Fit-for-Purpose Forest Finance: A Menu of Financial Mechanisms

A menu to scale up finance for tropical forests

Mapping 30 international financial mechanisms across actors, financial instruments, and forest objectives.

Executive Summary

Tropical forests play a critical role in mitigating climate change by absorbing and storing vast amounts of CO2. They are also essential for climate adaptation, safeguarding biodiversity, regulating water cycles, and supporting rural communities.

Integrating forests into climate solutions presents both a major challenge and an opportunity. The world’s 1.27 billion hectares of tropical forests store nearly one-third of historical global emissions. Capturing this potential requires not only protecting existing forests but also restoring over 180 million hectares lost since 2001—a strategy that could sequester more than 49 gigatons of CO2 equivalent (GtCO2e).[1]

Achieving this goal demands ambitious efforts to end deforestation, conserve standing forests, and restore ecossystems, supported by tailored policies and effective forest finance mechanisms that reflect the diverse contexts of tropical forest nations. Current investment flows fall far short of this need: Climate Policy Initiative tracked a total of US$ 18.2 billion in finance for Agriculture, Forestry, and Other Land Use (AFOLU) for 2023, illustrating the scale of the challenge when compared to the capital required to unlock the full potential of tropical forests, estimated by United Nations Environment Programme (UNEP 2025) at US$ 66.8 billion annually by 2030.[2],[3]

In August 2025, the United for Our Forests Group—which brings together 20 developing countries representing nearly two-thirds of the world’s tropical forests—issued a Joint Communiqué reaffirming a shared commitment to halt deforestation, accelerate restoration, and promote sustainable forest management, while calling for substantial and sustained financial support from developed nations. To inform these efforts, Climate Policy Initiative/Pontifical Catholic University of Rio de Janeiro (CPI/PUC-RIO) identified 30 international financial mechanisms currently mobilizing capital to advance forest objectives around the world.

This assessment provides an overview of existing financial mechanisms—their scale, financial instruments used, objectives, and geographic reach. By organizing the landscape of financial mechanisms, the report aims to help governments, donors, private investors, and practitioners as they design and scale targeted forest-climate finance strategies for different contexts. Together, these mechanisms represent a diverse set of options that, when used complementarily in a portfolio, can provide forest countries with a menu of approaches tailored to their specific needs, ensuring long-term funding for forests, reducing reliance on any single source, and facilitating collaboration to maximize outcomes (Figure 1).

Tropical forests play a critical role in mitigating climate change, but realizing their full potential demands tailored finance mechanisms that match the diverse realities of forest countries.

Figure 1. Menu of Financial Mechanisms for Tropical Forests

Source: CPI/PUC-RIO based on cumulative data publicly available on the official websites of the financial mechanisms and entities, as of the research completion date, 2025

The analysis defines relevant finance mechanisms for tropical forests as distinct arrangements through which international resources are mobilized, managed, and delivered to achieve clearly defined objectives in developing tropical countries, namely, to promote conservation, restoration, and deforestation reduction. Each mechanism may make use of one or more financial instruments.

While several financial mechanisms aligned with forest-related objectives exist, only those that are currently in operation and that have publicly available information on investments are included in the current menu.[4] It is important to note that these criteria may result in a potential underrepresentation of private actors given that they do not always make this information publicly available, and of mechanisms that are in a very early stage of development. Additionally, given that this is a mechanism-based analysis, not all sources of finance are featured.

Ultimately, this mapping exercise identifies a diverse set of actors responsible for capital disbursement and management: multilateral funds, multilateral organizations, governments, bilateral governments, private actors, and blended funds—each of which direct investments shaped by different mandates, capacities, incentives, and risk appetites.[5]

