In order to meet international climate goals, there is a collective challenge to “shift the trillions” in private capital to help drive the transition to a zero carbon, climate-resilient economy. Public sources of finance will not be able to meet this demand on their own.

As more initiatives among the business and investment community strive to ensure that their climate actions align with the Paris Agreement, in particular Article 2.1 (c) on ‘’making finance flows consistent with a pathway towards low GHG emissions and climate-resilient development,’’ tools will be needed to track overall progress against this ambition.

This brief, which is part of CPI’s work on tracking global climate finance flows, proposes a preliminary methodological approach and analytical framework to measure the nature and speed of shifts in private capital in response to climate change. It also outlines a way to present this information in a dashboard format, based on initial scoping of current publicly available data and methods completed in partnership with the European Climate Foundation in 2018.

The dashboard would ideally provide market participants, including both private capital investors and intermediaries, with:

– An accessible, at-a-glance overview of systemic progress.

– Insight into how their own market segment is performing (e.g. banking, insurance, listed equities, bonds).

– The ability to gauge whether their actions are sufficient to meet performance thresholds.

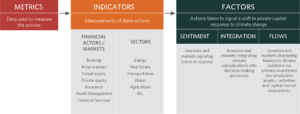

The dashboard framework includes three factors: sentiment and integration, capturing signals of investor intent and climate-proofed decision making, and flows, capturing primary financial flows in the real economy and secondary financial flows in the financial system. The brief identifies groups of indicators that could be used to assess each factor, covering each of the main financial system actors/markets and sectors. The brief then identifies potential data sources/metrics currently available that can help compile information for each indicator.

Two key limitations of the proposed dashboard are highlighted as areas for further work:

1. Current data gaps hinder the full realization of the proposed aggregate indicators. Further refinement of the framework and indicators, as well as collaborative data collection efforts, are needed to ensure the dashboard is as effective as possible in measuring and driving the shift in private capital.

2. Targets and benchmarks need to be further defined to enable an assessment of progress of different financial actors and markets, reflecting on both the scale and speed of progress.

As part of our continued work program aimed at comprehensively tracking the scale, nature, and sufficiency of global climate finance flows, CPI now looks to partners, old and new, to work jointly to consider ways to collectively implement and improve the dashboard proposed in this brief.