Cross-border guarantees are an important but underused tool for mobilizing private climate finance. A recent OECD evaluation found that guarantees leveraged 26% of all mobilized private finance between 2018-2020 and were among the preferred risk mitigation tools of private investors.

Studies suggest that larger and more effective credit guarantee facilities have the potential to mobilize 6-25 times more financing than loans. Their importance is even greater in emerging markets and developing economies (EMDEs), where geopolitical uncertainty and financial instability often hinder investment. Yet, the landscape of guarantee instruments and actors is fragmented.

Climate Policy Initiative has conducted a mapping exercise to better understand the landscape of guarantees for EMDEs. This aimed to highlight key gaps in the uptake of guarantees for climate finance and identify areas where further research is needed to increase their scale and effectiveness for climate finance in EMDEs.

Methodology

CPI undertook a scoping analysis to gain a baseline understanding of the global landscape of guarantees. We identified 52 different cross-border guarantee instruments from 34 key entities. These entities fall into four main types of provider:

- Multilateral development banks (MDBs),

- Development finance institutions (DFIs),

- Export credit agencies (ECAs), and

- specialized institutions.

Specialized institutions operate similarly to private sector organizations but are funded by governments and development institutions, generally focusing on guaranteeing specific types of risks in specific situations.

For each guarantee instrument, we analyzed key product criteria including: type of financial instruments guaranteed, sector and climate focus, geographic coverage, and type of risk covered.

We covered commercial, political, and currency risks for debt investments such as loans, bonds, and any other form of debt. Although less common, we also covered guarantees for equity investments, focusing only on political and currency risks, which are relevant in EMDEs. We categorized guarantees as either climate-agnostic, for a variety of projects including climate-related ones, or climate-exclusive, solely for climate-related projects.

While representative of the range of major cross-border guarantee facilities available for climate-related investments in EMDEs, our study is not exhaustive and does not delve into the ways in which guarantees are used at the national level to mobilize finance. Nevertheless, this scoping analysis provides valuable insights into the landscape of guarantee instruments and identifies avenues for further research to fill knowledge gaps on the effectiveness and scaling of guarantees.

Key findings

We categorized and assessed the guarantee instruments against a set of distinguishing criteria, resulting in the following findings.

