This publication is CPI’s analysis of Green FIDC, an innovative climate finance instrument endorsed by the Global Innovation Lab for Climate Finance (the Lab). CPI serves as the Lab’s Secretariat. Each instrument endorsed by the Lab is rigorously analyzed by our research teams. High-level findings of this research are published on each instrument, so that others may leverage this analysis to further their own climate finance innovation.

Context

Renewable energy and energy efficiency are crucial components of Brazil’s 2030 climate goals as the country aims to increase energy efficiency by 10% and reach a share of 23% non-hydro renewables in the electricity sector by 2030. In order to meet these targets, access to low-cost, long-term finance is critical.

There is a major funding shortfall for green projects in Brazil. The Brazilian National Development Bank (BNDES) provides most of the finance to renewable energy projects but the recent economic recession and new fiscal constraints have dropped project lending to its lowest since 2007. Most projects rely on this financing and this has put their viability in question. Long-term private finance is needed to fill the gap, but the market in Brazil is not well developed.

Approach

The Green FIDC builds on an existing financial structure in Brazil to provide lower-cost, long-term capital to renewable energy and energy efficiency projects

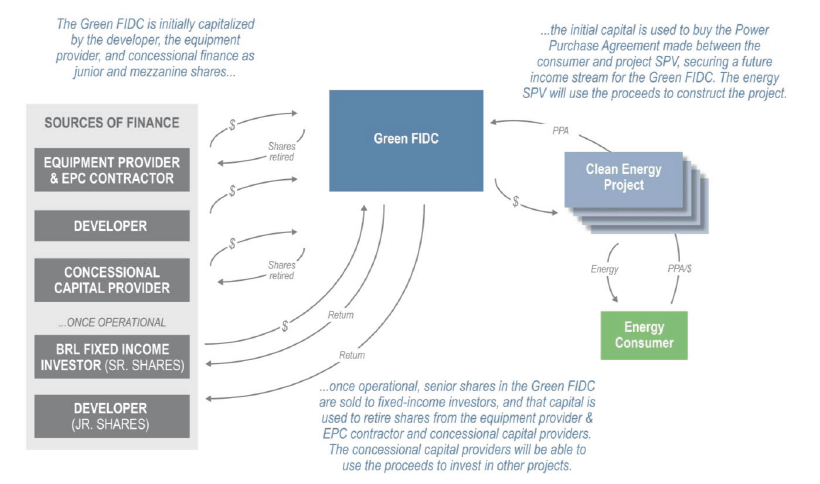

The Green FIDC builds on a Brazil-specific instrument, the Fundo de Investimento em Direitos Creditórios (FIDC) – used by companies in Brazil to raise capital by securitizing receivables through asset-backed securities. The proposed instrument is a new type of “Green” FIDC that combines existing FIDC regulatory frameworks, green certification criteria, the segregation of operational and financial risks, and a financial model tailored to the needs of renewable energy and energy efficiency projects.

In a two-stage process, the instrument would first provide construction and development finance for new construction (greenfield) projects through an asset-backed vehicle (the FIDC) that might segregate the funding providers and the operational management – thus reducing the risk to public and private investors. Once the project is fully operational, it would be refinanced through the sale of new senior shares of the FIDC in Brazilian Capital Markets. The structure uses risk-appropriate, public and/or concessional funds to efficiently and cost-effectively mitigate development risk during early stages when private capital is most scarce. Once projects transition into bankable ongoing businesses with stable cash flows, public capital would be repaid or recycled.

This approach allocates risks to investors best suited to handle them and helps overcome key barriers in the market.

Path Forward

The Green FIDC Program – including its pilot in the solar DG market – would lower Brazil’s grid emissions by avoiding up to 6 million tons of CO2, and could create up to 3,600 new jobs in the renewable energy sector

The proponents are currently developing a pilot for Órigo Energia using the Green FIDC concept to finance the sales of rooftop solar systems to Brazilian residential consumers. The lack of financing to rooftop solar systems has been a major obstacle to the expansion of this market in Brazil. Using the Green FIDC concept, residential consumers may access credit at lower interest rates and longer tenors – making the purchase of rooftop solar systems cheaper than energy bills. This pilot is currently fundraising for its first stage and has already secured 30% in junior and mezzanine shares from Brazilian private sector investors, demonstrating that the Green FIDC is commercially viable.

The proponents are also seeking USD 700k in preparation funding, and USD 75m in mezzanine capital to expand the pilot into an investment program – structuring another 3 Green FIDCs in different sectors – from energy efficiency to utility-scale renewable energy generation. Public and/or philanthropic support is needed in the initial stages of development. In the long-term, the aim of this program is to leverage up to USD 1 billion in clean investment through several FIDCs.