles and who receive credit under these conditions are mandatorily included in PROAGRO. In addition, even for producers who are not under the obligation to purchase insurance, PROAGRO’s rules generate few incentives for insurers to conduct a proper check of potential beneficiaries. This is because, although insurers are responsible for operating the program, they do not bear the risks of the insurance since, should a claim event occur, compensation would be paid by the National Treasury in the form of mandatory expenses.

In the case of the PSR, as insurers bear the insurance risk, they have incentives to conduct prior surveys of beneficiaries to identify producers who use riskier practices. This encourages insurers to limit the supply of policies to select lower-risk producers. By offering a premium subsidy, the government partially offsets the restrictions on the supply of insurance caused by adverse selection.

The problem of moral hazard occurs once insurance has been purchased, when there is incomplete information about the beneficiaries’ commitment to their activities. A producer may choose to implement less efficient agricultural management practices, thus increasing the risk of loss. Both PROAGRO and the PSR are subject to the problem of moral hazard, and both have measures to address it, such as the requirement that beneficiaries act in accordance with the practices set forth by the ZARC. The PSR also provides monitoring inspections to oversee crop implementation and development, which is not provided in PROAGRO. However, without an effective system to assess and verify losses, the moral hazard problem will persist.

Under the PSR, insurers have a higher incentive to monitor producers’ behavior effectively. Nonetheless, since 2015 MAPA has established instruments to monitor the behavior of insurers and check the veracity of the information and data on policies issued with subsidized resources. The inspection is conducted using probabilistic sampling by selecting operations from eight different subsidy value strata.[20]

In PROAGRO, because the government bears the insurance risk but the responsibility for monitoring lies with financial institutions, there are no incentives to adequately monitor producers, given that the cost of monitoring is high. Furthermore, as PROAGRO consists of costing credit insurance, the financial institutions responsible for inspecting and monitoring insurance are also the end recipients of government resources for the claimed policies. This causes PROAGRO’s rules to generate incentives for financial institutions to overestimate actual losses.

Another information asymmetry problem follows the occurrence of losses in both programs. Producers hold the information on actual production and report the losses to financial agents, who do not observe whether these losses have actually occurred. This would require sending technical staff to verify in situ the occurrence of claim events and to quantify and characterize losses in the field. On the producers’ side, there are incentives for fraud, such as adulterating crops or forging invoices,[21] which increases the reported value of damage to plantations and inflates compensation amounts.

Like producers and financial institutions, rural claims adjusters are insurance market agents who are also subject to incentive problems. According to a MAPA report, there is a lack of professionals trained to meet the growing demand of Brazil’s insurance industry. In addition to this lack of training, claims adjusters face various difficulties in their inspections, ranging from attempted fraud by producers to the offer of bribes, moral harassment, and attempted assault.[22] Such adversities provide incentives for adjusters to irregularly approve the payment of compensations to the benefit of producers. To mitigate these problems, the PSR has encouraged the technical training of claims adjusters, as described in the box below.

BOX 1. RURAL CLAIMS ADJUSTERS

Both PROAGRO and the PSR rely on the work of rural claims adjusters – i.e., professionals who prepare technical reports and conduct rural insurance inspections. Although there are similarities in the work of adjusters in both programs, there are significant differences in their characteristics and in the process of monitoring and assessing losses in the field.

Both programs rely on prior inspections to obtain information about the area in question and the technical conditions of the farmland. To this end, adjusters use modern tools such as GPS, satellite imagery, remote sensing, and public information systems. These tools make inspections more reliable.

In the event of losses resulting from adverse events, producers inform the financial agent, who sends an adjuster to the area to inspect the claim event. Although claim event inspections are similar to prior inspections, they also include the verification and qualification of damages.

In addition to prior inspections, there are also monitoring inspections.[23] They are conducted during the term of the policy in areas where insurance has already been purchased and the company wishes to oversee the implementation and development of the plantation. These investigations verify whether the planting date was in accordance with the ZARC and if the plantation follows technical recommendations.

In recent years, measures have been taken within the PSR to improve the training of its adjusters, while PROAGRO has experienced changes in its rules in the opposite direction. Since 2020, MAPA has published resolutions aimed at enforcing minimum parameters for the technical training of agricultural adjusters working under the PSR.[24],[25] On the other hand, until 2021, the MCR, which establishes PROAGRO’s rules, required the verification of losses by professionals who passed a certification exam organized by an entity of recognized technical capacity.[26] The current MCR does not mention the training of these agents under PROAGRO.

As such, PROAGRO seems to face more information asymmetry and incentive problems than the PSR. The program’s operating guidelines, such as the mandatory purchase of insurance by producers and the responsibility of insurers for inspecting claim events, create incentive problems in addition to other problems common to any insurance market. The following section shows how these problems affect the volume of claims and the costs of both programs.