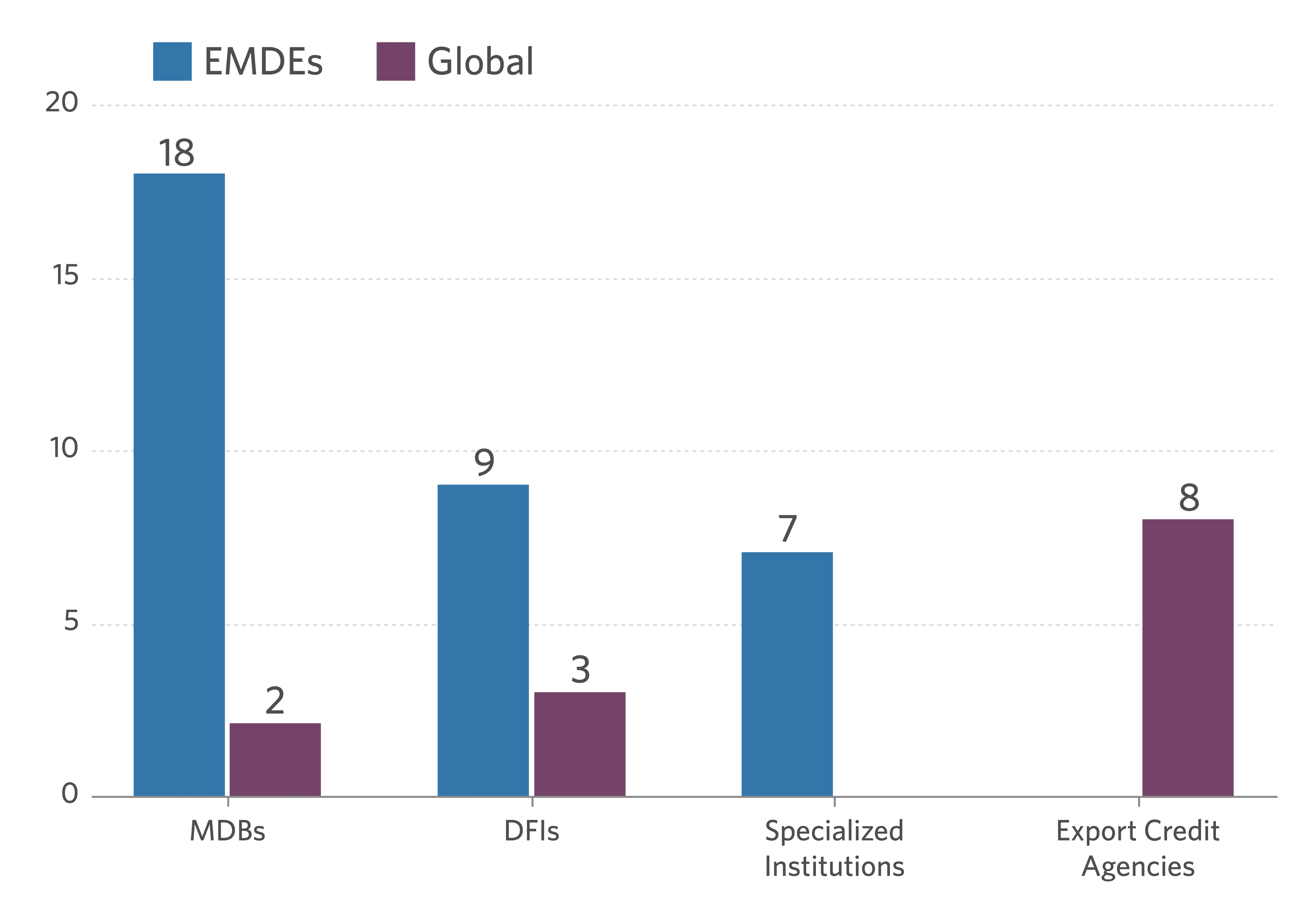

Geographical Coverage by Provider Type

More than half of the mapped guarantees are intended for EMDEs, with the largest share going to middle-income countries. MDBs and specialized institutions focus primarily on EMDEs, often targeting middle-income countries. While there is a pronounced focus on Africa by these institutions, further research is needed to determine whether this is indicative of a broader trend or reflects a bias in the data sample.

