Last week, I was in Marrakesh speaking at this year’s UN climate change conference, COP22, where I witnessed an important transition in moving from talk to action. Just a few weeks before the start of COP22, the Paris Agreement officially entered into force – the historic international agreement for action on climate change that emerged from COP21 last year. While COP21 was about promises and commitments, COP22 was about working out the details to put those promises in place.

Under the Paris Agreement, India has pledged that renewable energy will be 40% of the country’s expected electricity generation capacity in 2030, along with a 35% reduction in carbon intensity by 2030 from 2005 levels. In addition, India has also set one of the most ambitious renewable energy targets of all – 175 GW of renewable energy by 2022, including 100 GW of solar power. These important targets are not only good for the climate, but can also help meet the energy demand of India’s rapidly growing economy and population.

However, a lack of sufficient financing for renewable energy in India may present a formidable barrier to achieving these targets. This was a key item of discussion at COP22.

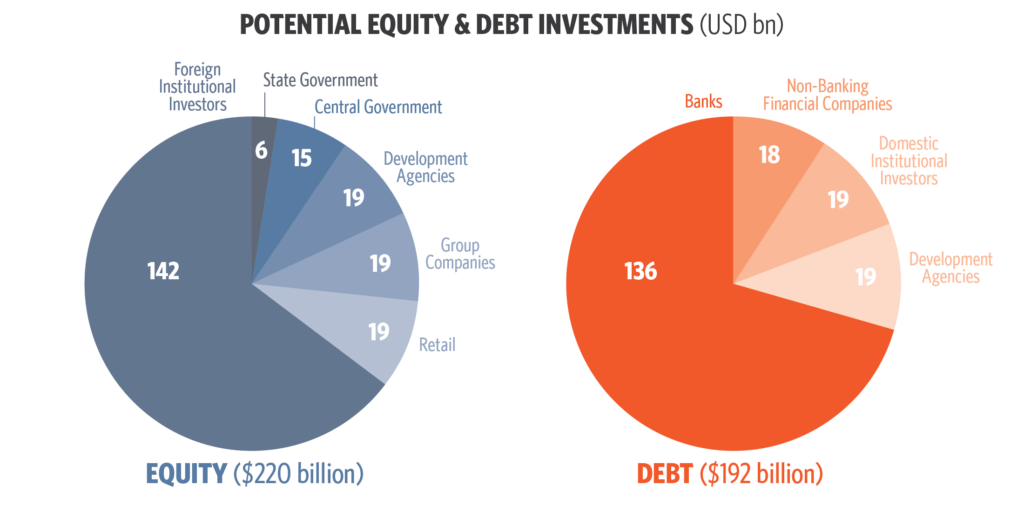

An upcoming report from Climate Policy Initiative shows that in order to meet the target of 175 GW of renewable energy by 2022, the renewable energy sector in India will require $189 billion in additional private investment, a significant amount. The potential amount of investment in the renewable energy sector in India is $411 billion, which is more than double the amount of investment required. However, in a realistic scenario, the amount of investment expected falls short of the amount required by around 30%, for both debt and equity.

In this context, and as India moves to implement its commitments under the Paris Agreement, the work of the India Innovation Lab for Green Finance is increasingly important. The India Lab is a public-private initiative that identifies, develops, and accelerates innovative finance solutions that are not only a better match with the needs of private investors, but that can also effectively leverage public finance to drive more private investment in renewable energy and green growth.

The India Lab has recently opened its call for ideas for the next wave of cutting-edge finance instruments for the 2016-2017 cycle, in the areas of renewable energy, energy efficiency, and public transport. Interested parties can visit www.climatefinanceideas.org. The deadline to submit an idea is December 23rd.

The India Lab is comprised of 29 public and private Lab Members who help develop and support the Lab instruments, including the Indian Ministry of New and Renewable Energy, the Ministry of Finance, the Indian Renewable Energy Development Agency (IREDA), the Asian Development Bank, the World Bank, and the development agencies of the French, UK, and US governments.

In October 2016, the India Lab launched its inaugural three innovative green finance instruments, after a year of stress-testing and development under the 2015-2016 cycle. They will now move forward for piloting in India with the support of the Lab Members. The three instruments include a rooftop solar financing facility, a peer-to-peer lending platform for green investments, and a currency exchange hedging instrument. Together, they could mobilize private investment of more than USD $2 billion to India’s renewable energy targets.

Now that the Paris Agreement has been ratified and the real work begins, the India Innovation Lab for Green Finance can help India transition from talk to action by driving needed private investment to its renewable energy targets. Visit www.climatefinanceideas.org to learn more and submit your innovative green finance idea by December 23rd.

A version of this first appeared in the Huffington Post.