The last two years have seen a steady increase in the number of climate and net zero announcements made by public and private financial institutions to align their financial flows with the Paris Agreement and Sustainable Development Goals. Because on average 97% of financial institutions’ emissions are in their portfolio rather than in their operations, tangible results in the real economy are only possible with action from financial institution counterparties, supported by active engagement from public and private financial institutions. Counterparties, as used here, broadly refers to companies on the other side of a financial transaction that have a close relationship to the real economy (e.g., an energy company or a consumer goods company).

Climate transition plans can be defined as time-bound action plans that outline how an organization plans to pivot its existing assets, operations, and business model towards a trajectory that aligns with the most recent and ambitious climate science recommendations. Whether for financial institutions or the companies in which they invest or lend to, climate transition plans should set out a theory of change for the real economy, recognize the critical changes required in governance, organizational and business processes, and identify the learning and capacity building needs within an entity for effective implementation to take place. In addition to examining the company’s climate-related financial risks, a responsible company must also consider its impact on the climate.

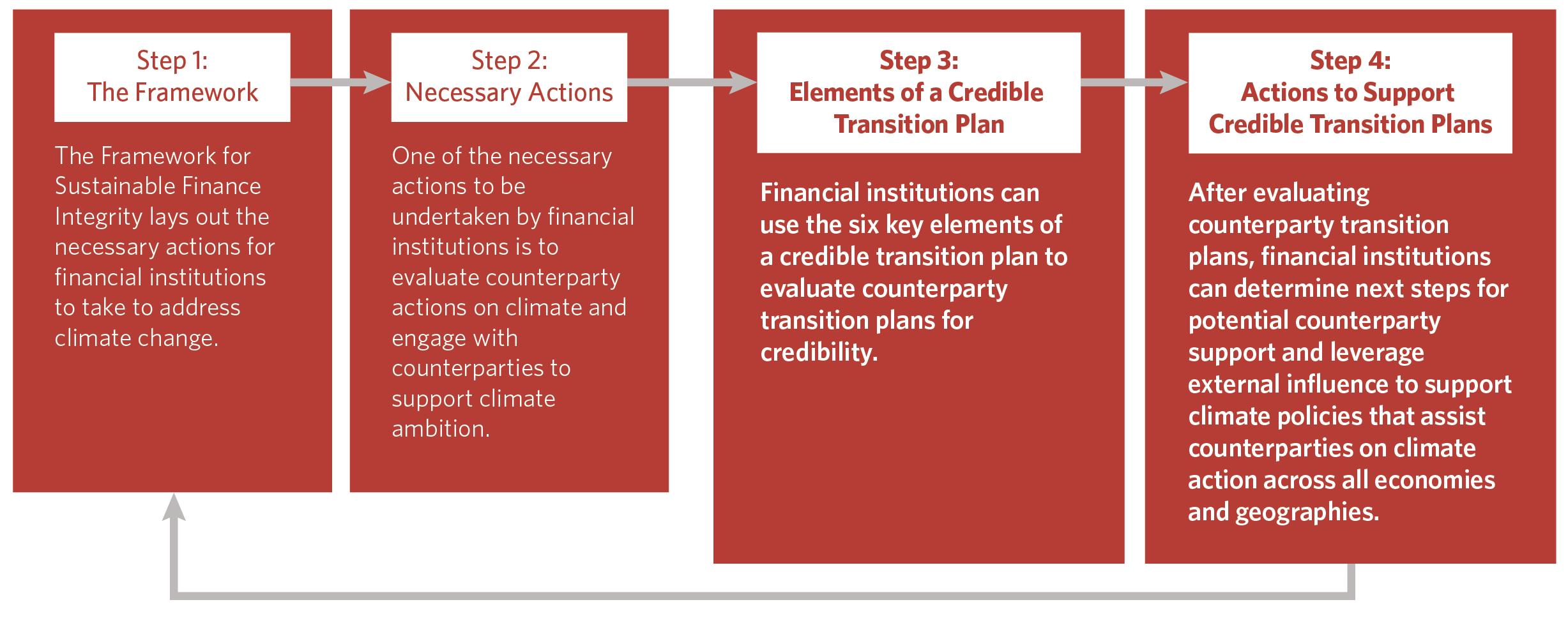

CPI’s Framework for Sustainable Finance Integrity (the Framework) outlines the necessary actions financial institutions need to consider when developing their own transition scenarios, and informs financial institutions about the credibility of their own transition plans. The Framework recommends financial institutions develop and publish a detailed policy for engagement and relationships with counterparties that fail to adopt and implement credible transition plans, and advocate for an environment that requires standardized climate reporting and encourages climate action. The outstanding question to address is ‘what makes a counterparty transition plan credible’?

