Indonesia needs to go through a rapid transition to decarbonize while achieving economic resilience, which requires significant investment flows. Several global and regional finance frameworks and taxonomies have begun to include the concept of ‘transition finance’, meaning the financial support required to implement long-term changes on the path to net zero and more sustainable practices.

The development of green taxonomies by regions (such as the EU Taxonomy and the ASEAN Taxonomy) and countries are meant to streamline guidance on which activities are aligned with decarbonization goals, and therefore increase confidence for financiers to invest in those activities. However, some activities needed on the transition path to net zero and more sustainable practices are not traditionally categorized as low-emissions activities. An example of these activities is investing in coal plants to help them plan for energy transition.

Taxonomies have evolved to provide assurance to financiers that transition activities are not necessarily bad. For instance, the EU sustainable finance taxonomy allows certain activities that are not yet low-carbon to be financed. In the absence of economically feasible low-carbon alternatives, this applies to any sector with lower-emission alternatives that can be implemented in ways that are still Paris aligned and do not lock-in carbon-intensive assets.

A transition taxonomy is therefore needed for two main purposes:

- Allowing transition finance to bridge the gap between traditional and green finance. For instance, Indonesia’s joint targets under the Just Energy Transition Partnership (JETP) include capping power sector emissions to 290MT by 2030 and reaching net zero by 2050. To achieve these, phasing out coal-fired power plants while accelerating the deployment of renewable energy sources is necessary. As financiers are now reluctant to finance coal, a transition taxonomy defines measurable parameters within which coal investment is allowed in order to facilitate early coal decommissioning.

- Avoiding greenwashing by imposing integrityto sustainable finance principles. The taxonomy could impose certain criteria to be embedded in existing risk management procedures and controls of businesses and financiers, which enhances their governance. Good governance helps them develop robust processes for delivering transparent public statements on the sustainability of their investments.

Invest in coal but focus on retiring it earlier

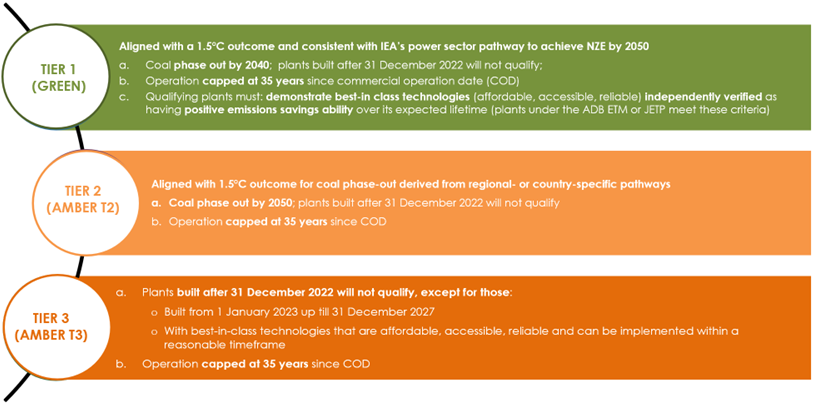

Recently, ASEAN Taxonomy for Sustainable Finance (Version 2) expanded its principles to finance transition activities, including for coal phase-out and the carbon capture, utilization and storage (CCUS) enabling sector. For instance, financing the phase-out of coal-fired power plants can be acknowledged as sustainable if the period of plant’s commercial operation is shortened to a maximum of 35 years. When not shortened, such plant has typical lifetime of 45-60 years. This is why investments in coal early retirement can fall under the green or amber/yellow category, instead of red (Figure 1).

Figure 1. Technical Screening Criteria (TSC) for Climate Change Mitigation of Coal Power Phase-Out

While the ASEAN taxonomy’s Technical Screening Criteria (TSC) is still aligned with Paris Agreement goals, it further accommodates ASEAN member countries’ diverse NZE pathways towards an equitable energy transition. It also accommodates planned coal phase-out programs in the region, including:

- Indonesia ETM – ADB’s scalable and collaborative initiative to leverage a market-based approach in accelerating the transition from fossil fuel to clean energy;

- Indonesia JETP – focused on transitioning away from coal power and towards vast deployment of renewables; and

- GFANZ’s Managed Phase Out program – which engages financial institutions to finance the early retirement of coal-fired power plants. This is a unique feature and a global first for a regional taxonomy, encouraging early private-sector action to reduce the region’s reliance on coal as a major energy source.

The ASEAN Taxonomy also introduced “social aspects” alongside the “Do No Significant Harm” (DNSH) and “Remedial Measures to Transition” (RMT) eligibility criteria under both the Foundation Framework and the Plus Standard. The three social aspects included here are: Respect for Human Rights, Prevention of Forced and Child Labour, and Impact on People Living Close to Investments. This means that in order to be acknowledged as taxonomy-aligned, transition activities must respect social safeguards and reflect the sentiment that the transition must be just and equitable.

