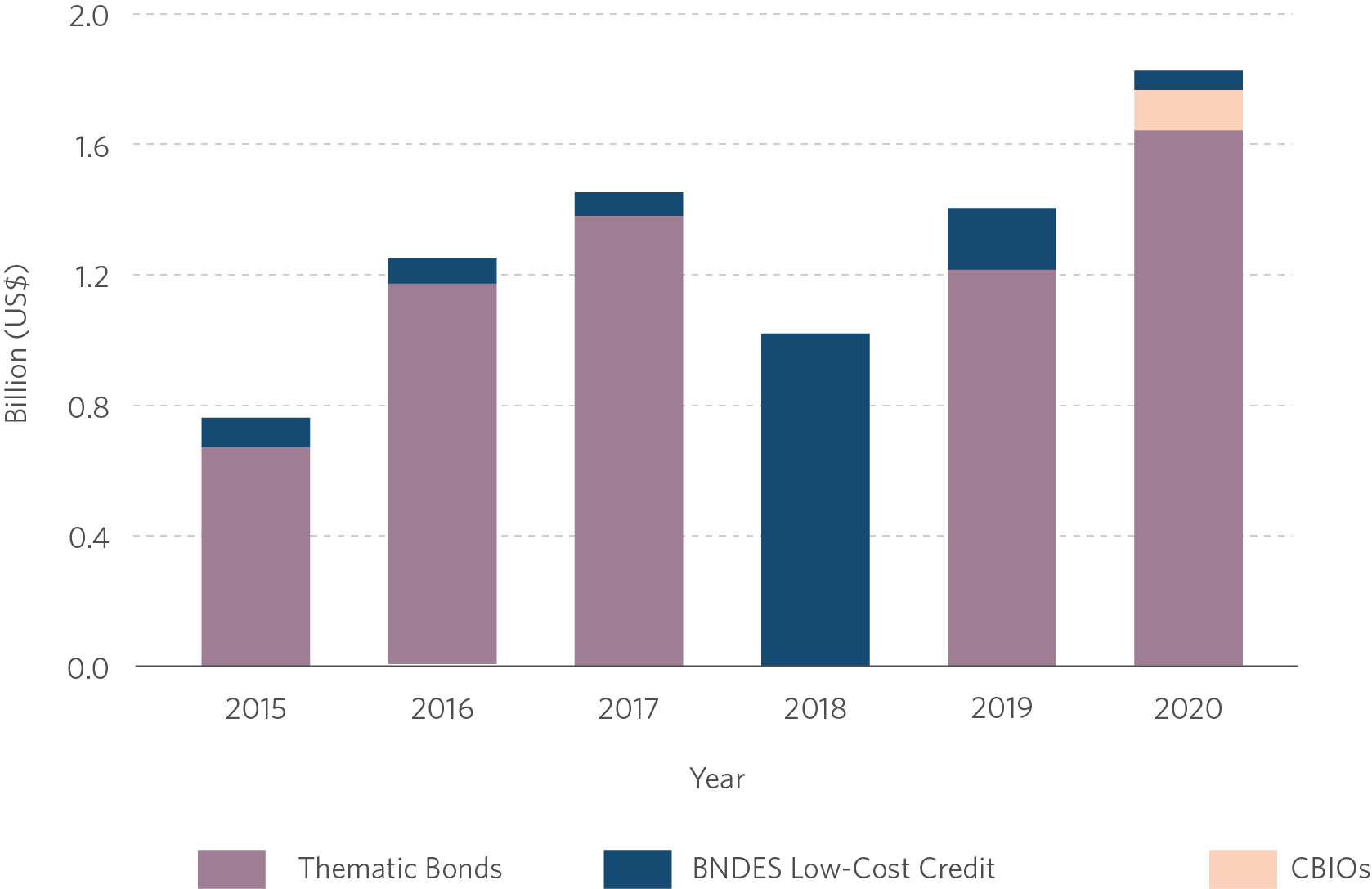

Three financial market instruments are relevant to climate finance: thematic bonds, low-cost credit operated by BNDES, and CBIOs (Figure 9). However, tracking climate finance in this area is hampered by a scarcity of data at the project level, which means that flows tend to be underestimated due to a lack of consistent and standardized disclosure of information. Data on the issuance of thematic bonds is currently the best type of information available.[1]

