Why urban climate finance matters for MDB reform

Addressing the global climate emergency requires urgent and comprehensive solutions that scale up investment, expedite collective response efforts, and carefully assess associated risks. In recent years, Multilateral Development Banks (MDBs) have substantially increased their climate finance investments, recording an increase in the annual average from USD 57 billion in 2017/2018 to USD 93 billion in 2021/2022 (CPI, 2023).[1]

Yet, to meet the goals of the Paris Agreement, an unprecedented surge in climate finance is needed, with an annual increase of at least 590% (CPI, 2021). MDBs have the potential to play a pivotal role in this critical endeavor by using public funds to leverage investment to increase the pace and scale of climate action – particularly in low- and middle-income countries (L&MICs).

Calls for reform by high-level groups, such as the G20 Independent Experts Group, and initiatives, such as Bridgetown, are discussing how to reform MDBs to be more “fit-for-purpose” to meet the emerging challenges of this century, including achieving sustainable development, rising debt levels, and pandemics, as well as climate change. Proposals include better-reflecting climate in MDB mandates and strategies, expanding the sources and quantity of climate funding, enhancing operational models, creating better financial instruments for improved debt sustainability and private capital mobilization, and leveraging policy support to maximize investment impact (Bridgetown, 2023; G20, 2023a, 2023b).

However, cities’ needs have rarely been raised in MDB reform discussions. While the Report to Governors on the World Bank Group’s Evolution Roadmap raised the importance of subnational support in early 2023, this wording does not feature in the final paper (World Bank, 2023b, 2023c). Earlier in 2023, US Treasury Secretary Janet Yellen also identified subnational access to development finance as an important reform area (Shalal, 2023).

To address the climate emergency, MDBs must work more closely and effectively with cities, which are at the forefront of the battle against the climate crisis. Despite occupying less than 2% of the earth’s surface, cities contribute to 70% of global energy use and 75% of total CO2 emissions (UNEP, 2021; World Bank, 2022c). As a result, they hold enormous investment potential, with climate-related opportunities in urban areas in L&MICs projected to exceed USD 29.4 trillion by 2030 (IFC, 2018). At the same time, the cascading impacts of climate change present dire implications in L&MICs’ cities and underpin the increasing need to finance urban adaptation, which is crucial to safeguard over a billion people in cities expected to be impacted by extreme climate events by 2050 (C40, 2018). Cities are also ambitious: more than 13,000 cities had joined the Global Covenant of Mayors as of October 2023, showing their willingness to collaborate with national and international organizations to address climate and economic challenges (GCoM, 2023).

Despite the attractive opportunities for urban climate investments, there is a significant shortfall in funding. From 2017 to 2018, cities globally received a yearly average of only USD 384 billion in climate finance, which is only 7-8% of the annual global climate finance required of between USD 4.5 trillion and USD 5.4 trillion (CCFLA, 2021b). The gap is more pronounced in L&MICs, which often lack conducive national conditions for local climate investments. Challenges to accessing urban climate finance include poor creditworthiness, limited fiscal decentralization, revenue uncertainty, and restricted access to capital markets. Political misalignment between different government levels and municipalities’ insufficient institutional capacity are also challenges. Additionally, the generally small ticket sizes of urban climate infrastructure projects can also deter investors.

The current MDB reform agenda presents a crucial avenue for addressing the global challenge of urban climate finance in L&MICs. While MDBs cannot address this challenge alone, MDBs are uniquely placed to support the urban climate finance agenda directly and through partnerships with national governments, given these banks’ large financial resources and deep technical and policy expertise. MDBs have the capacity to mobilize capital in both international and domestic markets, to bridge gaps where private investors face obstacles, and to bring cutting-edge development knowledge to projects.

This report presents the first assessment of ten[2] MDBs’ contributions to urban climate finance in L&MICs and explores opportunities for them to do more. Produced in collaboration with the C40 Cities Climate Leadership Group and the Global Covenant of Mayors, it provides analysis, insights, and recommendations to position urban climate finance as an important element of the MDB reform agenda and inform decision-making.

