Achieving the scale of investment needed for the climate transition—and capturing the economic and environmental benefits that come from it—is achievable but will require financial institutions (FIs) to play a central role.

Progress has been made, but the withdrawal of major FIs from climate coalitions since late 2024, as well as the disbandment of the Net Zero Banking Alliance and revisions to the Net Zero Asset Managers Alliance in 2025, highlight current challenges. Even as political backlash and regulatory uncertainty have driven some institutions to reassess public climate commitments, many still recognize decarbonization as essential to ensure sustainable growth and mitigate climate, nature, and economic risks.

With global decarbonization pathways already underway, the FIs who increase momentum and stay on course will be the ones that thrive most from the climate transition. Banks and asset managers must be responsive to shifts in market preferences and regulations toward sustainability, which will erode the value of carbon-intensive assets. Insurers must get ahead of disruption in the sector caused by physical climate impacts. Pension funds and other asset owners face growing fiduciary, stewardship, and legal pressure to consider climate and nature risks.

In addition, FIs continue to face real barriers to seizing the opportunities presented by net-zero action. These include inconsistent regulations, data gaps on risks, flows, and returns, and misalignment between climate commitments and capital allocation—often shaped by short-term incentives. In emerging markets and developing economies, the challenge is even greater: political and macroeconomic instability, underdeveloped pipelines of investable projects, and limited awareness of climate finance opportunities hinder progress, despite EMDEs being critical to global decarbonization.