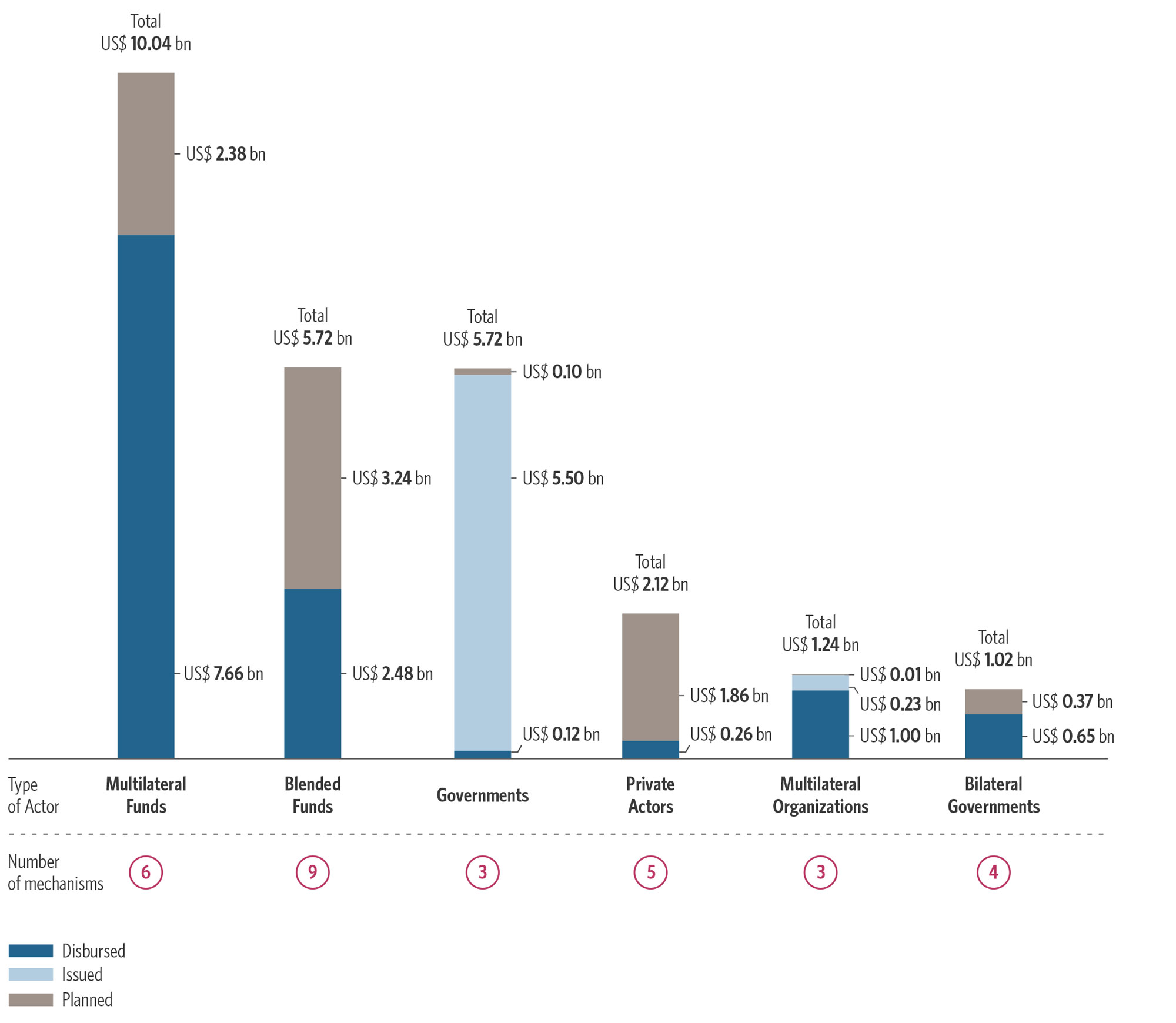

These actors are responsible for 30 financial mechanisms that total US$ 25.9 billion in planned, issued, and disbursed funds (Figure 2).[6] Ten of these mechanisms already report size equal to or exceeding US$ 1 billion, demonstrating that large-scale forest investment is possible and increasingly underway.

Figure 2. Funding Volume and Number of Financial Mechanisms by Type of Actor

Source: CPI/PUC-RIO based on cumulative data publicly available on the official websites of the financial mechanisms and entities, as of the research completion date, 2025

Multilateral funds play a prominent role in the investment profile, along with governments which together have already disbursed US$ 7.7 billion and issued US$ 5.5 billion. While the overall investment to date shows promise, meeting the forest finance gap requires commitment to the currently planned funds. Of the total funding available from existing financial mechanisms, 31% have yet to be issued or disbursed. This is particularly the case for blended funds and private actors where more than half of the funding remains to be mobilized, 57% and 88% respectively.