Between 2015 and 2020, climate finance for land use raised via thematic bond issuances totaled US$ 1.0 billion/year, accounting for 16% of the tracked finance. Most of this amount was from issuances by Brazilian companies abroad, which have experience in obtaining finance in the capital market. Twenty operations involving the issuance of these securities were identified in total.

Figure 9. Climate Finance for Land Use in Brazil in the Financial Market by Instrument, 2015-2020

Note: The values refer to the average amount in Brazilian Real (R$) during the analyzed period, deflated by the IPCA using December 2020 as reference. The values were converted into United States Dollar (US$), according to the average exchange rate for the corresponding year, as provided by the Central Bank of Brazil (Banco Central do Brasil – BCB).

Source: CPI/PUC-Rio with data from BNDES, MME, B3, and NINT, 2022

The volume of resources raised via this instrument has increased almost fourfold, from US$ 685 million in 2015 to US$ 1.6 billion in 2020, but these amounts constitute only a small portion of finance via the capital market. By way of comparison, finance channeled via thematic bonds in 2020 were equivalent to 57% of the total volume of CRA issued that year (US$ 2.9 billion/year).[2]

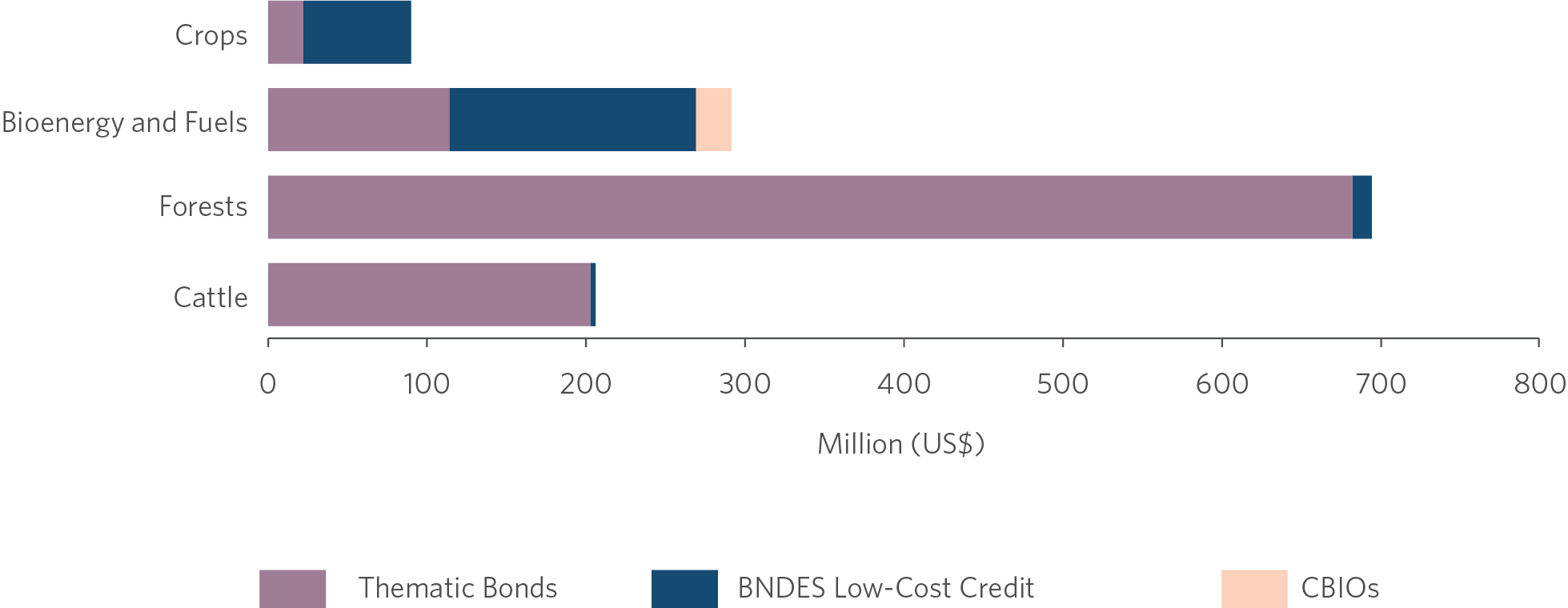

Thematic bonds were used to raise finance mainly for the forest sector (US$ 678 million/year) (see Figure 10). This was achieved by means of the work of pulp and paper producing companies, which have experience in securing finance in the capital markets and were pioneers in obtaining finance via thematic bonds.[3]

Cattle was another sector that used thematic bonds for climate finance (US$ 201 million/year). In 2015, Brasil Foods S.A. – BRF used this instrument to finance company projects related to energy efficiency, reduction of GHG emissions, renewable energy, water management and waste management, among other activities. Marfrig Global Foods S.A. was the other company, in the cattle sector, to raise climate-aligned finance via thematic bonds; it secured finance for the purchase of cattle for slaughter from non-deforested areas and areas that do not overlap with protected areas or lands.

Figure 10. Climate Finance for Land Use in Brazil in the Financial Market by Sector, 2015-2020

Note: The values refer to the average amount in Brazilian Real (R$) during the analyzed period, deflated by the IPCA using December 2020 as reference. The values were converted into United States Dollar (US$), according to the average exchange rate for the corresponding year, as provided by the Central Bank of Brazil (Banco Central do Brasil – BCB).

