Authors: Francisco Martes Porto Macedo, Climate Policy Initiative and David Steinbach, Independent Consultant

Cities contribute to 70% of global CO2 emissions (UN HABITAT, 2011), are home to over half of the global population, and generate over 80% of global GDP (World Bank, 2023). Undoubtedly, cities urgently need to invest in climate change mitigation and adaptation to deliver their climate action plans and boost resilience. However, of the USD 5 trillion required annually, only USD 384 billion is currently being invested (Negreiros et al. 2021).

Bundling smaller projects (demand-side financial aggregation) or investors (supply-side financial aggregation) is a promising strategy for a city to sponsor their green transition. Building on the Cities Climate Finance Leadership Alliance’s previous work Financial Aggregation for Cities, this report helps mainstream municipal financial aggregation by expanding the evidence base for relevant case studies. It aims to provide cities and CCFLA members with detailed “how-to” guidance that can be used as a reference when developing their financial aggregation instruments.

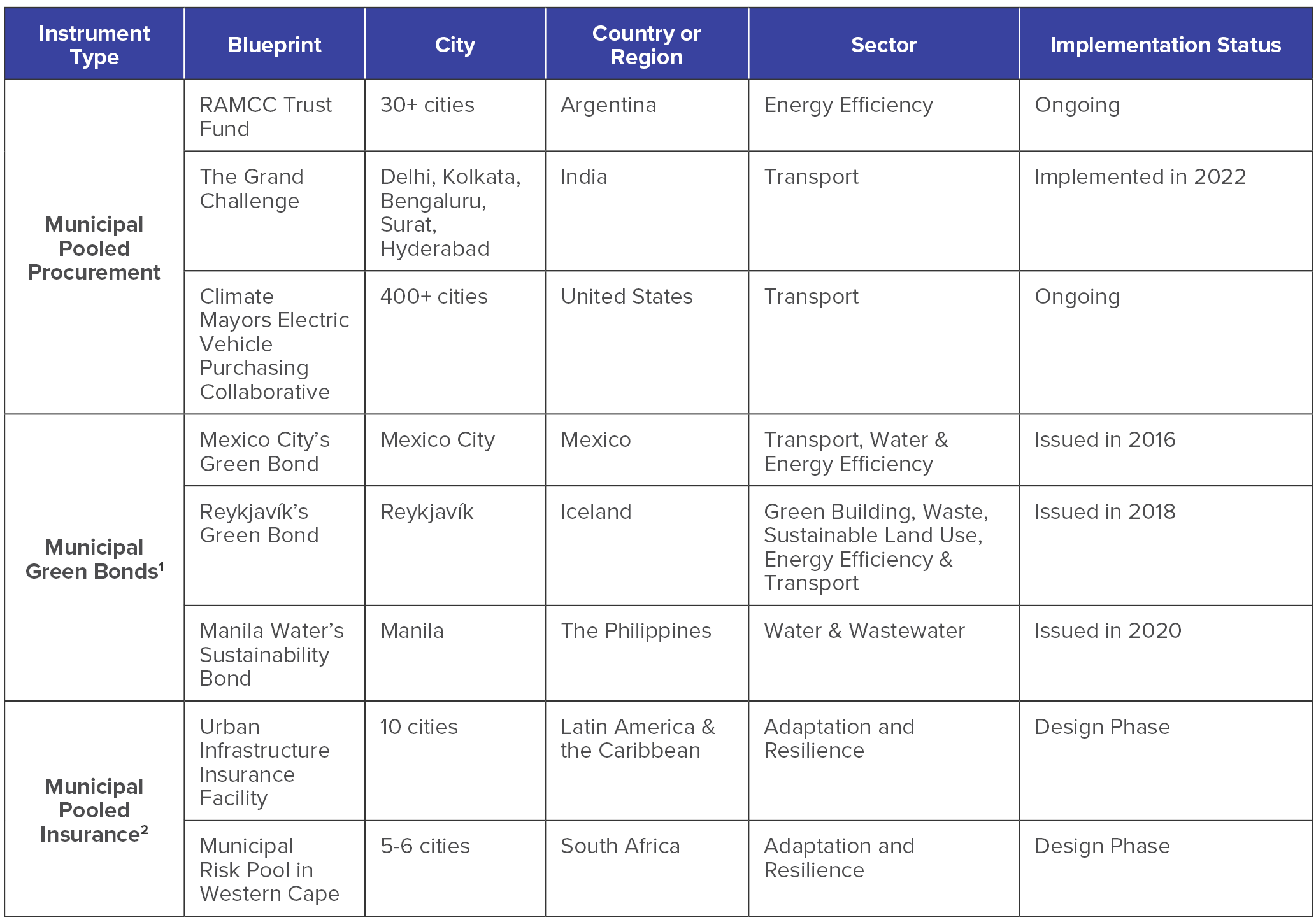

In particular, this report examines eight blueprints from three different kinds of financial aggregation instruments:

- Municipal pooled procurement: The combination of demand for products or services from two or more cities to enable the group to obtain more affordable prices than each party would get if they acted individually (Pinko et al. 2022).