Over the past decade, the world has lost over 100 million hectares of tropical forests with the drivers of deforestation varying widely between regions, from land clearing for cattle ranching and agriculture to illegal logging and fuelwood extraction. The three pillars of the forest agenda—protecting standing forests, halting deforestation, and promoting forest restoration—manifest differently across countries with tropical forests depending on their geography, land-use pressures, governance, and institutional capacity. Recognizing and responding to these diverse contexts is essential to strengthen the forest–climate nexus and to design effective, equitable, and scalable solutions.[7]

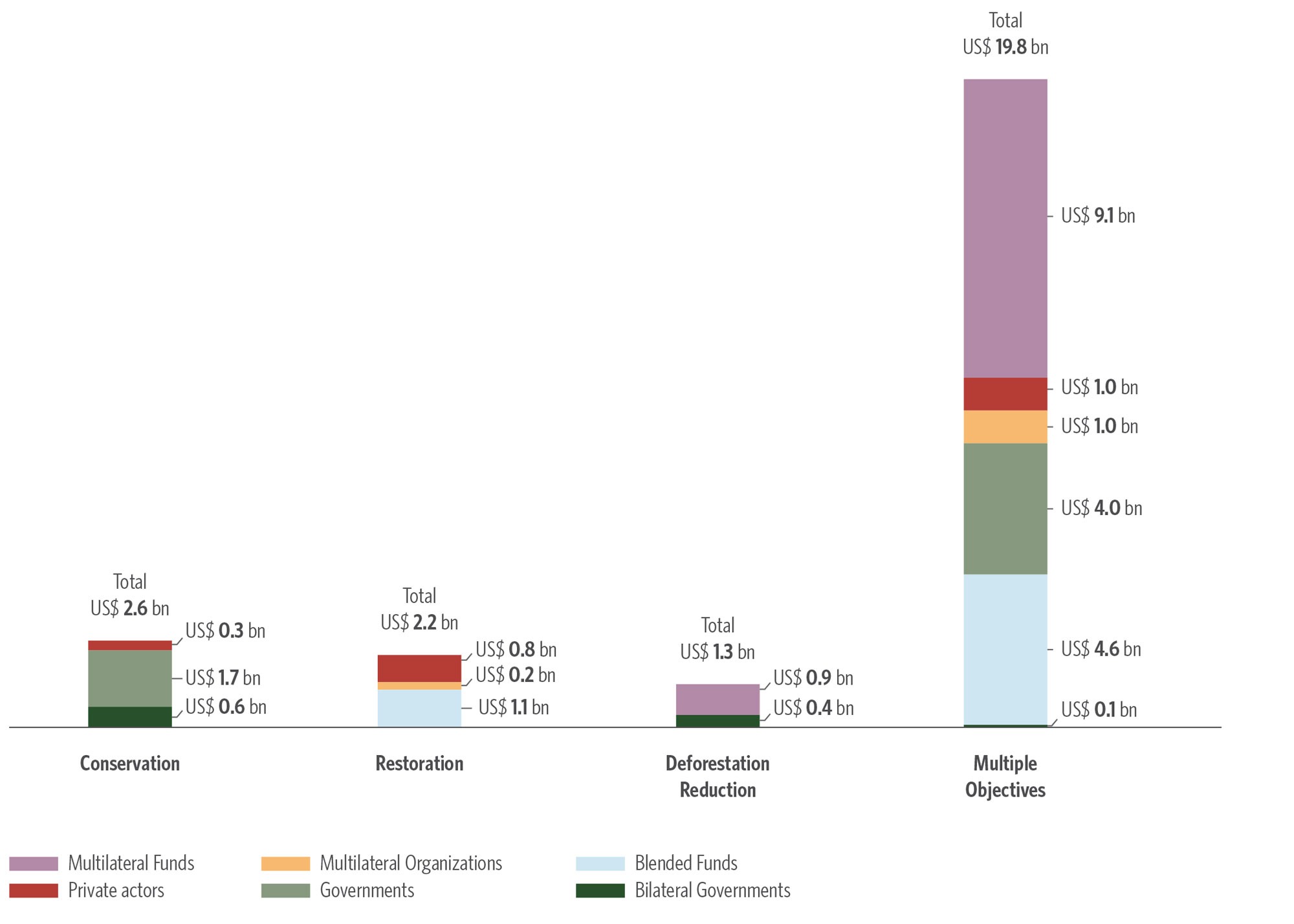

This reality paired with the profile of investors and the focus of financial mechanisms shown in Figure 3 highlights important lessons. Half of the 30 international financial mechanisms mapped have an exclusive focus on one of the three forest objectives: conservation (US$ 2.6 billion), restoration (US$ 2.2 billion), and deforestation reduction (US$ 1.3 billion). The other half of the mechanisms have multiple objectives. Ten of these mechanisms pursue dual objectives and together account for US$ 8.3 billion, nearly all of which focus on conservation plus another objective. An additional five mechanisms target all three objectives, totaling US$ 11.4 billion.

Figure 3. Funding Volume by Forest Objective and Type of Actor

Source: CPI/PUC-RIO based on cumulative data publicly available on the official websites of the financial mechanisms and entities, as of the research completion date, 2025

