The Amazon is unique. Not only is it one of the most important carbon sinks on the planet, but it is also home to the largest stocks of biodiversity worldwide. The institutional environment and public policies for the Amazon are just as distinctive. Brazil has considerable experience in using public policy to fight tropical deforestation without a negative impact on agricultural production. In fact, between 2004 and 2012, deforestation rates in the Brazilian Amazon dropped 80% while the contribution of the region’s agricultural sector to the GDP increased.[1]

However, a significant increase in deforestation in recent years has undone some of the positive effects of these policies. This issue has become increasingly central at the international level, affecting the country’s image and trade agreements. Preserving the forest is essential for the protection of water resources, which, in turn, are essential for agricultural production.

Much of rural credit in the Amazon is related to livestock, particularly cattle production, which is often linked to deforestation. Near 99% of deforestation is illegal,[2] and from 1985 to 2017 around 80% of the deforested area in this biome was converted to pastures.[3]

Therefore, deepening the analysis of rural credit in the region is key to understand how this important agricultural policy works and to better align government incentives with the country’s sustainability objectives. Access to credit must be directed to producers in accordance with the Forest Code, which requires the preservation or restoration of native vegetation in private areas. Forest protection is a public good. Therefore, aligning credit with compliance requirements for the Forest Code can justify, from an economic point of view, directing public resources to the agricultural sector. Another important step in this direction, of aligning agricultural policy with sustainability, is the Central Bank of Brazil’s recent initiative to create the Green Credit Bureau (Bureau Verde), a register of information on rural credit operations that will contain sustainability indicators.

In this brief, researchers from the Climate Policy Initiative/Pontifical Catholic University of Rio de Janeiro (CPI/PUC-Rio) deepen the understanding of rural credit in the Amazon biome,[4] building on previous foundational research on rural credit in Brazil, which outlined its impacts and provided policy recommendations.[5] By focusing on the characteristics of the Amazon region and its agricultural sector, the analysis reveals six specific standards and conditions of rural credit, providing evidence for public actions and policies for local development, the sustainability of agricultural production, and environmental conservation.

This analysis of the credit market in the Amazon biome points to low competition and insignificant participation by private funds and institutions; limited access, and a focus on cattle production. A financial structure tailored to the Amazon biome is essential to achieving productivity gains and reducing deforestation.[6]

BOX 1. MAIN CHARACTERISTICS OF RURAL CREDIT IN THE AMAZON

1. Most rural credit in the Amazon region is channeled to cattle farming: 57% of the amount of credit operations in the Amazon biome were related to cattle production in the 2019/20 agricultural year. This is in stark contrast with the rest of the country, where only 32% of rural credit is used to finance this activity. Deforestation in the Amazon has strong ties to cattle production.

2. Producers in the Amazon have less access to credit than producers elsewhere in the country. The 2017 Agricultural Census[7] found that 13% of all Brazilian rural producers were located in the Amazon.[8] The Amazon was home to 30% of the nation’s cattle herd and its agricultural production corresponded to 11% of the total value of national agricultural production according to IBGE data. However, in the 2016/17 agricultural year, the value of rural credit operations in the municipalities of this biome corresponded to only 7.2% of total rural credit in Brazil, indicating an underrepresentation of the Amazon in credit statistics. Limited access to credit represents an obstacle to intensifying and increasing cattle productivity, as suggested by a previous study by CPI/PUC-Rio.[9] Thus, the low availability of credit contributes to more extensive agricultural production because there are fewer resources available for investing in intensification, thus generating greater deforestation.

3. Agricultural activities in the Amazon are less business-oriented than the rest of the country. The amount of rural credit borrowed by companies in the biome accounted for a mere 4.8% of the region’s total in the 2019/20 agricultural year, while the volume of credit directed to companies elsewhere in Brazil accounted for 26% of the rest of Brazil in the same period. Regarding the use of credit, the categories “trade” and “industry”, which are typical for agriculture enterprises, corresponded to only 3.6% and 0.3% of the credit volume in the Amazon biome, which is much lower than in other parts of Brazil. The low prevalence of a more business-oriented agriculture is tied to lower investments and intensified production.

4. Regarding credit distribution channels, producers have limited credit options. There is a predominance of two public banks in the operation of rural credit in this biome: Banco da Amazônia and Banco do Brasil. In the 2019/20 agricultural year, either Banco do Brasil or Banco da Amazônia was the main source of rural credit in 78% of municipalities in the region.[10] The lack of other financial institutions offering rural credit in many municipalities indicates that there is little competition among banks offering credit, limiting options for producers.

5. For many years, the main source of financing for rural credit in the biome was the Northern Constitutional Fund (Fundo Constitucional do Norte – FNO), even though its total contribution to rural credit funding at the national level was insignificant. Since the 2011/12 agricultural year, other sources of funding (Compulsory Resources and Rural Savings) have become dominant, much like in the rest of the country. Agriculture Credit Notes (Letras de Crédito Agrícola – LCA) also gained considerable space in the composition of credit available for the biome, but more modestly so than they did in the rest of the country. LCA are private investments backed by loans granted to rural producers or cooperatives. The lower prevalence of these investments in the Biome implies a lower availability of credit.

