The Landscape of Climate Finance in Africa offers the most comprehensive overview of climate investment flows across the continent. This report identifies gaps and opportunities, serving as a critical resource for policy formulation, advocacy, and investment decisions in African climate finance.

To delve deeper into the data, explore the .

Key Findings

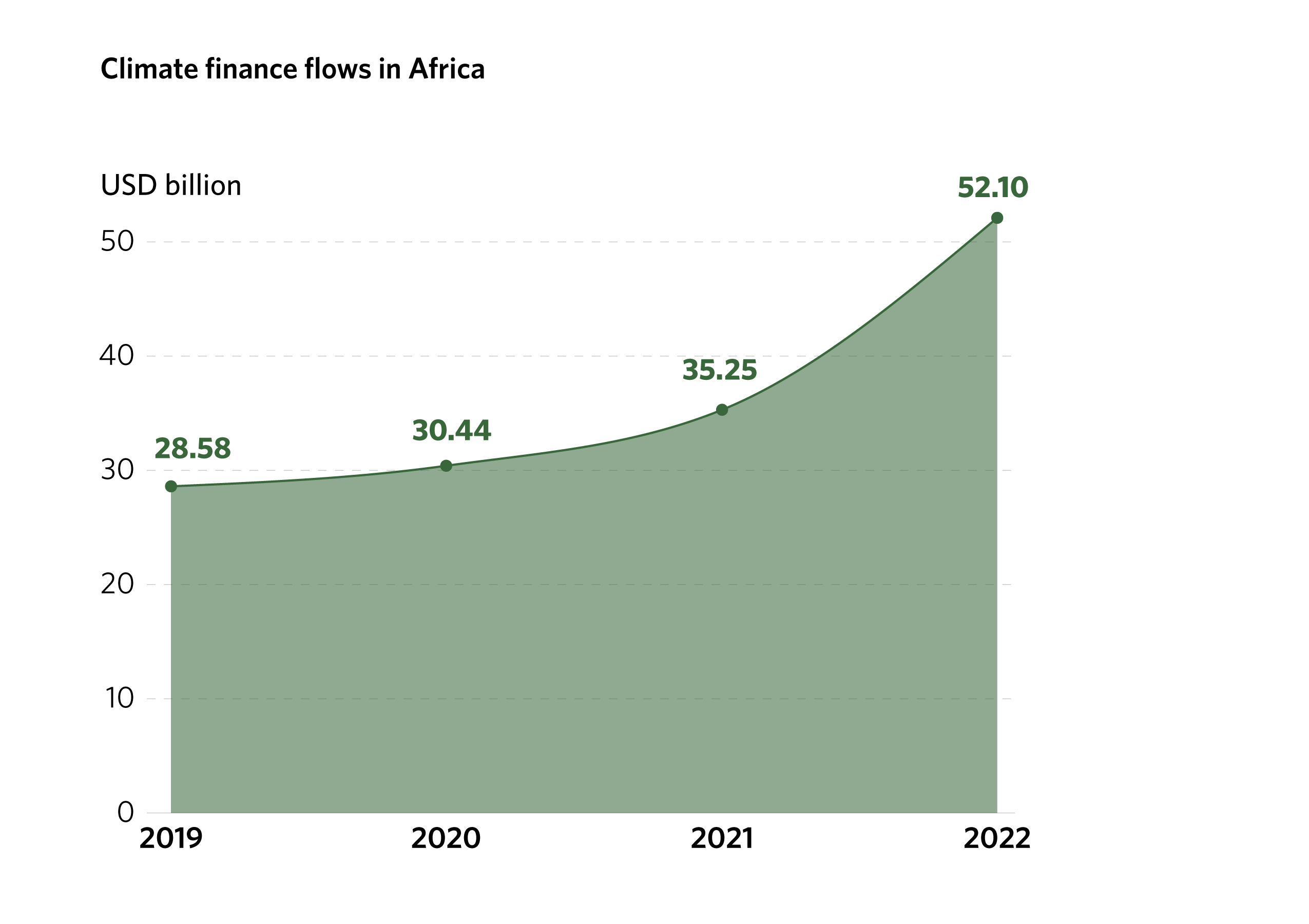

Climate finance in Africa surged in 2022 after stagnating in 2020 and 2021 amid the economic fallout of the COVID-19 crisis. Africa has seen a 48% increase in climate finance flows from USD 29.5 billion in 2019/20 to USD 43.7 billion in 2021/22. The majority of this increase came in 2022, when Africa’s annual climate investment crossed the USD 50 billion mark for the first time.