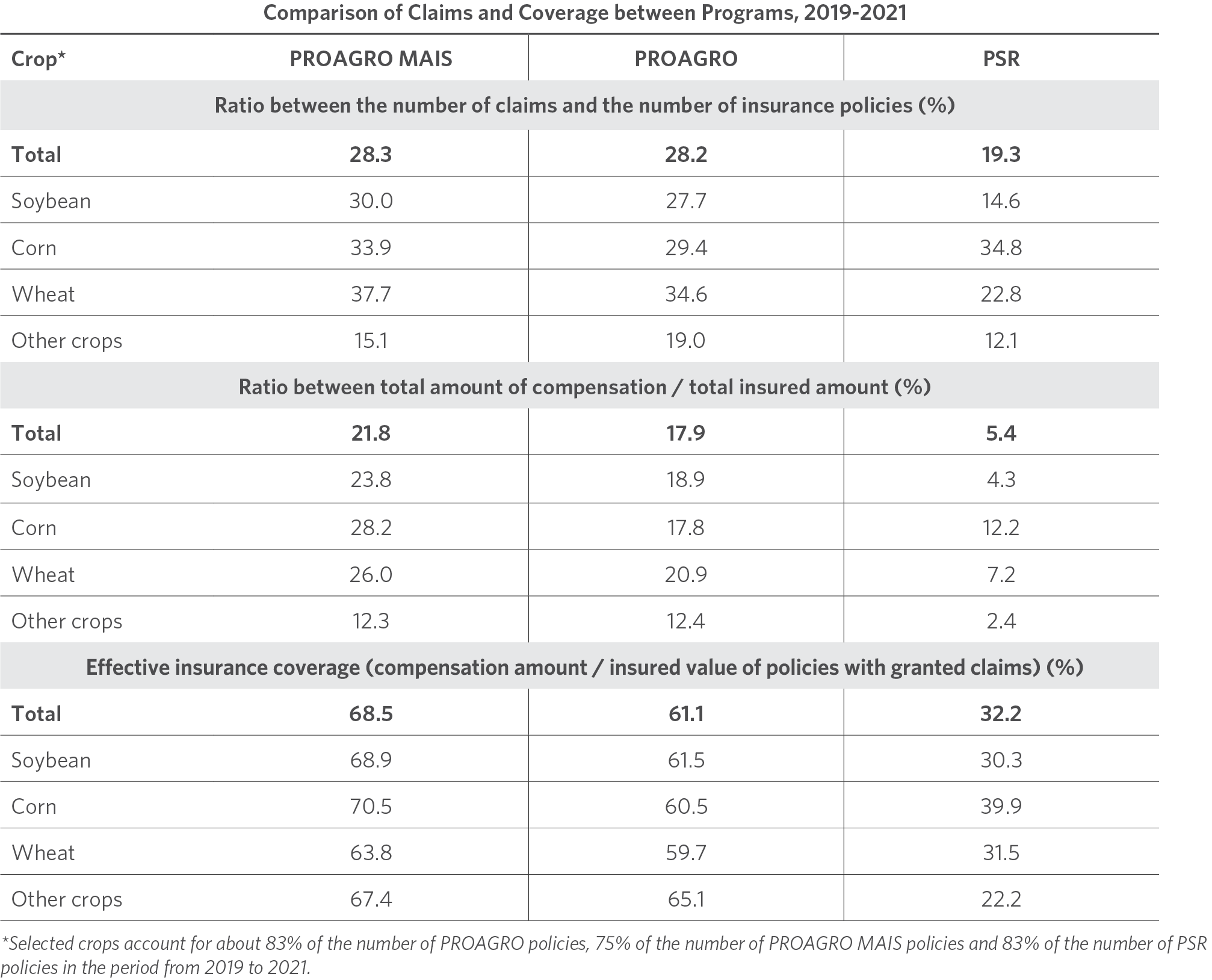

CONSEQUENCES OF INCENTIVES

Table 1 indicates that the PSR seems to work more effectively than PROAGRO. In the first two blocks, paid insurance claims are compared in the different programs. On average, in the period from 2019 to 2021, the proportion of policies with paid claims was 19.3% in the PSR, 28.2% in PROAGRO, and 28.3% in PROAGRO MAIS. An analysis of soybeans alone shows that 14.6% of the PSR policies had paid claims, while 30.0% and 27.7% of PROAGRO and PROAGRO MAIS policies had paid claims, respectively. These differences in the proportion of claims persist when looking at the proportion of policies with claims in terms of policy values. In the PSR, the value of policies involving claims accounts, on average, for 5.4% of the total amount of policies. In PROAGRO and PROAGRO MAIS, this number rises to 17.9 and 21.8%, respectively.

The last block in Table 1 shows that the differences between the PSR and PROAGRO are also striking from the standpoint of effective program coverage. The compensation amount corresponds to a much larger portion of the total value of policies with claims in PROAGRO than in the PSR. PROAGRO and PROAGRO MAIS compensations cover, on average, 61.1% and 68.5% of the insured value of policies with claims. In the PSR, the average effective coverage drops to 32.2%.

Table 1. Comparison of Claims and Coverage between PROAGRO, PROAGRO MAIS and the PSR, 2019 to 2021

*Selected crops account for about 83% of the number of PROAGRO policies, 75% of the number of PROAGRO MAIS policies and 83% of the number of PSR policies in the period from 2019 to 2021.

Note: To calculate the variables for PROAGRO and PROAGRO MAIS: the number and value of claims correspond to the amount and value of policies with granted coverage.

Source: CPI/PUC-Rio with data from the BCB (PROAGRO Data Matrix) and MAPA (Rural Insurance Atlas), 2022

The differences in terms of claims and coverage between PROAGRO and the PSR, as presented in Table 1, seem to be tied to incentives and the monitoring capacity of the programs. The operation design of PROAGRO gives rise to various information asymmetry problems, such as difficulties in ensuring that financial institutions conduct a proper pre-check of potential beneficiaries and in inspecting the actual occurrence of losses in the event of claim events. On the other hand, the operating design of the PSR partially solves some of the information asymmetry problems – e.g., under this program, insurers have incentives to carefully select insurance beneficiaries and verify losses.

