This publication is CPI’s analysis of Financing for Low-Carbon Auto Rickshaws, an innovative climate finance instrument endorsed by the Global Innovation Lab for Climate Finance (the Lab). CPI serves as the Lab’s Secretariat. Each instrument endorsed by the Lab is rigorously analyzed by our research teams. High-level findings of this research are published on each instrument, so that others may leverage this analysis to further their own climate finance innovation.

India has 9 of the 10 most polluted cities in the world. Auto-rickshaw fleets in Indian cities on average are responsible for around 10% of this pollution. Also, most auto-rickshaw drivers opt to rent their vehicles instead of own them, due to the high cost of financing and a lack of fitting financing options for ownership. This instrument aims to provide loans to drivers to enable ownership of electric auto-rickshaws, which will both reduce carbon emissions in Indian cities and enhance the livelihoods of drivers. Financing for Low-Carbon Auto-Rickshaws is a loan product that will enable drivers to purchase electric auto-rickshaws by providing debt financing for 100% of the purchase, lower interest rates, and no collateral requirements.

INNOVATION

Financing for Low-Carbon Auto-Rickshaws is a loan product that has several distinctive features to provide a feasible pathway for drivers to purchase an electric auto-rickshaw. Most financing options in India require collateral for a loan, only partially finance the vehicle, and/or have predatory interest rates. This instrument has no collateral requirements, and offers debt financing for 100% of the auto-rickshaw cost and lower interest rates.

Another important innovation is that this instrument uses a community-driven loan collection system that incentivizes timely loan repayments and reduces the risks of loan default. This instrument will incentivize drivers to switch from conventional auto-rickshaws to electric auto-rickshaws, and will allow drivers to earn 100-150% more income.

IMPACT

- Given the massive number of auto rickshaws in India alone, there is an opportunity to decrease carbon emissions by over 22 million tonnes annually.

- By offering drivers a feasible path to vehicle ownership, this instrument allows drivers to more than double their daily income when compared to renting.

DESIGN

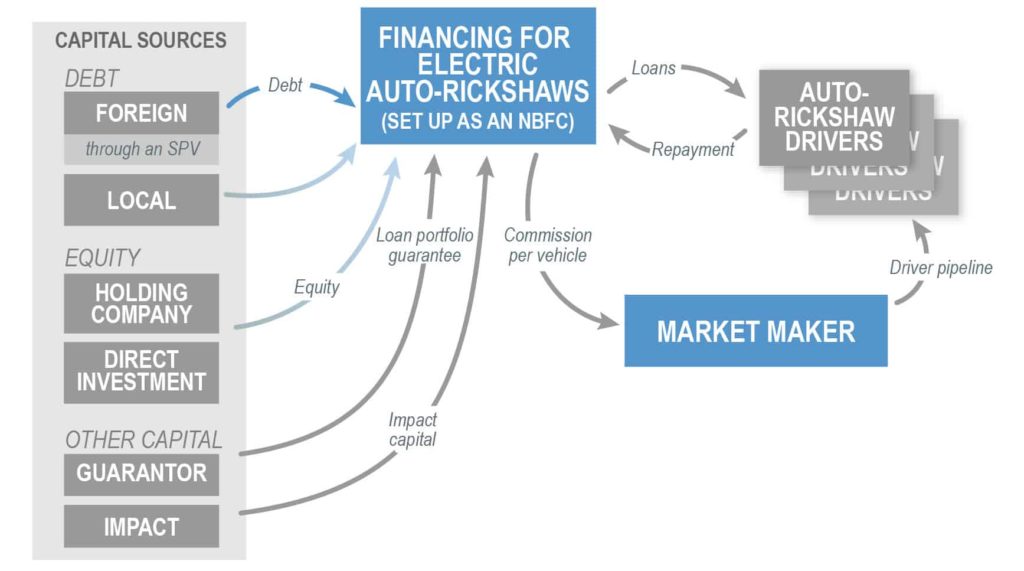

The instrument will be set up as a non-banking financial company (NBFC). The NBFC will pool in different types of capital – equity, debt, and concessional finance – to lower the cost of loans extended to the auto-rickshaw drivers.

• Equity: The equity capital providers would invest at the company level (NBFC) or at the holding company level.

• Debt: Debt capital can be sourced both from domestic and foreign lenders. Domestic capital providers would lend capital directly to the NBFC, while foreign debt capital providers would lend through an alternative investment vehicle (SPV).

• Concessional capital: Concessional capital – in the form of a partial credit guarantee and/or impact capital – would enable the NBFC to raise additional commercial debt and increase its credit rating of the NBFC, reducing the cost of borrowing.

To create a pipeline of loans, a non-profit arm of the proponent (market maker in the graphic) will run campaigns and programs to identify potential drivers/borrowers. The NBFC will be responsible for assessing applications, disbursing the loans to successful applicants, and managing collections of loan repayments through a community-based system that incentivizes timely payments.