Governments play a prominent role in funding conservation, a focus largely driven by the prioritization of supporting traditional communities. Conservation-focused mechanisms often face greater challenges in generating direct revenue streams, as standing forests yield limited financial returns without complementary economic activities or carbon-related incentives. This structural constraint means that public resources tend to play a stronger role in financing this objective.

Restoration is supported by fewer mechanisms, with blended funds and private actors predominately supporting mechanisms dedicated exclusively to restoration objectives. Restoration activities can be more easily linked to productive activities—such as sustainable agriculture or value chains connected to forest landscapes—which can attract private investment through clearer revenue models. Driving growth in this area will be important given that UNEP estimates that nearly half of the capital and operational investment needed to finance key interventions in tropical forest regions should be dedicated to forest restoration (US$ 33.2 billion).[8] While this analysis reveals fewer financial mechanisms exclusively focused on restoration, they have higher ticket prices.

Even fewer mechanisms, supported by multilateral funds and bilateral governments, focus solely on combating deforestation. The total value invested or planned is significantly lower compared to both conservation and restoration-focused initiatives, as shown in Figure 3. While fewer resources may be required for activities to combat deforestation, evidence indicates that they are highly cost-effective and a critical component in safeguarding tropical forests. In countries like Mexico, China, and Nigeria, where deforestation pressure is high, but carbon capture potential is limited, efforts to halt residual deforestation and prevent further degradation of fragile ecosystems remain essential.[9]