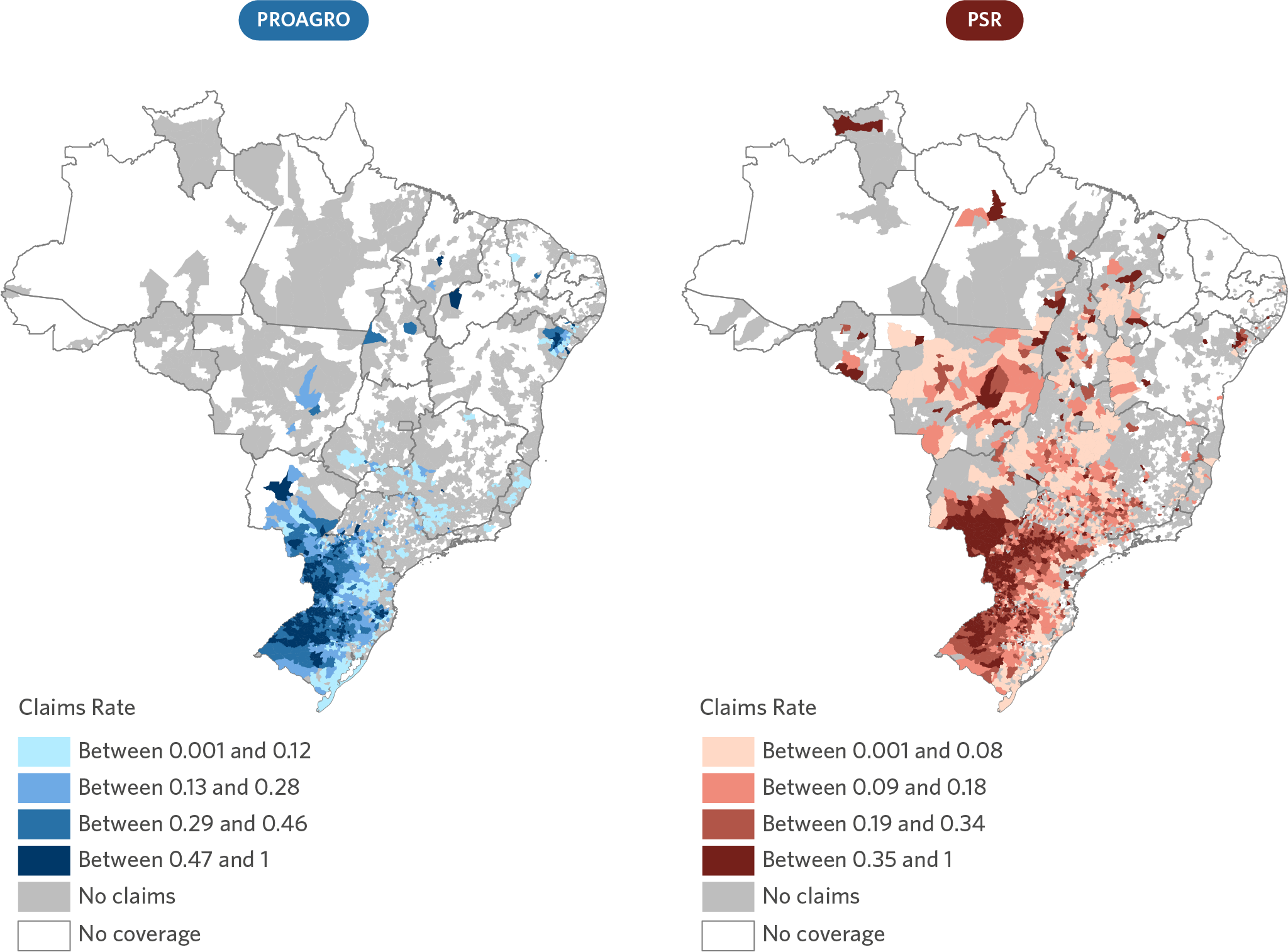

Figure 6 compares the claims rate of both programs and shows the quartiles of this rate for Brazilian municipalities in 2021.[27] The claims rate is determined by the ratio between the number of claims granted and the number of policies purchased in each municipality, per program. The maps show that notwithstanding significant differences in their geographical coverage, the majority of claims under the programs in 2021 are concentrated in the South Region of the country. Moreover, although the PSR has more municipalities with claim events than PROAGRO, the claims ratio of the PSR municipalities is lower. In the PSR, 50% of the municipalities with claims had a claim rate of up to 18%, while in PROAGRO the corresponding number was of up to 28%.

Figure 6. Quartiles of PROAGRO and PSR Claims Rate in Brazilian Municipalities, 2021

Note: The claims rate corresponds to the ratio between the number of policies with granted claims and the number of policies for each program. Blank areas on the maps correspond to municipalities that did not have PROAGRO or PSR insurance policies, respectively.

