This article originally appeared in Environmental Finance.

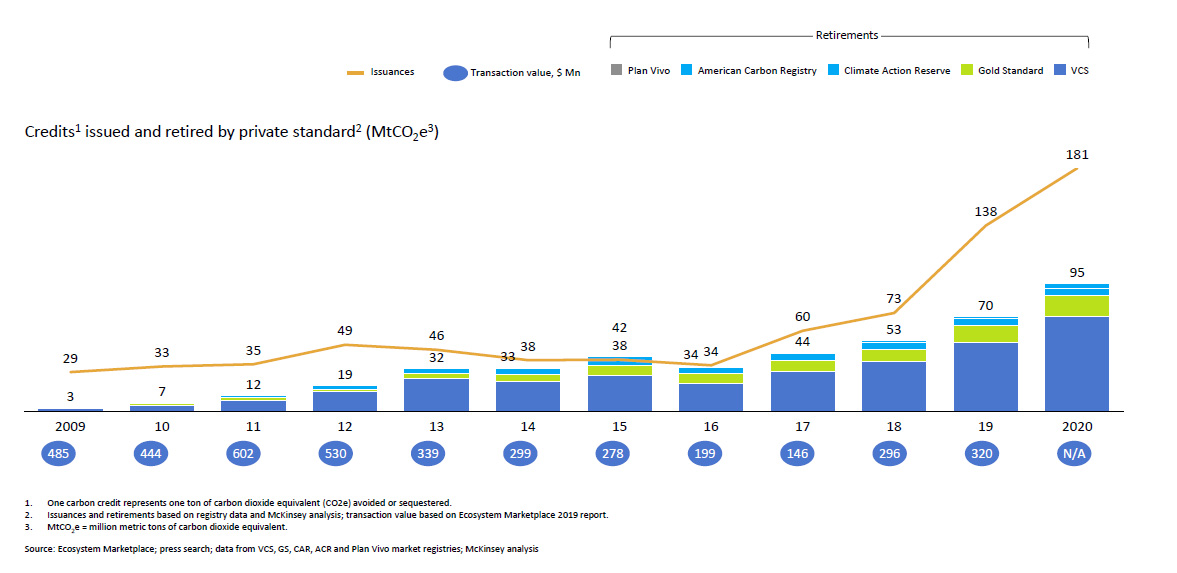

After lying relatively dormant for the better part of the last decade, demand for voluntary carbon offsets has seen a sharp uptake since 2019, driven by the growing number of private entities that are starting to operationalize their net-zero pledges and seeking to neutralize the non-abated balance of their emissions.

Carbon markets today: Voluntary carbon market is growing rapidly

The Taskforce on Scaling Voluntary Carbon Markets (TSVCM) predicts this will grow exponentially in the coming years, so it is focusing on building robust “plumbing” for trading to scale.