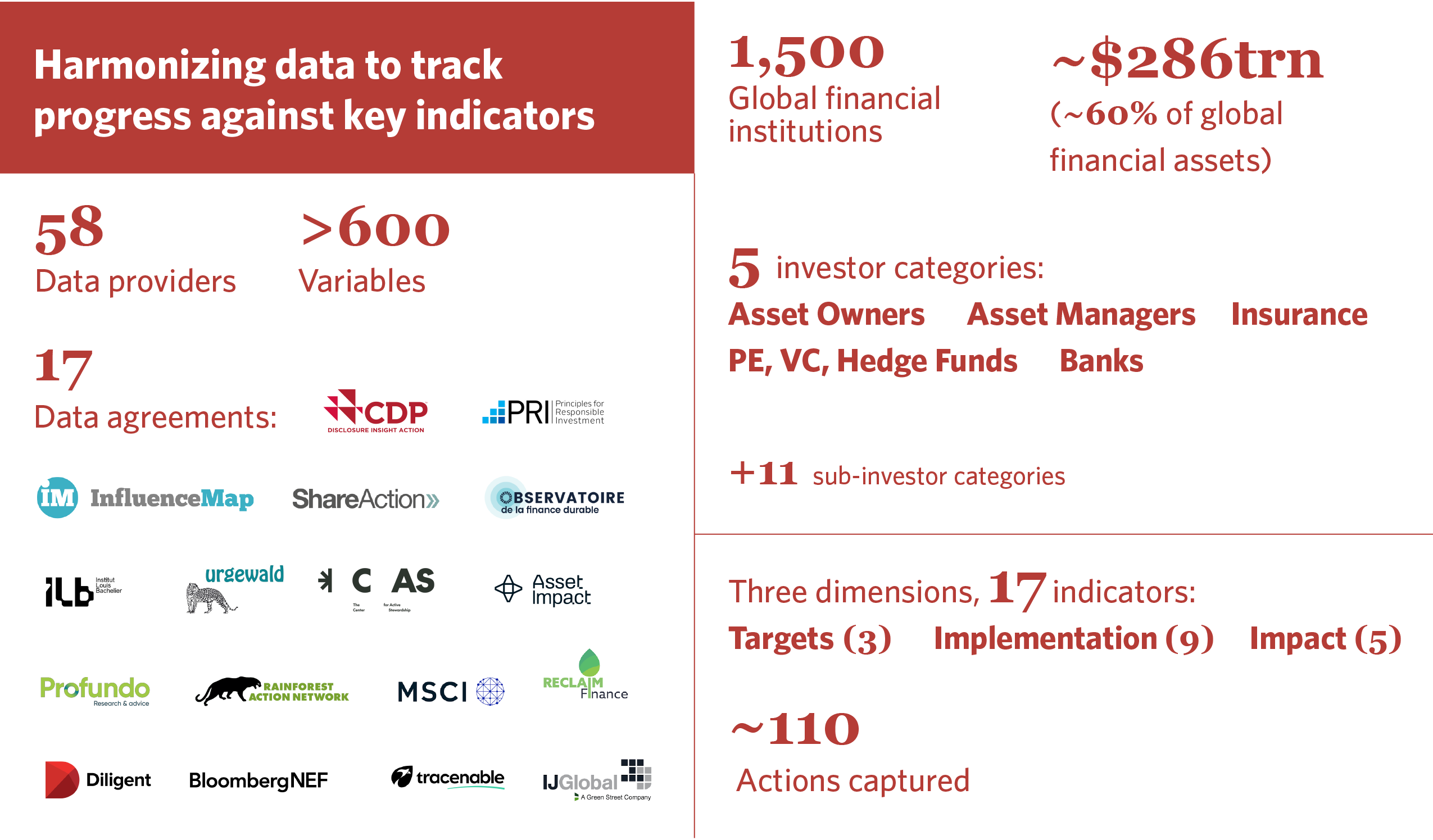

The importance of independent, credible tools to track progress, close information gaps, and guide effective action is more crucial than ever. CPI’s Net Zero Finance Tracker (NZFT) provides the only independent, standardized assessment of over 1,500 private FIs from 67 countries’ progress on climate Targets, Implementation, and Impact.

This report synthesizes data from 58 public and private external sources, as well as internal CPI data collection, on FIs’ progress toward climate alignment. This actionable data can empower civil society, regulators, and investors to hold institutions accountable in their transition to net-zero or implementation of their transition plans, strengthen net-zero strategies, and accelerate climate-aligned investment. The dataset offers multiple perspectives and can be explored through several lenses: aggregate trends for dimensions and individual indicators, trends for investor categories or regions and countries.

Key findings

TARGETS

Adoption of Targets signals FIs’ ambition, sets direction, and creates accountability for their climate action. As of 2024, Target-setting had expanded rapidly across NZFT-tracked institutions, but quality remained weak.

- Mitigation targets had been set by FIs representing 80% of AUM/O—but lacked depth. Comprehensive, validated targets aligned with 1.5°C pathways remained rare. Asset managers and banks led the way in mitigation targets, yet the quality varied in some key countries.

- Fossil fuel phase-out and exclusion targets had been set by 59% FIs by AUM/O, but a failure to apply policies across the entire fossil-fuel energy value chain and to halt financing of expansionist fossil fuel companies limits target credibility. In 2024, just 14% of FIs by AUM/O had credible fossil fuel policies, falling short of the IEA’s recommendation that no new fossil fuel expansion is needed.

- Climate investment targets tended to be of higher quality when adopted. However, FIs covering just 34% of AUM/O had set climate investment targets, showing limited growth. While quality could be improved, many of these operational targets incorporated important features, such as specified timelines and clear methodologies.

By institution type, banks and asset managers lead on setting targets, but insurers are more closely aligned with net-zero goals. Adoption and quality lags for both private equity and asset owners, although performance among asset owners is comparatively better, with pension funds outperforming sovereign wealth funds.

Most target-setting is voluntary, and recent withdrawals from and disbandment of net-zero alliances highlight the fragility of commitments without policy reinforcement. Any such retrenchment within 2025 may be reflected in next year’s NZFT dataset. While most jurisdictions have adopted legally binding national climate targets, these have not yet been translated into equivalent mandates for the financial sector. The challenge remains to improve quality, even out and raise progress across regions, and end the dominance of fossil-fuel financing to rapidly move portfolios toward net-zero, climate-resilient alignment.