Source: CPI/PUC-Rio with data from the BCB (PROAGRO Data Matrix) and MAPA (Atlas of Rural Insurance and Open Data), 2022

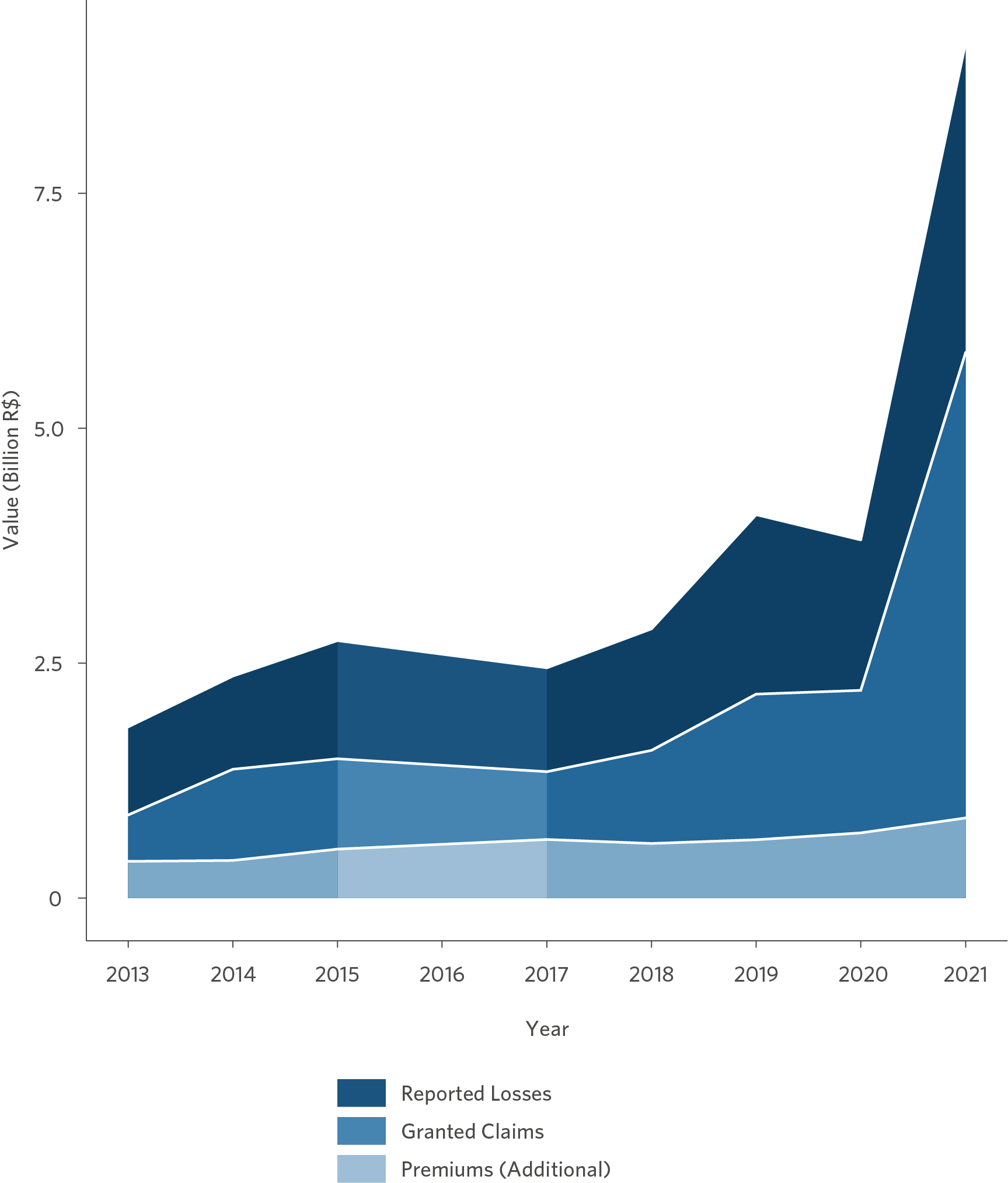

The values of claim events shown in Table 1 and Figure 6 under PROAGRO can be attributed, in part, to the increase observed in policies with reported losses in the last three years, which occurred due to droughts recorded in the South-Central region of the country.[28] Figure 7 shows the increase in the reporting of losses, granted claims and PROAGRO premiums in the past decade. The value insured in policies with reported losses rose from R$ 1.8 billion in 2013 to R$ 9.1 billion in 2021. As a result, the value of paid claims also increased: from R$ 0.8 billion in 2013 to R$ 5.8 billion in 2021.

However, the value of the PROAGRO Additional, which is equivalent to the premium paid by producers, did not follow this increase. While granted coverage grew seven-fold over the period, PROAGRO Additional has shown a modest increase since 2013, from R$ 390 million to R$ 852 million.

Figure 7. Additional Value, Granted Claims, and Insured Value in PROAGRO Policies with Reported Losses, 2013 – 2021

Notes: Values at December 2021 prices (IPCA-adjusted inflation). 2016 values are estimated from the average of values between 2015 and 2017. Values for 2016 in the PROAGRO Data Matrix were different from the values in PROAGRO Circumstantial Reports, published by the BCB.

