Executive Summary

The Brazilian Development Bank (Banco Nacional de Desenvolvimento Econômico e Social – BNDES) is the federal government’s primary instrument for long-term financing and investment in Brazil. The Bank also fosters the country’s economic and social development and aims to be the Brazilian sustainable development bank. BNDES is present in all Brazil’s regions, but its activity is not evenly distributed.

The North Region receives the highest share of disbursements in relation to its GDP. But it receives the lowest share of total BNDES disbursements in Brazil. This suggests that BNDES plays an important role as a development bank for the North, but the North Region does not hold the same financial prominence for the Bank.

Researchers at Climate Policy Initiative/Pontifical Catholic University of Rio de Janeiro (CPI/PUC-Rio) analyze the Bank’s activity in the Legal Amazon beginning in 2009. The states of the Legal Amazon include all the states of the North and the states of Mato Grosso and Maranhão. This brief presents the characteristics of the loans and economic activities that receive the most support throughout the region. This work aims to inform the identification of new investment opportunities and to prioritize challenges to regional development in the Bank’s plans for activity in the region.

During the period of the study, BNDES activity in the Legal Amazon targeted the infrastructure sector and primarily projects that generate electricity, such as the hydroelectric plants Belo Monte (state of Pará), Jirau (Rondônia), and Santo Antônio (Rondônia).

Even though the region is home to massive hydropower plants and is a major exporter of electricity to the rest of the country, a segment of its own population remains disconnected from the National Interconnected System (Sistema Interligado Nacional – SIN), relying on diesel generation, which are expensive and polluting. This gives BNDES a great opportunity to act on clean, quality energy for the local population and position itself as a driver of accelerated investment in the energy transition of the Legal Amazon.

Recently, two efforts were made along those lines. At the end of 2021, the Bank signed an agreement with Eletrobras to promote renewable energy projects to replace diesel fuel in the Amazon, making clean energy accessible to all by 2030. And in 2022, a pilot project was launched, aiming to finance the installation of systems for photovoltaic solar microgeneration in residences and businesses in the region (BNDES 2021 and BNDES 2022a).

For the region to receive support from the Bank that effectively addresses local challenges, a solid plan of practical action must be considered the region’s characteristics. In addition to the energy issue, another regional challenge is access to the basic services of sewage and water, garbage collection, and high-speed internet. An investment portfolio incorporating the region’s challenges will collaborate on designing actions to foster local development and improve the population’s quality of life.

BNDES

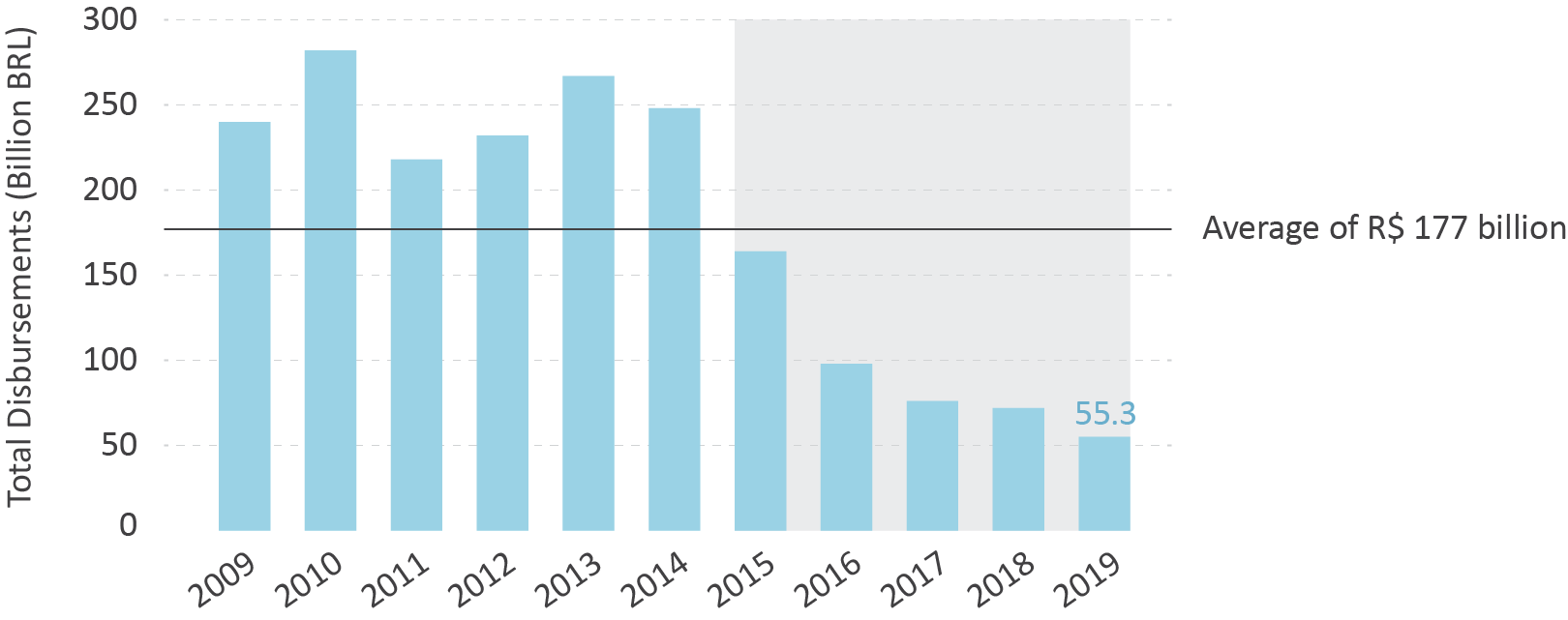

BNDES plays a substantial role in the Brazilian economy, both in terms of how much it spends and in terms of the share of its disbursements in the total credit. Between 2009 and 2019, the Bank’s disbursements varied significantly — in 2019 they were around R$ 55 billion, while in 2010 they were R$ 281 billion in real terms. During that same period, BNDES’s average share of the total credit was 18.9%, but that share began slipping and by December of 2019 it had dropped to 12.6%.[1],[2]

According to BNDES, in the definition of the BNDES long-term strategy, the Bank’s institutional identity includes a mission to facilitate and propose solutions that transform the productive sector and promote sustainable development. To achieve this, it provides financial support for investment, securities underwriting, and non-refundable grants to projects of a social, cultural, environmental, scientific, or technological nature. In keeping with its vision of being Brazil’s sustainable development bank, its grants focus on incentivizing innovation and on regional and socio-environmental development (BNDES nd and BNDES 2022d).

BNDES funds primarily come from government entities such as the Workers’ Assistance Fund (Fundo de Amparo ao Trabalhador – FAT) and the National Treasury of Brazil (Tesouro Nacional). Between 2017 and 2021, these entities were responsible for around 72% of available financial resources, with 40% from FAT and 32% from the National Treasury of Brazil. FAT gets its resources mainly from contributions such as the Social Integration Program (Programa de Integração Social – PIS) and the Program of Assistance to Civil Servants (Programa de Formação do Patrimônio do Servidor Público – PASEP). The goal of FAT is to finance unemployment insurance and salary bonus programs as well as some economic development programs (BNDES 2022c).

BNDES in numbers

BNDES disbursements are representative both in terms of amount and in terms of the relative share of the total credit. Figure 1 shows annual BNDES disbursements in Brazil and the proportion of its disbursements to the total credit for December of each year.

Figure 1. Total BNDES’ Disbursements in Brazil and BNDES’ Participation in Total Credit in December of Each Year, 2009 – 2019

1a. Total of BNDES’ Disbursements in Brazil

1b. BNDES’ Participation in Total Credit in December of Each Year

Note: Values deflated by the IPCA, with December of 2019 as a reference.

Fonte: CPI/PUC-Rio based on data from BNDES and the Time Series Generator System of the Central Bank of Brazil (Sistema Gerador de Séries Temporais – SGS), 2022

Figure 1 shows that starting in 2015 there was a drop both in BNDES disbursements and the proportion of its disbursements to the total credit. Throughout the period studied (2009–2019), BNDES disbursements averaged R$ 177 billion, in real terms, while the average share of BNDES disbursements over the total credit was 18.9%. In December 2019, BNDES disbursements totaled R$ 55.3 billion, and its share in the total credit was 12.6%.