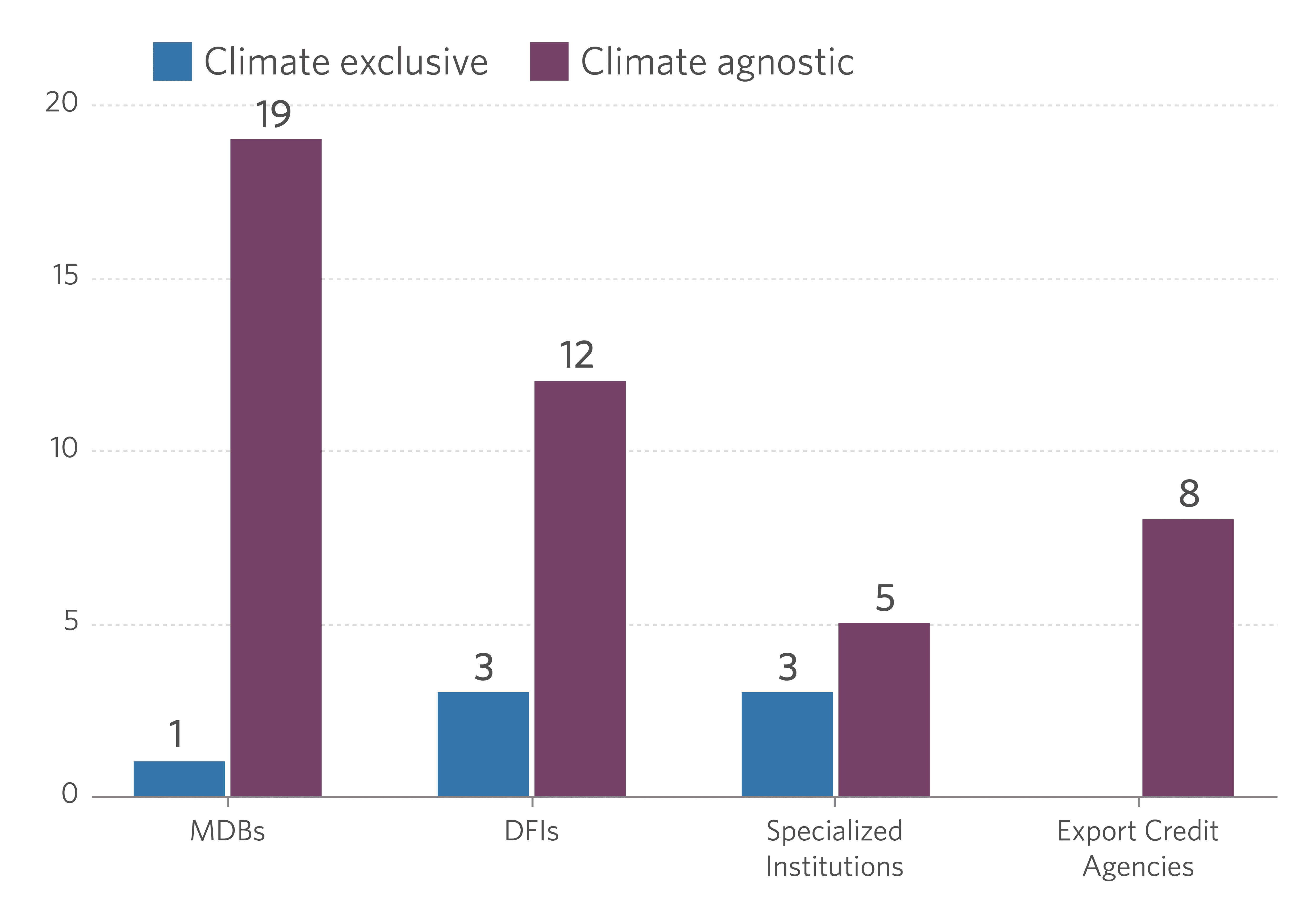

Climate Focus by Provider Type

The majority of guarantees do not focus exclusively on climate issues, with only a handful of specialized institutions and DFIs offering climate-specific guarantees.

Examples include the Green Guarantee Company and the U.S. International Development Financing Corporation. There is an opportunity for MDBs to increase the number of climate-exclusive guarantees they offer to better align with global climate goals. Additionally, care needs to be taken to ensure that existing and future climate-exclusive guarantees have a balanced focus on both climate mitigation and adaptation finance.