International sources provided 87% of Africa’s tracked climate finance, highlighting the region’s ongoing domestic resource and capital mobilization challenges. Private finance was spread evenly across domestic (49%) and international (51%) sources.

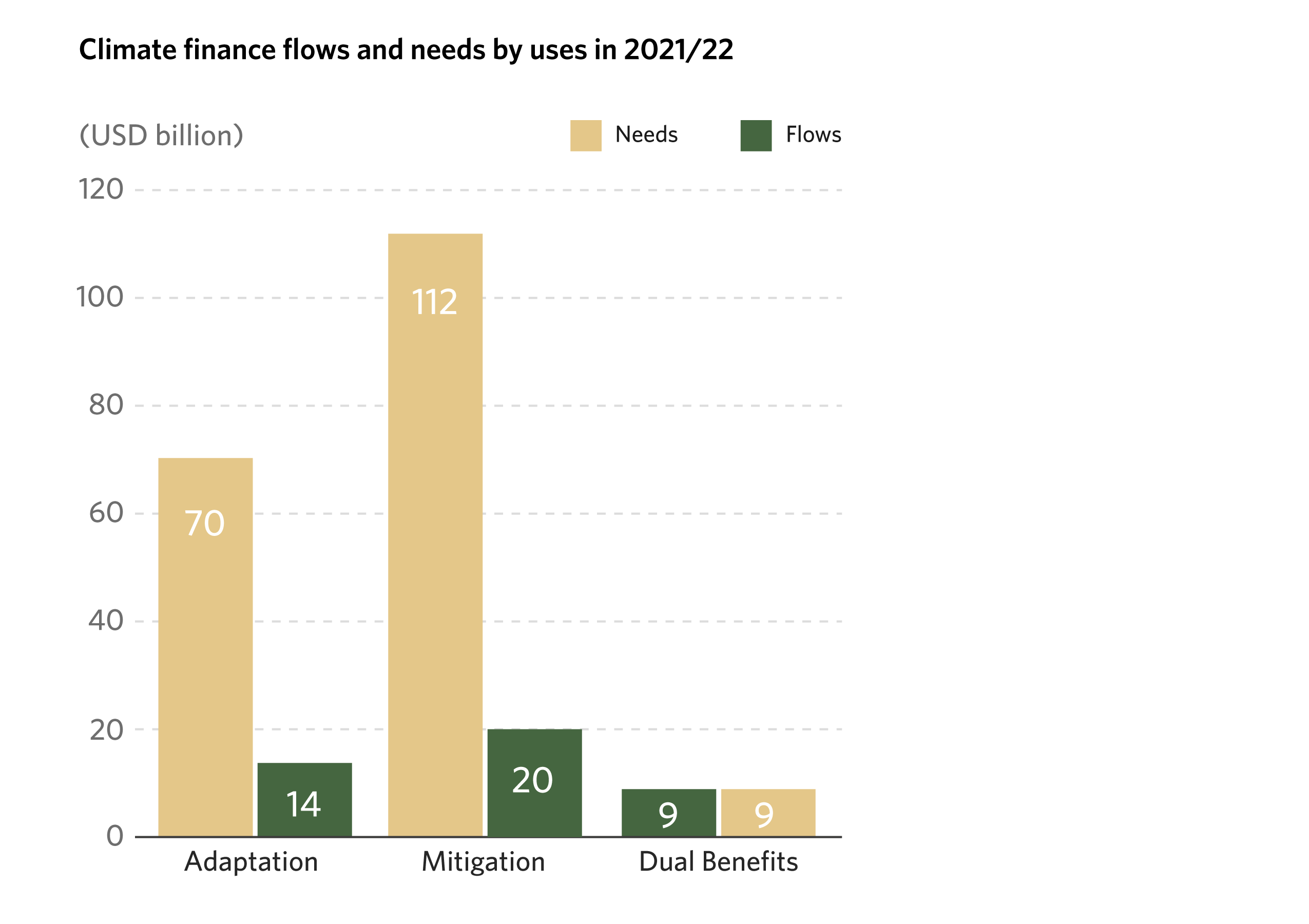

Africa’s climate finance flows must at least quadruple annually until 2030 to meet the investment needs for implementing its current NDCs: Only 23% of the estimated Africa’s needs are currently met.