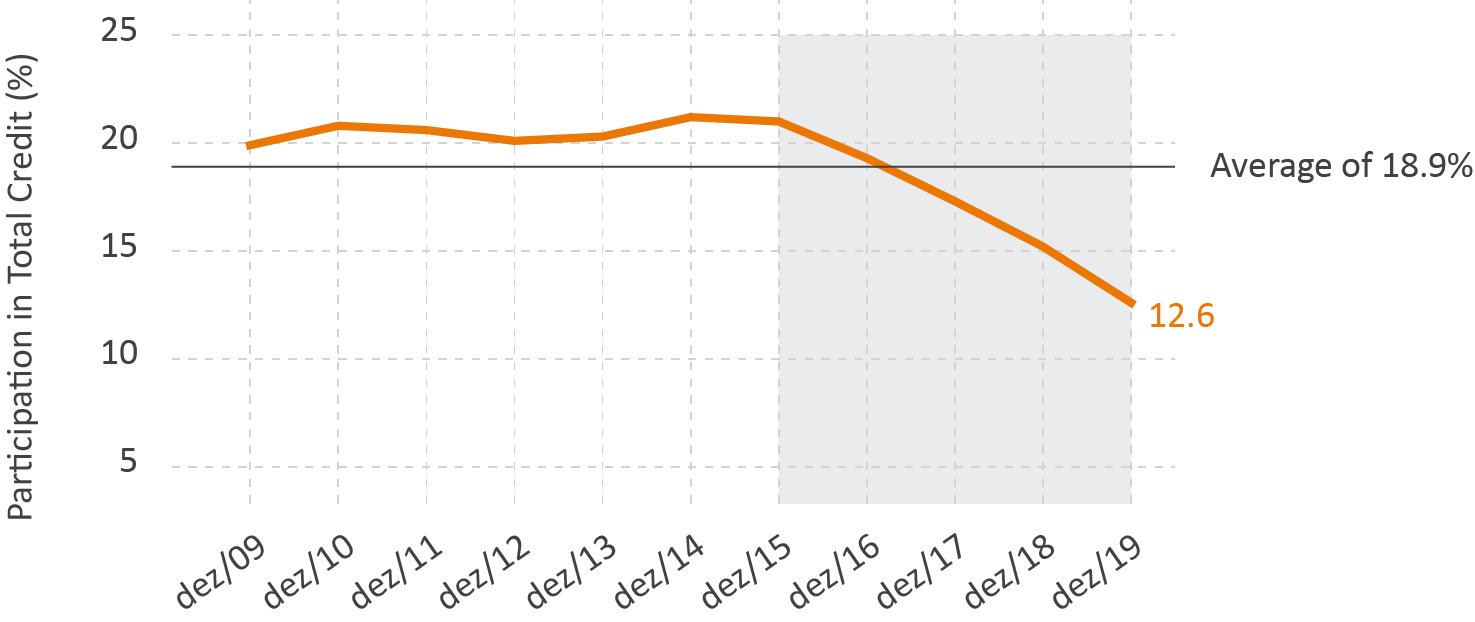

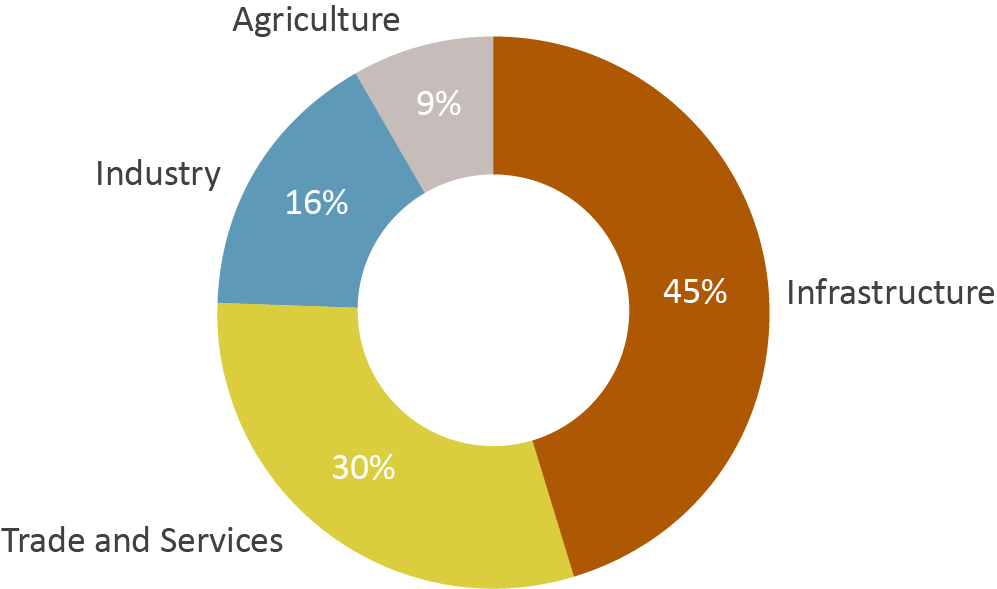

The total disbursements in Brazil span the sectors of industry, infrastructure, trade and services, and agriculture, as seen in Figure 2.

Figure 2. Share of Total Disbursements for Each Sector in 2009, 2014, and 2019

Source: CPI/PUC-Rio based on data from BNDES, 2022

In Figure 2, it is worth noting that the shares of the infrastructure and agriculture sectors increased, while the share of the industrial sector decreased. As Souza et al. (2021) point out, BNDES plays a key role in providing rural credit to the Brazilian agricultural sector. The authors show that the Bank’s disbursements to the sector almost quadrupled in real terms between 1995 and 2020. Over the last five agricultural years, 31% of the total volume of rural credit earmarked for investments originated from BNDES. The most significant portion of credit granted was used to purchase equipment and agricultural machinery such as tractors and harvesting equipment.

The importance of this investment can be seen in its impact on agricultural productivity, as Souza et al. (2022) noted. Expanded access to credit with resources from BNDES leads to higher productivity and the replacement of pastures with cropland without increasing deforestation (Souza et al. 2022).