6. There is a greater relevance in the Amazon of credit volumes offered by National Program for Family Farming (PRONAF) and National Program to Support MediumSized Rural Producers (PRONAMP). In the 2019/20 agricultural year, PRONAF’s operations in the Amazon accounted for 17% of total credit, while PRONAMP’s operations accounted for only 10%. In the other biomes, both PRONAMP and PRONAF accounted for 15% of the total value of operations in 2019/20. This may be explained by the fact that a criterion for PRONAF eligibility is“that the property does not exceed four fiscal modules. Since fiscal modules’ sizes varies by municipality and the largest fiscal modules were defined for the Amazon region, producers with relatively larger properties in the region are able to access PRONAF.

1. AMAZON, AGRICULTURE, AND THE ROLE OF RURAL CREDIT

The Brazilian Amazon is an environmental asset of critical importance to the country and the entire world. Between 2002 and 2019, the share of forest areas in the biome as a whole declined from 84% to 79%,[11] while the area devoted to livestock production rose from 10% to 13% in the same period. Planted areas, on the other hand, grew much less over this 17-year period, from 1% to 2%.

Agricultural production also increased in the Amazon biome. While the value of agricultural production in the Amazon grew 272% between 2002 and 2019 (to a total of R$ 39.54 billion), the growth rate for the rest of Brazil was 84% (with a total production value of R$ 321.47 billion).[12] As such, agriculture in the Amazon region accounted for 11% of the country’s production in 2019, compared to only 6% in 2002 (Figure 1). Soy was the primary driver of this increase. In 2002, the soy produced in the biome was valued at R$ 1.8 billion, equivalent to 17% of the total agricultural production in the region. By 2019 this amount had reached R$ 17.7 billion, corresponding to 45% of the total value of agriculture in the biome. Elsewhere in Brazil, the value of soy produced was R$ 107.9 billion in 2019, equivalent to 34.6% of the value of agricultural production in the rest of the country. Livestock also experienced a relevant expansion in the biome. The region’s cattle herd grew 107% between 2002 and 2019, while for the rest of the country the growth rate was 8%.[13] This means that 31% of the country’s herd were raised in the Amazon region in 2019, which is a 9% increase from 2002.

Figure 1. Evolution of Amazon’s Share in Brazil’s Agricultural Production (2002-2019)

Source: CPI/PUC-Rio with data from IBGE’s Produção Agrícola Municipal (PAM) and Pesquisa da Pecuária Municipal (PPM), 2021

This increase in production with an emphasis on certain products is reflected in the composition of rural credit in the biome. As seen in Figure 2, 81% of the number of contracts and 57% of the amount of credit operations in the Amazon biome in the 2019/20 agricultural year were related to cattle farming. These numbers are considerably higher than in the rest of the country, where 56% of the number of contracts and 32% of the value of credit operations are used for livestock activities. Regarding crop production, the highlight in the Amazon biome is soy, which accounts for approximately 18% of the total value of contracts, a proportion similar to the rest of the country (where 21% of the total value of credit contracts is related to soy).

Figure 2. Rural Credit Composition by credit Volume and Activity in the Amazon, 2019/20

BY ACTIVITY

BY PRODUCT

Note: The category “Others” entails cotton, rice, eucalyptus, sugarcane, açaí, and other 88 products.

Source: CPI/PUC-Rio with data from SICOR from Central Bank of Brazil, 2021

2. CREDIT RESTRICTIONS ARE MORE STRINGENT IN THE AMAZON

Producers in the Amazon region have less access to credit than the in rest of the country. As Figure 3 shows, the share of rural credit in the Amazon biome has historically been very low. Over the last 20 years, on average only 7.5% of the total number of contracts and 6.3% of the total amount of rural credit went to producers in the Amazon. Agriculture Census data show 679,000 agricultural producers in the Amazon biome in 2017,[14] equivalent to 13% of all agricultural producers in Brazil. This is an 11% increase from the number of producers in the Amazon in the 2006 Census.[15] As such, producers in the region face greater restrictions when seeking rural credit.

Figure 3. Evolution of the Number and Volume of Rural Credit Contracts in the Amazon and Other Biomes, 2000/01 – 2019/20

3a. Evolution of the Number of Contracts

3b. Evolution of Volume of Contracts

Note: Data refers to rural credit contracts and considers working capital, investment, trade, and industrialization. December 2020 constant values (inflation adjusted by IPCA).

Source: CPI/PUC-Rio with data from RECOR and SICOR from Central Bank of Brazil, 2021

The average value of rural credit contracts in the Amazon region has been increasing. Today, it exceeds the average amount for the rest of the country by 54% (Figure 4). The average amount of credit agreements in the biome region in the 2019/20 agricultural year was R$ 155,000, a 529% increase from the average amount in the 2000/01 agricultural year.[16]

Figure 4. Evolution of the Average Value of Rural Credit Contracts in the Amazon and Other Biomes, 2000/01 – 2019/20

Note: Data refers to rural credit contracts and considers working capital, trade, and industrialization. December 2020 constant values (inflation adjusted by IPCA).