The question of captive coal power

Discussions have emerged around the extent of “greenness” that can be attributed to coal plants in support of the transition towards a low-carbon economy. In Indonesia, developing the downstream industry has been declared a national priority. Such decision is deemed essential to reduce reliance on the extractive sector and build integrated local supply chains for green products that support energy transition, such as electric vehicles. To achieve this, integrated mining and battery producers powered by a fleet of approximately 20 GW of captive coal plants are currently in the pipeline to be built over the next decade. These represent upcoming licensed coal plants which could not feasibly be targeted for early coal retirement.

At the same time, global investors are becoming increasingly critical about the emissions scope of their investments. Electric vehicle factories powered by coal, for example, will not be attractive to investors looking to decrease their value chain (Scope 3) emissions.

Indonesia is in dire need of increased investment into renewables and low-carbon supply chains from upstream to downstream. To support this, the taxonomy should include captive renewable plants instead of captive coal plants in the green category. This will do more to boost investor confidence and encourage greening the supply chain comprehensively.

Adopting transition finance: ways forward for Indonesia Green Taxonomy 2.0

Last year Indonesia’s G20 presidency, in particular the G20’s Sustainable Finance Working Group, proposed the following five pillars of a Transition Finance Framework:

- Identification of eligible transition activities and investment through principle-based, taxonomy-based criteria, or a combination of both approaches;

- Reporting and disclosure of transition plans, activities, and investment that can be verified and compared, which can support decisions of financiers;

- Transitions-related finance instruments, such as debt and equity instruments, de-risking products, and other instruments including blended finance;

- Policy measures that provide market signals to incentivize and accelerate capital flows and to improve the bankability of transition activities; and

- Mitigation of socioeconomic impacts and support for broader just transition.

Based on these pillars, and further learning from transition finance implementation in the EU and ASEAN taxonomies, we outline the following key considerations and steps to adopt transition finance into the next iteration of Indonesia green taxonomy:

- Develop clear definition and criteria of transition activities, which should:

- Be easy-to-understand, applicable to all parties, document-based, credible, and scientifically justifiable.

- Consider Indonesia’s Nationally Determined Contribution (NDC) while still prioritizing reasonable and gradual transitions, as well as regional and/or international best practices, relevant policies, and prevalent technologies.

- Advance the development of technical threshold and screening criteria to fit Indonesia’s specific needs (i.e., power sector decarbonization) and further consider ASEAN’s unique characteristics of energy transition pathways to promote inclusivity and interoperability between taxonomies. For starter, NDC sectors may adopt qualitative and quantitative measures from the ASEAN Taxonomy if they are aligned with the sectoral requirements.

- Leverage the taxonomy as regulatory and industry guidance for reporting and disclosure:

- Incorporate the latest updates of domestic and regional transition strategies to strengthen existing disclosure policies. For example, POJK 51/ 2017, that currently requires financial institutions to allocate and disclose their investment in sustainable business activities, should be synchronized with the direction of future taxonomy iteration.

- Ensure that disclosure requirements enable the industry to access reliable and verifiable information on transition activities as well as related risks and opportunities. This information can be used as a basis for businesses and financiers in redirecting their investment strategy and operations to align with sectoral transition pathways (e.g., MEMR’s Power Sector NZE Roadmap, Indonesia’s FOLU Net Sink 2030) and national targets.

- Promote the use of tailored finance instruments to support the transition.

- Leverage the USD 20 billion JETP financial commitments to develop innovative financing structures that enable early retirement of coal plants at commercial or concessional terms. More financial institutions should be encouraged to explore these innovative structures. Familiarity with such structures will help progress the pipeline of transition projects, as well as scaling up of the transactions going forward.

- Engage global financial institutions to support transition finance. Despite not being affected by Indonesia or ASEAN’s taxonomy, transition taxonomies are being discussed in other jurisdictions as well. As we look to global investors to contribute to Indonesia’s decarbonization goals, global financial institutions should be part of the discussion on net zero pathways relevant to ASEAN and Indonesia, and the clear and measurable thresholds of eligible transition activities to finance.

- Focus on just transition and decarbonization pathways:

- Adopt policy measures to align transition activities categorized as “green”, particularly for coal decommissioning, with the national roadmap and pathways. These include Presidential Regulations 112/2022 on Accelerated Renewable Energy Deployment for the Provision of Electricity (Perpres 112/2022), Indonesia Net Zero Emission (NZE) Roadmap for the Energy Sector, Indonesia ETM program, and the upcoming JETP Comprehensive Investment and Policy Plan (CIPP).

- Develop a Just Transition Finance Framework to create awareness and confidence to crowd in finance from multiple sources. This may serve as practical guidance for financiers to ensure that the substantial benefits of a green economy transition are equitably shared among key stakeholders, such as governments, industries, communities, workers, and consumers.

The consideration of transition activities as either “green” or “yellow” in the taxonomy may enable wider application or integration of low-carbon technologies into investment portfolios, as long as screening criteria clearly set forth the threshold and timeline that are aligned with the NZE pathways. By incorporating transition finance guidelines into green taxonomy, Indonesia stands to benefit from sending a clear market signal to industry and investors. accelerating the pace and impact of finance towards achieving the country’s ambitious decarbonization goals.