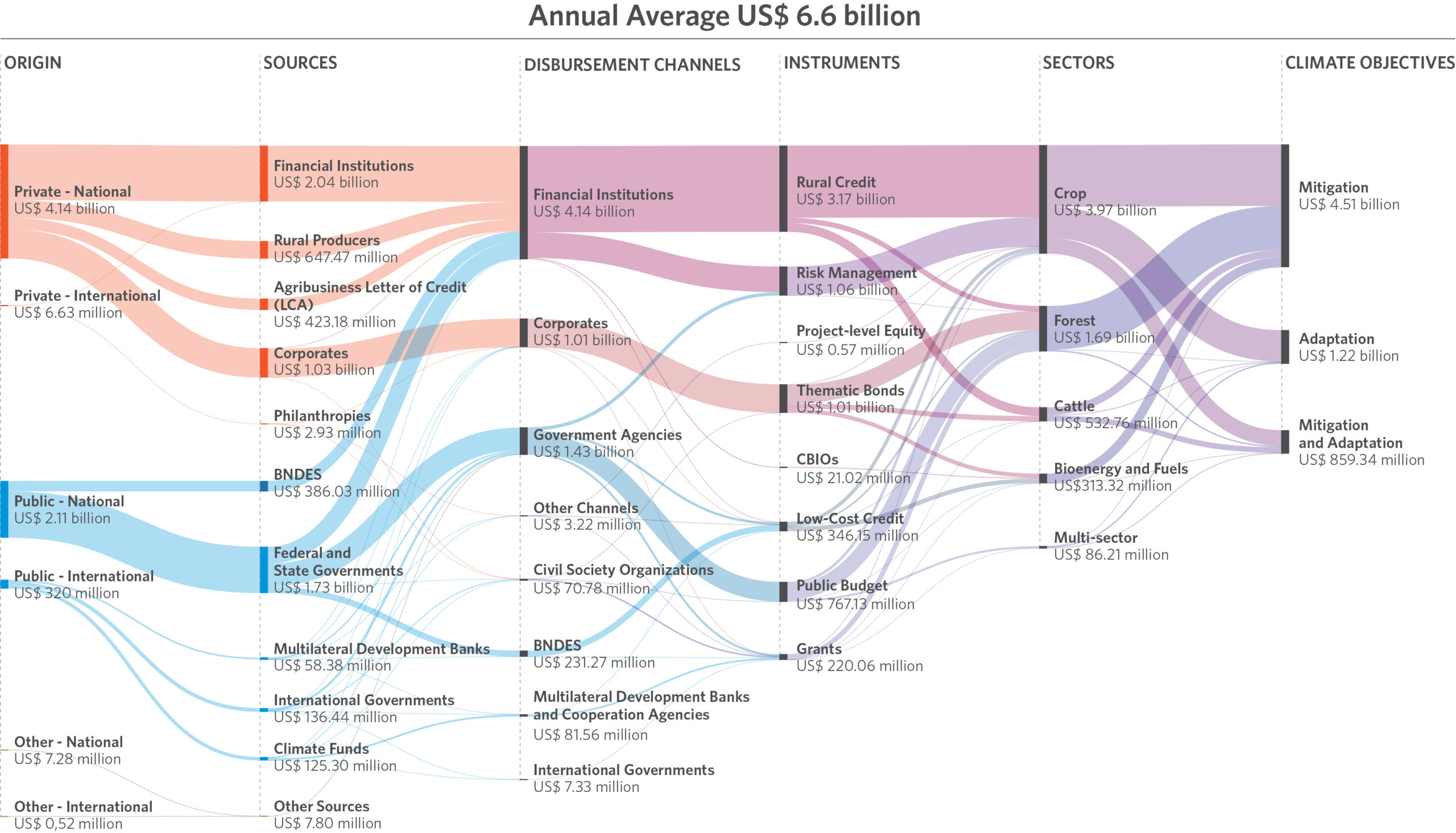

A significant portion of climate finance originated from rural credit and was directed towards mitigation actions.

