Effective and large-scale mobilization of finance by public financial institutions (PFIs) for climate solutions is crucial to addressing the global climate investment gap. Given their counter-cyclical role and ability to link diverse financial and political actors, PFIs are integral to supplying, channeling, and catalyzing climate finance from a range of sources, particularly in emerging markets and developing economies (EMDEs).

Examining PFIs’ approaches, commitments, and actions on climate finance can help to identify gaps and opportunities for further action. This is important in the context of ongoing multilateral development bank (MDB) reforms, which may have trickle-down effects on smaller financial institutions.

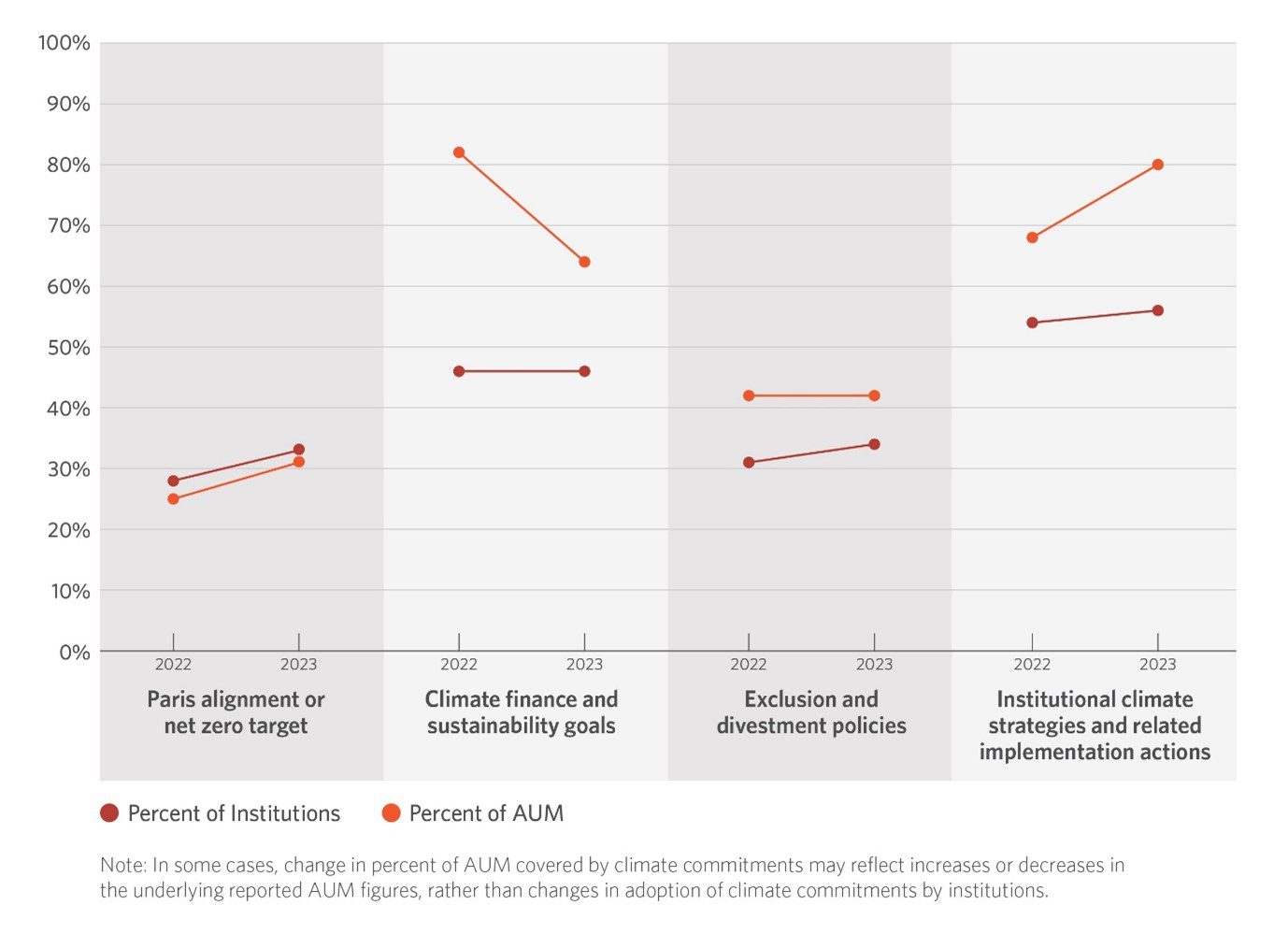

Since 2022, CPI has been tracking the commitments of the 70 largest PFIs covered by the Finance in Common Public Development Banks (PDBs) Database (Finance in Common, 2021; CPI, 2024). Our tracking covers mega, large, and medium-sized banks, which represent 94% of total assets under management (AUM) held by PFIs captured in the PDB database.

Our pilot exercise in 2022 found just 20 of the 70 PFIs, holding 25% of tracked AUM, to have net zero or Paris alignment targets (CPI, 2022a). The majority of these were MDBs, and many of the targets lacked specificity and were not supported by interim targets. CPI has now updated its tracking analysis for 2023 to evaluate whether any significant commitments were made by PFIs following COP27 and to understand how frequently larger PDBs are making or updating their commitments.

Key findings

Tracked commitments for 2023 show little change from the previous year. New commitments were only found for two institutions, both of which had already created climate strategies and goals. While these institutions deepened their climate action by setting net zero/Paris alignment targets, we found no by PFIs that were not already engaged on climate.

To complement the commitment tracking exercise, CPI has also reviewed the climate strategies of 49 micro- to medium-sized PFIs in EMDEs to identify examples of best practices in PFI climate action. The resulting case studies and analyses provide examples for how larger PFIs that have yet to act can overcome barriers and incorporate climate into their strategies and investment decisions.

The climate strategies of these smaller banks — selected across size, mandate, and various EMDEs — broadly suggest that mainstreaming of climate action does not correspond to institutional capacity and is instead most influenced by robust support from shareholder governments.

Recommendations

- Governments of countries with large or medium-sized PFIs that have not yet made climate commitments can implement strong Nationally Determined Contributions and support climate action in order to enable PFIs to develop climate strategies and make commitments.

- Large and medium-sized banks that feel constrained on climate action due to capacity issues should look to the ambitious smaller banks for examples of how to maximize impact with fewer resources.

- Additional analysis is needed on how to integrate climate considerations for PFIs with narrow mandates, particularly those working in high-emitting sectors.