FIs moving toward internal target-setting and monitoring of transition and climate risks can help strengthen credibility and resilience. However, unless commitments are reaffirmed and better aligned with policy frameworks, these trends may manifest as stagnation or retrenchment in next year’s NZFT dataset (covering 2025).

IMPLEMENTATION

Integrating climate considerations into governance and business processes is essential to turn ambition into meaningful change. FIs have significantly progressed in their quality of implementation actions, showing clear progress, though best practices remain rare.

- Most progress was seen on disclosure of climate risk (covering 79% of FIs by AUM/O in 2024), climate risk management (83%), and internal accountability (77%).

- There is the greatest room for FIs to improve on policy engagement, disclosure of investment data, and working toward net zero without using carbon offsets. Policy engagement is a key tool given the impact that countries’ climate policies have in driving further financial response and impacts in the real economy.

- Shareholder engagement has broadened, with 806 entities (73% of FIs by AUM/O) reporting some sort of action in 2024. However, FIs supporting more than 75% of climate resolutions declined from 21% to just 6% (in terms of AUM/O) in 2021 to 2024. This decline was driven by US entities, reflecting political headwinds and FIs’ concerns over shareholder proposals that do not meet business interests.

Banks, asset managers, and insurers lead on Implementation, while asset owners (especially sovereign wealth funds) and private equity are behind. Regional gaps remain stark, with Western Europe ahead and the Middle East and North Africa showing the weakest progress.

IMPACT

What ultimately matters is the impact that FIs achieve in the real economy.

- Physical climate and nature risks threaten financial stability. Estimated projected portfolio losses escalate to 5% globally under +2°C to +3°C warming scenarios, especially in asset-heavy sectors and regions that are particularly vulnerable to climate change (e.g., the projections rise to 10-15% in EMDEs).

Despite this, NZFT-tracked FIs continued to show mixed progress across energy finance indicators in 2024:

- Financed emissions have decreased only slightly since 2019. CPI’s independent assessment of portfolio emissions also highlights potential inconsistencies in FIs’ self-reported figures.

- Nearly three-quarters of energy capital stocks remain in FF holdings the majority of which are expanding their operations.

Similarly, credit financing remains skewed toward fossil fuels. Banks’ bond and equity underwriting and loans to FF companies accounted for 70% of all tracked new credit finance, with just 30% for clean energy.

This underscores the need to integrate effective climate risk management into fiduciary duty and support the transition away from emission-intensive activities that contribute to physical climate risk and are potentially exposed to transition risks that remain unaddressed by transition plans.