The investment gap is significant for both mitigation and adaptation objectives, with only 18% of annual mitigation needs and 20% of adaptation needs being met in 2021/22.

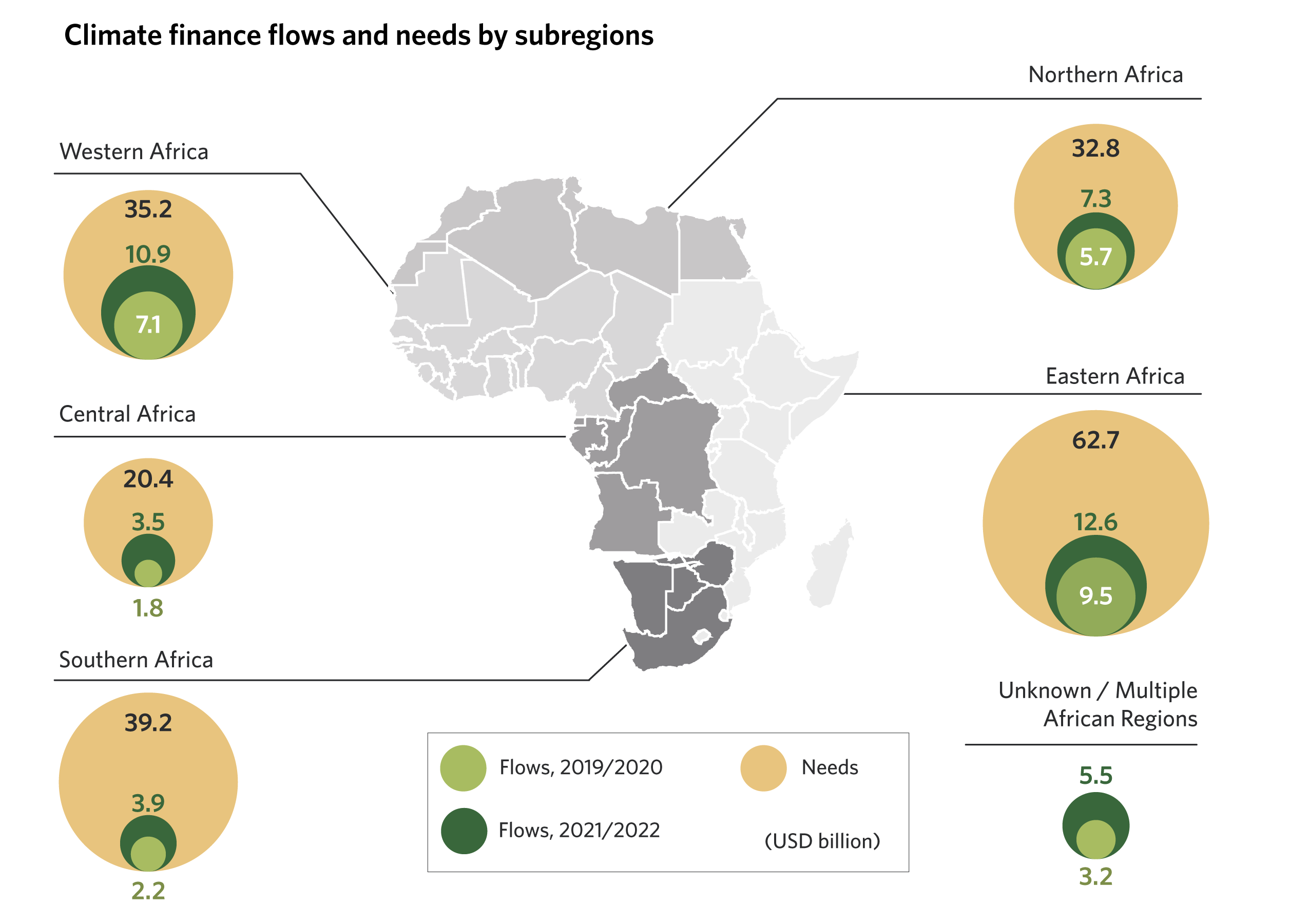

While all regions remain significantly underfunded by at least 3 to 6 times, the largest funding gap is observed in Southern Africa.

