Low-carbon and resilient agrifood systems are vital to ensure the food security of a growing human population and global economic development.

These systems are the processes and actors that convert natural resources and the environment into benefits and costs for humans through agricultural production and agro-industries (Campanhola and Pandey, 2019).

This report presents the first comprehensive analysis of climate finance flowing to these systems globally, with the aim of better informing decision-makers in this space. Establishing this baseline for financial flows can help to track action against the efforts required to mitigate and adapt to climate change.

Agrifood systems include high-emitting and climate-vulnerable sectors, yet climate finance flowing to them is strikingly low.

Key findings

- In 2019/20, agrifood systems received a tiny fraction (4.3%) of total global climate finance tracked at the project level, with an annual average of USD 28.5 billion.

- For the same period, only one in five dollars of total venture capital (VC) investments in agrifood tech went to companies focused on climate change solutions. This represents an annual average of USD 4.8 billion in VC investments.

- Climate finance for agrifood systems must increase at least sevenfold from current levels to reach the most conservative estimated needs for the climate transition, which is in the order of hundreds of billions of dollars annually (FOLU, 2019).

- General finance channelled to agrifood-related sectors suggests that enough liquidity exists globally to finance this transition. Global public subsidies for agriculture and fisheries are estimated at around USD 670 billion per year, with most of this supporting harmful practices (World Bank, 2023b). In addition, an estimated USD 630 billion of private capital per year is available for investment in food systems (Elwin et al, 2023). Partly repurposing these flows to support climate interventions could provide a major boost in moving towards the levels of climate finance needed.

Exploring the data

The report explores climate finance going to agrifood systems by sector, geographic destination, as well as by financial instrument and source.

Climate finance to agrifood sectors

Investments in agriculture and forestry activities form the bulk of the USD 28.5 billion of agrifood system climate finance tracked at the project level (42% and 41%, respectively). Components of agrifood systems that are essential for climate mitigation (food loss/waste, and low-carbon diets) collectively receive less than 1% of tracked investment. However, investments in these areas are prominent among the climate finance tracked at company level, representing 50% of total VC finance (or USD 2.1 billion).

Agriculture: At USD 11.9 billion per year in 2019/20 in project-level finance and nearly USD 2.1 billion per year in VC investments, climate finance for agriculture remains far below the estimated needs of USD 30-218 billion/year).

Forestry: This sector attracted the second-largest share of project-level climate finance, with an annual average of USD 11.7 billion in 2019/20. However, tracked VC investments were only USD 0.06 billion over the same period. These amounts fall short of estimated annual investment needs of (USD 55-753 billion per year).

Food loss/waste, and low-carbon diets: Opportunities to finance food loss/waste and low-carbon diets remain untapped, with only USD 0.1 billion at the project level and USD 2.2 billion at the company-level annually in 2019/20. This represents a minor fraction of annual needs, estimated at USD 48-50 billion.

Fisheries and aquaculture: Similarly, project-level climate finance to fisheries and aquaculture was USD 0.1 billion per year, and USD 0.1 billion in VC, while an estimated USD 11 billion is needed each year.

Climate objectives

Mitigation finance in agrifood systems at the project-level in 2019/20 was USD 14.4 billion. This represents only 2% of the total project-level climate finance tracked across all sectors for this period, despite agrifood systems contributing nearly one third of global greenhouse gas (GHG) emissions. In addition, USD 3.0 billion (equivalent to over two thirds of VC funds tracked) was mitigation focused.

Adaptation finance reached USD 7.3 billion of project-level climate finance for agrifood systems in 2019/20. This represents only 1.11% of the total climate finance tracked for the same period across sectors, even though agrifood systems and farmers are highly vulnerable to climate risks. On the VC side, only 26% of tracked investments went to adaptation-focused agrifoodtech startups (or USD 1.27 billion).

Dual benefits: The remaining USD 6.7 billion representing 23% of project-level climate finance for agrifood activities and USD 0.5 billion representing 11% of tracked company-level VC investments went to agrifood activities with dual mitigation and adaptation objectives. This highlights a missed opportunity, considering that agrifood systems are uniquely positioned to deliver double wins by using climate-smart agriculture integrative approaches.