BNDES in Brazil’s Regions

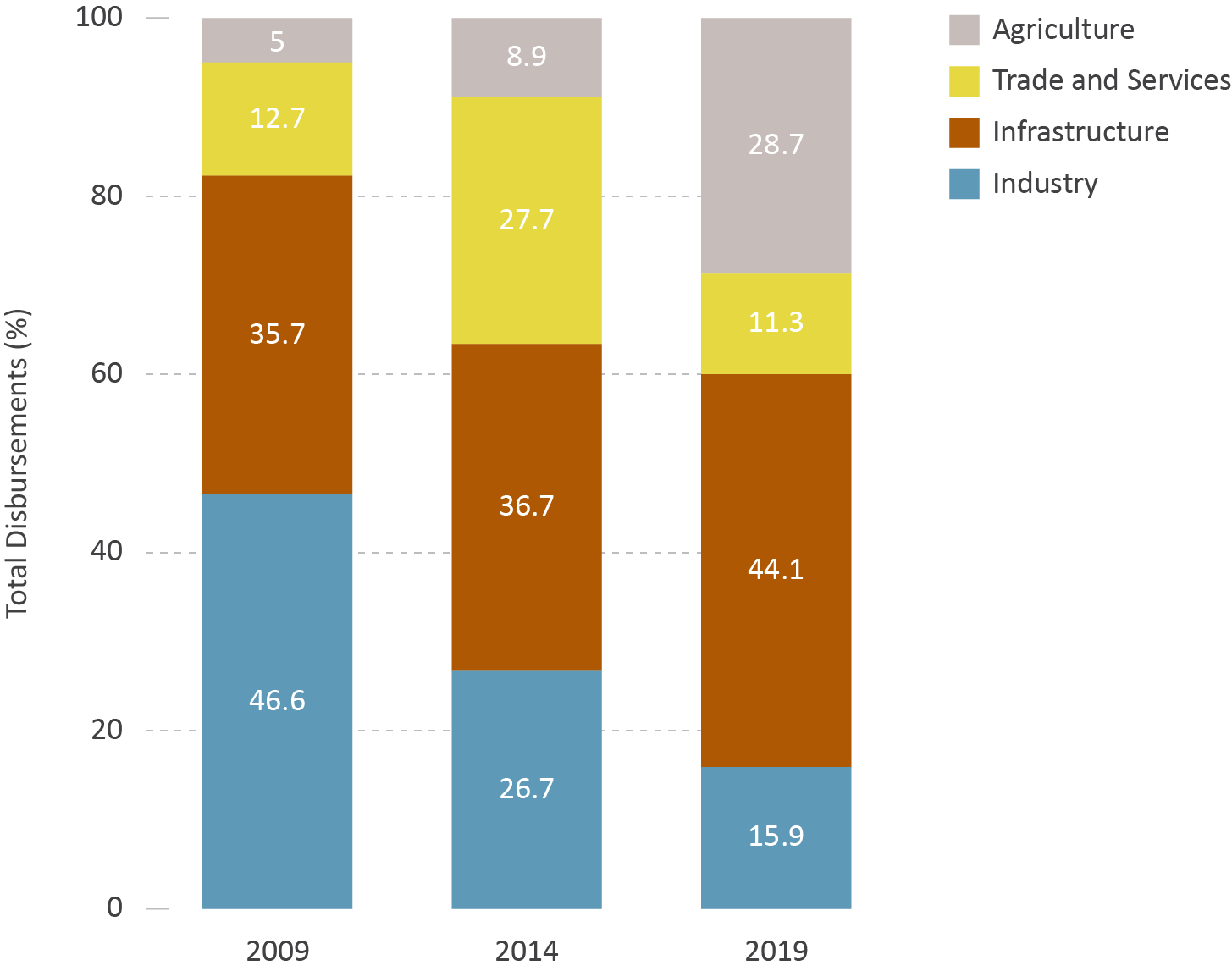

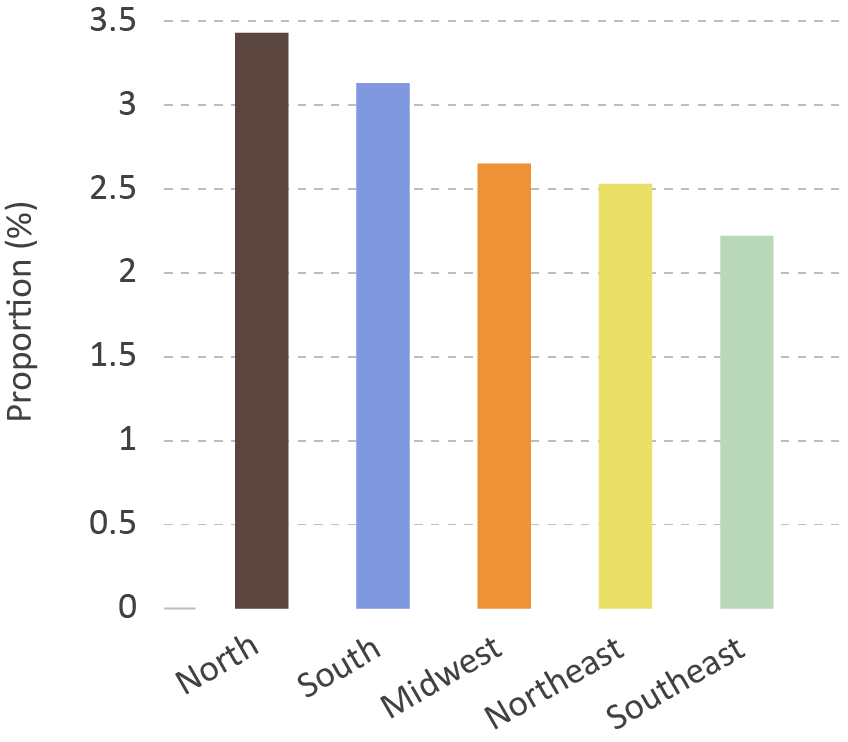

BNDES is present in all Brazil’s regions, but its activity is not evenly distributed. Figure 3 shows the share of BNDES disbursements, between 2009 and 2019, and the proportion of total disbursements in each region in relation to the regional GDP.

Figure 03. Share of Disbursements by Region and Proportion of Disbursements in Relation to Regional GDP, 2009 – 2019

3a. Share of Disbursement by Region

3b. Share of Total Disbursements in Relation to Regional GDP

Note: Values deflated by the IPCA, with December of 2019 as a reference.

Fonte: CPI/PUC-Rio based on data from BNDES and IBGE, 2022

Figure 3 shows that the greatest share of resources went to the Southeast region, followed by the South and the Northeast. The North received the lowest amount of disbursements between 2009 and 2019. Yet it had the highest share of total disbursements in relation to the regional GDP.

The North Region receives the highest share of disbursements in relation to its GDP. But it receives the lowest share of total BNDES disbursements in Brazil. This suggests that BNDES plays an important role as a development bank for the North, but the North Region does not hold the same financial prominence for the Bank.

The states of the North Region have many common characteristics, such as being fully included in the Legal Amazon. Apart from the states of the North, the Legal Amazon comprises the state of Mato Grosso and part of Maranhão. The regions’ boundaries are not restricted to geographic factors or to the ecosystem; they also consider regional similarities and challenges. As such, the Legal Amazon was designated by the federal government to meet the planning needs for the economic and social development of the entire region.

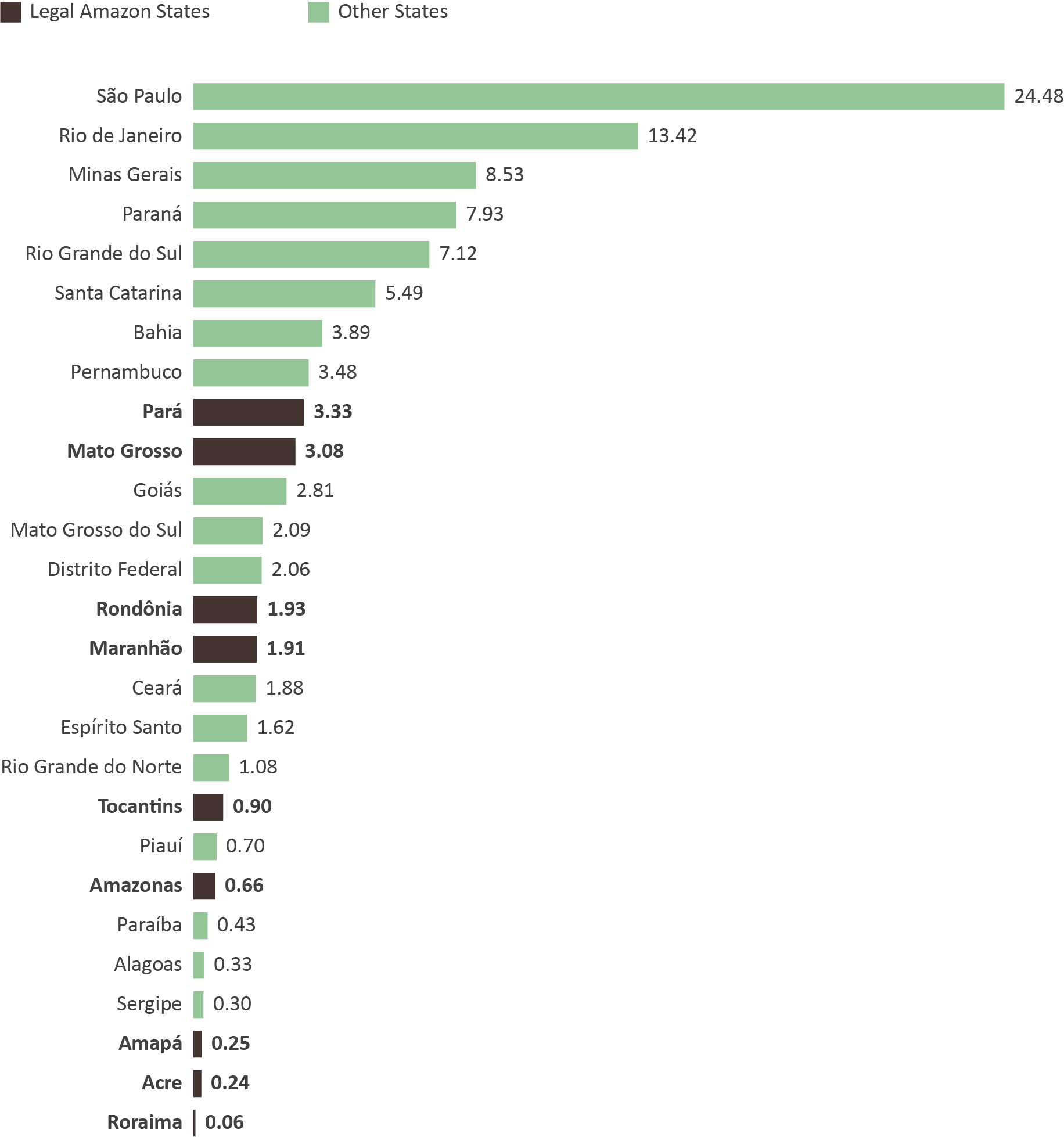

As shown in Figure 4, in terms of the state’s share of BNDES disbursements, the states with the highest proportion of disbursements in the North Region are Pará (3.33%) and Rondônia (1.93%). There is also an apparent similarity between the share of disbursements in these two states and in Mato Grosso (3.08%) and Maranhão (1.91%)—states that are part of the Legal Amazon, but not the North Region. Tocantins, Amazonas, Amapá, Acre, and Roraima have less than a 1% of the total BNDES disbursements.[3]

These results offer a picture of what BNDES does in the Legal Amazon and how it contributes to the economic and social development of the region. This understanding aims to help the Bank improve its activities in the region and better align its investment portfolio with its mission of promoting sustainable development.

Figure 4. Share of Total Disbursements by State, 2009 – 2019

Source: CPI/PUC-Rio based on data from BNDES, 2022

BNDES in the Legal Amazon

To describe the characteristics of BNDES contracts in the Legal Amazon, it is essential to have a set of data containing information about the client and the financing. This study, therefore, uses annual data from BNDES contracts between 2009 and 2019. BNDES gives transparency to the contracts signed, making information available such as the value of the contract, the disbursement, client name, CNPJ number (a registration number from Federal Revenue of Brazil), product, sector, state, among others.[4]

Only operations for firms were analyzed, and all contracts related to the BNDES Card were excluded. In 2019, these disbursements made up 54% of Brazil’s total, amounting to around R$ 1.8 billion for the Legal Amazon.[5]

It is worth mentioning that in addition to BNDES, the region has another public instrument to foster growth: North Constitutional Fund (Fundo Constitucional do Norte – FNO). In 2019, it had R$ 9.3 billion earmarked for financing. Appendix 1 gives a brief background of this program.