Direct and Indirect Finance

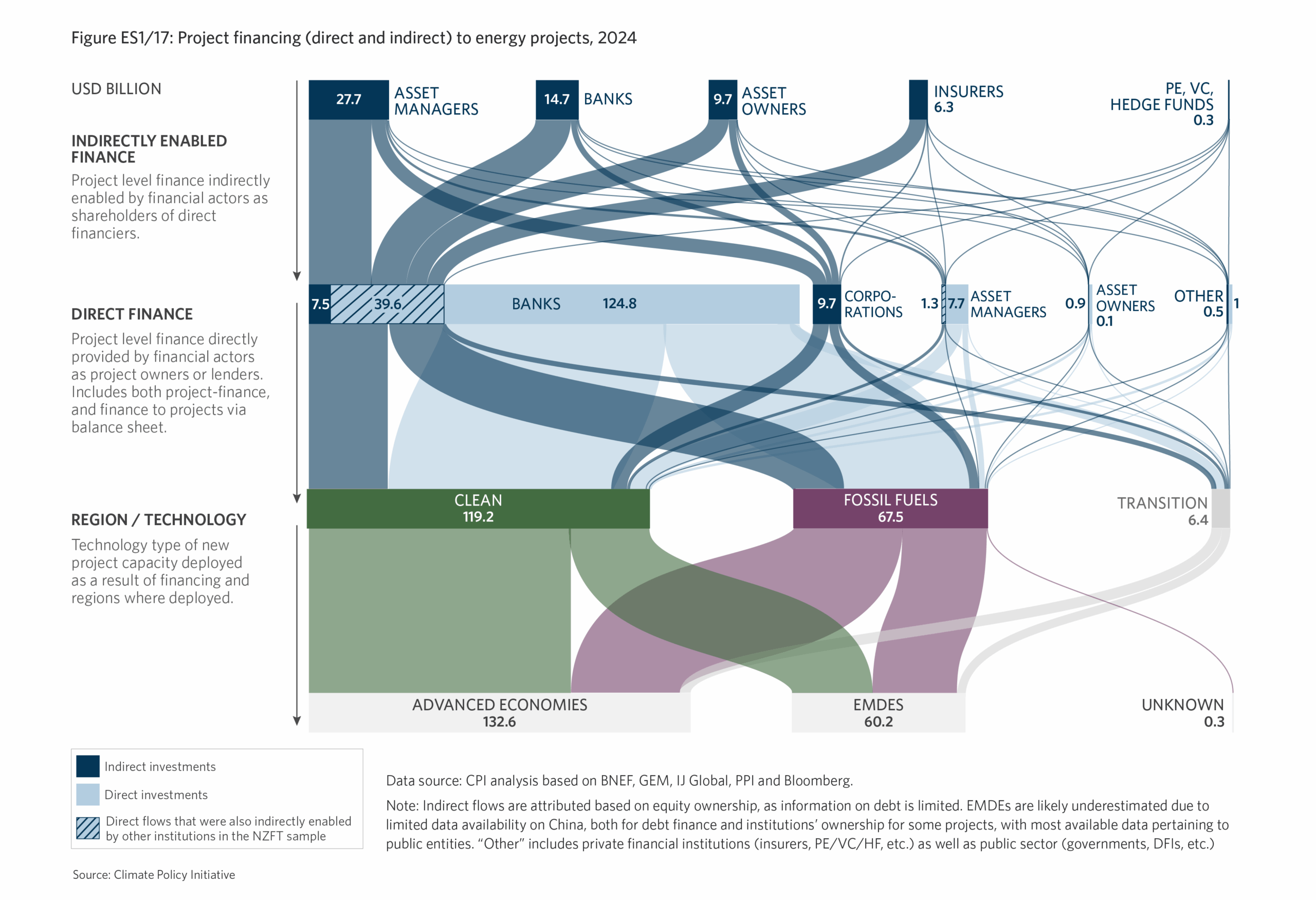

Focusing on how capital is deployed on the ground, direct finance to clean and transition energy projects has been growing by 18% anually from 2019 to 2024. This led to a total of almost USD 126 billion for clean and transition projects financed directly or indirectly enabled by FIs (e.g., as shareholders) in 2024.

Clean energy project finance was also concentrated in advanced economies, with emerging markets receiving just 29% of global energy flows in 2024. Banks remained the primary providers of direct project finance for new energy projects (USD 164 billion or 94% of total). Asset managers played a critical role in indirectly enabling new project finance through their positions as shareholders, with USD 28 billion enabled (47% of the total enabled finance) by supplying equity to companies investing in energy assets.

Despite these clean energy trends, new FF projects are still funded, contrary to the International Energy Agency (IEA) warning that new fossil energy investment is incompatible with net zero. This means that current levels already overshoot this pathway and exacerbate the economic risks associated with climate change.

The way forward

The dataset offers multiple perspectives and can be explored through several lenses: aggregate trends for dimensions and individual indicators, as well as trends for investor categories, regions, and countries.

For more insights and practical ways on how FIs can improve their climate performance, access the full report.