This publication is CPI’s analysis of The Fund for Nature, an innovative climate finance instrument endorsed by The Global Innovation Lab for Climate Finance (the Lab). CPI serves as the Lab’s Secretariat. Each instrument endorsed by the Lab is rigorously analyzed by our research teams. High-level findings of this research are published on each instrument, so that others may leverage this analysis to further their own climate finance innovation.

ABOUT

Natural climate solutions make up over one-third of the climate mitigation needed to keep warming below two degrees Celsius. Yet they get less than 2% of global climate finance. An opportunity to help fill this gap lies in voluntary carbon markets, which many companies use as part of their strategies to meet ambitious, science-based net zero commitments.

However, nature-based carbon projects require up-front financing, often only available through the pre-sale of carbon credits at steep discounts. In an opaque market with potentially misaligned incentives, project developers and local partners are frequently offered terms well below the full value of their projects.

While many climate investors want to gain exposure to nature-based solutions, they need vehicles that provide scale, diversification, and risk mitigation to enable them to participate in the market.

The Fund for Nature is Africa’s first debt fund for high-integrity, nature-based carbon projects.

INNOVATION

The Fund for Nature is a first-of-its-kind debt fund for nature-based carbon projects. It aims to increase the supply of high-quality nature-based carbon projects to meet the growing demand from corporate off-takers while increasing the economic benefit to project implementers and local communities.

A blended finance structure brings in mission-aligned private capital, allowing the fund to aggregate a portfolio of high-integrity projects and offer commercial returns to investors.

The fund will provide market-rate debt to projects backed by long-term, standardized offtake agreements. This structure allows projects to achieve better terms from carbon credit buyers, including a higher price for carbon – retaining more value for on-the-ground actors and accelerating debt repayment.

IMPACT

The Fund for Nature will begin implementation through a pilot transaction that will then be rolled into a pilot fund focusing on Sub-Saharan Africa. After the pilot phase, a USD 100 million fund will catalyze up to USD 900 million of commercial capital through direct investment and carbon credit sales, with significant potential to scale further in subsequent funds. The instrument targets carbon removal projects through the restoration of tropical forests and mangroves and avoided emissions by conserving irrecoverable carbon sinks such as peatlands.

DESIGN

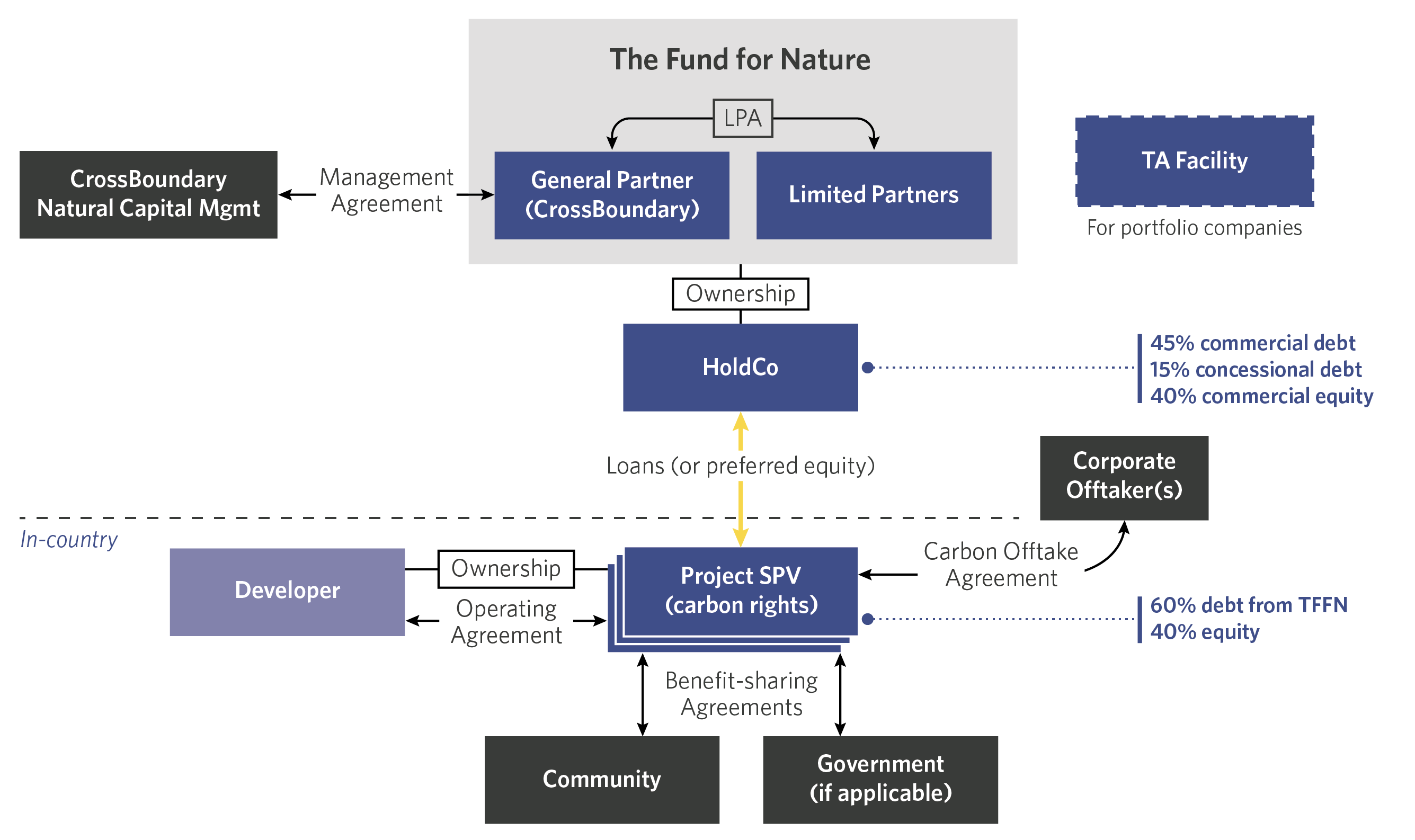

CrossBoundary will be the general partner and manager of the fund, with limited partners as investors in the fund. CrossBoundary targets a 50/50 debt-to-equity ratio, with a blended finance structure in the pilot fund. Projects may or may not have a special purpose vehicle outside the country of operations.

The portfolio will be owned by an offshore vehicle, HoldCo, which will have first rights to repayment from carbon credit sales revenues. To mitigate project and execution risks, a technical assistance fund will be capitalized to provide targeted support services to developers and local implementers.

Local communities and governments (where applicable) will share in the benefits of carbon credits sale. Through offtake agreements that better align incentives and achieve a higher carbon price, The Fund for Nature will increase the “size of the pie,” resulting in more revenue staying with local communities and partners. More equitable benefit-sharing also ensures the project’s long-term viability by aligning the incentives of all partners involved.