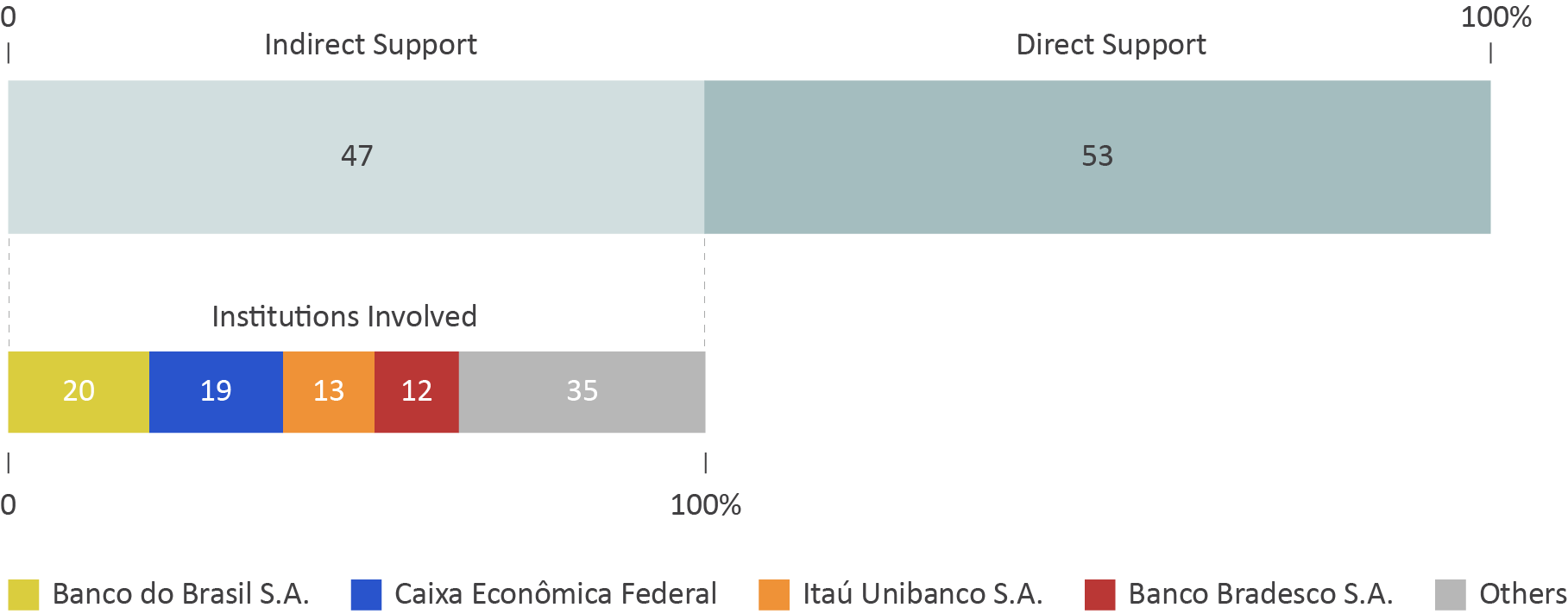

Types of Support

There are two forms of support for financing—direct and indirect. Direct financing is handled directly with BNDES, and to qualify, a company generally must request a loan of more than R$ 40 million. Indirect financing is handled through the intermediary of an accredited financial institution, which is responsible for analyzing the loan and assumes the risk of non-payment. It also negotiates the conditions of the loan with the client, such as the deadline for payment and the guarantees required, respecting rules and limits defined by BNDES.[6],[7]

It should be noted that the transfer of values to accredited financial institutions is tied to the funding lines. Therefore, even when an institution acts as an intermediary in the transaction, the purposes of the contracts signed will correspond to the lines or programs established by BNDES. Moreover, each institution has the autonomy to decide which funding lines it would like to operate. So just because BNDES has a line or program does not necessarily mean that it will be available to every accredited institution, given the autonomy that each institution has in deciding how it intermediates its resources.

Throughout the period analyzed, indirect support accounted for 47% of disbursements, which attests to the role intermediary institutions play in BNDES activity in the Legal Amazon. Figure 5 shows the share of each form of support for the Legal Amazon and the most important financial institutions for indirect support.

Figure 5. Share of Direct and Indirect Support and the Institutions Involved in Indirect Support in the Legal Amazon, 2009 – 2019

Note: Values deflated by the IPCA, with December of 2019 as a reference. Does not include operations of the BNDES Card or those carried out with private individuals. The category “Others” refers to others financial institutions accredited by BNDES.

Fonte: CPI/PUC-Rio based on data from BNDES, 2022

Throughout the period from 2009–2019, the most important institutions of indirect support disbursements were the Bank of Brazil, with a 20% share, followed by Caixa Econômica Federal (19%), Itaú Unibanco (13%) and Bradesco (12%).

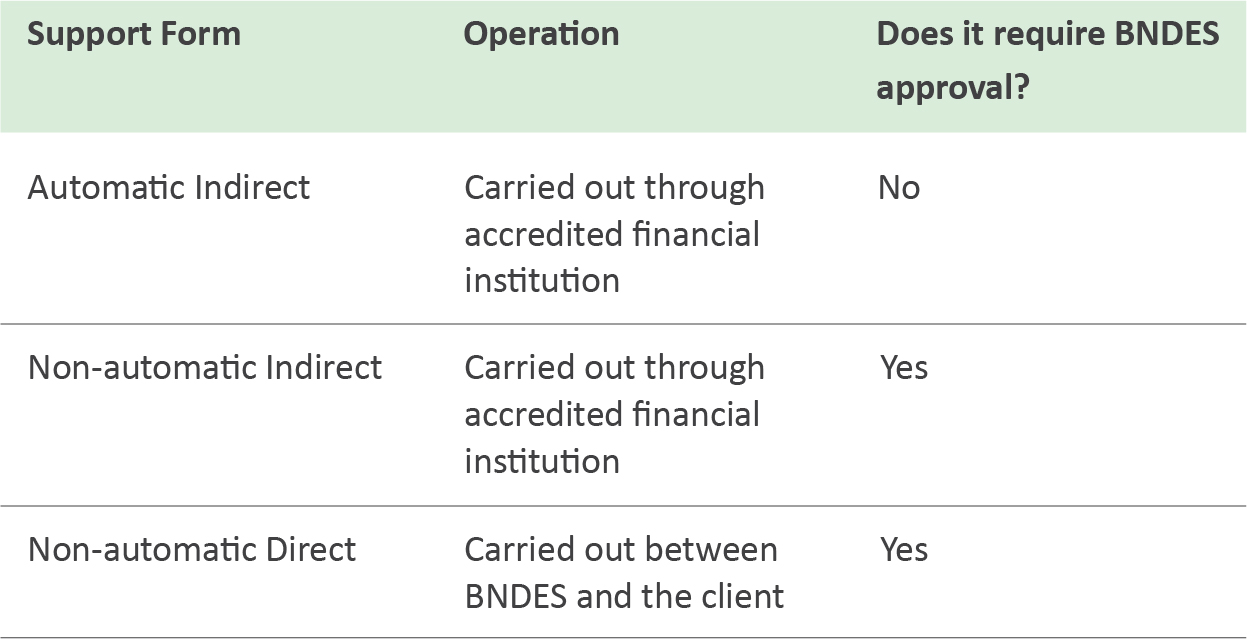

Support modalities

In addition to direct and indirect support, credit is granted in two modalities-automatic and non-automatic. Automatic operations occur only with indirect support and do not require prior evaluation by BNDES. Non-automatic operations, regardless of whether they are direct or indirect, require analysis by BNDES before credit is granted.

In the Legal Amazon during the period analyzed, around 74% of disbursements were non-automatic, which indicates that BNDES is actively involved in project approval. Table 1 illustrates the difference among the three types of support.

Table 1. Types of Support and BNDES Modalities

Source: CPI/PUC-Rio, 2022

Characteristics of Firms Requesting Funding from BNDES in the Legal Amazon

Large firms account for the highest share of direct disbursements in direct operations. This is mainly because direct operations are a line of financing for a high amount of money per project. In 2019, the average disbursement value per contract was around R$ 133 million in the Legal Amazon.

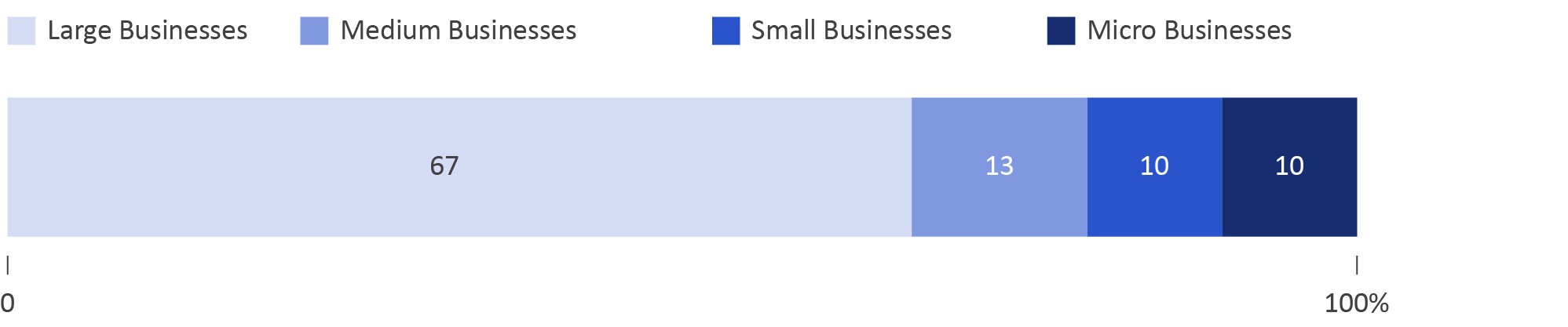

Indirect operations, meanwhile, have more variability in the size of clients requesting financing. Figure 6 shows, for indirect support, the volume of disbursements and the average number of contracts, by size of client, between 2009 and 2019.