Source: CPI/PUC-Rio with data from RECOR and SICOR from Central Bank of Brazil, 2021

Historically, agriculture and livestock farms[17] in the Amazon biome were larger than in the rest of the country (Figure 5). In the Amazon, the ratio between the total area of agriculture and livestock establishments (in hectares) and the number of producers in 2017 was 125.98, 4.62% higher than in 2006. In the biome, the average area of establishments devoted to agriculture in 2017 was 61.90 hectares (14.56% greater than the average area in the 2006 census), while those devoted to livestock featured an average of 203.75 hectares (a 1.03% drop from 2006). In the rest of the country, on the other hand, the ratio between the total area of agricultural farms (in hectares) and the number of producers in 2017 was 60.47, a 6.18% increase from 2006. For the other biomes, the average area of establishments devoted to agriculture in 2017 was 42.14 hectares (22.07% greater than the average area in 2006), while the average area devoted to livestock was 74.41 hectares (8.7% lower than in 2006). These reductions in the average area of farms for livestock in the rest of the country are related to the greater intensification of production.

Figure 5. Average Area of Agricultural Farms from 2006 to 2017, in the Amazon and Other Biomes

3. BORROWERS AND PURPOSES OF RURAL CREDIT

In the Amazon, individuals account for 99.7% of all contracts and 95.2% of the total amount of rural credit in the 2019/20 agricultural year. In the rest of the country, the average number of contracts with individuals is similar to the Amazon at 99.4% in 2019/20. However, the difference in the percentage of total credit allocated to each region is quite stark. Although only 0.6% of credit agreements are signed with firms, they accounted for 26% of the amount of credit borrowed that year in the rest of Brazil (Figure 6). The data suggest that companies in the Amazon not only account for a small percentage of the number of rural credit contracts, but also that the contracts are for considerably lower amounts than in the rest of the country. Therefore, agriculture in the Amazon biome seems not to be very business-oriented, which is tied to lower investments and less intense production.

Figure 6. Number of Contracts and Rural Credit Volume by Producer Type in the Amazon and Other Biomes, 2019/20

Source: CPI/PUC-Rio with data from RECOR and SICOR from Central Bank of Brazil, 2021

As for the purpose of credit, the situation is similar to the rest of Brazil: most rural credit in the Amazon is directed toward working capital and investment contracts, both for the number of contracts and in contracted amounts (Figure 7). In the 2019/20 agricultural year, 36% of all contracts in the Amazon (compared to 43% for the rest of the country) and 53% of the total amount of credit in the biome (compared to 57% for the rest of the country) was used for working capital.

Figure 7. Evolution of Number of Contracts and Rural Credit Volume by Credit Type in the Amazon, 2000/01 – 2019/20

7a. Number of Contracts

7b. Rural Credit Volume

This does not hold true for credit used for investment. Besides the proportion of investment contracts being higher in the Amazon than in the rest of the country for the 2019/20 agricultural year (64% for the Amazon biome and 56% for the rest of the country), the amounts allocated for investment differ greatly. In the Amazon biome, investment contracts received 43% of the amount of available credit; in the rest of the country, only 24% were used for that purpose. The 19-point difference was almost entirely offset by the fact that very little credit was used for trade and industry[18] in the Amazon biome, which are typical categories for more business-oriented agriculture. In 2019/20 only 0.7% of the contracts and 3.6% of the credit amount were used for trade, while in the rest of the country it was 1.3% of all contracts and 13% of the total amount. Credit for industrialization accounted for only 0.01% of all contracts and 0.3% of the total amount available for the biome, compared to 0.1% of contracts and 6.4% of the credit amount for the rest of Brazil.