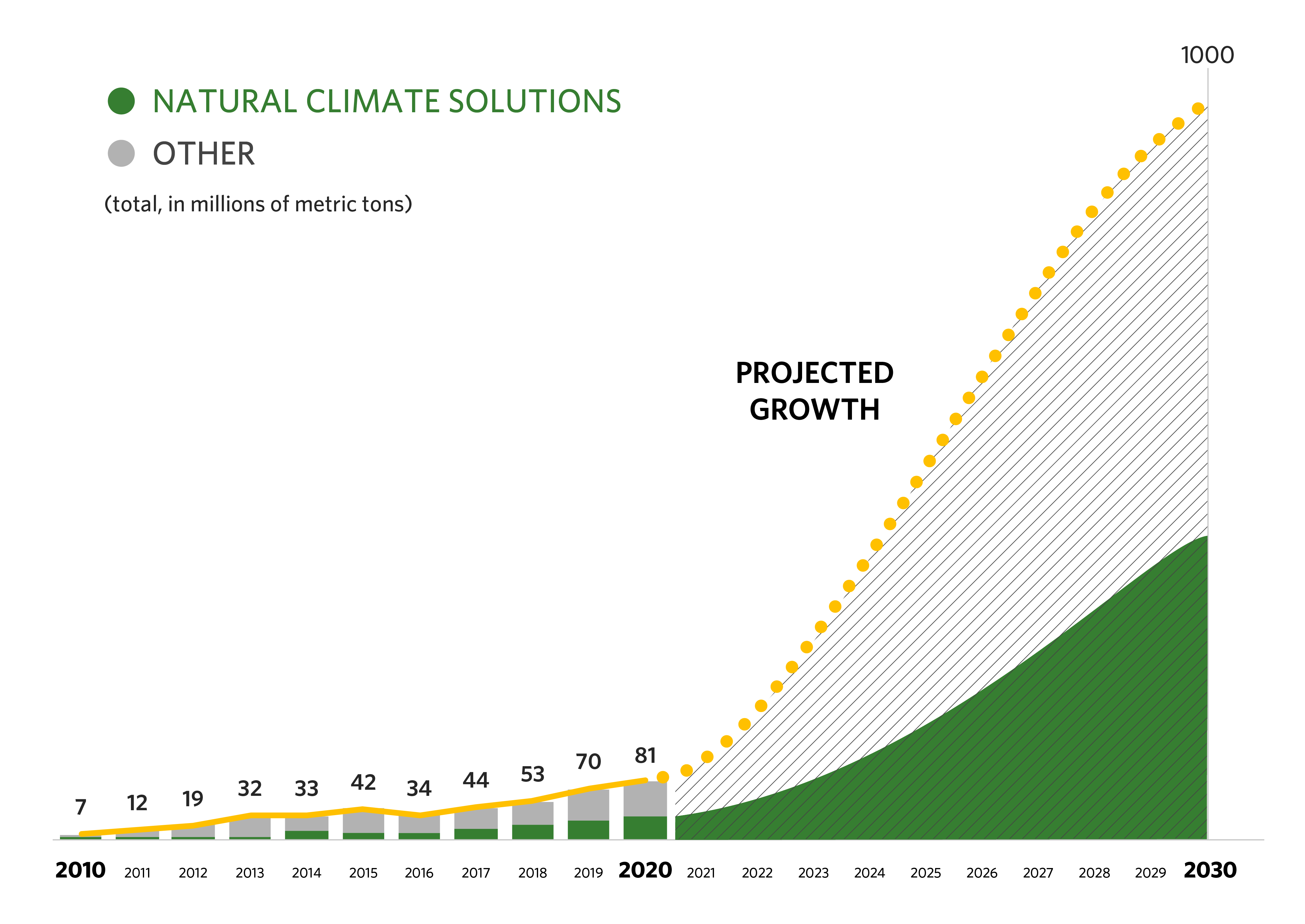

Growth forecast of voluntary carbon markets to 2030

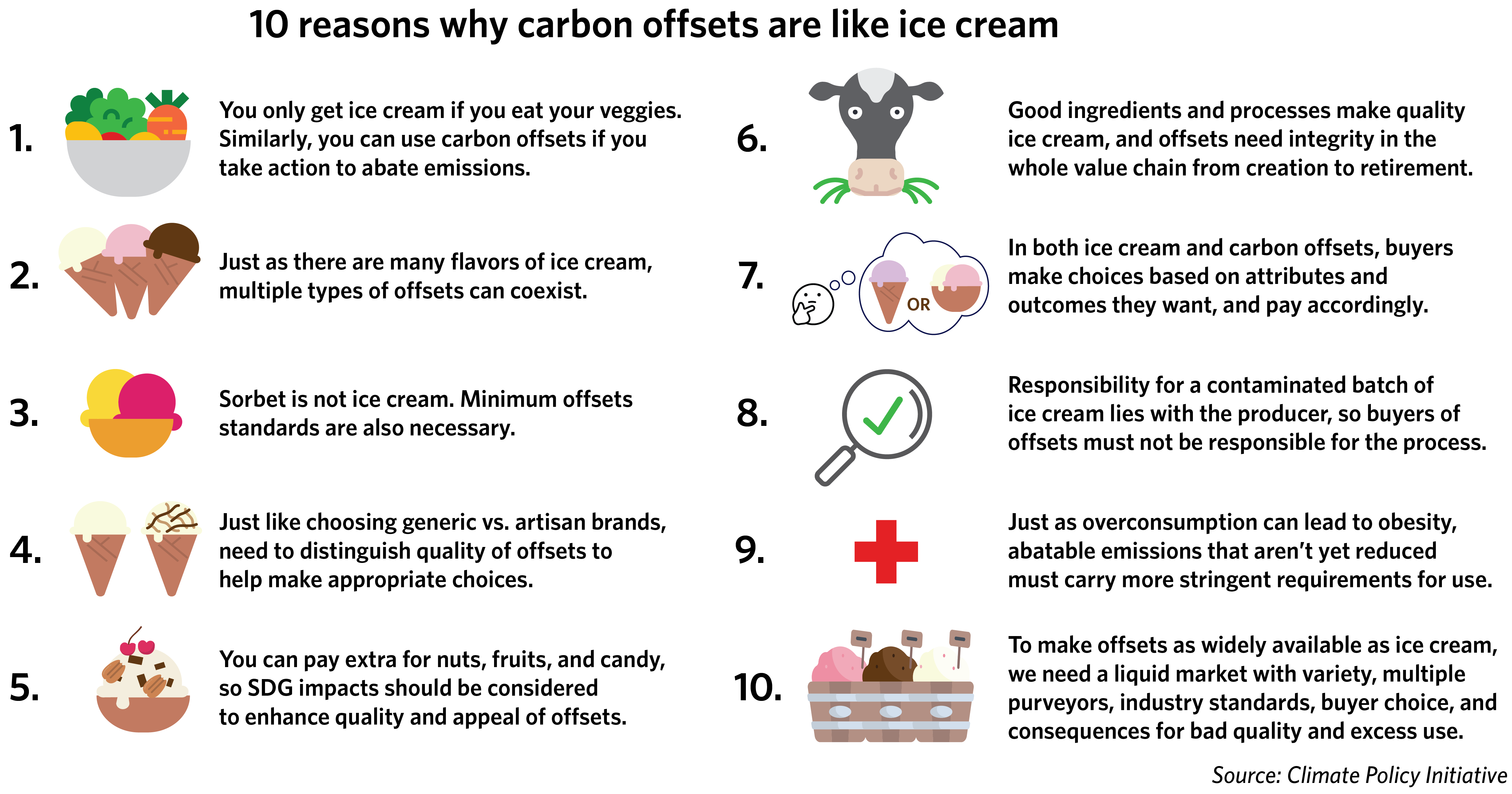

Voluntary carbon offsets should not and cannot be the leading tactic for zeroing out private sector emissions. Emphasis must be placed on reducing emissions as much as possible. However, offsets play an important transition role in neutralizing emissions that are more difficult to abate, while also serving as an important funding mechanism to protect natural capital. We could think of them as a reward, like ice cream is when you eat your veggies.

Because voluntary carbon markets are essential en route to reaching “true zero,” we cannot afford further delay on scaling the market. Rather than criticizing voluntary carbon markets on their potential for abuse or deferring focus on true abatement, we need to support the process of building integrity across the entire voluntary carbon market supply and use chain: supply-side, demand-side, and for intermediaries; from offset creation to aggregation to trading and retirement.

Integrity of demand: flexibility is key

While we must maintain significant pressure on emitters to reduce their (Scope 1-3) emissions with a sense of urgency and based on targets validated by science (much like the recently launched Voluntary Carbon Markets Integrity – VCMI – initiative plans to), we should also be open to the idea that not all emission abatement actions need to be treated equally. This is not about arguing whether a ton is a ton, but we do need to account for the relative difficulty or ease of abatement in any given sector. For example, the pricing or availability of offsets could be flexible depending on the level of difficulty of abatement.