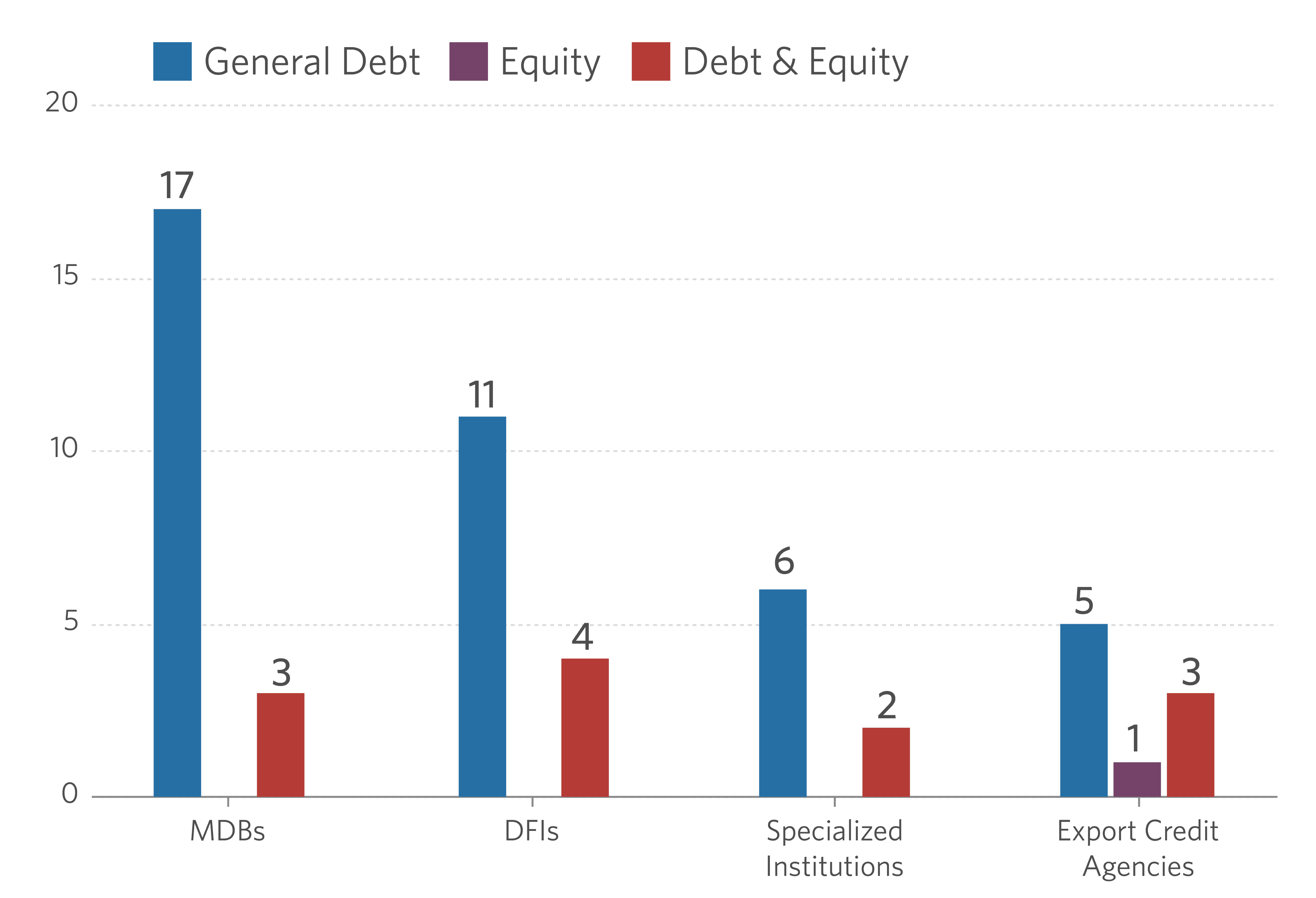

Instrument Type by Provider Type

The mapping exercise found a predominance of debt guarantees, with a low presence of equity investment opportunities. This is consistent with the distribution of financial instruments tracked in CPI’s Global Landscape of Climate Finance (GLCF). While equity investments are meant to take risks, further research is needed to determine whether the relatively limited availability of equity financing for climate projects in EMDEs is a binding constraint on climate finance flows due to political and currency risks. If so, the research could explore the potential role that guarantees for political and currency risks in equity investments could play in easing that constraint.