Figure 6. Share of Disbursements with Indirect Support and Average Number of Firms by Client Size in the Legal Amazon, 2009-2019

6a. Share of Disbursements with Indirect Support, by Client Size

6b. Average Number of Firms by Client Size

Note: Values deflated by the IPCA, with December 2019 as a reference. Does not include operations of the BNDES Card or those carried out with private individuals.

Source: CPI/PUC-Rio, based on data from BNDES, 2022

With indirect support, 80% of disbursements were directed to large and medium-sized businesses. Yet most firms that are looking for lines of financing are micro and small businesses. Therefore, accredited financial institutions play a key role, especially for micro and small businesses.[8]

BNDES Products, Programs, and the Economic Sectors that Receive the Most Support in the Legal Amazon

Available financing is classified in terms of the product it pertains to, which defines the general financing rules, as well as by the interest rate, deadlines, conditions, and others.

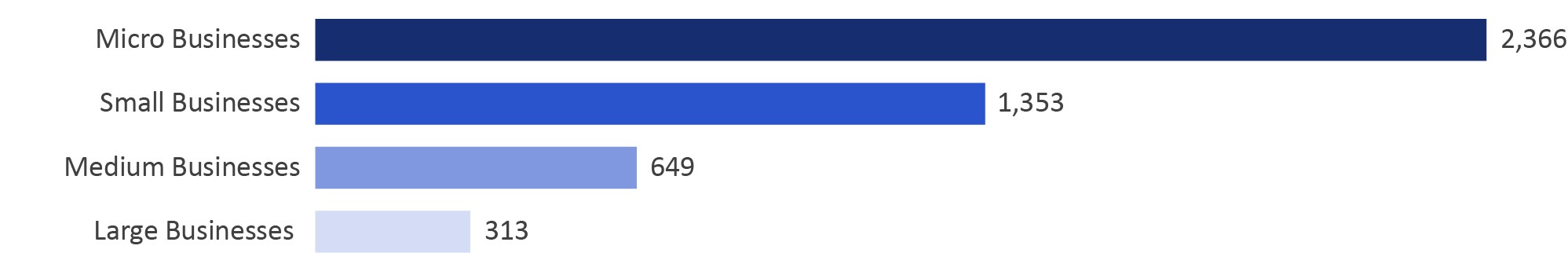

Figure 7 shows the share of disbursements between 2009 and 2019 by product.

Figure 7. Share of Disbursements by Product in the Legal Amazon, 2009 – 2019

Note: Values deflated by the IPCA, with December 2019 as a reference. Does not include operations of the BNDES Card or those carried out with private individuals.

Source: CPI/PUC-Rio, based on data from BNDES, 2022

Figure 7 shows that the most important products are:

- BNDES FINEM: targets mid-sized and large businesses with the goal of investment.

- BNDES Project Finance: tied to project implementation. A business’s estimated cash flow stipulates the amount of credit the project can leverage.

- BNDES FINAME: tied to the purchase and production of machines and equipment licensed by BNDES.

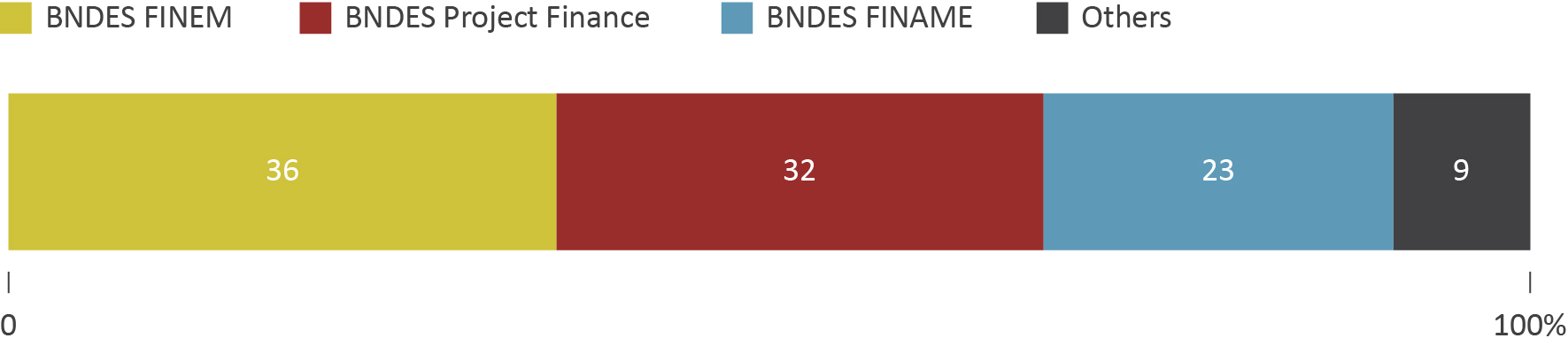

For the most part these products are associated with the infrastructure sector, as seen in Figure 8, which shows the share of disbursements by the economic sector from 2009 to 2019 and looks specifically at BNDES FINEM, Project Finance, and FINAME.

Figure 8. Share of Disbursements for BNDES FINEM, Project Finance, and FINEMA, by Economic Sector, in the Legal Amazon, 2009-2019

Note: Values deflated by the IPCA, with December 2019 as a reference. Does not include operations of the BNDES Card or those carried out with private individuals.

Source: CPI/PUC-Rio, based on data from BNDES, 2022

Figure 8 shows that the primary activities in the Legal Amazon are related to the generation of electricity.[9],[10]

BNDES FINEM

The most significant lines of financing from BNDES FINEM for the Legal Amazon are related to the infrastructure and trade and services sectors, with 52.2% and 27.5% of the disbursements for the period, respectively. Primary infrastructure sector activities include projects related to electricity generation, such as installing small hydroelectric plants in Alto Jauru, Indiavai, Jararaca, and elsewhere.[11]

In the trade and services sector, loans were made to public administration entities and activities involve modernizing tax management, expanding public sanitation, and installing state development programs.

BNDES Project Finance

The biggest program lines of BNDES Project Finance for the Legal Amazon are related to the infrastructure sector, with 87% going to the generation of hydroelectric power. BNDES Project Finance contracts for electricity include hydropower installations in Belo Monte (Pará), Ferreira Gomes (Amapá), Jirau (Rondônia), Cachoeira Caldeirão (Amapá), Estreito (Tocantins and Maranhão), and Santo Antônio (Rondônia).[12],[13]

BNDES FINAME

BNDES FINAME is automatic financing and thus does not require prior evaluation by BNDES, so project descriptions do not exist, unlike other products. However, it is possible to evaluate the economic sectors this product serves. Figure 9 shows each sector’s share of disbursements for the Legal Amazon for the BNDES FINAME product.

Figure 9. Share of Disbursements from BNDES FINAME in the Legal Amazon by Economic Sector, 2009–2019

Note: Values deflated by the IPCA, with December 2019 as a reference. Does not include operations of the BNDES Card or those carried out with private individuals.

Source: CPI/PUC-Rio, based on data from BNDES, 2022

The infrastructure sector makes up a higher average share of BNDES FINAME (Figure 9). Within this product for the period studied, there were two major lines of financing: the Investment Support Program – Capital Goods (Programa de Sustentação do Investimento – Bens de Capital – PSI–BK), accounting for 64% of disbursements for the period, followed by BK Aquisição e Comercialização, with 31%.

BK Aquisição e Comercialização is a credit line for the financing of machines, equipment, industrial systems, IT and automation goods, buses, trucks, and business aircraft. Until 2015, PSI–BK also financed the purchase of machines and equipment produced in the country. It was a subprogram of the Investment Support Program, created to address the financial crisis of 2008, and as such, it offered more attractive loan conditions (BNDES sda).[14]

For both lines of financing, activities are similar and mainly involve the construction of dams and reservoirs for generating electricity, as well as earthworks, the construction of roads and railways, and railway freight shipping.

The Energy Sector and Regional Challenges

According to Figure 8, over 70% of disbursements from BNDES Project Finance, FINEM, and FINAME for the infrastructure sector in the Legal Amazon between 2009 and 2019 went to the electricity sector. And of that total, around 90% was, more specifically, for electricity generation.