Source: CPI/PUC-Rio with data from BNDES, NINT, B3, and MME, 2022

BNDES approved US$ 242 million/year for climate finance with low-cost credit for company-run projects; most finance was granted to the bioenergy and fuel sector (US$ 155 million/year) to finance, mainly, projects about bioenergy production.[4] BNDES finance can combine different credit lines and conditions and, therefore, can be used to finance different activities within the same project. In general, finance was directed towards energy co-generation activities based on sugarcane bagasse, including the development of transmission lines and investments in machinery and crop production and for energy production. These operations were financed by BNDES FINEM, a product geared towards medium and large-sized enterprises for investment purposes.[5]

BIOs averaged US$ 21 million/year in climate finance for land use in the period considered in this report (2015 to 2020). However, it should be noted that 2020 was its first year of issuance, and that year saw US$ 126 million in CBIOs traded, an amount equivalent to more than twice the climate finance tracked for BNDES low-cost credit in that same year (US$ 60 million).[6]

CBIOs were established by the National Policy for Biofuels (Política Nacional de Biocombustíveis – RENOVABIO) to increase the use of renewable fuels in the Brazilian transport grid and reduce CO2 emissions.[7] CBIOs are certificates issued by biofuel producers and importers based on the trade of their products; they are certified by the Brazilian National Agency for Petroleum, Natural Gas and Biofuels (Agência Nacional do Petróleo, Gás Natural e Combustível – ANP). The ANP also sets compulsory annual targets individually for the reduction of GHG for distributors that sell fuels, which can only be met through the purchase of CBIOs (ANBIMA 2023; B3 2020).[8]

The tracked flows show an opportunity for public policies that encourage instruments that contribute to directing private finance and investments meant for climate mitigation and/or adaptation objectives.

THE ROLE OF BNDES IN CLIMATE FINANCE FOR LAND USE

BNDES plays a central role in climate finance for land use, operating on different fronts. Primarily, the Bank was the main source of public finance that channeled finance to rural credit operations (US$ 386 million/year).