4. CREDIT DISTRIBUTION CHANNELS: THE PREVALENCE OF PUBLIC BANKS

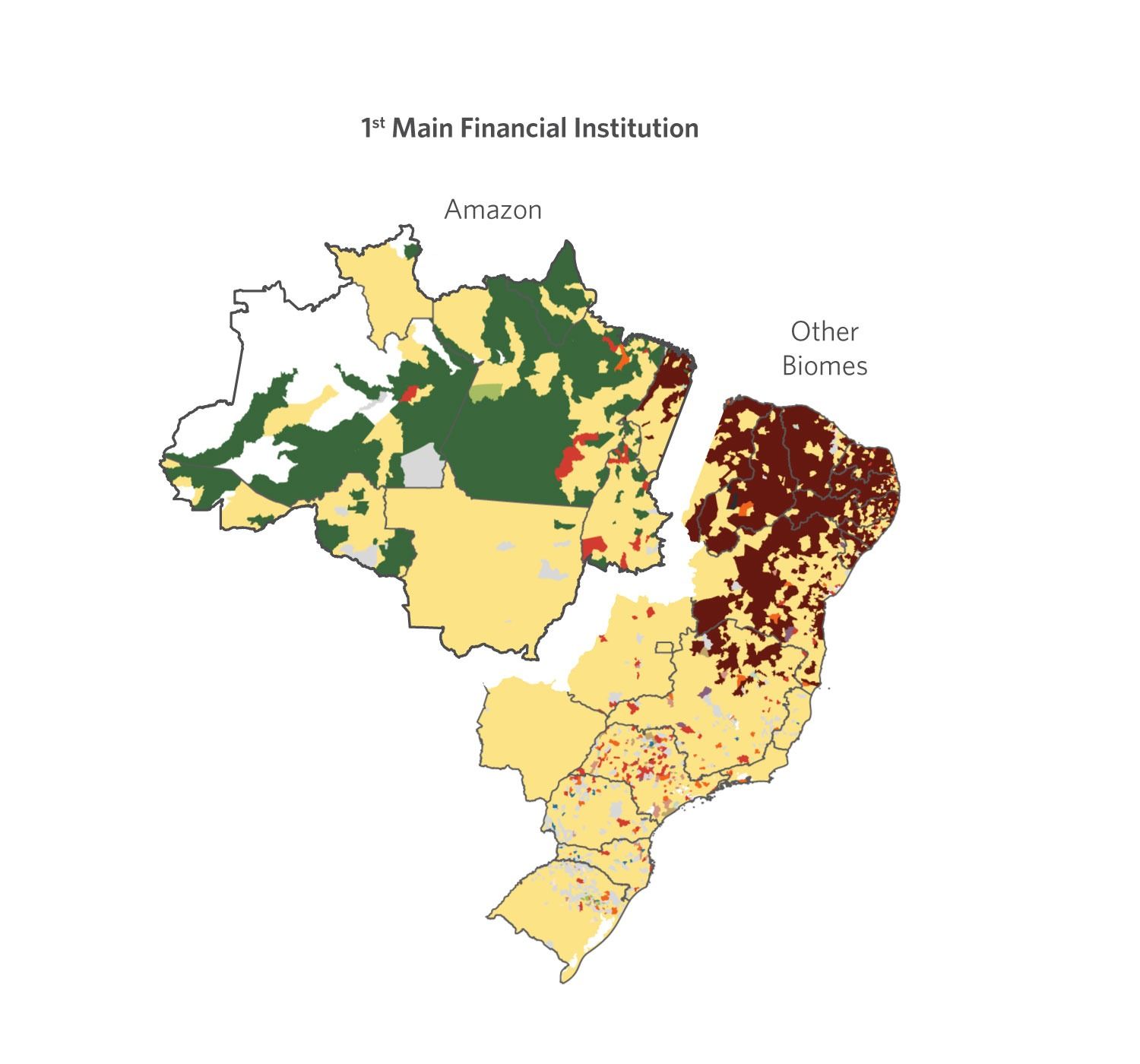

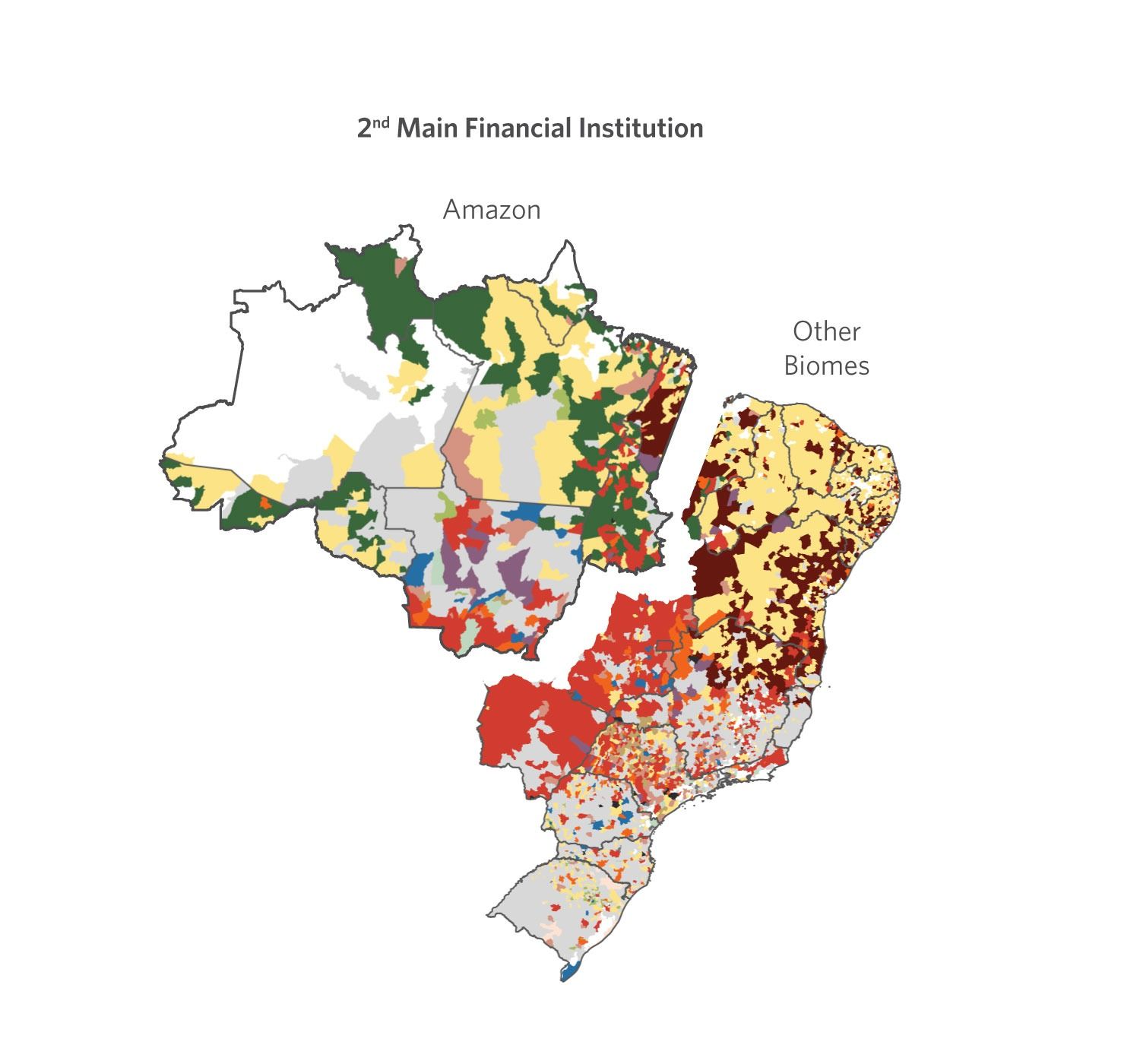

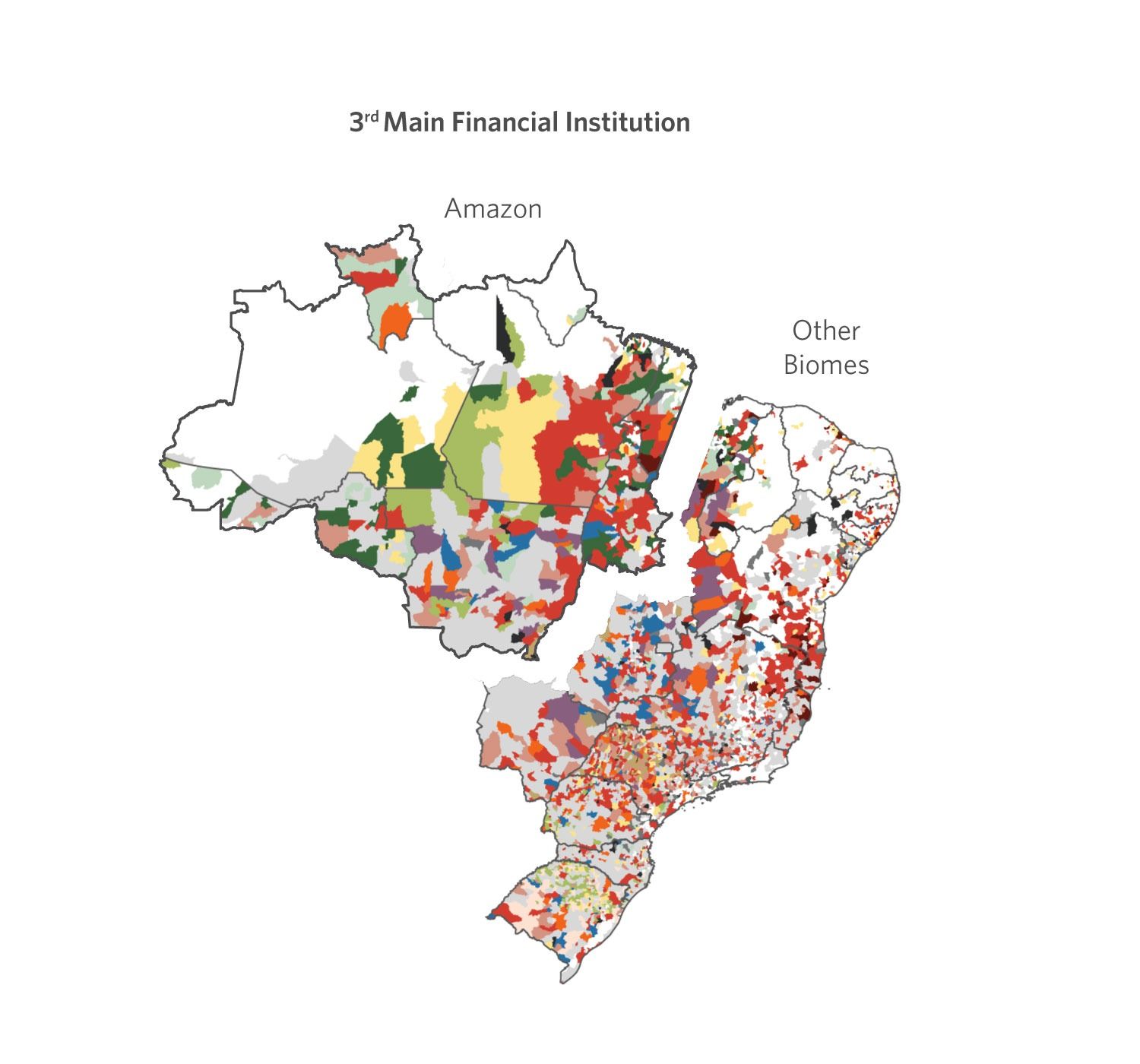

Competition in rural credit markets in the Amazon is low, which means there are few alternatives available in the region for farmers to get loans. Figure 8 shows the three main financial institutions for each municipality in the Amazon. In most municipalities, Banco do Brasil or Banco da Amazônia are the primary supplier and, where this is not the case, one of these two banks are the second or third largest suppliers.