- Municipal green bonds: Debt instruments issued by cities to raise finance from capital markets to make investments that support climate change mitigation and adaptation in line with a green finance framework (MSRB 2018).

- Municipal insurance pooling: The combination of cities’ demand for insurance to buy coverage as a block, enabling the group to achieve economies of scale and pay lower premiums (Pinko et al. 2022).

The eight blueprints were selected to highlight some of the different shapes and formats these instruments can adopt. They highlight their implementation pathway in different geographies with contrasting institutional frameworks and enabling conditions.

Table 1. Summary of financial aggregation blueprints included in the report.

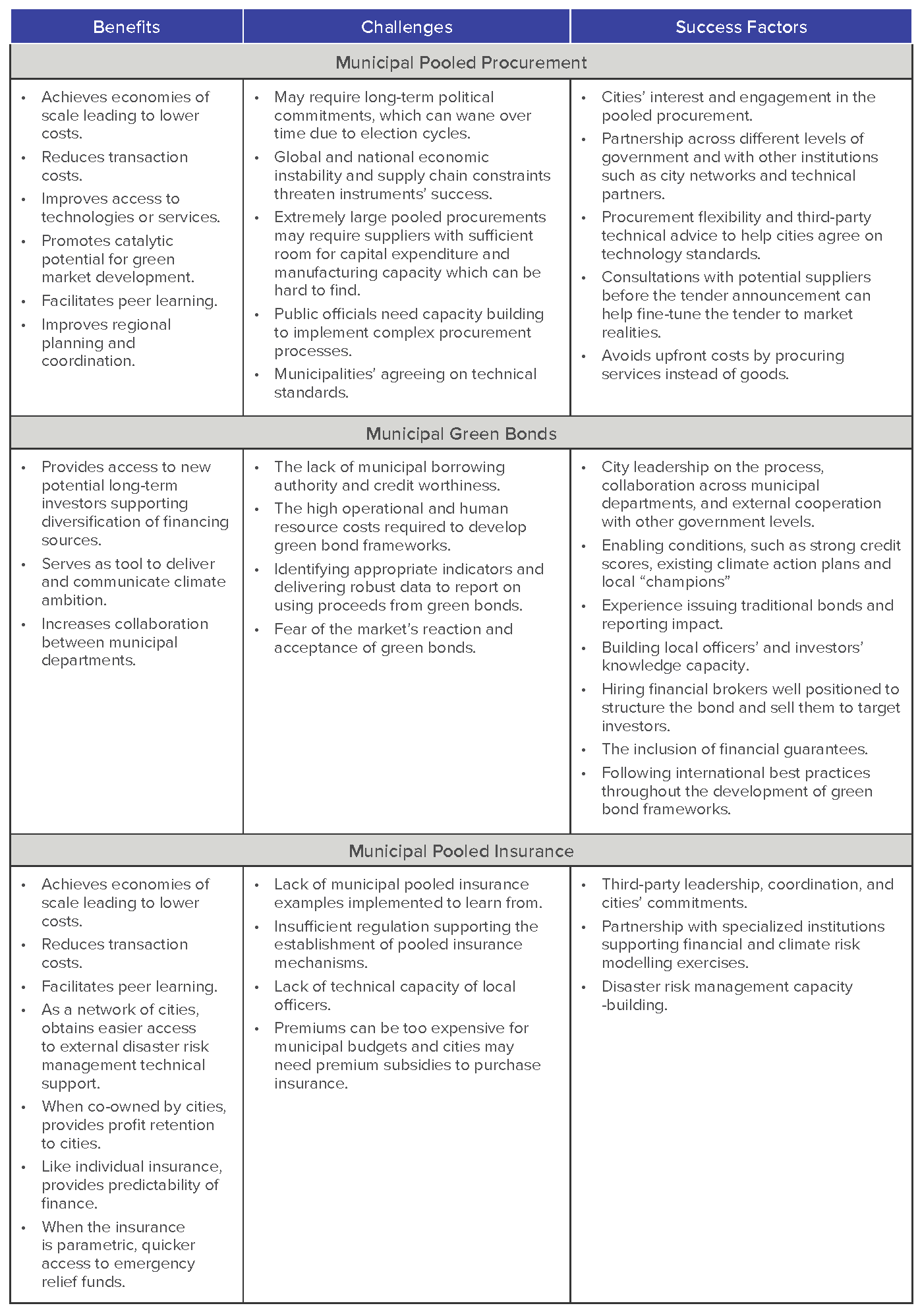

Looking across the blueprints, the report highlights insights about the benefits, challenges, and success factors of the different financial aggregation instruments analyzed:

Table 2. Report main takeaways.

—————

[1] In this report blueprints for municipal green bonds and private utility sustainability bonds were examined. Throughout the report, the term “municipal green bonds” is used for simplicity rather than the more unwieldy “municipal green and private utility company sustainability bonds”.

[2] Given that municipal insurance pooling is an emerging area of practice with few existing cases of operational mechanisms in place, the examples presented in this section draw on municipal insurance pooling mechanisms that are currently in the design phase. The blueprints are thus less comprehensive than in Sections 2 and 3.