BNDES also channeled US$ 242 million/year in low-cost credit to companies in the land use sector. Such finance is made up of different lines of credit, including the Climate Fund Program – (US$ 15 million/year).

BNDES also manages the Amazon Fund, the main climate fund to channel international finance for land use in Brazil; it approved an average of US$ 53 million in project finance between 2015 and 2020.

WHY IS IT DIFFICULT TO ESTIMATE THE SHARE OF PRIVATE CLIMATE FINANCE?

In recent years, the ESG agenda – in which climate change plays a key role – has gained relevance in the risk assessment of investments and corporate strategies. These developments were accompanied by the adoption of transparency requirements in the disclosure of investments, but improvements are still needed in that regard.

There are no regulations in the private market that make it mandatory to disclose information about finance at the project level and there is little transparency about the allocation of finance raised, mainly due to the high number of players involved in these operations and because of confidentiality issues (Rosenberg et al. 2018). Furthermore, available reports use different criteria and methodologies to disclose their information and fail to produce essential information that may be comparable across companies or across different sectors (The Climate Risk Disclosure Law and Policy Lab/SLS 2021).

This context makes it challenging to track and quantify the extent to which banking operations and fundraising in the capital market contribute to climate finance. It is critical to improve the transparency of data sources, establish guidelines for classifying flows, and increase the availability of granular data at the project level, as well as information on project locations. Disclosure requirements must also be improved to enable a better understanding of project implementation and operation. Clearer disclosure regulations and standards will allow for more accurate estimates.

These improvements are particularly important for land use, given the stark heterogeneity across rural producers throughout the country and the need to finance a just rural transition (Chiavari and Antonaccio 2023). For example, financial structures must be fostered and developed to channel large-scale private finance to smaller actors in the land use value chain, such as family farmers, indigenous peoples, and traditional communities, among others, and to monitor effective implementation.

[1] Standards and guidelines in the thematic bonds market are far from uniform; this situation affords a great deal of discretion to external reviewers, who use different evaluation methods to verify adherence to the guidelines and standards when such bonds are issued. The information on the emissions of these securities is generally at the project level, which means it is possible to pinpoint operations that finance climate mitigation or adaptation activities. This occurs because bonds undergo a project evaluation and selection process, which features requirements such as transparency reports and information on the management of finance raised, and which often require information on the use of proceeds.

[2] A query was made for “capital market in numbers” and the column “CRA” was selected to calculate the average issued volume of this security (ANBIMA 2023)

[3] In 2016 Suzano Papel e Celulose issued its first green bond, certified by the Climate Bonds Initiative (CBI), in the amount of US$ 500 million (CBI 2016).

[4] This finance is mostly carried out by means of direct operations requested by corporations and negotiated directly with BNDES. BNDES operations pertaining to rural credit were analyzed in the section on agricultural credit policy.

[5] BNDES finance is classified according to the product to which it belongs, which sets the general rules for the finance operation. BNDES FINEM, BNDES Project Finance, and BNDES FINAME constitute the most relevant products of that nature (Holz, Schutze and Assunção 2022).

[6] As presented, this flow represents the financial value of CBIOs traded in 2020 on B3 (Brasil, Bolsa, Balcão), the main stock exchange in Brazil (B3 2020). The price of CBIO credit is negotiated in the market.

[7] CBIO is a security traded on the stock exchange, in which each credit is equivalent to 1 ton of CO2. A Law no. 13,576/2017 gave rise to RenovaBio, a policy devised to meet the obligations taken on by Brazil at the United Nations Conference on Climate Change 2015 (COP 21) (B3 2020).

[8] With the aim of providing greater liquidity to this market, individuals or legal entities resident and non-resident in Brazil are allowed to invest in CBIOs. However, this so-called non-obliged investor is not obligated to comply with GHG emission reduction targets (ANBIMA 2020, CBI 2020).