FAST-Infra—the ‘Finance to Accelerate the Sustainable Transition-Infrastructure’ Initiative—has today opened an 8-week public consultation on a new sustainable infrastructure labelling system.

This new FAST-Infra Sustainable Infrastructure Label (SI Label) is designed to enable project sponsors, developers and owners to signal the positive sustainability impact of infrastructure assets, and attract investors seeking assets which positively contribute to sustainable outcomes.

The joint venture is established by HSBC, IFC (International Finance Corporation), OECD (Organisation for Economic Co-operation and Development), GIF (Global Infrastructure Facility) and CPI (Climate Policy Initiative). It aims to increase the flow of private finance to emerging markets sustainable infrastructure in order to create pipelines of bankable projects.

Why is a new label needed?

The SI Label aims to close the trillion-dollar sustainable infrastructure investment gap, with urgency, by transforming sustainable infrastructure into a mainstream, liquid asset class.

A key objective is to provide consistency regarding the quality and sustainability of assets in the market, drawing in more institutional investors at the post-construction phase and scaling up private financing volumes for suitable projects in emerging markets.

The label certification aims to increase financing potential, and in turn to motivate governments to design more projects with sustainability criteria at their core, and encourage developers to maintain high environmental, social and resiliency standards at all stages of the infrastructure lifecycle.

What is covered in the new label?

The SI Label is broadly aligned with the UN SDGs and G20 Principles for QII, and draws upon best practice from existing frameworks, standards, and taxonomies. It will introduce a series of 14 baseline and ‘positive contribution’ criteria (‘Sustainability Objectives’) against four dimensions of sustainability – environmental, social, governance and adaptation & resilience. Each criterion is further described by reference to existing standards and associated with a series of indicative KPIs and methodologies.

What action do you need to take?

The FAST-infra initiative is inviting feedback from all stakeholders. The deadline for submitting comments for this consultation has now passed.

- Review the draft SI Label proposal

- Download and complete the label feedback PDF form

- Send your completed SI Label feedback PDF form to fastinfra@cpiglobal.org

Open letter of support – FAST-Infra label consultation

The Sustainable Markets Initiative’s Financial Services Taskforce, alongside the Taskforce champions from the Asset Managers & Asset Owners and Insurance Taskforces, have released an open letter of support for the SI Label, outlining the contribution that a globally applicable label to designate infrastructure projects through their positive sustainability impact will have in the goal of closing the trillion-dollar sustainable infrastructure investment gap:

“We believe that the SI Label could significantly contribute to achieving this goal, putting Nature, People and Planet at the heart of global value creation.”

Public Consultation Feedback – Framework Document

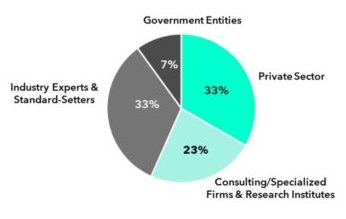

Following a series of stakeholder roundtables held in Spring 2021, the FAST-Infra Sustainable Infrastructure Label (SI Label) Working Group engaged in a formal public consultation period from June to August, 2021. Feedback was provided by 30 entities, spanning: government entities (7%); consulting/specialized firms and research institutes (23%); industry experts and sustainability standard-setters (33%); and, the private sector (33%).

Over 170 points of feedback were collated, which provided guidance, additional resources for consideration, and clarifications on the SI Label Framework, SI Label Sustainability Dimensions & Criteria Table, Governance Framework, and Frequently Asked Questions Document. In aggregate, responses from the public consultation showed positive feedback to the SI Label concept, and a willingness to endorse and apply the label within their respective organizations. Please refer to the consolidated matrix of comments file for more details on how the SI Label Working Group addressed each item of feedback.