Low access to debt capital remains one of the key barriers to achieving the Indian government’s target of 40GW of rooftop solar installations by 2022. Foreign capital can help bridge the gap in debt availability for rooftop solar, however, foreign currency debt exposes rooftop solar project sponsors to the risk of foreign exchange rate fluctuation.

Specifically, rooftop solar sponsors are reluctant to use foreign currency debt due to a variety of factors:

- International investors are unable to hedge the risk that arises due to currency mismatches when debt is in USD while cashflows are in INR

- There are issues related to poor credit quality and credit history of small-scale project developers that preclude these developers from accessing hedging instruments from commercial hedge providers that would otherwise allow them to access foreign debt

- India’s managed foreign exchange policy makes currency risk hedging instruments expensive

Taken together, there are market gaps for small-scale rooftop solar project sponsors accessing the most commonly used hedging instruments i.e. cross-currency swaps, options and call-spread strategies. These barriers may be circumvented by either reducing the credit risk exposure to the borrowers by the hedge providers in the form of guarantees, or by transferring the foreign currency from the borrowers to another stakeholder by routing the loan through an intermediary.

This instrument design case study for the US-India Catalytic Finance Solar Program (USICSF) explores solutions to enable foreign currency debt to the Indian solar rooftop sector through the lens of a case study of debt investment by the Overseas Private Investment Corporation under the US-India Clean Energy Finance Facility program.

Analyzing all the pertinent constraints to the stakeholders in this case study (including borrowers, hedge providers, donor entities, guarantors and the lender) we propose a solution that appears most feasible: A Transitional Foreign Exchange (FX) Debt Platform. We also identify and assess alternative, but noteworthy solutions, which may be successfully implemented under different contexts and preconditions.

Proposed Solution: Transitional Foreign Exchange Debt Platform

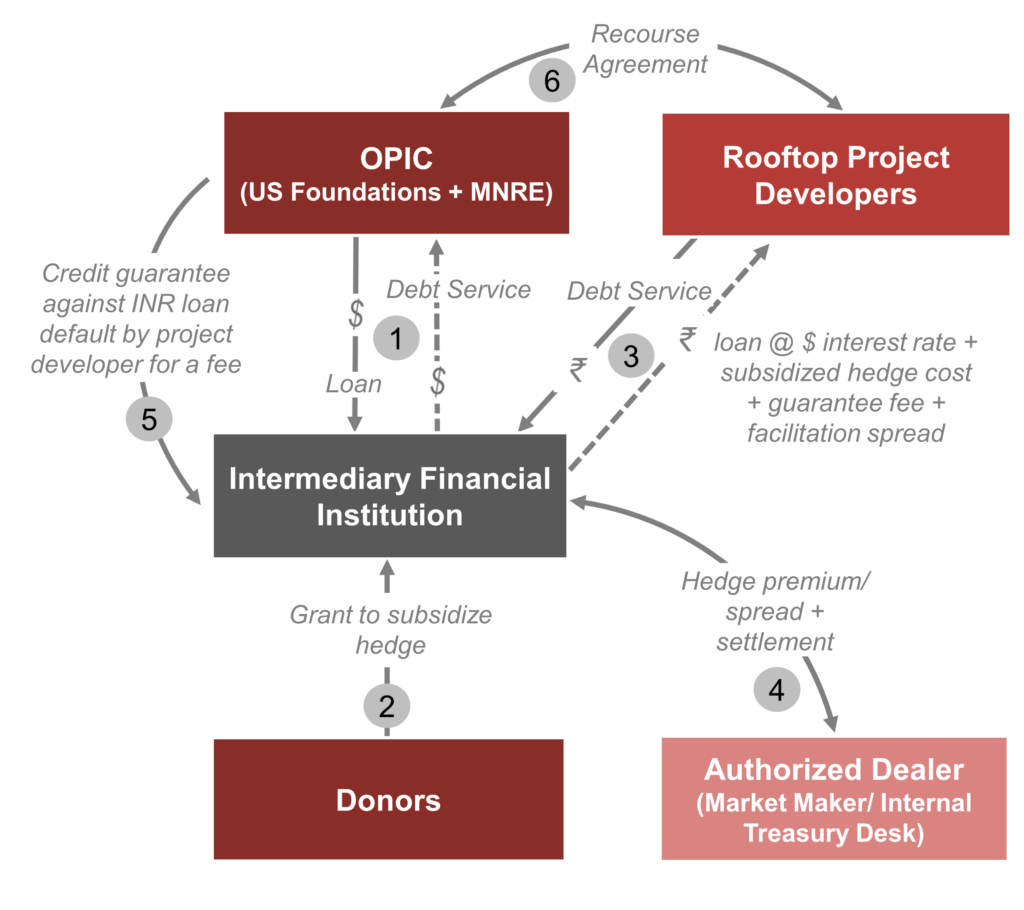

The Transitional FX Debt Platform entails routing foreign currency debt from OPIC through a local Indian private sector financial institution as the intermediary, on to the borrowers in INR. Figure ES1 illustrates the structure of this solution. We find that the following elements would be critical to the success of such a platform:

- Local intermediary: The local Indian private financial institution that acts as an intermediary would manage the foreign currency risk arising from the mismatch in currencies of its assets and liabilities through the financial markets or through its internal treasury desk. We find that the cost of raising the credit profile of small-scale rooftop sponsors through guarantees to the foreign currency hedge providers – either funded or unfunded – is too high, and the structure unprecedented for donor stakeholders to act as guarantors. Hence, we propose this approach of routing loans through an intermediary local financial institution.

- Credit guarantee: The credit risk exposure of the intermediary to the end borrower would be partially or completely mitigated by means of a credit guarantee offered by OPIC against the payment of a guarantee fee. This ensures that the credit risk exposure to the borrower would ultimately sit with OPIC, while the partial risk-sharing between OPIC and the intermediary also helps develop the local debt markets in lending to the rooftop solar sector.

- Donor grants: We propose that donor grants from philanthropic sources under USICSF be provided to the intermediary financial organization. This is due to the inefficient market pricing of USD-INR swaps, which makes it likely that the landed cost of INR debt to the intermediary (including cost of hedging, guarantee fee, cost of USD debt, overheads and profit margins) exceeds domestic benchmark rates. To minimize the risk of moral hazard, stipulations should be made that INR loans to borrowers are made at a predetermined range of rates linked to a domestic benchmark rate. Further, owing to the Government of India’s mandate of not passing donor grants to private sector institutions, we recommend that the donor grants be sourced from philanthropic foundations or development finance institutions.

Under the Transitional FX Debt Platform, each dollar of donor grant capital invested in the Platform enables $17 to $34 of additional foreign debt into the solar rooftop sector.

Figure ES1: Structure of the Transitional Foreign Exchange Debt Platform