Figure 8. Main Rural Credit Provider by Municipality in the Amazon and Other Biomes, 2019/20

Note: The main financial institutions are defined as those that lend the highest volume of credit in each municipality.

Source: CPI/PUC-Rio with data from RECOR and SICOR from Central Bank of Brazil, 2021

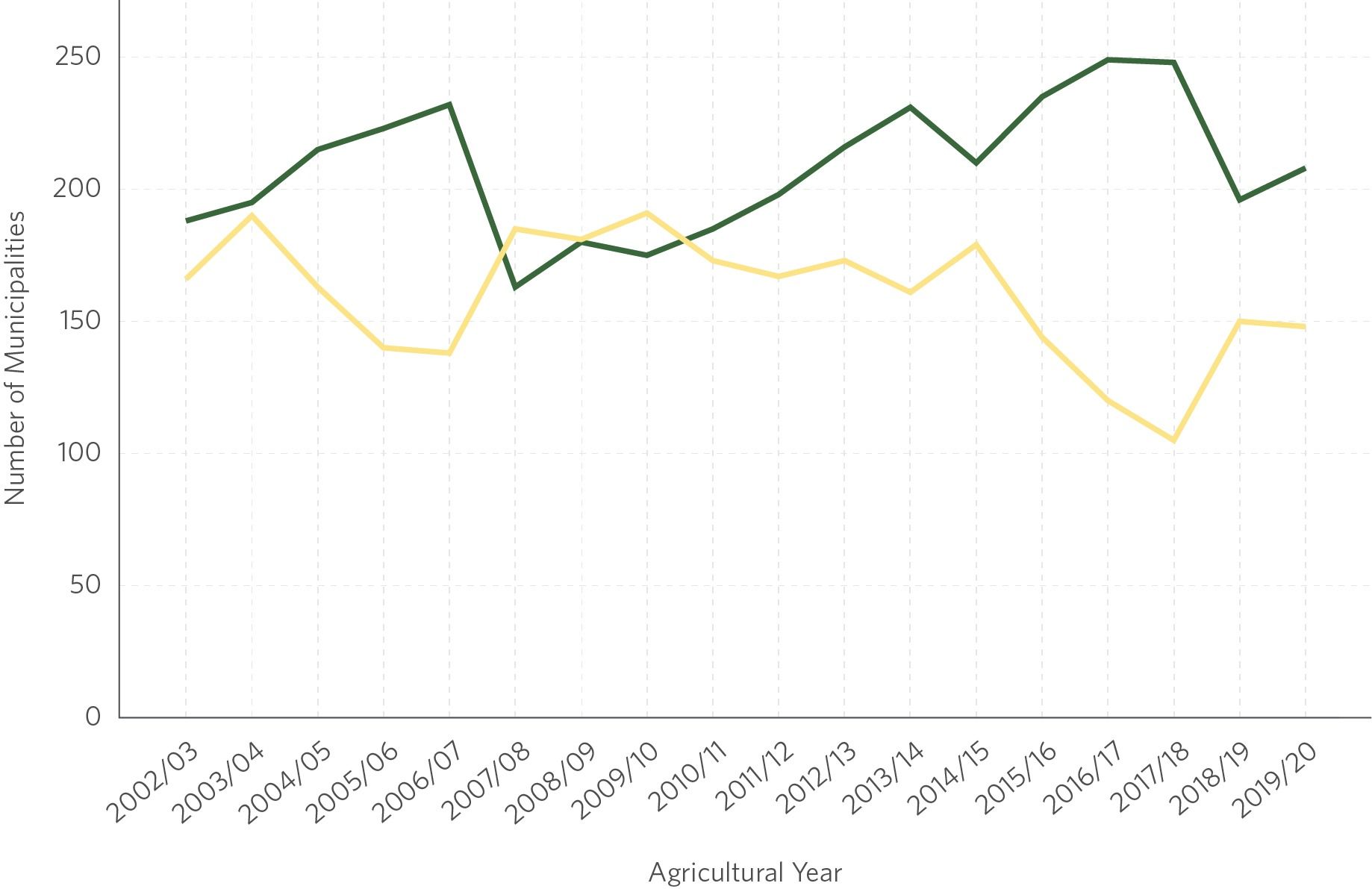

Figure 9 shows that the competitive landscape of the sector has had little change between the 2002 and today. In 2019/20, Banco do Brasil was the main supplier of rural credit in 208 municipalities, while Banco da Amazônia was in 148 ones, meaning that these two credit providers are the main suppliers for over 70% of the region. The same banks accounted for 44% and 17% of the volume lent in the same agricultural year. Although other banks account for the remaining 39%, they do not have the same spatial penetration, thus preventing many producers from accessing these competitors in the credit market. Promoting greater competition among financial institutions, by creating instruments to ensure greater participation by private banks and cooperatives, can make the credit distribution system more efficient in the region.

