Indonesia’s government has ambitious dual revenue and emission reduction goals: its 2015 revenue targets are 21% higher than 2014 targets, and it aims to reduce emissions 29% by 2030. These dual goals make it a growing priority to find ways to encourage productive land use that can generate domestic revenue, while also curbing emissions and deforestation.

In a series of two studies, CPI’s analysis indicates that Indonesia has opportunities to improve its fiscal policy frameworks to meet both goals simultaneously. The first study, “A Framework for Analysis” looks at land use revenues broadly, pointing to promising opportunities to address inefficiencies. The second study, “Early Insights on Taxation in the palm oil supply chain” looks at how to incentivize higher productivity models in the palm oil sector, more specifically.

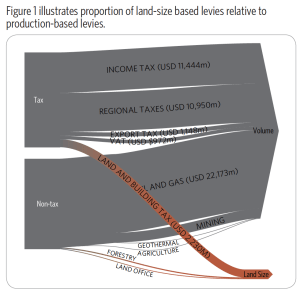

While there is observable GDP growth in the land use sector, government revenue is not experiencing the same growth rates (Ministry of Finance 2013). And while the tax-to-GDP ratios of some land use sectors, such as oil and gas and mining, are moderately healthy, other sectors, such as agriculture, are under-performing at a tenth of Indonesia’s average tax-to-GDP ratio (Prastowo 2013, Arnold 2012). At the same time, our analysis reveals that most revenue streams in Indonesia are based on production instead of land size. There is therefore no disincentive for producers using land unproductively, since levies will be the same whether production is done intensively or extensively.

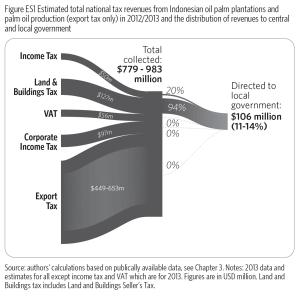

While there is observable GDP growth in the land use sector, government revenue is not experiencing the same growth rates (Ministry of Finance 2013). And while the tax-to-GDP ratios of some land use sectors, such as oil and gas and mining, are moderately healthy, other sectors, such as agriculture, are under-performing at a tenth of Indonesia’s average tax-to-GDP ratio (Prastowo 2013, Arnold 2012). At the same time, our analysis reveals that most revenue streams in Indonesia are based on production instead of land size. There is therefore no disincentive for producers using land unproductively, since levies will be the same whether production is done intensively or extensively. Indonesia is the largest producer of palm oil, which makes a significant contribution to the national economy. However, palm oil is also a primary driver of deforestation and greenhouse gas emissions.

Indonesia is the largest producer of palm oil, which makes a significant contribution to the national economy. However, palm oil is also a primary driver of deforestation and greenhouse gas emissions.