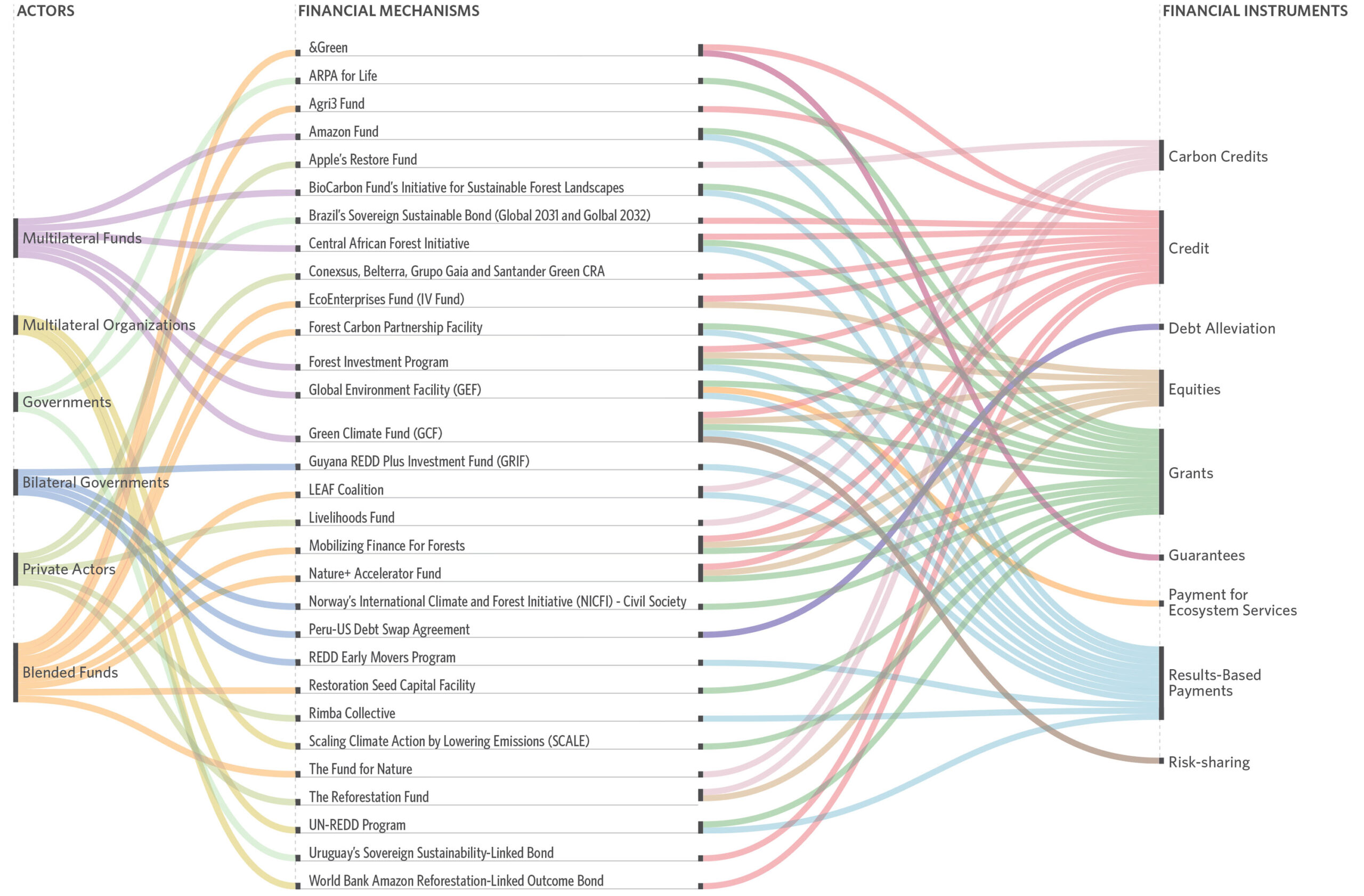

To achieve their forest objectives, the mapped financial mechanisms employ a combination of different instruments. Figure 4 illustrates the relationship between actors, financial mechanisms, and the instruments used.

Figure 4. Relationship between Actors, Financial Mechanisms and Financial Instruments Deployed for Forest Finance

Source: CPI/PUC-RIO based on cumulative data publicly available on the official websites of the financial mechanisms and entities, as of the research completion date, 2025

This report shows that several mechanisms employ different financial instruments simultaneously, ranging from more traditional tools to those with higher degrees of innovation. Instruments fundamentally define the legal nature and fundraising structure of mechanisms, deriving from the objectives to be achieved and the types of resources mobilized, and reflecting the mandates, risk appetite, and operational capabilities of each actor. In general, three types of instruments dominate forest finance: credit, grants, and results-based payments.

Overall, there is a strong reliance on credit instruments, indicating that traditional instruments are also well aligned with climate finance objectives. In addition, the use of grants and results-based payments reflects a specific need for forest finance through public actors.

Results-based payments instrument include Reducing Emissions from Deforestation and Forest Degradation in Developing Countries (REDD+). Jurisdictional REDD+ mapped in this study total over US$ 15.3 billion, constituting over half of total funding. These mechanisms are promoted by different types of actors, namely:

- • Bilateral governments, through the REDD Early Movers Program and the Guyana REDD+ Investment Fund (GRIF)

- • Blended funds, through initiatives such as the LEAF Coalition, the Forest Carbon Partnership Facility, and The Fund for Nature

- • Multilateral funds, including the Forest Investment Program, the BioCarbon Fund’s Initiative for Sustainable Forest Landscapes, the Global Environment Facility (GEF), the Green Climate Fund (GCF), the Amazon Fund, and the Central African Forest Initiative (CAFI)

- • Multilateral organizations, through the UN-REDD Programme

Enhancing forest finance will require expanding the use of new and existing instruments. Carbon credits, generated by projects or jurisdictions, that avoid emissions or sequester carbon, allow companies and individuals to offset their emissions. Their current use is relatively limited (e.g., five mechanisms, including the LEAF Coalition, The Fund for Nature, The Reforestation Fund, Livelihoods Fund and Milkywire’s Forest & Landscape Fund include carbon credits). The absence of a unified international carbon market leads to wide disparities in prices and limits cross-border forest financing. However, carbon credits hold the potential to provide consistent, predictable funding for forest projects.