Source: CPI/PUC-Rio with data from the BCB (PROAGRO Data Matrix), 2022

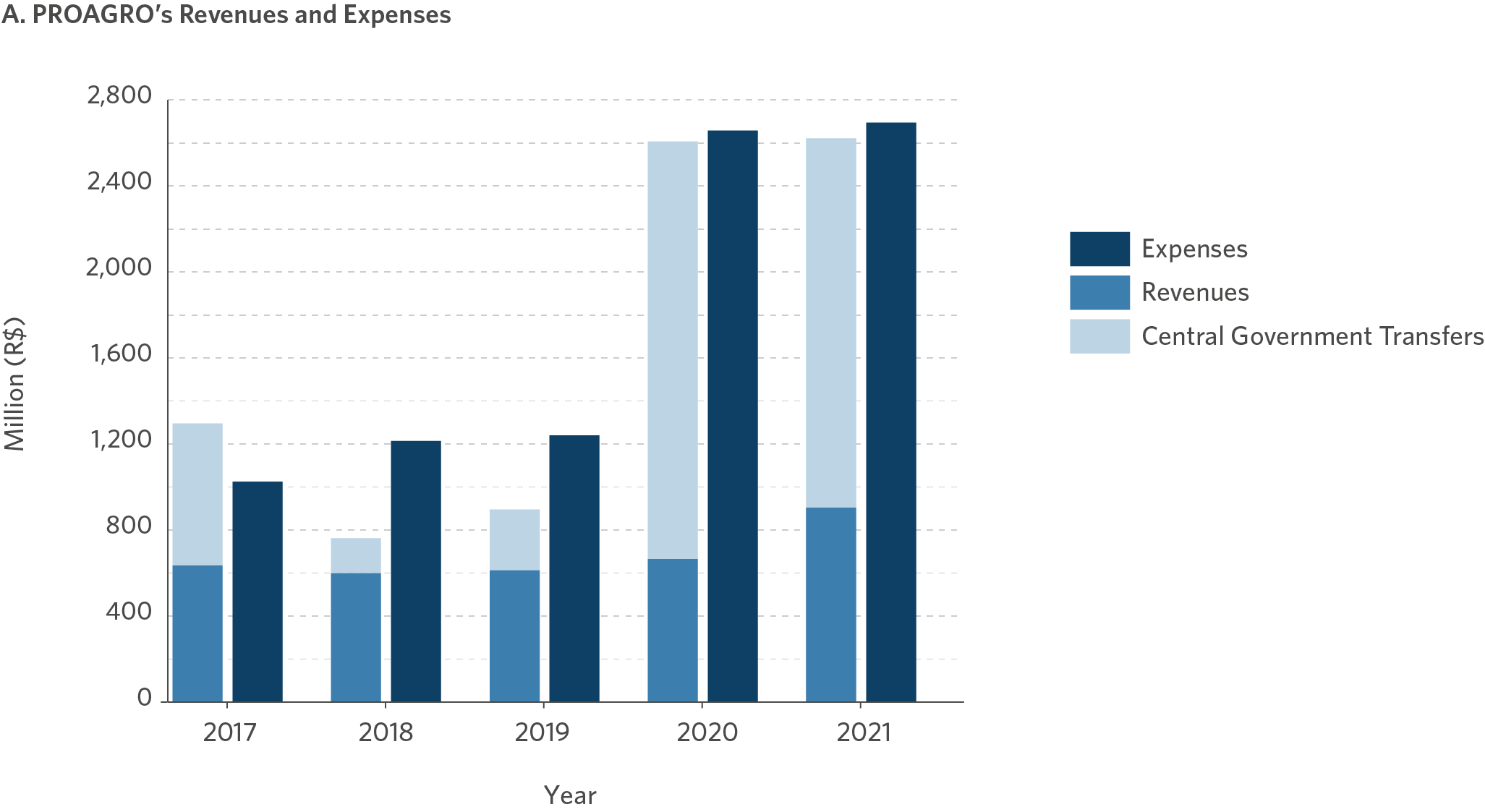

The mismatch between the trends observed for the additional and the granted coverage impacts PROAGRO’s accounts, as shown in Figure 8a. Despite the increase in premium revenues, PROAGRO demands an increasingly higher amount of central government transfers to cover expenses arising from the increase in claim events in recent years.