Figure 9. Number of Municipalities and Share of Credit Volume by Financial Institution, 2002/03 – 2019/20

5. PRIMARY SOURCES OF FUNDING FOR RURAL CREDIT

In the 2019/20 agricultural year, the three main sources of funding in the Amazon were Compulsory Resources, the FNO and Rural Savings – Restricted (Figure 10). Compared to the rest of the country, Compulsory Resources and Rural Savings – Restricted also featured among the main sources of funding for rural credit, but elsewhere in the country, LCA come in second place.

Figure 10. Evolution of Rural Credit Volume by Funding Source in the Amazon, 2000/01 – 2019/20

The FNO has, historically, been an important source of funds for northern Brazil, accounting for almost half of the rural credit in the region (49% in the 2000/01 agricultural year). However, the FNO has lost ground more recently, falling to a mere 17% of credit in the Amazon in 2019/20. This source of funding is operated exclusively by Banco da Amazônia; accounts for 96% of the number of rural credit contracts signed by the bank and 91% of the volume of loan funds. In 2019/20, only 2.3% of FNO funds were allocated to the National Program for Low-Carbon Emissions in Agriculture (Programa para Redução da Emissão de Gases de Efeito Estufa na Agricultura – ABC) and 8.3% to PRONAF. This means that 89.3% of its funds were loaned per FNO’s own distribution rules. In 2019/20, only 1% of FNO rural credit contracts and 7.5% of the total amount were directed to firms. Of the remainder (borrowed by individuals), 64% of the contracts – but only 6% of the total amount – were linked to PRONAF. With regard to the activities financed by the FNO, 31% of the contracts and 32% of the amount went to agriculture, while 69% of the contracts and 68% of the value went to livestock in 2019/20.

LCA, currently the second largest source of funding for rural credit in the rest of the country, also make up a considerable source of funds for the Amazon region. In the 2014/15 agricultural year, LCA accounted for only 0.1% of funding sources in the biome; by the following year, this number jumped to 5% and by 2019/20 it was 12%. Elsewhere in the country, LCA accounted for 0.5% in 2014/15 and 9% the following year; in 2019/20, LCA were responsible for 16% of all rural credit available.

6. RURAL CREDIT PROGRAMS

In an assessment of rural credit programs in the Amazon biome, PRONAF, a credit program aimed at small producers and family farming, is relevant and shows little variation in the historical series under analysis, both in the Amazon and in other Brazilian biomes. In the 2019/20 agricultural year, PRONAF credit operations in the Amazon accounted for 17% of all credit volume and 73% of the number of rural credit contracts. In the rest of the country PRONAF’s credit operations corresponded to 15% of the total amount of available credit and 73% of credit contracts in the 2019/20 agricultural year. PRONAF rules limit credit access to producers that own areas up to 4 fiscal modules in size.[19] Because the size of fiscal modules varies by municipality and the largest fiscal modules are in the Northern region, Amazon producers with larger properties can still access PRONAF, whereas in other parts of the country farms of these sizes would not be eligible.

PRONAMP, a credit program aimed at medium-sized producers, has had a different trajectory (Figure 11). PRONAMP, grew less in the Amazon biome than in the rest of the country. PRONAMP credit operations in the Amazon accounted for 0.3% of the total amount of credit in 2000/01, rising to 10% in 2019/20. Though relevant, this figure remains significantly lower than the percentage for PRONAF operations, which was 17% in that same year. In the other biomes, PRONAMP has grown sharply since 2000/01, becoming as relevant as PRONAF in credit volume. Both programs accounted for 15% each of the total amount of operations in 2019/20.

Figure 11. Evolution of Rural Credit Volume by Program in the Amazon, 2000/01 – 2019/20

CONCLUSION

This brief delves deeper into previous analyses of rural credit, focusing on the Amazon biome. Rural credit in the region has increased in recent years, but producers in the biome continue to have less access to credit than those in the rest of the country. The main credit providers are public banks, Banco do Brasil and Banco da Amazônia, and face little competition. Furthermore, agricultural activities in the Amazon are less business-oriented than in the rest of the country, as evidenced by the low amount of credit going to enterprises and also by few credit contracts directed to trade and industrialization in this biome. Sources of credit in the region have diversified in recent years, as the FNO loses prominence and private funds – such as the LCA – gain more ground. Nevertheless, this increase in private funding has not significantly changed the financial institutions operating rural credit in the region.