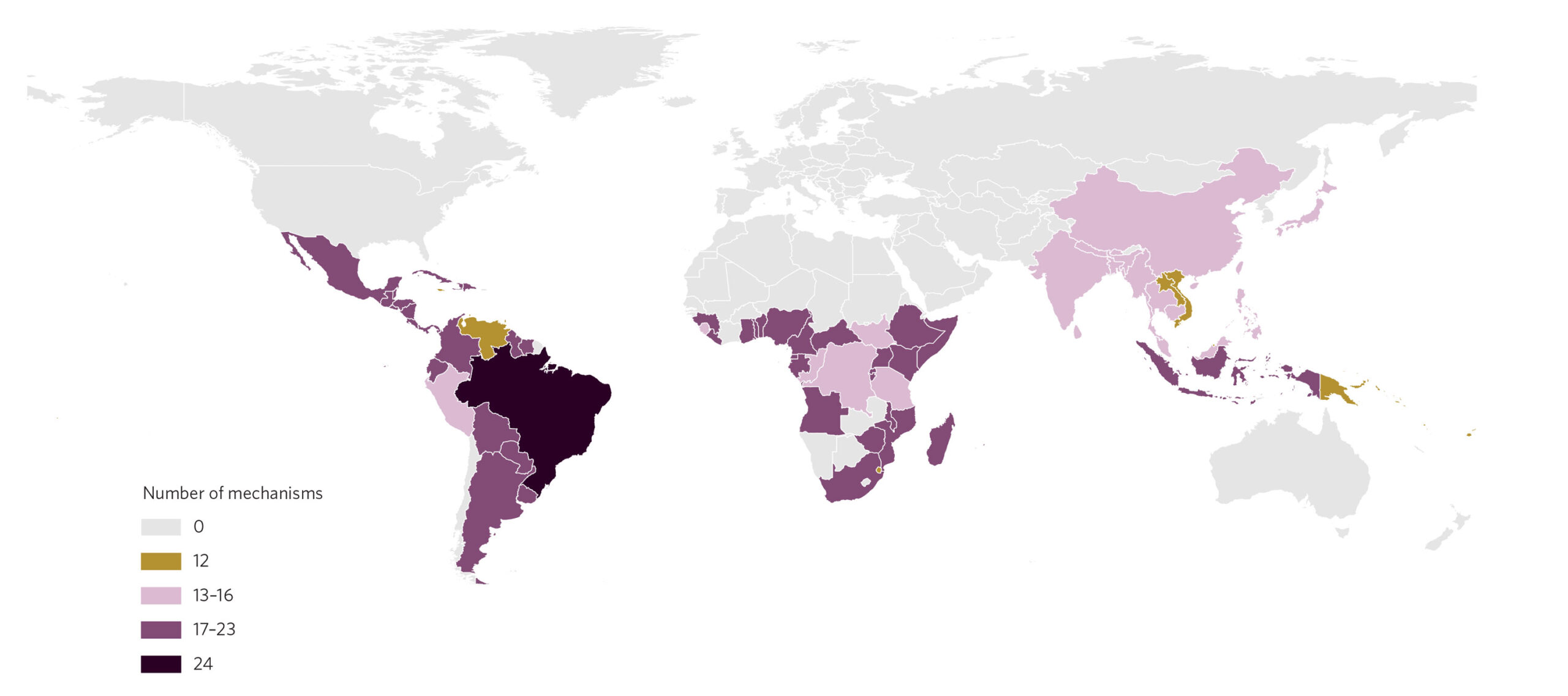

Finally, understanding the geographical scope is critical in assessing the current state of financial mechanisms for forest finance. Of the 30 mechanisms analyzed, nearly half (48%) are globally accessible, while others operate at national (28%) or regional/multi-country levels (24%). Overall, Brazil and Guyana stand out with the greatest access to mechanisms, 24 and 19 respectively, reflecting a broader concentration of initiatives across Latin America (Figure 5).