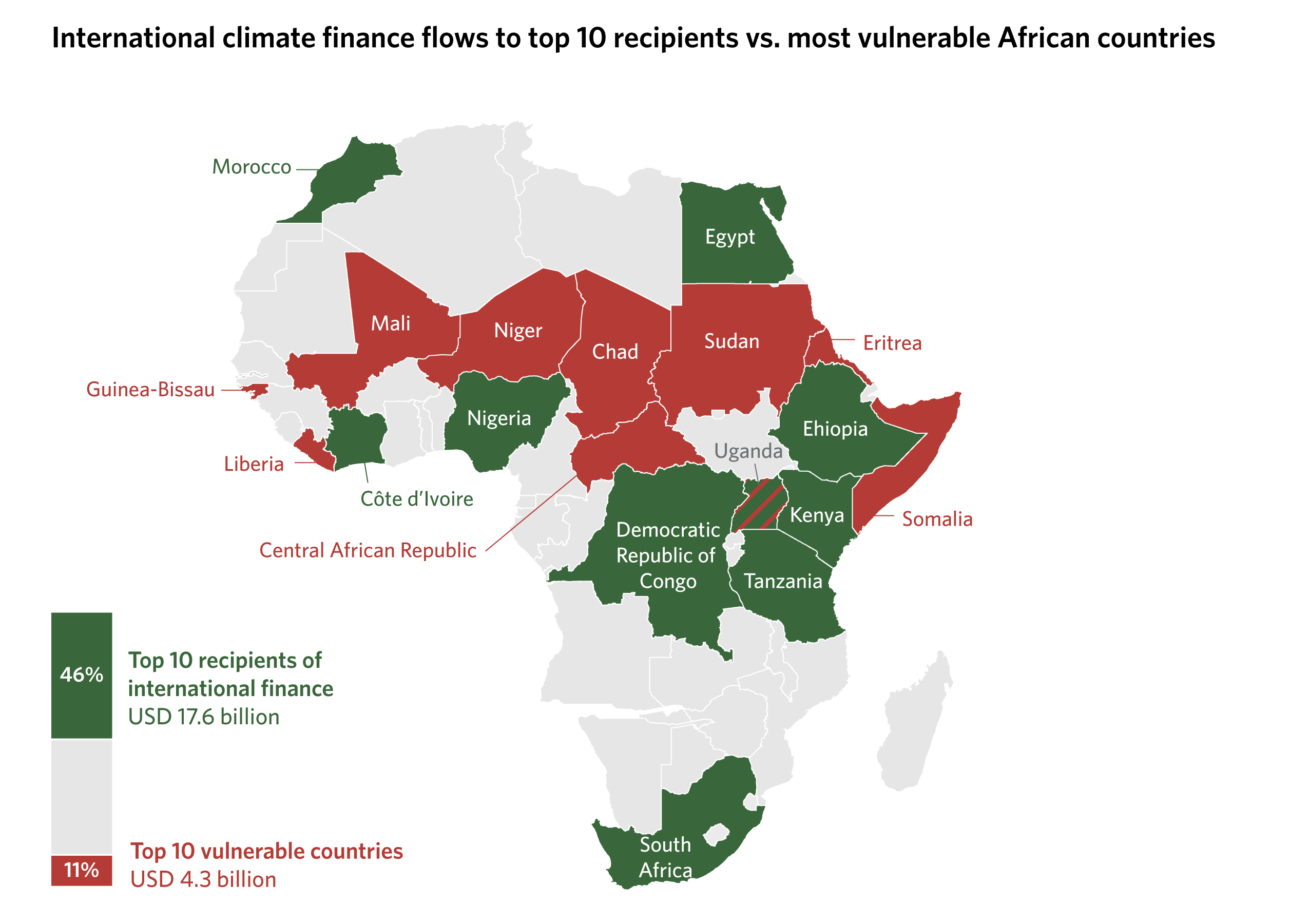

International climate finance flows remains heavily concentrated in a small number of African countries, with top ten countries receiving 46% of total funding, while ten African countries that are the most vulnerable to the negative impacts of climate change receive only 11% of the finance, leaving them severely underfunded. These disparities become even more pronounced when looking at private investments, where ten countries received 76% of the total private climate finance in Africa, while the remaining countries received only 16%.