This brief complements the Framework and these initiatives by:

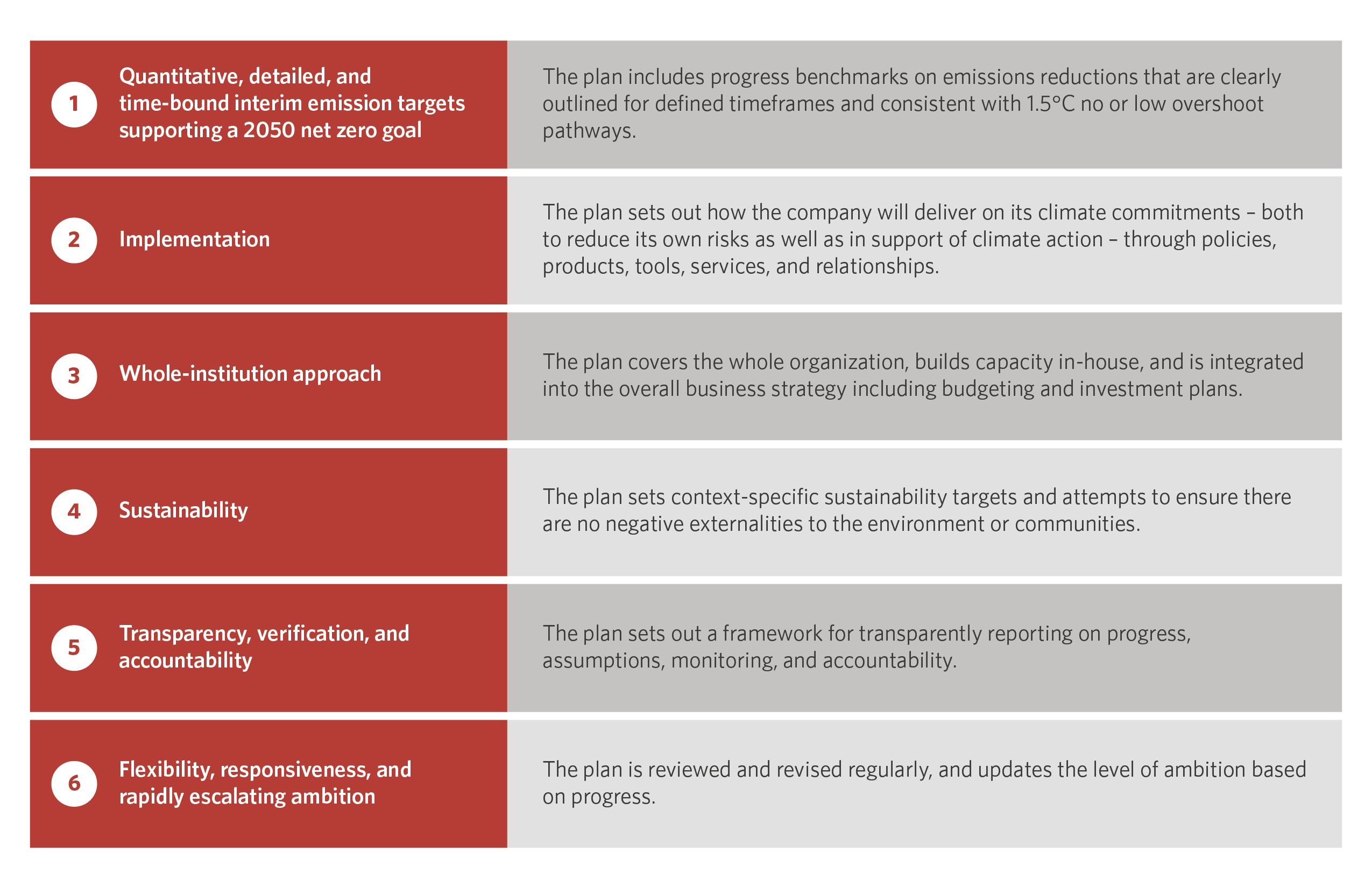

- proposing a set of key elements for financial institutions to consider when evaluating the credibility of counterparty transition plans;

- outlining steps financial institutions can take in response to the transition plan assessment, depending on the credibility of the counterparty transition plan, as an answer to the “what next” question;

- discussing how financial institutions can support the external regulatory and policy mechanisms that are needed to create an enabling environment for counterparties to effectively develop and enact their transition plans; and

- opening a discussion on the impact of transition plans and net-zero expectations on financial institutions and companies in developing economies, an area that deserves further research and consideration.

The elements outlined in this brief were developed through an evaluation of existing transition plans, current disclosure guidance, and discussion with subject experts, with an aim to identify which criteria acted as signifiers of ambitious climate action. Acknowledging that data and methodological challenges still exist on this topic, the elements have been crafted to allow them to be applied to a variety of sectors, geographies, and counterparty types and sizes, and the criteria within are designed to be ambitious while still acknowledging the uncertainty around transition planning.

This brief is not intended to displace the existing benchmarks or criteria for net zero company plans. The overlap between the assortment of existing initiatives and this brief serves as a complement and highlights the importance of engagement with counterparties as a way to reduce real economy emissions. The elements outlined in this brief were developed to examine what criteria would be most relevant from a financial institution’s perspective, to identify the places where financial institutions are best equipped to provide support, and to apply to a broad swath of companies, including those in different geographies, in different sectors, and of different sizes. Rather than focusing solely on emissions mitigation targets, these elements include climate adaptation, just transition, and larger sustainability goals. The brief aims to look for signs of commitment to climate action and the long-term viability of the transition plan, seeking to identify the information that truly signifies credibility from a counterparty.