Clarissa Costalonga e Gandour and Pedro Hemsley co-authored this post.

In Brazil’s agricultural sector, fluctuations in crop prices that are not mitigated by insurance or public policy can hinder farmers’ productivity and income, as well as the agriculture sector’s economic growth. For example, a farmer who makes planting decisions under the expectation of high harvest prices, which then fall short, can suffer severe losses. Understanding agricultural price volatility and mitigation is important to improving relevant public policy.

As part of CPI’s series of work on how to improve agricultural productivity while reducing deforestation in Brazil, we recently looked at agricultural price volatility, current policy to mitigate price risks, and what Brazil could do differently.

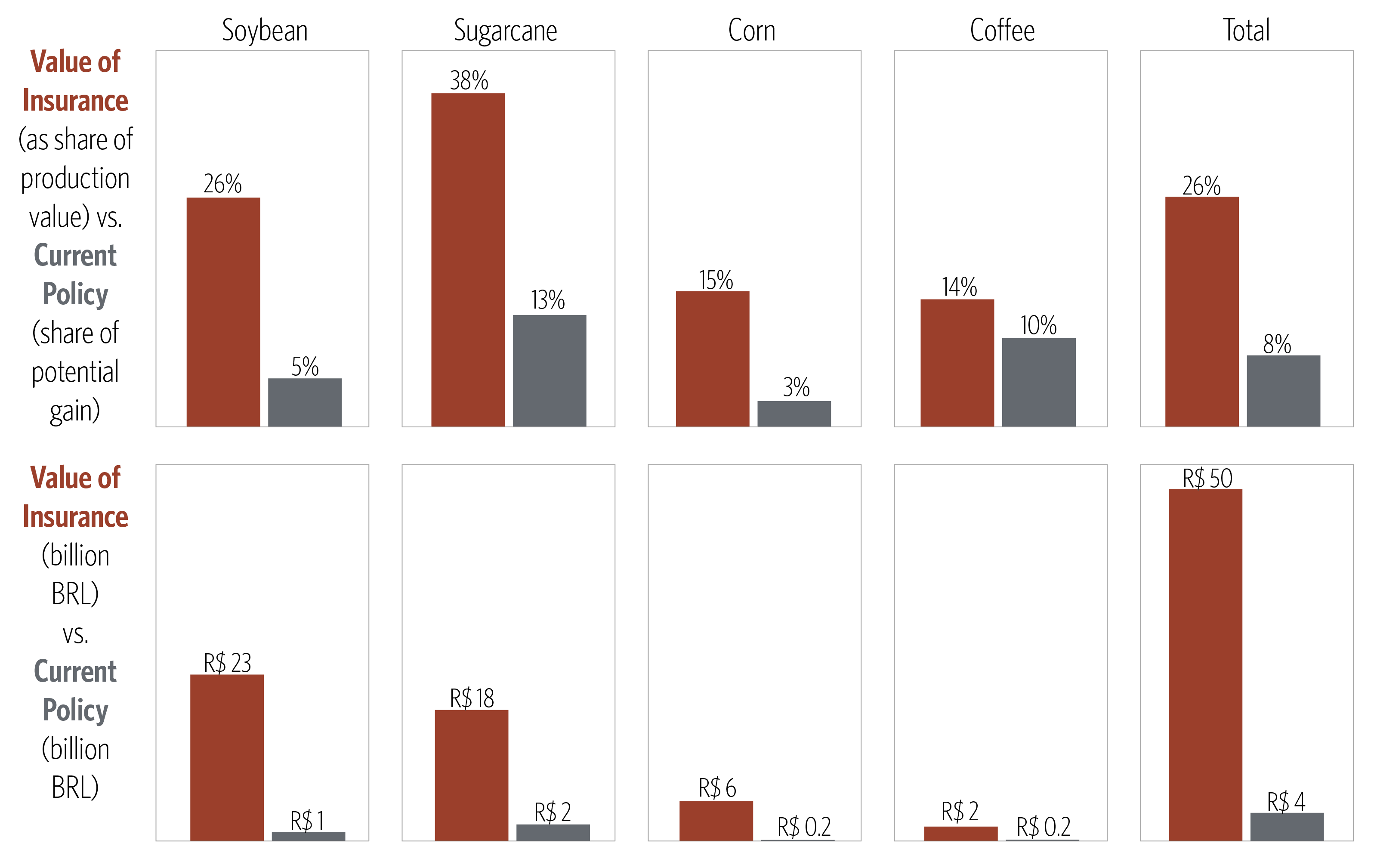

Our main finding is that current policy in Brazil does not meet farmers’ needs. The policy for price risk mitigation is based on direct government intervention in the market: when prices fall below a threshold, the government takes part of total output and allocates it out of the market. In 2013, the federal budget for price risk mitigation totaled BRL 5.4 billion, with over two fifths of it being destined for government buyouts and storage expenses. However, we find this policy yields only 8.03% of total production value, or BRL 4 billion per year in gains to producers of the four most important crops in Brazil – soybean, sugarcane, maize, and coffee.

Additionally, the value of fully eliminating price volatility, which is what producers are willing to pay, is 25.91% of total production value, which is three times higher than what current policy achieves. This strongly suggests that current policy does not meet the needs of the market. This is particularly relevant for small farmers, who are hurt the most by price volatility.