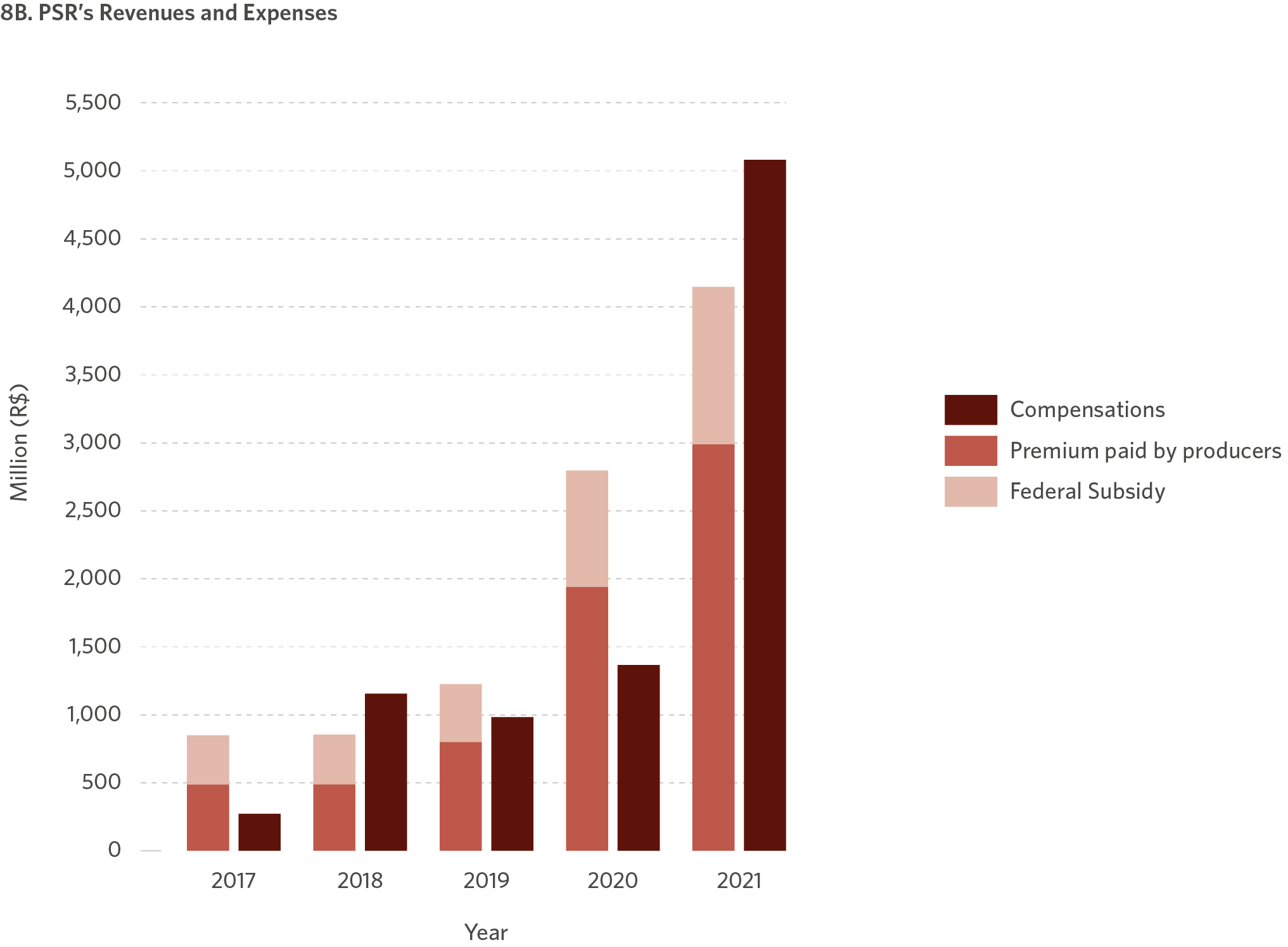

Figure 8. PROAGRO and PSR Revenues and Expenses, 2017 – 2021

Note: Revenues include: Contribution Income, Interest Income, Net Provisions and Other Income (excluding Central Government Transfers). Expenses include: Benefits Expenses, Loss Verification Service, Agents’ Salaries, Interest Expenses, Net Provisions, Administration Fees, and Other Expenses. PROAGRO expenses in 2021 differ from the R$ 5.8 billion in granted claims because the values in this chart refer only to expenses paid in the 2021 fiscal year. Values at December 2021 prices (IPCA-adjusted inflation).

Source: CPI/PUC-Rio with data from the BCB,[29] 2022

The PSR, on the other hand, shows an increase in the premium paid by producers due to the rising number of policies in recent years, as shown in Figure 8b. Although the federal subsidy has also increased, the amount of premiums paid by producers has grown at a much higher rate, indicating that rural insurance is becoming increasingly independent from the program. Moreover, although the PSR also recorded an increase in the number of compensations between 2019 and 2021, such increase occurred alongside an increase in premiums, which exceeded compensations in most years. In this sense, the PSR balance captured by the financial institutions operating rural insurance is positive.

Note: The premium paid by producers is the value of the insurance premium minus the federal subsidy. Values do not include other program income or expenses, such as expenses relating to the loss verification service and agents’ salaries. Values at December 2021 prices (IPCA-adjusted inflation).

Source: CPI/PUC-Rio with data from MAPA (Atlas of Rural Insurance and Open Data), 2022

Pathways to Advance Public Policy

The analysis of the data presented in this report shows that the design of one of the primary and oldest public rural insurance policies in Brazil, PROAGRO, generates incentives that reduce efficiency in the use of public resources. Comparing the rules and performance of PROAGRO and the PSR, it is clear that PROAGRO’s inefficiencies are related to the separation of the entity responsible for bearing the insurance risk (the government) from those that run the program (financial institutions).

Under PROAGRO, financial institutions have few incentives to check and monitor beneficiaries properly. As a result, the proportion of claims over the insured area and over the total value of policies is much higher in PROAGRO than in the PSR. Because PROAGRO has lower premiums that are close to those of the PSR, there has been a significant deterioration in the program’s accounts.

Other incentive problems should be considered in the design of PROAGRO and the PSR. Public insurance policies should be designed to encourage producers to use production techniques that reduce the risk of claim events. Furthermore, insurance claim adjusters should have incentives to ensure the veracity and legitimacy of the claim. Currently, some measures are already moving in this direction. Both PROAGRO and the PSR require their beneficiaries to produce in accordance with the ZARC, thereby reducing the risk of claim events. In addition, MAPA has encouraged investments in the training of rural insurance claim adjusters, aiming at improving the quality of the claim’s inspection process.

Additional measures may contribute to mitigating the risks associated with incentive problems. For example, some soil management techniques significantly improve soil dynamics and crop water availability, thus reducing weather-related risks. The inclusion of management criteria in the ZARC would reduce the moral hazard on the part of producers. Another example of a measure to restrict information asymmetry is the introduction of parametric insurance, which is a more accurate form of inspecting claim events at lower transaction costs.[30]

BOX 2. PARAMETRIC INSURANCE

Parametric insurance differs from traditional insurance by using pre-established values of an index as reference rather than conventional on-site loss assessments. For example, in case of excessive rainfall, compensation occurs when the rainfall value exceeds a parameter agreed upon by the insured and the insurer. It should be noted that in this insurance category, even where no significant losses in production have occurred, the producer may be entitled to compensation if the referred index for a weather event reaches the stipulated value.