Deforestation in the Amazon has increased in recent years, and 99% of it is illegal. Much of the rural credit in the region finances cattle production, an activity often linked to deforestation. With international markets increasing focus on environmental sustainability, a more transparent and efficient credit system may contribute to the preservation of the biome. Credit must be made accessible to environmentally responsible producers who abide by the Forest Code and employ good land use practices. Greater alignment of credit instruments with the Forest Code – with new ways to verify compliance – presents an opportunity for public policy to generate incentives for economic and social well-being. The Central Bank of Brazil’s recent initiative to create the Bureau Verde is an important step in that direction.

The authors would like to thank the excelent research suport given by Solange L. Gonçalves, Eloiza R. F. de Almeida, and Nathalia Lima de Oliveira. We also would like to thank Natalie Hoover El Rashidy, Giovanna de Miranda, and Jennifer Roche for revision and editing, and Matheus Cannone and Nina Oswald Vieira for the graphic design work.

[1] Gandour, Clarissa. Why Is Protecting the Amazon Important?. Rio de Janeiro: Climate Policy Initiative, 2019. bit.ly/38ImgZE.

[2] MapBiomas. Sistema de Validação e Refinamento de Alertas de Desmatamento com Imagens de Alta Resolução. V. 5.0. 2019. bit.ly/2Os44wr.

[3] Silva, Daniel, et al. Fluxos financeiros para a pecuária na Amazônia Legal. Brasília: IPAM, 2019. bit.ly/3tB7LyP.

[4] The authors used as definition of the Amazon biome the minimum geographical unit of the Brazilian territory, municipalities. When municipalities had more than one biome, the classification was made based on the identification of the predominant one. That is, a municipality is classified as belonging to the Amazon if most of its territory is composed by this biome.

[5] Souza, Priscila, Stela Herschmann, and Juliano Assunção. Rural Credit Policy in Brazil: Agriculture, Environmental Protection, and Economic Development. Rio de Janeiro: Climate Policy Initiative, 2020. bit.ly/2QIbaxB.

[6] Bragança, Arthur and Juliano Assunção. Pathways for Sustainable Agricultural Production in Brazil: Necessary Investments and Potential Gains of Increasing Efficiency. Rio de Janeiro: Climate Policy Initiative, 2019. bit.ly/2ROtTI9.

[7] The reference period for the 2017 Agricultural Census is from 10/01/2016 to 9/30/2017.

[8] IBGE. Agricultural Census. 2017. bit.ly/38FjG6j.

[9] Souza, Priscila, João Mourão, and Juliano Assunção. The Impact of Rural Credit on Agriculture and Land Use: An Analysis of Brazilian Biomes. Rio de Janeiro: Climate Policy Initiative, 2021. bit.ly/3t8QfRG.

[10] Considering all 356 municipalities with more than 50% of their territory classified as part of the Amazon biome.

[11] MapBiomas. Sistema de Validação e Refinamento de Alertas de Desmatamento com Imagens de Alta Resolução. V. 5.0. 2019. bit.ly/2Os44wr.

[12] IBGE. Produção Agrícola Municipal. 2019. bit.ly/3cE0Ygy.

[13] IBGE. Pesquisa da Pecuária Municipal. 2019. bit.ly/3s3EY5e.

[14] Number of agricultural properties is used as a proxy for agricultural producers. It refers to all categories of producers based on their relationship to the land (i.e., owners, settlers, tenants, partners, occupiers, or producers without areas). In the rest of the country, the number of producers dropped from 4.56 million in 2006 to 4.39 million in 2017. In other words, there was a 4% decrease between the two censuses.

[15] The Amazon biome accounted for only 5% of all rural credit available in 2006, and for 7.6% in 2017.

[16] All figures in this report have been deflated according to the Broad Consumer Price Index (Índice de Preços ao Consumidor Amplo – IPCA) and are shown in constant December 2020 prices.

[17] According to the Census, agricultural farms are any production or exploration units devoted, partially or in full, to agricultural, livestock, forestry and aquaculture activities, regardless of size, ownership (whether they belong to a single producer, to several producers, to a company or to a group of companies), or location (urban or rural area) for production purposes, either for sale (trade) or subsistence (livelihood of producers and their families). The area of any given agricultural establishment is, therefore, the total area devoted to these activities as identified in the census. This area is subdivided into nine groups: i) production of temporary crops; ii) production of vegetables and flowers; iii) production of permanent crops;

iv) production of certified seeds and seedlings (these four groups were grouped together as Agriculture, as shown in Figure 3);

v) livestock farming; vi) forest production – planted forests; vii) forest production – native forests; viii) fishing; ix) aquaculture. This analysis depicts only the most relevant groups: agriculture and livestock farming.

[18] According to the Rural Credit Manual (Manual de Crédito Rural), the purpose of trade credit is to provide rural producers or their agricultural cooperatives with the resources necessary to commercialize their products on the market. Credit for industrialization is intended for rural producers or cooperatives seeking to industrialize agricultural products, provided that, at least, 50% of the production to be processed is produced by the company itself (or by associates).

[19] The fiscal module unit originated in the 1980s. It is defined by INCRA as “the minimum area where agricultural activity can provide, in each municipality, subsistence and social and economic progress to the families who invest their workforce”.