Geographic destinations

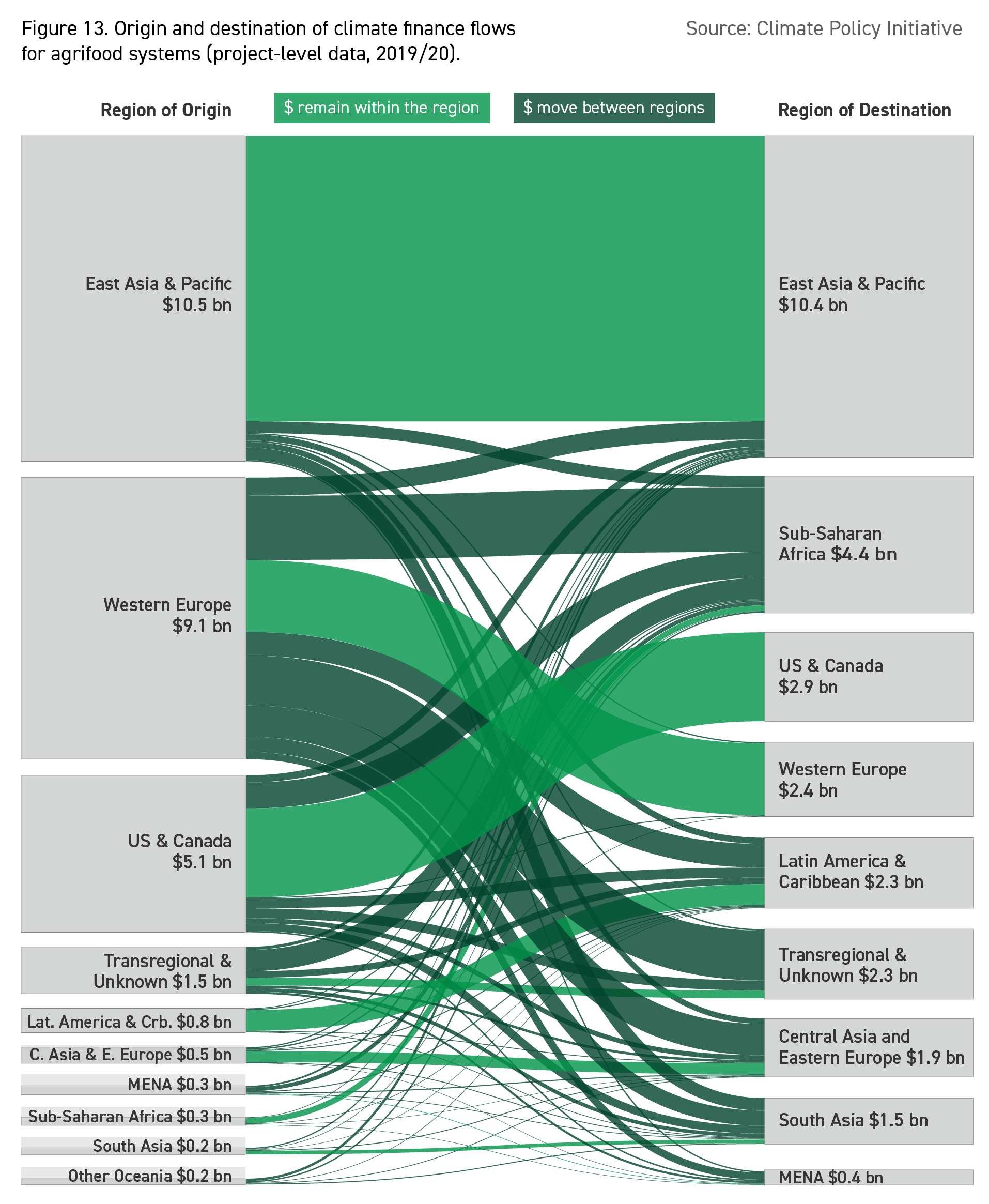

More than one third of the total project-level climate investments in agrifood systems, equivalent to USD 10.4 billion, target the East Asia and Pacific region, including a substantial portion of domestic finance in China. Sub-Saharan Africa is the second-largest recipient at USD 4.4 billion (16%). With USD 2.9 billion, the US and Canada constitute the third destination region (10%).

When compared to their contributions to global GHG emissions from agrifood systems, South Asia (10% of emissions), and Latin America and the Caribbean (16%) are particularly underserved by climate agrifood finance, attracting 5% and 8% respectively. Sub-Saharan Africa and South Asia are the regions with the greatest climate vulnerability for food and agriculture production but receive only 16% and 5% of finance, respectively.

In addition, the US and Canada are the destination markets for the bulk of tracked VC investments, receiving nearly 75% of the USD 4.8 billion total. Western Europe is the second largest recipient (15%). This points to an opportunity to tap other markets, like India, which is one of the largest agrifoodtech markets globally, but only received 2% of climate agrifood VC. This disconnect stems largely from a nascent market for upstream agri-technologies.

Financial instruments and sources

Debt accounted for the largest share (44%) of project-level finance to agrifood systems in 2019/20, followed by grants (38%) and equity (4%). Among tracked adaptation projects, grants constitute almost 50% of all finance, whereas project-level market-rate debt accounts for 50% of mitigation financing.

In 2019/20, public sources accounted for 85% (USD 24.2 billion) of total project-level climate finance tracked for agrifood systems, with development finance institutions being the highest contributors. Private sources accounted for only 12% of project-level finance, amounting to USD 3.3 billion. Commercial finance institutions accounted for the largest share, with exclusive focus on renewable energy for agrifood use. On top of that, we also tracked USD 4.8 billion of private VC investments to agrifood tech companies.

Editor’s note: This report was updated in February 2024 to reflect changes to the initial analysis on

venture capital investments published in July 2023.