According to data from the Generation Information System (Sistema de Informações de Geração da ANNEL – SIGA) of the National Electric Energy Agency (Agência Naciional de Energia Elétrica – ANEEL), the hydroelectric plants that began operating between 2009 and 2019 in the Legal Amazon and received funding from BNDES accounted for 22% of Brazil’s hydropower generation capacity. Table 2 shows these plants.

Table 2. Plants with BNDES Funding in the Legal Amazon

Source: CPI/PUC-Rio, based on data from SIGA/ANEEL and BNDES, 2022

The energy produced is distributed to the various Brazilian regions via the National Interconnected System (Sistema Interligado Nacional – SIN), a system of energy production and transmission linking plants to consumers throughout the country. However, although the Amazon is a major energy producer for the rest of the country, a portion of its own population remains disconnected from the National Interconnected System. In 2020, the Legal Amazon generated 26% of the country’s electricity but around four million people in the region were not yet connected to the National Interconnected System —14% of the region’s population (Schutze et al. 2022).

Around three million people in the Legal Amazon get their electricity from isolated systems, which are locations where there is a power generator that serves the local population. In isolated systems, electricity is generated mainly by thermal plants that run on diesel fuel. Another nearly one million people lack full access to electricity services, living with just a few hours of electricity per day from diesel generators.

Thermal plants are polluting and expensive. The additional cost of generating energy on isolated systems compared to the National Interconnected System is absorbed by all consumers on their electricity bills. According to Schutze et al. (2022), the estimated value of these charges in 2022 was more than R$ 10 billion, which amounts to an annual per capita subsidy of over R$ 3,000 per person served by isolated systems. As such, measures to reduce the dependence on diesel would positively impact the environment and Brazilian consumers.

One possible way to achieve this would be to link areas served by isolated systems to the National Interconnected System, bringing greater reliability and quality to the power supply. This would stimulate industrial activity as well as trade and services activity. Another possibility would be to increase the share of renewable sources for generating energy in areas where connecting to the National Interconnected System is not an option.

In the case of people without access to public electricity services, one possible solution is decentralized photovoltaic solar generation. Electricity is needed for a range of practices that contribute to the quality of life: refrigerating medications, vaccines, and food; pumping drinking water; using computers in schools; enhancing territorial security; and engaging in sustainable, productive activities. So, access to electricity is essential to the region’s development and better quality of life for the population.

Energy transition in the Amazon is good for the environment, leading to lower electricity bills for all Brazilians and allowing the local population to have a better quality of life and well-being.

At the end of 2021, BNDES signed an agreement with Eletrobras to promote renewable energy projects to replace diesel fuel in the Amazon. The initiative falls under the United Nations Energy Compact to make clean energy accessible to all by 2030. Economic, technological, legal, and regulatory studies will be conducted to ensure that the new incentives or programs take regional challenges into account.

Moreover, in 2022, BNDES acquired 95% of the R$ 60 million in “green” debentures issued by the Solar Amazon Securitizer Company of Financial Credits (Amazônia Solar Companhia Securitizadora de Créditos Financeiros). The transaction will finance the installation of photovoltaic solar microgeneration systems in residences and businesses in the region. Around 1,600 projects to install photovoltaic systems will be completed over up to 150 months. This is an innovative pilot project, and it will give consumers access to BNDES resources without the traditional intermediary of a Bank. It aligns with the Bank’s vision of promoting sustainable development (BNDES 2021 and BNDES 2022a).

BNDES, therefore, has an excellent opportunity to drive the acceleration of investments related to the energy transition in the Amazon, both by replacing diesel generation with renewable generation in the systems that will remain isolated and by integrating some isolated systems into the National Interconnected System. The inequality in electricity service must be reduced to promote a better quality of life for the local population.

Other Regional Challenges

The Legal Amazon is currently the most isolated area in Brazil. Improving transportation and communication networks, in addition to energy, is critically essential to accelerating development in the North Region. Araújo et al. (2022b) have built a market access metric and estimate that the market access of a typical municipality in the Legal Amazon is around two times lower than that of a typical municipality in the rest of the country.[15]

As Araújo et al. (2022c) point out, using logistics infrastructure to improve the economic ties between the Legal Amazon and other areas is key to boosting the region’s economy and creating jobs and income for the local population. But the strategy of investing in traditional logistics interventions (roads and railways, among others) comes at a high socio-environmental cost.

Araújo et al. (2022a) argue that improving the delimitation of the area of influence for logistics infrastructure projects can help mitigate the socio-environmental risks of these projects. In addition, one strategy to minimize some of the isolation without incurring the socio-environmental risks typical of traditional logistics infrastructure projects is to invest in better internet access.

Using 2019 data from Continuous National Household Sample Survey (Pesquisa Nacional por Amostra de Domicílios Contínua – PNAD-Contínua), Araújo et al. (2022c) show that only a quarter of residents of rural areas in the Legal Amazon have access to 3G or 4G mobile internet, and 45% of residents of urban areas and 55% of residents of rural areas in the Legal Amazon do not yet have access to broadband internet.

According to Chein and Procópio (2022), the pattern of urbanization in the Amazon is characterized by a dispersed population, low demographic density, only two metropolitan areas and a scarcity of mid-sized cities, great distances between urban centers, and a lack of access to basic services such as sewage and water, garbage collection, electricity, and internet. Although the characteristics of municipalities within the Legal Amazon vary widely, its residents fare worse than the rest of the country on the indicators studied.

The new Basic Sanitation Legal Framework, passed in 2020, establishes that by 2033, 99% of the population will have access to potable water, and 90% will have access to sewage collection and treatment. To meet this goal, the Instituto Trata Brasil (2020) estimates that the states of the Legal Amazon will have to make an annual average investment of R$ 6 billion, in 2018 values, between 2019 and 2033.

The heterogeneity of the Legal Amazon reveals the need to design public policies that incorporates the inequalities observed and the need for targeted analyses. A portfolio of investments that considers the region’s challenges and reduces isolation and inequality could, therefore, combine interventions related to replacing diesel fuel for electricity generation and better access to the internet and basic sanitation.

Final Considerations

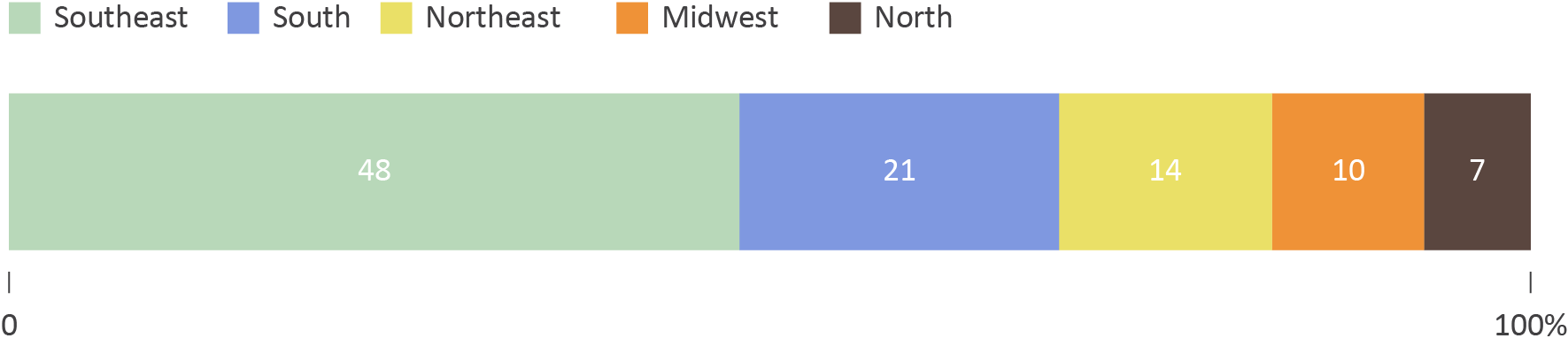

BNDES is a development bank that is present in every region of Brazil. The North received the smallest share of total disbursements between 2009 and 2019 – just 7%. Yet, in terms of the proportion of these disbursements in the regional GDP, the North stands out, with the greatest regional share. It can thus be inferred that the North Region does not play an important role for BNDES, while the disbursements from BNDES are vital to the North.

Disbursements in the Legal Amazon are concentrated in the infrastructure sector, and especially in the electrical energy sector. They mainly support the construction of large hydroelectric plants that serve the entire country. BNDES must prepare for a new round of loans, considering investments that take regional particularities into account as well as the needs of the local population.

Therefore, although BNDES already funds major investments in the Legal Amazon in the energy sector, there is still room for improvement in future investments, with actions that involve the infrastructure sector and that focus on regional development and on reducing the inequalities in access to quality energy, access to the internet, and access to the basic services of sewage, water, and garbage collection.

References

Agência Nacional de Energia Elétrica (ANEEL). SIGA – Sistema de Informações de Geração da ANEEL. sd. bit.ly/3tzZZaN.

Araújo, Rafael, Arthur Bragança and Juliano Assunção. Accessibility in the Legal Amazon: Delimiting the Area of Influence and Environmental Risks. Amazônia 2030, 2022a. bit.ly/3e1ppJf.

Araújo, Rafael, Arthur Bragança and Juliano Assunção. Accessibility in the Legal Amazon: Measuring Market Access. Amazônia 2030, 2022b. bit.ly/3e8rFyC.