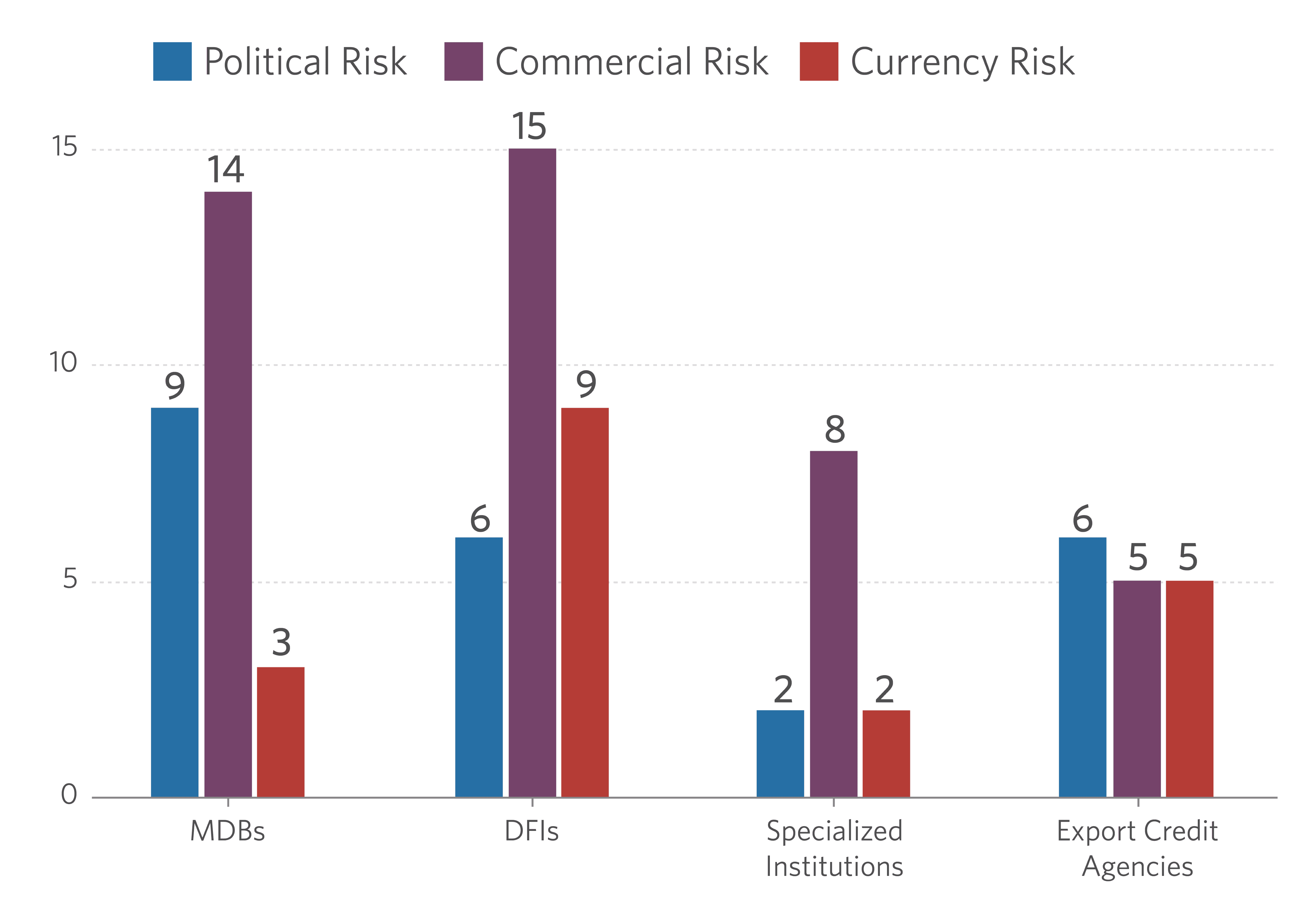

Risk Coverage by Provider Type

Guarantees predominantly cover commercial risks, with less emphasis on political and currency risks. Political and currency risk products are often limited in scope, expensive, and complex. Potential solutions to expand, simplify, and potentially discount the availability of political and currency risk coverage in EMDEs for climate finance have gained traction in the last year, which could lead to greater availability of guarantees for climate projects.