In this sense, parametric insurance reduces information asymmetry between the insurer and the insured, since the index value is observed by all parties and addresses the issue of incentives to claim adjusters, as direct interactions between the beneficiary and the adjuster are drastically reduced. Moreover, this type of insurance entails low monitoring costs, as there is little need for audits and inspections.

However, the use of an objective index as a parameter for reimbursement in insurance policies can generate inefficiencies, because even if regional weather events have not seriously damaged the crops, compensation may still be required. The opposite is also true – i.e., yields significantly affected by weather events can be entitled to reimbursement at a sub-optimal amount.

Empirical evidence shows that rural producers increase investments in their farms when parametric insurance is provided. This is because investment restrictions for small producers are more associated with the risks faced by these producers than with financial constraint.[31]

In Brazil, a challenge in expanding this insurance model lies in the lack of effective and reliable data. In this sense, the recent case of the first parametric insurance policy, which uses data from the National Institute of Meteorology (Instituto Nacional de Meteorologia – INMET) and involves the issuance of negotiable derivatives at the Brazilian Stock Exchange (B3), may increase the availability of information and thus make this type of insurance feasible.

Migrating rural insurance policy resources to the PSR would mitigate some of the information problems highlighted in this report. There is a large intersection between the two programs regarding the main insured crops and assisted municipalities, but other challenges remain.

The budget aspect of the PSR has a component of uncertainty. As the amount of resources allocated to subsidize insurance policies is set by decree, the PSR budget may be subject to restrictions on the disbursement of resources, thus jeopardizing its execution and generating insecurity for producers as to the guarantee of access to subsidies to pay for insurance premiums.

Additionally, since the decision on the subsidy is made as insurance policies are received by MAPA, insurers have leeway to select the policies they prefer to submit. This can encourage insurers to choose producers with the highest payment potential to receive the subsidy and, therefore, offer policies at a higher premium. Consequently, a portion of the resources originally earmarked for producers would be captured by insurers.

Furthermore, since the decision on the subsidy is made after the policy has been purchased, producers do not know in advance whether they will receive it or not. Consequently, given the uncertainty regarding the value of the premium to be paid, small producers with greater financial restrictions may be discouraged from purchasing rural insurance. Therefore, establishing an evaluation rule for insurance contracts that gives producers greater predictability as to whether they will receive subsidies – and that affords more transparency to the order in which policies are submitted to MAPA – can improve the program and increase public spending efficiency.

Benefiting small producers requires the creation of mechanisms to prioritize them beyond PROAGRO. To some extent, MAPA has already been expanding the reach of the PSR by increasing the program’s annual budget and implementing a pilot project under the PSR for operations included in PRONAF in 2020. Lastly, it requires adapting the current PSR rules so that the program can include a greater diversity of crops and municipalities in regions where PROAGRO’s presence is even stronger. Although the government has announced a policy to allocate exclusive resources to the North and Northeast regions,[32] the number of insurance policies under the PSR in 2021 in both regions remained below 3% of the total policies subsidized by the program.

The current PSR subsidy with the use of public resources is justifiable from the point of view of promoting the growth of the rural insurance system. Once this system has been established, there will be efficiency gains associated with the reduction of risks related to adverse events and the guaranteed supply of essential goods, hence generating a return to society in the form of greater predictability in the grain and food market.

However, as shown in this report, the PSR has experienced significant growth in recent years, thus confirming the development – and possibly greater autonomy – of the rural insurance market in Brazil. In this sense, the maintenance of the PSR subsidy should also seek to promote positive changes in the Brazilian rural sector, stimulate sectoral productivity, and lay the groundwork for more sustainable agriculture. Allocating PSR and PROAGRO resources to producers that use more sustainable agricultural practices will ultimately contribute to reducing risks in agriculture.

The authors would like to thank Arthur Coelho for research assistance, Juliano Assunção, Wagner Oliveira, Leila Harfuch, and Gustavo Dantas for comments and suggestions, Natalie Hoover El Rashidy and Giovanna de Miranda for the editing and revision of the text, and Meyrele Nascimento and Julia Berry for formatting and graphic design. The authors also thank the Central Bank of Brazil and Agroicone for the valuable exchanges.

[1] According to the United States Environmental Protection Agency – EPA, eight of the ten hottest years on record have occurred since 1998. bit.ly/3Agqzda.

[2] Values at December 2021 prices (IPCA-adjusted inflation).

[3] Rothschild, Michael, and Joseph Stiglitz. “Equilibrium in Competitive Insurance Markets: An Essay on the Economics of Imperfect Information”. The Quarterly Journal of Economics 90, no. 4 (1976): 629-649. bit.ly/3QPA0WX.

[4] Bester, H. “Screening vs Rationing in Credit Markets with Imperfect Information”. American Economic Review 75, no. 4 (1985): 850–855. bit.ly/3tRXuk1.

[5] Broecker, T. “Credit Worthiness Tests and Interbank Competition”. Econometric 58, no. 2 (1990): 429–452. bit.ly/39NSupO.

[6] Stiglitz, Joseph. “Risk, Incentives and Insurance: The Pure Theory of Moral Hazard”. The Geneva Papers on Risk and Insurance 8, no. 26 (1983): 4-33. bit.ly/3OmLkbd.

[7] Holmstrom, B., and J. Trolley. “Financial Intermediation, Loanable Resources, and the Real Sector”. Quarterly Journal of Economics 112, no. 3 (1997): 663–691. bit.ly/3tVFrte.