Key findings and recommendations for MDBs

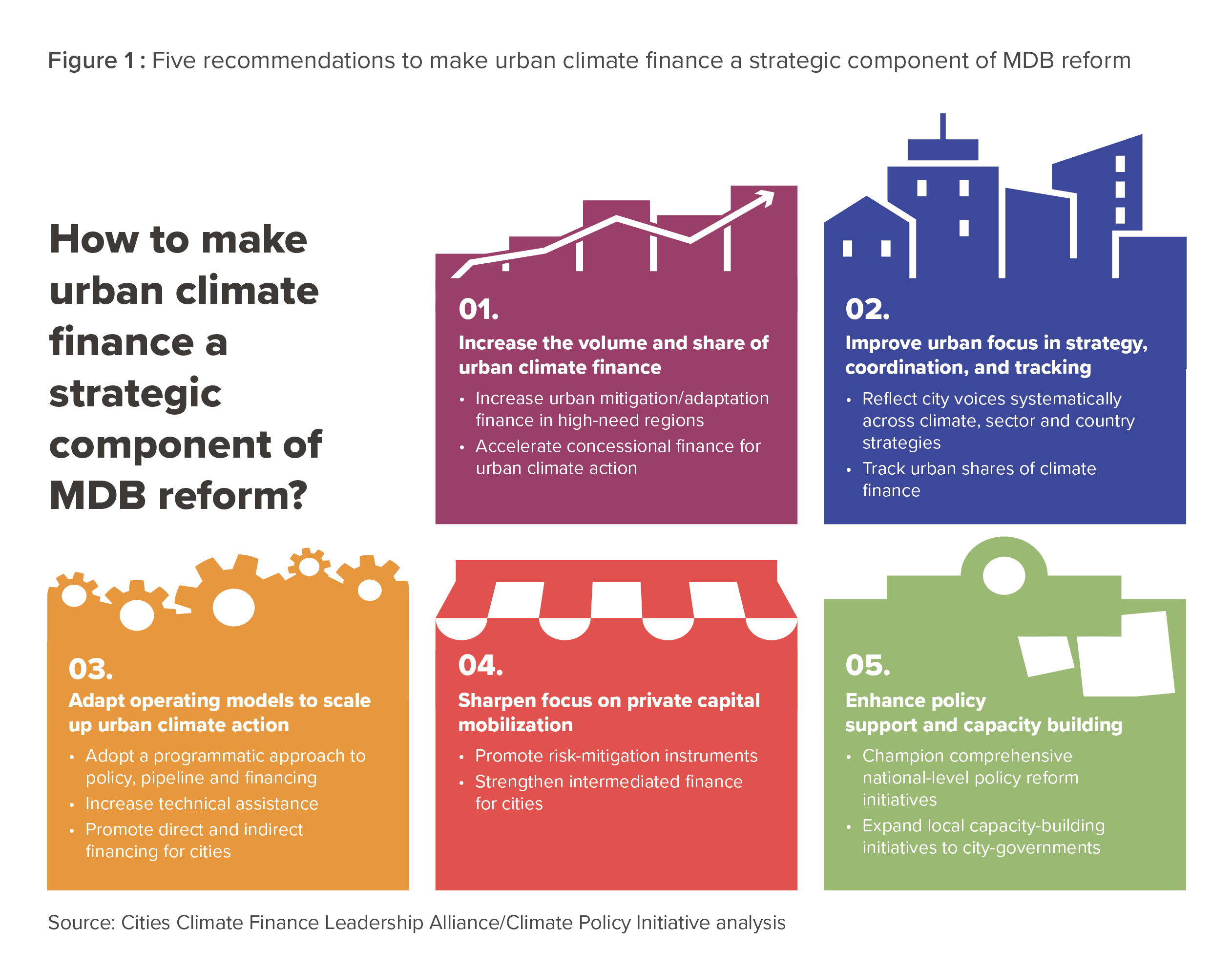

Our analysis identified five key areas of work to help increase the volume and effectiveness of urban climate finance in line with current MDB reform agendas. For each area, we provide concrete recommendations, supported by analytical findings, on how MDBs could enhance urban development and local climate action (see figure below). The key areas of work are:

- Urban climate finance volumes and shares

- Strategies and coordination

- Operating models

- Private Capital Mobilization

- Policy support and capacity building

- Increase the volume and share of urban climate finance

| Recommendations: 1.1. Increase volumes and share of urban climate finance in MDB total climate finance, focusing on those regions with the most pressing urban mitigation and adaptation needs. 1.2. Accelerate concessional finance for urban climate action by leveraging existing MDB concessional funding and partnering with international climate funds and bilateral donors to increase these funds further. |

Our analysis found that 21% of tracked climate-related MDB finance to L&MICs from 2015 to 2022 went to urban projects. This share has remained relatively constant over time despite rising urbanization, especially in Sub-Saharan Africa and the Middle East and North Africa (MENA), which have received relatively less urban climate-related finance than other regions.

A larger share of MDB urban climate-related finance is dedicated to adaptation (32%) compared to MDB climate-related finance as a whole, for which the adaptation share is 18%. Nevertheless, considering cities are often at the frontline of response to climate-related shocks and stressors, there remains a pressing need to accelerate urban adaptation investment and mitigation.

Concessional capital plays a crucial role in facilitating urban climate action, particularly for adaptation. Additional concessional funds targeting urban climate finance should be mobilized via programmatic partnerships between MDBs and thematic climate funds such as the Green Climate Fund (GCF) and the Climate Investment Funds (CIF), and/or bilateral funders. The CIF Smart Cities Program, which is currently fundraising, is an example of a platform that can leverage concessional capital for urban climate action at scale while coordinating the investments of six MDBs.[3]

- Improve urban focus in strategy, coordination, and tracking

| Recommendations: 2.1. Consider the urban dimension in a systematic and coordinated manner when formulating MDB country, sector, and climate strategies, and reflect the voice of cities. 2.2. Track and monitor the urban shares of climate finance and report them in the Joint Reports on MDBs’ Climate Finance. |

Most MDBs include climate as a cross-cutting priority in their urban strategies. Still, their country and climate strategies do not consistently account for cities’ role in sustainable development. MDBs should systematically assess the contribution of cities to each country’s climate and development goals and include city representatives in the development of country, sectoral, and thematic strategies. While national governments largely drive country strategies, MDBs also contribute significantly and can help to ensure urban priorities are included. For example, some World Bank Country Climate Development Reports (e.g., for Türkiye and Egypt) have a high urban focus, including assessments of cities’ climate risks, as well as their possible resilience and low-emissions development trajectories (World Bank, 2022b, 2023a). MDBs should roll out such approaches systematically across all the countries in which they are active.

In strategy development and implementation, more effective coordination is also needed across MDB departments (e.g., those working on urban, water, transport, and climate issues) and across different MDBs, particularly in developing country-level platforms.

Additionally, harmonizing definitions and tracking urban climate finance can help measure progress and prioritize future action. To enhance transparency and accountability, MDBs should, at minimum, internally track their urban climate finance flows and report on them consistently. We propose that this be achieved by disclosing such flows in the Joint Reports on MDBs’ Climate Finance.

- Adapt operating models to scale up urban climate action

| Recommendations: 3.1. Adopt a programmatic approach to urban climate policy, pipeline development, and finance. 3.2. Increase the provision and effectiveness of technical assistance geared at closing cities’ planning-to-investment gaps. 3.3. Promote direct and indirect financing for cities to address their distinct and diverse needs, including local currency financing. |

Shifting away from a project-by-project approach for urban climate investment to a more strategic programmatic approach would help to scale up MDBs’ urban climate finance, support their internal coordination between their climate- and urban-focused teams, and enhance engagement with cities. Such an approach, as exemplified by the EBRD Green Cities program, could help streamline planning, pipeline development, finance, and implementation support around cities’ needs, as well as being flexible to finance projects across a broad range of investment sizes.