Figure 5. Number of Eligible Mechanisms by Tropical Forest Countries

Source: CPI/PUC-RIO based on cumulative data publicly available on the official websites of the financial mechanisms and entities, as of the research completion date, 2025

The current geographical scope of financial mechanisms reveals an underexplored potential among forest countries that have large forest areas and significant restoration potential due to past deforestation. Only three of the top ten nations with the highest carbon capture potential—Brazil, Cameroon, and Colombia—are eligible for a significant share of the mapped mechanisms.[10] Matching and expanding the access of other countries according to their potential is crucial to deliver results at scale.

As the world looks toward COP30 in Belém, tropical forests must move to the center of climate strategies. These ecosystems are not only vulnerable to climate change, but they are essential in addressing it. Tropical forests offer one of the most immediate and scalable opportunities for climate action.

This report presents a menu of 30 existing financial mechanisms that aim to mobilize US$ 25.9 billion for tropical forests and support key forest objectives, including conservation, restoration, and deforestation reduction. However, these mechanisms are not delivering at the scale and magnitude required to unlock the full potential of tropical forests, estimated by UNEP (2025) at US$ 66.8 billion annually until 2030.[11] The analysis offers insights into the current finance landscape of forest finance:

- • A diverse set of actors manage financial mechanisms that are at varying stages of development and differ considerably in scope, scale, and financial volume, with some playing a more prominent role in terms of volume allocated.

- • Of the US$ 25.9 billion in funding identified from current financial mechanisms, 31% has yet to be issued or disbursed. Delivering planned finance is still a challenge, especially for blended funds and private actors where planned funding reaches 57% and 88% respectively.

- • Financial mechanisms for forests have three main objectives: conservation, restoration, and deforestation reduction. Countries face different dynamics, and a fit-for-purpose forest finance architecture requires a better matching between investment and needs. Currently, a majority of the mechanisms contain a conservation focus. Restoration shows room for expansion and offers an investment profile that aligns well with blended funds and private actors. Deforestation reduction objectives must continue to play a critical role in maintaining and safeguarding current forest cover.

- • The geographical scope of current mechanisms highlights accessibility issues and calls for a greater understanding of the different contexts of forest nations across the globe to ensure greater alignment and to identify new opportunities where current initiatives can be scaled further or replicated in other geographies and context.

Beyond providing a menu of financial mechanisms, this report also reveals key lessons for improving the global financial architecture for tropical forests:

- • Expansion of forest finance will benefit from greater knowledge about existing approaches and transparency regarding disbursements, allocations, and timeframes. Currently this information is highly dispersed and lacks standardization. The lack of publicly available information limits the ability to understand the full scope of forest finance and determine its gaps and potential.

- • Tropical forest nations have different forest objectives based on their distinct contexts and aligning investment with needs requires coordinating and engaging a broad range of public, private, and philanthropic actors that can direct investments according to their different mandates, capacities, incentives, and risk appetites.

- • A robust forest finance architecture ensures the quality—not just quantity—of climate finance. Targeting and delivering resources and the use of financial instruments efficiently is essential to meet the needs and potential of developing countries and drive large-scale impact.

- • Meeting the forest finance gap requires increasing the scalability of existing mechanisms—in both design and implementation—to mobilize finance at the magnitude required for forests protection, restoration, and deforestation control, as well as complementing them with innovative mechanisms in a portfolio approach. This includes the use of blended finance structures, such as the Tropical Forest Forever Facility (TFFF), which compensates countries that preserve forests, and of jurisdictional performance-based carbon payments for restoration at scale, as in the Reversing Deforestation Mechanism (RDM) proposal, as well as further exploring the role of international capital markets for forest objectives.

↑ Go back to the top of the page

This study was prepared to inform discussions within the United for Our Forests group and does not necessarily represent the official views or positions of the Government of Brazil.

This work is supported by a grant from Norway’s International Climate and Forest Initiative (NICFI), Climate and Land Use Alliance (CLUA), and Porticus Foundation. This publication does not necessarily represent the view of our funders and partners.