Araújo, Rafael, Arthur Bragança and Juliano Assunção. Accessibility in the Amazon: Digital Solutions. Amazônia 2030, 2022c. bit.ly/3cwWjRH.

Assunção, Juliano, Amanda Schutze and Rhayana Holz. Does the Manaus Free Trade Zone Have an Impact on Industry Efficiency? Rio de Janeiro: Climate Policy Initiative, 2022. bit.ly/3wD1mqr.

Banco Central. Sistema Gerenciador de Séries Temporais. bit.ly/3lvxSF6.

Banco Nacional de Desenvolvimento Econômico e Social (BNDES). BNDES Finame BK Aquisição e Comercialização. sda. bit.ly/3OnelUL.

Banco Nacional de Desenvolvimento Econômico e Social (BNDES). Dados sobre Operações de Financiamentos. sdb. bit.ly/317D8sd.

Banco Nacional de Desenvolvimento Econômico e Social (BNDES). FAT ao longo do tempo. sdc. bit.ly/3OeA29r.

Banco Nacional de Desenvolvimento Econômico e Social (BNDES). Forma de Apoio. sdd. bit.ly/3JUFc79.

Banco Nacional de Desenvolvimento Econômico e Social (BNDES). Quem somos? sde. bit.ly/3I9enMQ.

Banco Nacional de Desenvolvimento Econômico (BNDES). BNDES firma pacto de energia da ONU para descarbonização na Amazônia. 2021. bit.ly/3vGQRBd.

Banco Nacional de Desenvolvimento Econômico (BNDES). BNDES financiará geração de energia solar por consumidores na Região Norte de maneira inédita. 2022a. bit.ly/3yWSVbJ.

Banco Nacional de Desenvolvimento Econômico e Social (BNDES). Estatísticas Operacionais do Sistema BNDES. 2022b. bit.ly/3rBaBoC.

Banco Nacional de Desenvolvimento Econômico e Social (BNDES). Fonte de Recursos. 2022c. bit.ly/3vqPG98.

Banco Nacional de Desenvolvimento Econômico (BNDES). Identidade Institucional – Propósito, Visão, Missão, Valores, Princípios e Comportamentos. 2022d. bit.ly/39UU5K8.

Chein, Flávia and Igor Vieira Procópio. As Cidades na Amazônia Legal: Diagnóstico, Desafios e Oportunidades para Urbanização Sustentável. Amazônia 2030, 2022. bit.ly/3LUXOpo.

Empresa de Pesquisa Energética (EPE). Planejamento do Atendimento aos Sistemas Isolados Horizonte 2025 – Ciclo 2020. 2021. bit.ly/3sZCeIN.

Instituto Brasileiro de Geografia (IBGE). Produto Interno Bruto dos Municípios. sd. bit.ly/3EENejD.

Instituto Trata Brasil. Cenário para investimentos em saneamento no Brasil após aprovação do novo marco legal. 2020. bit.ly/3Q8WXDY.

Pereira, Leila and Priscila Z. Souza. Priorities That Do Not Prioritize: The Mismatch Between the Objectives and the Application of Resources from Constitutional Funds Leads to Credit Concentration in the Rural Sector. Rio de Janeiro: Climate Policy Initiative, 2022. bit.ly/ConstitutionalFunds.

Schutze, Amanda, Luiz Bines and Juliano Assunção. Rivers of Diesel in the Amazon: Why Does the Region with Brazil’s Biggest Hydroelectric Plants Still Rely on Expensive, Dirty Fuel? Rio de Janeiro: Climate Policy Initiative, 2022. bit.ly/RiversOfDieselAmazon.

Souza, Priscila, Gabriel de Campos, Stela Herschmann, Pedro Vogt, and Juliano Assunção. 6 Peculiarities of Rural Credit in the Amazon: New Research Shows Credit Restrictions and Extensive Land Use in Agriculture Rio de Janeiro: Climate Policy Initiative, 2021a. bit.ly/3AWnnDs.

Souza, Priscila, André Sant´Anna, Luciano Machado, Barbara Intropidi, and Pedro Vogt. Credit for Investments in Brazilian Agriculture and the Role of the Brazilian Development Bank. Rio de Janeiro: Climate Policy Initiative, 2021b. bit.ly/3e75OYe.

Souza, Priscila, André Sant’Anna, Luciano Machado, Barbara Intropidi, and Pedro Vogt. Rural Investment: BNDES Credit Contributes to Agricultural Intensification. Rio de Janeiro: Climate Policy Initiative, 2022. bit.ly/3KzbE0x.

Appendix 1. Other Types of Financing for the North

North Constitutional Fund (Fundo Constitucional do Norte – FNO) is an important money lender for the productive private sector in the North Region, and its goal is to contribute to regional development by strengthening small producers and reducing income disparities. The Superintendency of Development for the Amazon (Superintendência do Desenvolvimento da Amazônia – SUDAM) is responsible for defining the directives and priorities for how the funds are used. The FNO prioritizes small-scale productive segments, family farms, businesses that use primary materials and local labor and produce basic foods for local consumption, and sustainable projects. Since 2011, the FNO has lent 51% of resources to beneficiaries belonging to mini, small, and small-medium-scale categories.

The FNO gets its financial resources from 0.6% of proceeds directed from the Income Tax (Imposto de Renda – IR) and Tax on Industrialized Products (Imposto sobre Produtos Industrializados – IPI). In 2019, while BNDES lent R$ 2.8 billion to the North, including individuals and legal entities, the value set for the FNO was R$ 9.3 billion. The FNO is thus an important development agent for the region.

A bit more about the Constitutional Funds (Pereira e Souza 2022)

In the report Priorities That Do Not Prioritize: The Mismatch Between the Objectives and the Application of Resources from Constitutional Funds Leads to Credit Concentration in the Rural Sector, researchers from CPI/PUC-Rio study the allocation of resources from the Constitutional Funds of the North, Northeast, and Midwest. The report shows that although these funds establish rules prioritizing small producers and low-income areas, the loose eligibility criteria mean there is no real prioritization in resource allocation, contributing to resource concentration. The researchers confirm, for example, that 97% of producers have a level of income from agricultural activities that qualifies them priority beneficiaries since their gross annual income is less than R$ 16 million.

Appendix 2. Rural Credit in the Amazon

The report 6 Peculiarities of Rural Credit in the Amazon and the Role of BNDES, by researchers at CPI/PUC-Rio (Souza et al. 2021a), identifies the main characteristics of rural credit in the Amazon:

- Most rural credit in the Amazon region is channeled to cattle farming: 57% of the amount of credit operations in the Amazon biome were related to cattle production in the 2019/20 agricultural year. This is in contrast with the rest of the country, where only 32% of rural credit is used to finance this activity.

- Producers in the Amazon have less access to credit than producers elsewhere in the country. Thus, the low availability of credit contributes to more extensive agricultural production because there are fewer resources available for investing in intensification, thus generating greater deforestation.

- Agricultural activities in the Amazon are less business-oriented than the rest of the country. The amount of rural credit borrowed by companies in the biome accounted for a mere 4.8% of the region’s total in the 2019/20 agricultural year, while the volume of credit directed to companies elsewhere in Brazil accounted for 26% of the rest of Brazil in the same period. The low prevalence of a more business-oriented agriculture is tied to lower investments and intensified production.

- There is a predominance of two public banks in the operation of rural credit in this biome: Banco da Amazônia and Banco do Brasil. This suggests that producers have limited credit options.

- Agriculture Credit Notes (Letras de Crédito Agrícola – LCA) also gained considerable space in the composition of credit available for the biome, but more modestly so than they did in the rest of the country. LCA are private investments backed by loans granted to rural producers or cooperatives. The lower prevalence of these investments in the biome implies a lower availability of credit.

- There is a greater relevance in the Amazon of credit volumes offered by National Program for Family Farming (Programa Nacional de Fortalecimento da Agricultura Familiar – PRONAF) than in the National Program to Support Medium-Sized Rural Producers (Programa Nacional de Apoio ao Médio Produtor Rural – PRONAMP). A criterion for PRONAF eligibility is that the property does not exceed four fiscal modules. Since fiscal modules’ sizes varies by municipality and the largest fiscal modules were defined for the Amazon region, producers with relatively larger properties in the region are able to access PRONAF.

Appendix 3. BNDES and the Manaus Industrial Park

Manaus Free Trade Zone is an industrial policy that aims to develop and boost industry and the economy and contribute to the development of the North Region. To achieve this, fiscal benefits are awarded to industries located within the Manaus Industrial Park (Polo Industrial de Manaus – PIM), and that comply with the Basic Productive Process (Processo Produtivo Básico), which is a set of operations that characterize the industrialization of a product.