Programmatic approaches support the development of robust pipelines of financeable urban climate projects. These can be developed by increasing funding for existing in-house project preparation facilities (PPFs) (e.g., the ADB’s Cities Development Initiative for Asia and the World Bank and EIB’s City Climate Finance Gap Fund), improving coordination with external PPFs, and ensuring effective linkages between technical assistance and financing activities. A joint-MDB project preparation facility could also be explored for MDBs to collaborate more closely on project origination and development.

Given that 49% of MDBs’ tracked urban climate-related finance has been channeled through national governments – and this percentage is likely to be even larger after accounting for data gaps – exploring direct and intermediated means of financing cities can empower further climate action. City governments seeking sovereign loan guarantees often face bureaucratic hurdles and political differences with national governments. MDBs should, therefore, seek to finance cities directly through non-sovereign operations where possible, which only constitutes 2% of tracked MDB urban climate-related finance. There is also potential for greater use of public and private financial intermediaries to finance a wide variety of cities, given that only 4% of tracked MDBs’ urban climate-related flows went via this route from 2015-2022. Intermediaries such as national development banks and local commercial institutions can scale up investment in cities that may not be able to borrow directly from the MDBs, such as small- to medium-sized ones, and can contribute to enhancing the deployment of local currency instruments. Finally, foreign exchange risk was identified as a key barrier to MDB financing by cities in L&MICs. Yet, only 6% of tracked MDB urban climate-related finance was reported in currencies other than euros or US dollars.

- Sharpen focus on private capital mobilization

| Recommendations: 4.1. Promote risk-mitigation instruments to increase private sector engagement and investment in urban climate projects. 4.2. Strengthen MDB finance to the private sector by investing in urban climate action both directly and through intermediaries. |

MDBs can play a particularly relevant role in supporting cities to access private finance, addressing issues of low creditworthiness, limited technical capacity, and regulatory barriers. MDBs should seek to identify opportunities for private sector involvement in urban climate action and deploy risk-mitigation instruments such as guarantees and blended finance. To date, MDBs have made little use of such tools for climate finance in urban settings. Guarantees and grants make up around 2.7% of all tracked MDB climate-related finance (urban and non-urban) but less than 0.1% of all MDB urban climate-related flows. While tracked data on financial instruments has significant limitations, our interviews confirmed the need for MDBs to scale up risk-sharing instruments to crowd in private capital for urban projects.

Moreover, MDBs, particularly their private sector focused arms, can invest directly or indirectly in private companies developing urban climate solutions and help to mobilize additional private capital. They can invest directly in companies, as exemplified in the IFC Utilities for Climate Initiative, or indirectly through national development banks, local commercial banks, and privately managed blended funds such as the Subnational Climate Fund.

- Enhance policy support and capacity building

| Recommendations: 5.1. Work with national governments to champion comprehensive national-level policy reform initiatives to improve the enabling environment for urban climate action. 5.2. Expand local capacity-building initiatives to enhance city governments’ financial and management capacity and their ability to work with other finance providers. |

MDBs can work with national governments to improve the enabling environment for urban climate finance. This can include deploying policy-based instruments to support city-level climate action, as well as national reforms that strengthen subnational financial capacities and reduce regulatory barriers affecting cities’ revenue and risk profiles and their ability to crowd in private capital. This can take the form of policy-based loans to support efforts such as fiscal decentralization, vertical policy integration, and subnational financial management.

Moreover, MDBs can reinforce efforts to strengthen cities’ ability to strategize, prepare, and execute climate projects alongside other financial partners. Ongoing related initiatives include the joint MDB Public-Private Partnerships (PPP) Certification Program delivered by APMG International and the AfDB’s Urban & Municipal Development Fund, which aim to address regulatory barriers and technical capacity gaps among local stakeholders (AfDB, 2023b; APMG, 2019).

