Innovative financing solutions for a climate-friendly economic recovery

This report assesses the potential for Results-based Finance (RBF) to expand post-COVID recovery funds while improving sustainability efforts.

By linking financial rewards to climate objectives, RBF enables innovative financing arrangements that can accelerate funding from the private sector.

The idea that results-based finance can contribute to achieving long-term climate objectives is not new. What is novel is combining financing models, indicators linked to climate performance, and partnerships to create new investment alternatives that improve public spending and attract the private sector towards low-carbon transitioning efforts. This is especially important considering the limited funding available from the public sector, especially in emerging markets where COVID is exacerbating debt burdens.

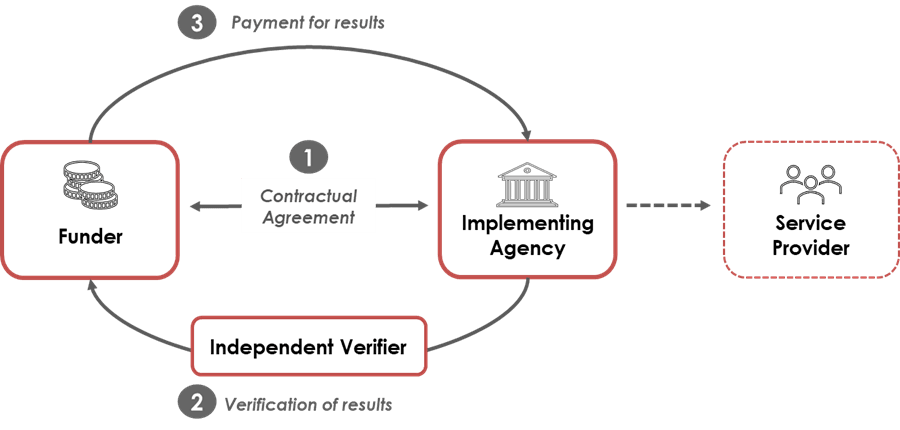

Instead of contracting delivery of individual activities, the contract specifies that payments will be made if certain outputs or outcomes are achieved, which are verified by an independent third party. This aligns the incentives from all parties in a way that maximizes efficiency. Results can take the form of simple outputs that are readily monitored – like the number of trees planted – or more complex arrangements focused on outcomes such as the restoration of a forest.

Opportunities

RBF interventions are well suited to target sectors most affected by COVID-19, while reducing risk and pressure for public spending.

Considering needs for economic recovery post COVID-19, RBF interventions are well suited to sectoral focus, targeting industries most affected by the pandemic, such as tourism and transport, and industries that are catalytic to create more sustainable urban environments, like solid waste management, energy, and water and sanitation. Among the main benefits of this sectoral approach are the creation of numerous jobs from implementing these initiatives, reduction of risk and pressure for public spending, reallocation of sector priorities with more long-term focus, and optimization of public funds supporting workforce development programs that can be directly tied to these interventions.

The table below shows some potential opportunities that are well suited, considering investment needs for climate in a way that also contributes to economic growth.

| Sector | Climate Objectives | Example Strategies |

| Urban Development | ||

| Transport | Mitigation | · Electrification · Public transport systems |

| Water and sanitation | Mitigation Adaptation | · Infrastructure (stormwater, sanitary systems, rain gardens, etc.) |

| Solid waste management | Mitigation | · Systems and infrastructure development (landfills, collection, etc.) |

| Tourism | Adaptation | · Restoration and conservation of natural ecosystems |

| Land use | Mitigation Adaptation | · Reforestation and conservation of ecosystems · Sustainable land management and agricultural practices |

| Transition | ||

| Energy | Mitigation | · Renewable energy, energy transition, energy efficiency, and accelerated coal retirement |

| Industrial | Mitigation | · Energy efficiency improvement in processes of material preparation · Infrastructure development · Low carbon production methods incentives |

The figures below highlight some of the need and potential impacts that investments in these sectors can have on both the economy and society:

- Solid waste management comprises 20% of municipal budgets in low-income countries on average and generates about 5% of global emissions.

- The funding gap required for water infrastructure is $144 billion annually.

- The travel and tourism industry contribution to global GDP has been 10% on average in the last 20 years.

- Renewable energy and energy efficiency measures for decarbonizing the energy sector can achieve up to 90% of the required CO2 emission reductions.

Regulatory frameworks and legislation are already in place in both developed and developing economies to deploy RBF instruments. There are also many successful examples that can be replicated such as RBF schemes that tie payments to carbon emission reductions and environmental impact bonds that provide investors financial incentives if project outcomes are achieved.

Challenges

While RBF has significant potential to reduce costs and improve project delivery, it also faces important challenges related to implementation.

To maximize RBF success, support is needed throughout the project design and development phase.

Contracting can be complex and parties may not have enough information to create an appropriate contract. The monitoring and verification can be cost prohibitive as results can take a while to materialize and be captured in the contract timeframe – especially at the outcomes level. Realigning incentive structures can lead to unintended consequences which should be considered carefully. A famous anecdote is the “cobra effect” which originated in India under British rule. The government of Delhi wanted to rid the city of cobras and paid residents a reward for every dead snake brought in. After some initial success with the scheme, enterprising people started breeding cobras which led to an increase in the overall population of snakes in the city.

Another important challenge to consider is the funding needed to support the upfront work by the implementer as payments may not be received for a considerable amount of time until results are achieved. There is also the issue of counterparty risk. The implementer will want to have reasonable assurance that the funder will be there and able to pay once the project is completed. These are all significant challenges to solve and can greatly complicate project implementation.

Conclusions

RBF is an exciting opportunity to innovate on public procurement, mobilize private finance, and contribute substantial climate and economic impacts.

RBF presets significant opportunities for key sectors including energy, transportation, water and sanitation, waste management and tourism. These sectors are particularly important to a post-COVID-19 economic recovery and will require trillions of dollars of investment over the coming decades.

RBF approaches can increase the economic efficiency of public procurement and leverage private finance which will help limited public funds stretch further. However, this new approach also faces important challenges to implementation, and it is likely that support will be needed through the project design and development phase. Up-front funding is also likely to be needed in projects where results will take a significant amount of time to materialize. Once the concept is proven in specific sectors, support can be phased out.