Most of the climate finance for land use in Brazil, between 2015 and 2020, came from domestic sources (95%) and two-thirds from private finance. Rural credit channeled a significant portion of this amount and almost half of the total climate finance for land use (US$ 3.2 billion/year). This conclusion is derived from an unprecedented Landscape on land use in Brazil released by the Climate Policy Initiative/Pontifical Catholic University of Rio de Janeiro (CPI/PUC-Rio).

“Rural credit is the main instrument to finance activities aligned with climate objectives for land use in Brazil. As such, a relevant portion comes from private finance directed by public policies. However, climate-aligned flows account for only 8% of the total volume of rural credit in Brazil whose annual average was US$ 42.2 billion/year in the period under analysis.”, says Priscila Souza, head of policy evaluation of CPI/PUC-Rio.

Between 2015 and 2020, climate finance for agriculture and forests in Brazil increased from US$ 6.6 billion in 2015 to US$ 7.1 billion in 2020, which represents a growth of 65% in Brazilian reais. Despite the significant increase, crucial challenges remain in obtaining sufficient resources to meet climate goals.

“Brazil’s transition to a low-carbon economy requires compatible finance with the climate target set by the country under the Paris Agreement. A pivotal question arises: where will the financing come from?”, asks Joana Chiavari, research director of CPI/PUC-Rio. In Brazil, agriculture and deforestation together account for almost three quarters of the country’s GHG emissions.

Landscape of Climate Finance for Land Use in Brazil, 2015–2020

Source: CPI/PUC-RIO with data from SICOR/BCB, SIOP/MPO, MAPA, SES/SUSEP, MMA, BNDES, MME, B3, NINT, OECD-DAC, and IDB, 2023

The public budget channeled US$ 767 million/year (11%) of finance aligned with climate objectives. Most of it was directed to public policies of the forest sector (75%). The CPI/PUC-Rio’s researchers observed that the volume of public budget decreased from US$ 993 million in 2015 to US$ 394 million in 2020.

International finance accounted for 5% of climate finance flows. It originated mostly from public sources: foreign governments (US$ 136 million/year), climate funds (US$ 125 million/year) and multilateral development banks (US$ 58 million/year), channeled mainly via grants (US$ 216 million/year). The Amazon Fund channeled 0.7% of the total climate finance for land use tracked in the country between 2015 and 2020.

“There is a strong expectation that the country will successfully attract large volumes of international finance for the climate agenda. However, the Landscape’s numbers indicate that the inflow of international finance is still far from its full potential.”, says Chiavari.

The majority of climate finance was directed towards mitigation of climate change (68%). Finance for climate adaptation accounted for only 19%, while flows with both mitigation and adaptation objectives stood at 13%. “Increasing climate finance flows for adaptation is crucial to manage climate risk in agriculture, to improve the resilience of agricultural systems and to reduce the vulnerability of rural producers.”, explains Souza. In Brazil, finance for adaptation came from public and private sources.

The agricultural risk management instrument is the main tool for climate adaptation, which accounted for US$ 1.1 billion/year in finance aligned with climate objectives. Rural insurance was the most relevant of these instruments with a total of US$ 625 million/year.

The crop sector was the main recipient of climate finance, receiving 60% of flows in the mapped period; the forest sector received 25% and cattle received 8%. “It’s essential to develop financial strategies that promote a transition to low-carbon agriculture and protect forests, increase climate resilience and food security, reduce socioeconomic vulnerabilities and provide best protection to producers from negative impacts of climate change”, says Souza.

This report on climate finance for land use provides a baseline for characterizing financial flows that contribute to land-use-related climate mitigation and adaptation. The researchers developed a methodology based on CPI’s international experience in tracking climate finance flows globally since 2011.

“The detailed analysis of climate finance flows for land use helps identify financial gaps and the actors involved in mitigation and adaptation actions, following the progression of resources and enhancing private and public resources. The message is clear: we need to increase finance to match current climate challenges.”

Read the publication in full: bit.ly/LandscapeClimateFinance

About CPI/PUC-Rio

CPI is an analysis and advisory organization with deep expertise in finance and policy. CPI has six offices around the world. In Brazil, CPI has a partnership with PUC-Rio. CPI/PUC-Rio supports public policies in Brazil through evidence-based research and strategic partnerships with members of the government and civil society.

Media Contact:

Camila Calado Lima

camila.lima@cpiglobal.org

+55 (86) 99966-0560