Emissions that are abatable but not yet reduced should ideally have more stringent (potentially more expensive) requirements for using offsets vs. non-abatable emissions. This will provide an incentive to abate more and use less offsets over time. We also need to acknowledge that the offset landscape will change over time, evolving to stay aligned with our global goal to be net zero by 2050.

Integrity of supply: a new focus on diversity

While most of the recent critiques of voluntary offset markets have been on demand-side integrity (who should be able to use what, when, how much, and for how long), we must place equal focus on supply-side integrity for the entire system to work.

Supply side integrity has traditionally emphasized validation, verification, and issuance with robust monitoring and reporting. This focus has been productive, and we are now seeing a growing body of initiatives and entities that are addressing the burgeoning demand on the process given the expected size and sophistication. There is still much work to do in this area, however, because for the voluntary carbon market to work efficiently at scale, ultimate users of offsets should not be held responsible for shortcomings of origination and aggregation if these users are doing it right, i.e., using offsets according to prescribed standards of integrity.

For the next phase of improving supply-side integrity, in addition to ensuring the quality of the offsets brought to market, we must also look at diversity and quantity, as well as how these are brought to market from the point of origination.

We need to encourage and support approaches to creating new types of credible offsets that accelerate action towards meeting net-zero commitments and help bring these to market. Modern markets thrive on customization and choice. Like ice cream that we welcome in a myriad of flavors using a variety of choice ingredients. The same is true for carbon offsets. For the market to scale, we must significantly expand the variety of offsets that are usable to meet net zero commitments. That not only includes expanding the type of removal credits, including nature-based solutions and carbon sequestration technology, but also expanding the use of avoided emissions credits in areas like avoided deforestation, active methane management, and accelerated retirement of mid-age coal power. SDG additions could and should also be considered to enhance the quality of offsets. Much like toppings and add-ins enhance and customize individual ice cream servings.

Accelerating supply

While there is potential to expand the quantity and diversity of supply of net zero-compatible carbon credits, several challenges could prevent this supply from reaching the market.

As shown earlier, demand is accelerating geometrically, but there is no organized effort to supply this need at scale with acceptable quality of credits. The infrastructure being created by the TSVCM will be worth it only if there are robust credits in sufficient quantities being traded. We must urgently marshal public, private, and civil society forces to increase the development of carbon offset projects at unprecedented pace.

Because of the urgency at hand, resources must not only be applied towards expanding quantity and diversity, but also speed. Currently, supply-side project development experiences exceptionally long lead times between the initial investment and eventual sale of offsets. This must be addressed if we are to get robust markets functioning in time to make a true impact in the next three decades. Ideally, the market will cease to exist by mid-century when we achieve true zero, and the market would evolve to next generation, removal-related offsets that address “net negative” emissions.

We must also address the issue of delivered volumes. Small ticket sizes are the bane of liquidity and efficiency. This doesn’t mean we must sacrifice quality, but we need mechanisms that aggregate offsets at market-level volumes, and in such a way that fairly compensates along the value chain. In other words, a “fair trade” approach for offsets that ensures that sufficient value ultimately ends up with the creators / originators of the offsets, whether they be cocoa farmers in Africa or indigenous communities helping protect forests.

Finally, we must expand the geographic reach of market participants. For example, most of the current supply of nature-based sequestration is concentrated in a small number of countries. Efforts to better incorporate carbon offsets into NDC plans and biodiversity protection initiatives should be pursued in the many countries and regions where they are underutilized.

Delicious and abundant

If you’ve made it this far, you’re probably wondering what the title has to do with this blog on voluntary carbon markets. Well, in various meetings trying to explain the market needs and opportunities, at one point it came to me that voluntary carbon markets should be like ice cream.

As we all work to build a robust, ethical carbon offset market at scale to support a sustained transition to net-zero, maybe keeping this analogy in mind will make the effort, and the result, all the more satisfying.

Vikram Widge is Senior Advisor, Climate Finance at Climate Policy Initiative. He has extensive experience with carbon markets while at IFC previously and has been invited to be a member of the Voluntary Carbon Markets Integrity initiative’s Expert Advisory Group.