Sectoral Coverage by Provider Type

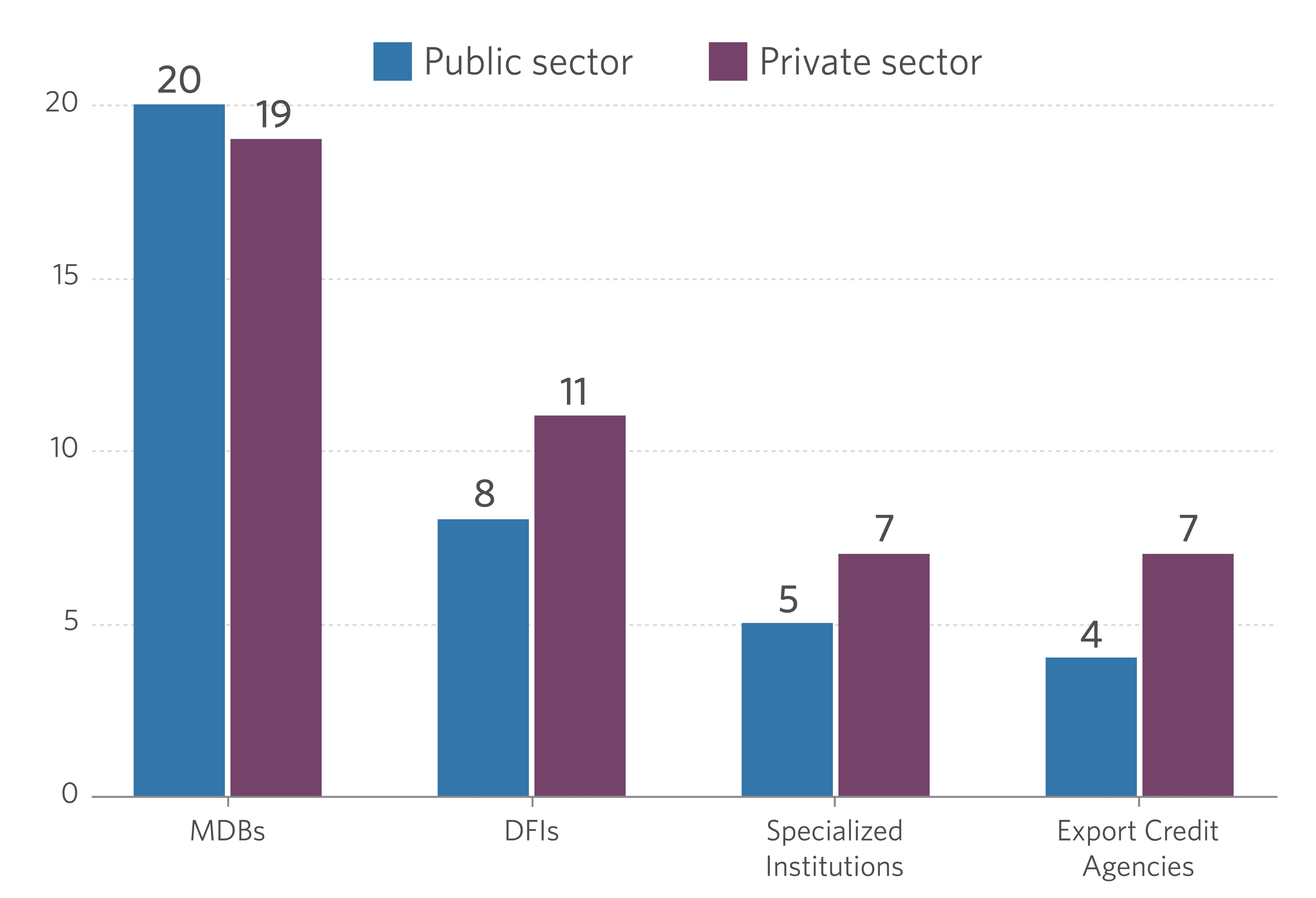

We analyze how guarantees cover investments in both private and public sector projects, including sovereign debt, state-owned enterprises, and public-private partnerships, as both play a critical role in the energy transition in EMDEs.

The distribution of guarantees is relatively even across the private and public sectors, with a slight preference for the private sector among providers, suggesting a balanced market for guarantee coverage.

Recommendations for future research

To improve the effectiveness of guarantees in catalyzing private sector finance, particularly for green transitions in EMDEs, further research is needed. Guarantees in climate finance are difficult to track due to low default rates, so the additionality of guarantees on climate finance flows is not fully understood. The remaining areas of research include:

- Cost of obtaining guarantees, including how these costs affect the accessibility of guarantees to different entities.

- Delivery mechanisms and the impact of different approaches, such as direct insurance, intermediaries, or pooled guarantees instruments.

- Scale and limits of guarantees to help reach the estimated USD 2.4 trillion per year needed for the green transition in EMDEs (excluding China).

- Utilization rates to determine the percentage of available guarantees that are used.

- Duration of guarantees and whether this has a significant impact on project success, particularly in the context of green initiatives, which often have longer development and payback periods.

- Comparative analysis with other instruments to provide insights into the relative effectiveness of guarantees in mobilizing private finance for green transitions compared to other traditional financial instruments.

- Climate-related research focused on how to tailor guarantees specifically adapted to different climate-related projects and sectors, assess their effectiveness, and align them with the unique needs of each project.

- Role of national development banks in providing guarantees through credit guarantees, which are essential for catalyzing domestic private investment.

- Leadership opportunities by MDBs to catalyze a much larger universe of guarantee providers at a regional and national level through qualifying financial institutions such as DFIs and local financial institutions.

- Nature and scope of guarantee coverage, examining how commercial risks are divided between partial and full coverage and whether pari passu or first loss risk sharing is more prevalent.

- Sizes of guarantees and financial instruments to establish the threshold at which cross-border guarantees become unattractive or nonviable.

- Impact of local regulatory challenges on guarantees, including how these instruments fit with domestic financial regulations and the role of local financial institutions in enabling effective guarantee implementation.