Conclusion and next steps

Ongoing calls for MDB reform present a crucial opportunity for these banks and their partners to accelerate investment for urban climate solutions in L&MICs. In the face of rapidly increasing urbanization and climate vulnerability, these cities urgently need to break down barriers to accessing critical financial resources. Strengthening L&MIC cities’ capacity to respond to the climate crisis is a necessity for meeting global climate goals, and MDBs can play a crucial role in stewarding this process.

MDBs have made significant urban climate investments in recent years. Many have developed urban strategies and expertise for the climate transition and have provided public and private entities in L&MICs with TA, capacity building, and policy support to accelerate urban climate investment. By mobilizing concessional finance, they have helped L&MIC cities to access otherwise unreachable finance sources.

There is a compelling need to ramp up these efforts and enhance their effectiveness. Overall, MDB urban financing volumes appear to have plateaued at a critical juncture in the transition to low-carbon urbanization and increasing urban vulnerability to climate change. Gaps remain in prioritizing urban needs across MDBs’ climate and country strategies and how they work with other actors in the international financial architecture to mobilize funding. Current project-based approaches limit MDBs’ ability to catalyze systemic urban transformation and traditional MDB instruments are often not tailored to cities’ needs, for example, being too large and rarely in local currency.

Ongoing calls for MDB reform emphasize scaling up climate finance to where it is most needed, deploying risk-sharing instruments, and promoting more systemic ways of funding and collaborating among financiers, presenting an opportunity to scale the volume and effectiveness of urban climate finance. This will require concerted collective efforts by MDBs, in collaboration with shareholder governments and local stakeholders, to prioritize urban needs systematically and implement robust programs that accelerate urban climate project development from inception and investment through to implementation. This can be accomplished by leveraging existing initiatives and instruments supporting urban climate projects, as well as developing new, more fit-for-purpose ones. Inter-MDB cooperation has great potential to adopt joint strategies to scale up urban climate finance.

The findings of this paper offer a platform for reflection on how MDBs can collectively enhance their support for urban climate finance amid ongoing reform efforts. Based on these conclusions, the CCFLA aims to take the following next steps:

- Promote an open dialogue between MDBs and cities to discuss practical action to further develop this report’s recommendations.

- Join forces with other global actors discussing MDBs’ urban climate finance investment, such as the Sustainable Development Solutions Network Urban SDG Finance Commission.

- Engage national governments, particularly those that are MDB shareholders, in

the debate on how to scale and increase the quality of urban climate finance investments from MDBs. - Further explore innovative solutions to increase MDBs’ financial instruments that can respond to cities’ needs.

- Further explore the challenges and opportunities for MDBs to scale private-sector funding for urban climate projects.

[1] Data for 2017/2018 include finance from Asian Development Bank (ADB), African Development Bank (AfDB), Asian Infrastructure Investment Bank (AIIB), European Investment Bank (EIB), European Bank for Reconstruction and Development (EBRD), Inter-American Development Bank (IDB), Islamic Development Bank (IsDB), New Development Bank (NDB), and World Bank Group (WBG). For 2021/2022, data includes all the previous MDBs plus the Council of Europe Development Bank (CEB).

[2] These MDBs are the same as those contributing to the Joint Reports on MDBs’ climate finance: African Development Bank (AfDB), Asian Development Bank (ADB), Asian Infrastructure Investment Bank (AIIB), Council of Europe Development Bank (CEB), European Bank for Reconstruction and Development (EBRD), European Investment Bank (EIB), Inter-American Development Bank Group, including Inter-American Development Bank (IDB) and Invest (IDB Invest), Islamic Development Bank (IsDB), New Development Bank (NDB), and the World Bank Group, including World Bank, International Financial Corporation (IFC), Multilateral Investment Guarantee Agency (MIGA).

[3] The CIF currently works through six MDBs: the AfDB, ADB, EBRD, IDB, World Bank, and the IFC.