The authors would like to thank Arthur Vieira and Thiago Catarino for research assistance. This publication benefited from comments and suggestions from Amanda Brasil-Leigh, Phillipe Käfer, and Vikram Widge. The authors would also like to thank Camila Calado and Maria Carolina Cassella for editing and revising the text and Meyrele Nascimento and Nina Oswald Vieira for formatting and graphic design.

[1] Assunção, Juliano et al. The Forest-Climate Nexus: A Fit-for-Purpose Framework for Climate Impact. Rio de Janeiro: Climate Policy Initiative, 2025. bit.ly/Forest-Climate-Nexus.

[2] Naran, Baysa et al. Global Landscape of Climate Finance 2025. Climate Policy Initiative, 2025. bit.ly/3Kz6DJP.

[3] United Nations Environment Programme (UNEP). State of Finance for Forests 2025: Unlock. Unleash. Realizing forest potential requires tripling investments in forests by 2030. 2025. bit.ly/48uSRlb.

[4] Mechanisms that lack sufficient information or are at an early stage were not included in this mapping. The information presented in this Menu comes directly from the official webpages of the financial mechanisms and entities and therefore relies on data reported by the respective agencies. This approach presents certain limitations, particularly regarding the timeliness and completeness of information on mobilized resources and financed activities.

[5] Actors in this analysis are characterized according to the nature of their financing and governance. Public actors include government-led mechanisms implemented by national or regional institutions using domestic public resources; multilateral funds, which receive contributions from three or more countries and operate with autonomous management; multilateral organizations, composed of multiple countries that design and execute programs and projects across borders; and bilateral government mechanisms, which channel public funds directly from one country to another. Private actors refer to mechanisms financed exclusively by the private sector that invest in or provide financing for forest-related projects. Blended funds combine different types of capital—public, philanthropic, and/or private—under autonomous or dedicated management structures.

[6] Planned resources refer to expected or pledged amounts that have not yet been effectively invested. This category encompasses terms such as planned, pledged, aimed, and signed contributions. Issued resources correspond to financial instruments that have been formally issued, as in the case of sovereign bonds. Disbursed resources denote funds that have advanced beyond the planning phase and have been effectively allocated or invested in projects. The terminology associated with this category includes invested, disbursement, allocated, committed, mobilized, approved, recorded, transferred, and use of funds.

[7] Assunção, Juliano et al. The Forest-Climate Nexus: A Fit-for-Purpose Framework for Climate Impact. Rio de Janeiro: Climate Policy Initiative, 2025. bit.ly/Forest-Climate-Nexus.

[8] United Nations Environment Programme (UNEP). State of Finance for Forests 2025: Unlock. Unleash. Realizing forest potential requires tripling investments in forests by 2030. 2025. bit.ly/48uSRlb.

[9] Near-real-time forest monitoring and alert systems based on satellite imagery have contributed to tracking deforestation on a global scale and enhanced the effectiveness of enforcement-centered measures. Real-Time Deforestation Detection System (Sistema de Detecção de Desmatamento em Tempo Real – DETER) has enabled Brazil to overcome law enforcement shortcomings by targeting environmental enforcement in the Amazon in regions indicated by the alerts. Global Forest Watch (GFW), a platform that offers open data on deforestation and forest cover made significant contributions to improving the ability of conservation and forest management organizations to respond to and reduce the impacts of fires, deforestation, and other illegal or undesirable forest activities in Madagascar, Indonesia, Bolivia, and Peru. MapBiomas Alerta, a system for validating and refining alerts on the deforestation of native vegetation across all Brazilian biomes using high-resolution images, has also contributed to these efforts. Learn more at: Assunção, Juliano et al. The Forest-Climate Nexus: A Fit-for-Purpose Framework for Climate Impact. Rio de Janeiro: Climate Policy Initiative, 2025. bit.ly/Forest-Climate-Nexus.

[10] Carbon capture potential is estimated using a spatial regression approach based on environmental and geographic covariates. Estimates by country can be found at: Assunção, Juliano et al. The Forest-Climate Nexus: A Fit-for-Purpose Framework for Climate Impact. Rio de Janeiro: Climate Policy Initiative, 2025. bit.ly/Forest-Climate-Nexus.

[11] United Nations Environment Programme (UNEP). State of Finance for Forests 2025: Unlock. Unleash. Realizing forest potential requires tripling investments in forests by 2030. 2025. bit.ly/48uSRlb.