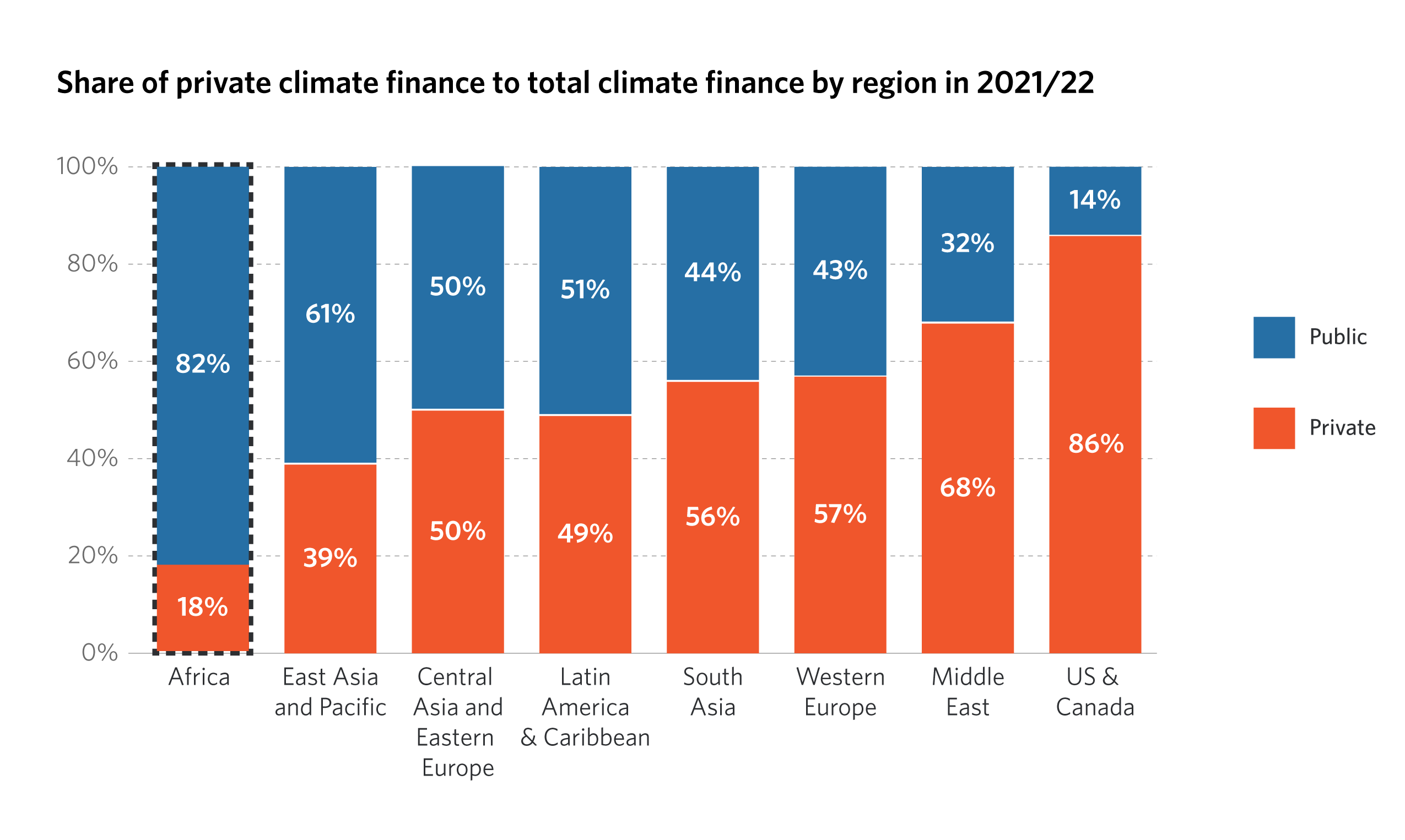

Private sector finance almost doubled between 2019/20 and 2021/22 (to reach USD 8 billion), demonstrating a substantive growth in commercial participation and market development. However, this accounts for just 18% of Africa’s total climate flows, a far lower share of climate flows than any other region globally.

Climate finance flows continue to be primarily in the form of debt instruments despite high debt vulnerability in the region.

Explore the data further by using our interactive tools.