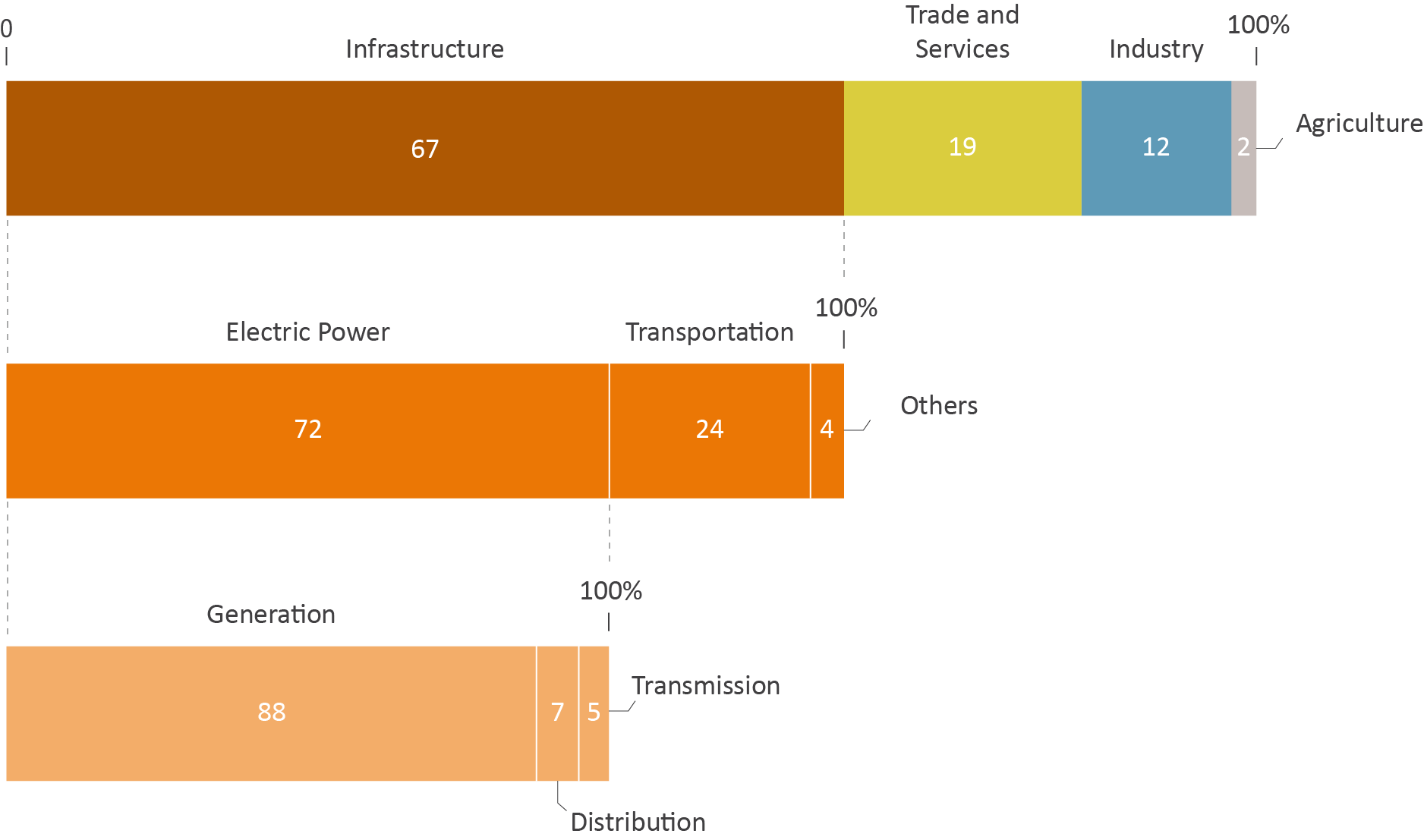

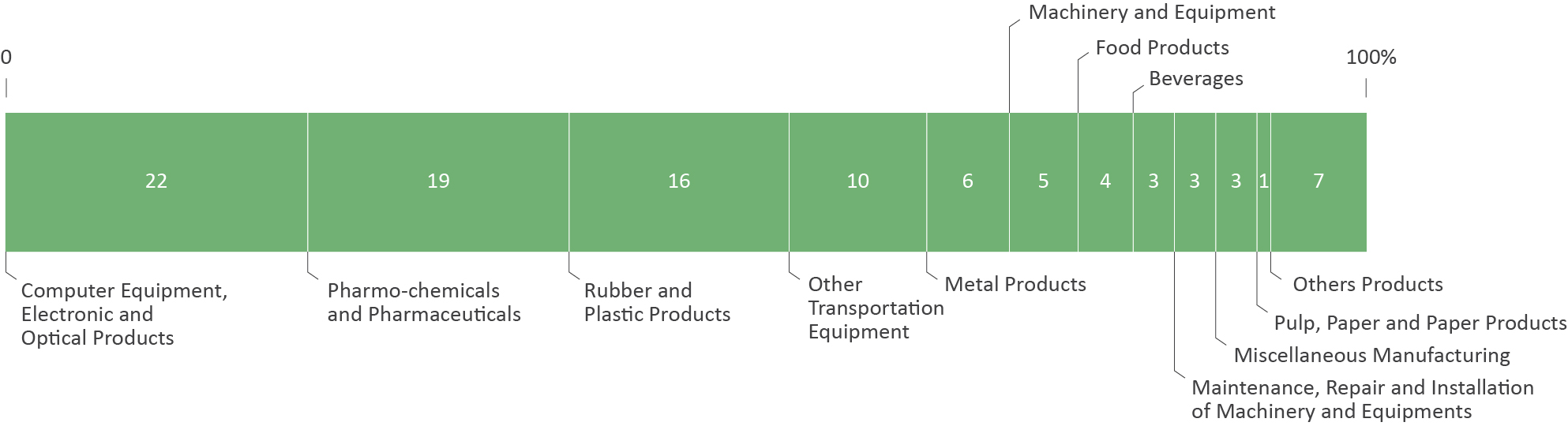

An analysis of BNDES activity in the PIM reveals that from 2009–2019, 25% of disbursements for the processing industry in the North went to the PIM. The sectors that received the highest amounts of disbursements during the period studied are shown in Figure A.

Figure A. Share of Total BNDES Disbursements for the PIM, by Economic Sector, 2009-2019

Source: CPI/PUC-Rio, based on data from BNDES, 2022

The IT equipment sector has a 22% share of the total disbursements for the PIM, followed by the pharmachemical and pharmaceutical sector (19%), rubber and plastic (16%), and other transportation equipment (10%) (Figure A). It is worth noting that the sectors with the biggest share of disbursements, except the pharmachemical and pharmaceutical sectors, received the highest volume of fiscal incentives in 2015, as noted by Assunção, Schutze, and Holz (2020).

The authors emphasize that despite the fiscal waivers, the analysis does not show any productivity gains for these sectors. However, to determine whether there were productivity gains among the businesses in the PIM that received financing from BNDES, additional research is needed to verify the productivity of these businesses at the company level.

[1] The disbursement was deflated by the Extended National Consumer Price Index (Índice Nacional de Preços ao Consumidor Amplo – IPCA) and December 2019 is the base period.

[2] All the analyses carried out in this section were based on data from the BNDES system’s operational statistics (BNDES 2022b).

[3] It is worth mentioning that only part of Maranhão is in the Legal Amazon, but the entire state was considered for this study.

[4] All the analyses conducted in this section were based on data from the BNDES financing operational statistics (BNDES sdb).

[5] The BNDES Card is a credit line designed specifically to finance the acquisition of goods and services by Brazilian enterprises.

[6] There is also a mixed form of support, which combines direct and indirect forms. The risk of these transactions is shared between BNDES and the accredited financial institution.

[7] In certain circumstances, direct support may be available for financing beginning at R$ 20 million.

[8] BNDES classifies companies in four categories and uses the Gross Operating Income (Receita Operacional Bruta – ROB) as the cut-off:

– Micro business: ROB less than or equal to R$ 360,000

– Small business: ROB greater than R$ 360,000and less than or equal to R$ 4.8 million

– Medium business: ROB greater than R$ 4.8 million and less than or equal to R$ 300 million

– Large business: ROB greater than R$ 300 million

It is worth mentioning that the cut-off point may be adjusted over time. For more information: bit.ly/3jNRsvl.

[9] It is worth mentioning that BNDES financing in the rest of Brazil is also directed toward the infrastructure sector, which made up 49% of total disbursements between 2009 and 2019. But unlike the standard in the Legal Amazon, the contracts involve the transportation sector, which received 53% of the total funding for the infrastructure sector.

[10] It is important to emphasize that between 2009 and 2019, the holding company Grupo J&F received BNDES disbursements of a total value of R$ 6.9 billion, of which R$ 37.2 million were earmarked for the Legal Amazon. Of this, R$ 33.2 million went to cattle slaughter, in the industrial sector. For more, see bit.ly/3t770Qb.

[11] Since this financing is not automatic, it is possible to obtain project descriptions.

[12] Like BNDES FINEM, BNDES Project Finance is not automatic, so it is possible to obtain project descriptions.

[13] It is important to mention that a single project can fall under two different products. Electricity projects financed by BNDES FINEM might therefore also use resources from BNDES Project Finance, for example.

[14] This program was extended several times and was terminated in 2015.

[15] The market access of a region is the average of the market size of its trading partners weighted by the transportation costs between the region and its trading partners.