This publication is CPI’s analysis of Climate Insurance-Linked Resilient Infrastructure Financing (CILRIF), an innovative climate finance instrument endorsed by The Global Innovation Lab for Climate Finance (the Lab). CPI serves as the Lab’s Secretariat. Each instrument endorsed by the Lab is rigorously analyzed by our research teams. High-level findings of this research are published on each instrument, so that others may leverage this analysis to further their own climate finance innovation.

ABOUT

Cities are often at the frontline of responding to extreme climate events but face fiscal constraints which limit investment in pre-disaster resiliency and post-disaster recovery, especially in emerging economies. Cities also face liquidity challenges when they are impacted by climate events which can lead to increased debt burdens and reallocation of funds planned for development activities.

Insurance can play a crucial role in transferring and mitigating risk and can raise risk awareness, provide incentives for risk mitigation, and support economic growth and capital mobilization. Still, cities underutilize insurance, with few including insurance components in their resilience strategies.

CILRIF is a novel offering of long-term (>10 years) municipal climate insurance, with known premiums dependent on municipal resiliency measures and a unique linked financial product to access capital for climate resilience.

INNOVATION

Climate Insurance Linked Resilient Infrastructure Financing (CILRIF) is a long-term “known price” insurance solution that incentivizes municipalities to invest in resilient infrastructure.

CILRIF aims to enable cities to access affordable, 10-20-year climate insurance with pre-arranged premiums – contingent upon the cities’ commitment to invest in climate resiliency.

If a city implements the adaptation measures set out in the insurance policy, the insurance premium will decrease to reflect the managed risk. A city’s access to insurance coverage is also expected to reduce the city’s financing cost and allow access to relatively lower cost capital for development.

IMPACT

The initial target cities for CILRIF are Durban (South Africa) and Makati (the Philippines), focusing on riverine floods. The next near-term target city is Freetown (Sierra Leone), which focuses on extreme heat.

CILRIF aims to support cities in building climate resilience via (1) structuring the insurance policy for long-term coverage with pre-arranged premiums, (2) incentivizing follow-through on resilience building through results-based premium pricing structure, and (3) offering finance for resilience building through the financing facility.

DESIGN

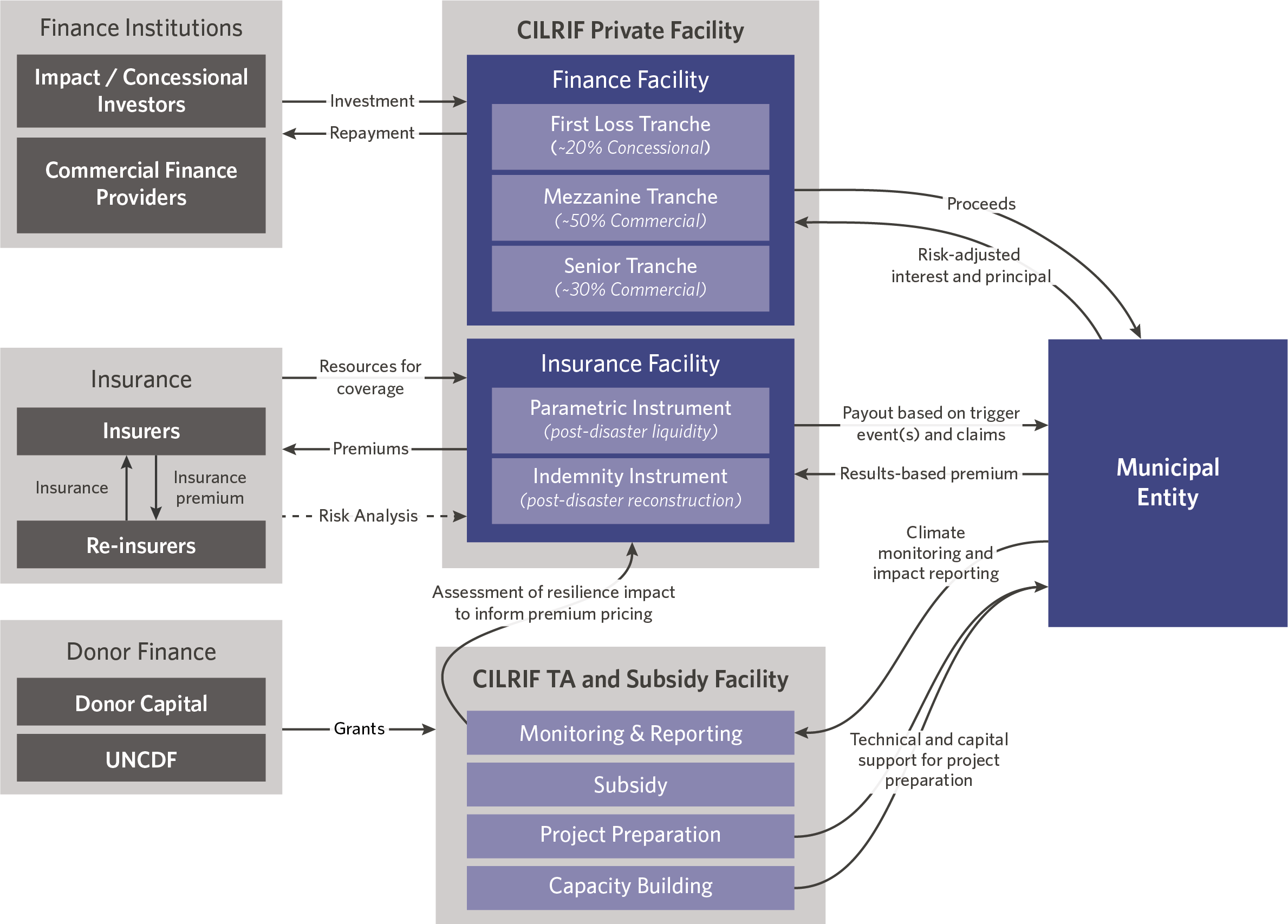

CILRIF will operate a climate risk insurance facility and an infrastructure finance facility. The preliminary expectation is to create a centralized financial structure (CILRIF Private Facility), with an operator managing the two separate components, to be designed to prevent any conflicts of interest.

Cities participating in CILRIF will have access to long-term climate insurance and reduced financing costs informed by their resilience investments. Insurance premiums will reduce commensurately to the increase in city resilience.

The CILRIF Private Facility will carry the residual risk from the insurance facility and the debt financing facility on its balance sheet. CILRIF is being housed in the same entity to ensure the benefits of pricing climate risk, as well as building resiliency and purchase of insurance, get translated into actual pricing. This entity is responsible for pricing both sides of the transaction- buying and selling of climate risk.