[8] Townsend, Robert M. “Optimal Contracts and Competitive Markets with Costly State Verification”. Journal of Economic Theory 21, no. 2 (1979): 265-293. bit.ly/3tXKb1G.

[9] There are a number of indices and other more complex applications that can be used in the context of parametric insurance. An alternative is to use a variable trigger to define insurance disbursement (for example, by using rain variance relative to a reference path). Another alternative is to base the parametric insurance index on total losses estimated by a third party for a given event and sector.

[10] For more detail, see Table 2: Parametric Insurance.

[11] Central government transfers are recognized in PROAGRO’s financial statements at the time when the National Treasury disburses resources. The program uses the accrual basis of accounting, so temporary mismatches may occur due to the registration of provisions, the payment of which is made at a later date when the National Treasury transfers the funds. (BCB. Programa de Garantia da Atividade Agropecuária – Proagro. Demonstrações Financeiras. 2022. bit.ly/3QM6Es7).

[12] The Minimum Price Guarantee Policy (Política de Garantia de Preços Mínimos – PGPM), which aims to correct price distortions to producers, has not made any payments since 2019 due to the increase in exchange rate (MAPA. Government Support. 2022. bit.ly/3O2otkf).

[13] More information about ZARC can be found at bit.ly/3OD9Mor and bit.ly/3xYdxOO.

[14] BCB. PROAGRO Data Matrix. bit.ly/3QoklNK.

[15] The activity groups are: (i) grains (separated into soybean and other crops); (ii) fruit, vegetables, coffee, and sugarcane; (iii) forests; (iv) cattle; and (v) aquaculture. The table with subsidy limits can be found at: bit.ly/3HXhx6I.

[16] MAPA. Indicadores Gerais. 2022. bit.ly/3Q7Imsz.

[17] Assunção, Juliano, and Priscila Souza. Risk Management in Brazilian Agriculture: Instruments, Public Policy, and Perspectives. Climate Policy Initiative, 2020. bit.ly/3wlQInY.

[18] Central Bank Resolution no. 4,528 of 2016 implemented the rate differentiation by crop (bit.ly/3b519o0). Until the end of 2016, PROAGRO rates were not differentiated by crop type and had the following structure: (i) 2 percent for irrigated crops in any region and for dryland farming linked to PRONAF and located in the semi-arid region of the area of influence of the Northeast Development Superintendence (Superintendência do Desenvolvimento do Nordeste – SUDENE); (ii) 3 percent for non-irrigated, non-zoned projects linked to PRONAF and for those not linked to PRONAF located in the semi-arid region of the area of influence of SUDENE; (iii) 4 percent for other non-irrigated projects. Since crop-differentiated rates were implemented, they have remained stable or increased by a few percentage points (around 1 p.p. to 3 p.p.) by crop.

[19] CGSR. Programa de Subvenção ao Prêmio do Seguro Rural. Plano Trienal do Segro Rural 2019-2021. 2018. bit.ly/3n9GyC9.

[20] Secretaria de Política Agrícola – Comitê Gestor Interministerial do Seguro Rural. Resolução no. 40. 2015. bit.ly/3n1rEgS.

[21] TCU. Auditoria Operacional no Programa de Garantia da Atividade Agropecuária (PROAGRO) e no Zoneamento Agrícola do Risco Climático (ZARC). 2013. bit.ly/3OwaB2c.

[22] MAPA. Requisitos Básicos para Capacitação de Peritos Rurais. Brasília: AECS, 2020. bit.ly/39gKUDW.

[23] The basic requirements manual for training rural adjusters describes prior and monitoring inspections: MAPA. Requisitos Básicos para Capacitação de Peritos Rurais. Vol. 1. Brasília: AECS, 2020, p. 16. July 12, 2022. bit.ly/39gKUDW.

[24] MAPA. Resolução nº 40. 2020. bit.ly/3b7zbIp.

[25] MAPA. Resolução nº 89. 2021. bit.ly/3O6kQe4.

[26] CMN Resolution no. 4,418 of 2015 bit.ly/3OarVtX, revoked by CMN Resolution no. 4,903 of 2021 bit.ly/3yyTrLc.

[27] Although 2021 had a higher number of claims compared to the other years, the claims under PROAGRO are always higher than those under the PSR.

[28] ANA. Monitor de Secas. 2022. bit.ly/3Ny0WY4.

[29] BCB. Programa de Garantia da Atividade Agropecuária PROAGRO. Relatório Circunstanciado 2016 a 2019. sd. bit.ly/3N5dTbD. and BCB. Programa de Garantia da Atividade Agropecuária – Proagro. Demonstrações Financeiras. 2021. bit.ly/3HKlStU.

[30] Harfuch, Leila, and Gustavo Dantas Lobo. Seguro Rural no Mundo e Alternativas para o Brasil: Diferentes Desenhos e suas Interlocuções com a Adoção de Boas Práticas e Tecnologias. Agroicone. 2021. bit.ly/3A0YhmS.

[31] Karlan, D., R. Osei, I. Osei-Akoto, and C. Udry. “Agricultural Decisions after Relaxing Credit and Risk Constraints”. The Quarterly Journal of Economics 129, no. 2 (2014): 597–652. bit.ly/3bicLUP.

[32] MAPA. Programa de Seguro Rural apresenta novidades no Plano Safra. June 29, 2022. bit.ly/3uIg2ns.