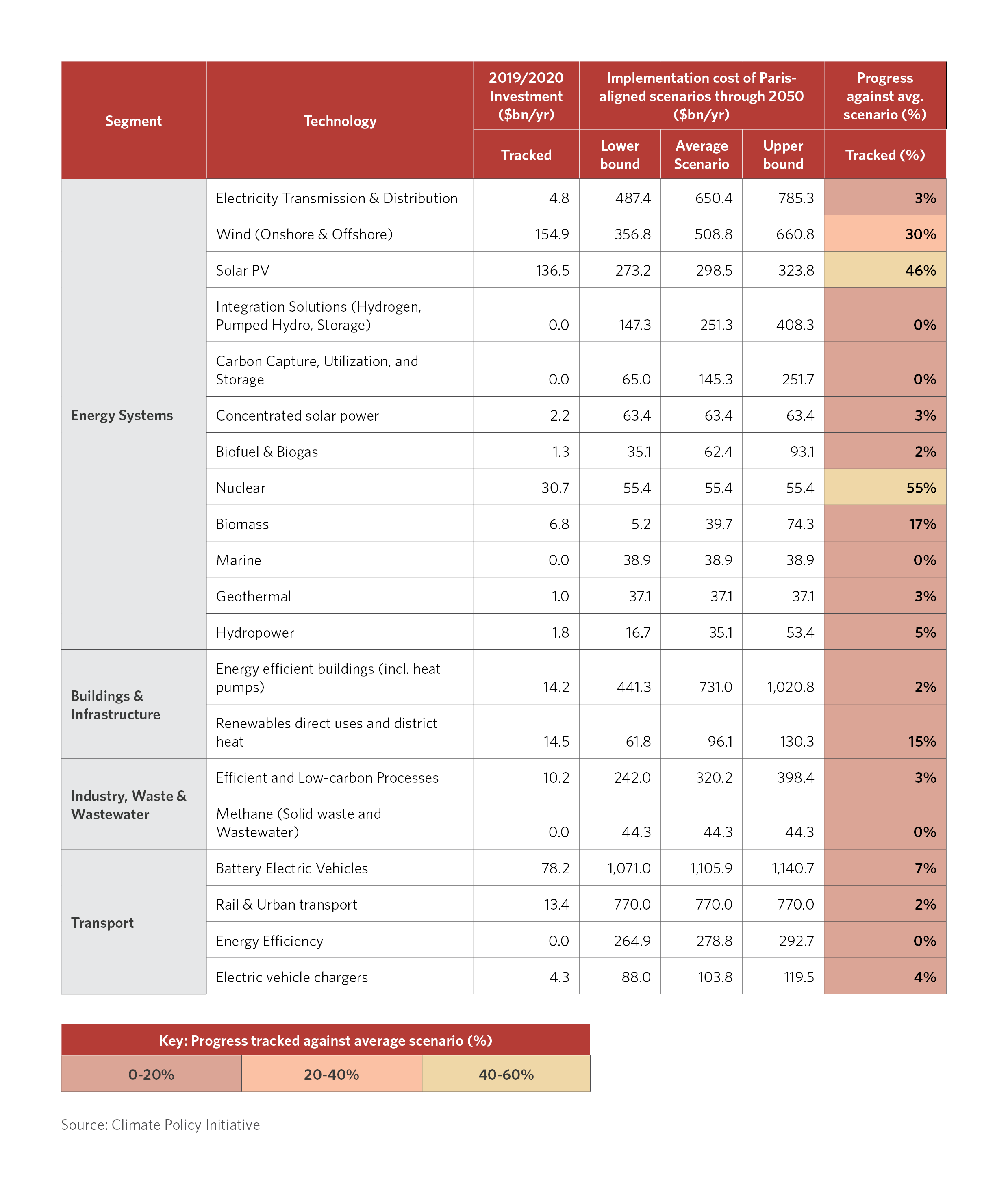

Better climate finance data enables investors and policymakers to make better decisions. But until now, no comprehensive estimates existed of the scale of climate finance needed by sector to deliver net zero by 2050.

In partnership with global law firm A&O Shearman, CPI assessed the scale of the financing needed to decarbonize the global economy across a range of technologies, from energy efficient buildings to electric vehicles. This new analysis sheds light on needs, current funds available, and the roles different stakeholders can play to close the gap.

This works consist of two parts:

- a Net Zero Financing Gap Tool, an online tracker that visualizes the gap between committed financing and the sums needed to deliver net zero by 2050, broken down by year and across a range of technologies; and

- the accompanying report, which explains in detail the scale of investment required, and contains recommendations on how the gap can be closed.

The report also includes key recommendations on how to close the financing gap:

- Stakeholders need to align

- Policy must incentivize long-term private investment

- policy and financial support will need to be directed towards critical decarbonization technologies that are not currently at commercial viability

- alignment between stakeholders will require enhanced engagement and a reframing of public debate

- A just transition is essential