Cities are not receiving the finance they need to adapt to the effects of climate change. Multilateral development banks, by leveraging their balance sheets and technical expertise, can be a cornerstone in attracting the financing needed for cities in low- and middle-income countries to realize their climate action plans.

As we assess the outcomes of the 28th United Nations Climate Change Conference, or COP 28, and ready ourselves to take the necessary further action, the pivotal role of cities in combating the climate crisis has received unprecedented recognition.

In a first-of-its-kind collaboration, the COP 28 presidency, alongside Bloomberg Philanthropies, hosted the first Local Climate Action Summit. This gathering united hundreds of local leaders, spotlighting their indispensable contributions to reducing emissions and managing climate risks, and also saw the initiation of nationwide initiatives to expedite climate action.

Nevertheless, the critical challenge of financing urban climate action remains. Cities consume 78% of global energy use and produce over 60% of total greenhouse gas emissions. Those in low- and middle-income countries face significant climate risks, including extreme weather events. Cities therefore present climate investment opportunities of nearly $30 trillion by 2030. Most importantly, cities are willing to act. Over 13,000 have committed to urban climate investments via the Global Covenant of Mayors.

Despite this potential, there’s a notable climate investment gap, with cities worldwide receiving only 7-8% of that required. Cities face significant hurdles, including poor creditworthiness, fiscal constraints, and institutional capacity gaps, hindering their ability to secure funding and implement sustainable projects.

Multilateral development banks play a crucial role in advancing urban climate finance by leveraging their large balance sheets and technical expertise. Engaging with national governments, MDBs can create investment-friendly environments for city climate projects. Ongoing reform efforts among MDBs present an opportunity for more coordinated action, offering a low-hanging fruit to expedite climate goals effectively.

During COP 28, major MDBs issued a joint statement, committing to improved climate and development integration, emphasizing increased climate finance, outcome measurement enhancement, and strengthened country-level collaboration.

For the second year, the imperative to reform MDBs was included in the final COP text. The call is clear: MDBs must intensify collaboration to create a more substantial impact and continue to expand their climate finance. However, urban needs have been overlooked in MDB reform discussions, as seen in key documents such as the World Bank’s “evolution road map.”

U.S. Treasury Secretary Janet Yellen recognizes the importance of subnational access to development finance, signaling a potential shift in considering urban requirements in ongoing reform dialogues.

However, a key challenge now beckons: How can MDBs translate these insights into tangible strides toward sustainable urban development? A new paper by the Cities Climate Finance Leadership Alliance provides some answers to this.

More finance and reporting needed, particularly for urban adaptation

MDBs are actively addressing urban climate finance challenges, with dedicated practice areas and substantial climate portfolios. Initiatives such as the European Investment Bank and World Bank’s City Gap Fund and the African Development Bank’s Urban and Municipal Development Fund provide technical assistance for project preparation.

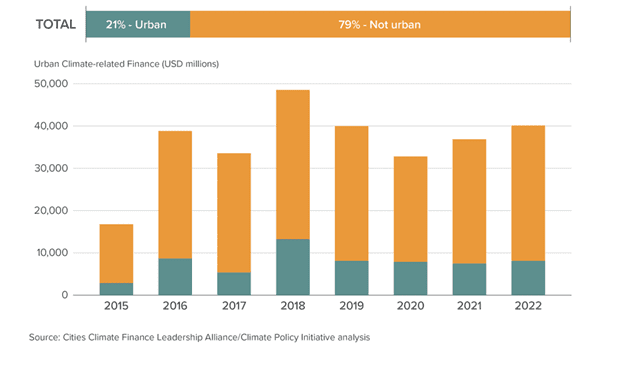

Cities Climate Finance Leadership Alliance research indicates that between 2015 and 2022, 21% of climate-related MDB finance to low- and middle-income countries supported urban projects. Despite increasing urbanization, tracked MDB urban climate-related finance has remained relatively stable.

Urban share of MDB climate-related finance to LMICs, from 2015 to 2022.

As MDBs undergo reshaping, there’s a need to boost urban climate finance, especially for adaptation in high-need regions. Currently, urban mitigation efforts receive more funding than adaptation, with climate-vulnerable regions like sub-Saharan Africa and the Middle East and North Africa receiving the least urban climate-related investment.

Importantly, MDBs should report on the urban share of their climate finance to monitor progress. While some MDBs internally monitor this, inconsistent definitions hinder coordinated and transparent reporting.

“COP 28 isn’t the grand finale for MDB reform — it’s the kickoff for banks to team up with … stakeholders to create a solid plan to increase urban climate investments.”

A change in MDB operating models

City leaders find it challenging to access MDB finance due to the current project-focused approach, with MDBs prioritizing large infrastructure projects.

Smaller city investments often fall below funding thresholds, and sovereign guarantee requirements create difficulties in politically tense situations between national and local governments. Small- to medium-sized cities may struggle to afford MDB financing in hard currencies.

To enhance urban climate finance, MDBs should adopt a more programmatic approach, as demonstrated by the European Bank for Reconstruction and Development’s Green Cities program. This model supports cities with jointly developed climate action plans, promoting coordination and efficiency in addressing diverse urban needs.

While not all MDBs directly finance cities, they can leverage intermediaries such as national development banks and local commercial banks to support municipalities, infrastructure projects, and companies involved in urban climate solutions.

With MDB capacity building, these local institutions can contribute to systemic urban climate transformation at the national level.

Combining strengths to achieve scale

COP 28 isn’t the grand finale for MDB reform — it’s the kickoff for banks to team up with national governments, local leaders, the private sector, and other stakeholders to create a solid plan to increase urban climate investments. MDBs cannot tackle the urban climate challenge alone but can be the driving force along with other actors.

A great starting point for MDBs is to collaborate more closely to leverage each other’s strengths in their overlapping regions and sectors of operation. For example, MDBs could cooperate to develop country sector platforms to scale up more coordinated pipelines of urban climate investment.

As implementation continues at speed after COP 28, urban climate finance should be prioritized as a strategic element of MDB reform. Strengthening the capacity of cities in LMICs to respond to the climate crisis is a necessity for meeting global climate goals, and MDBs can play a key role in stewarding this process.

The good news is that MDBs will not be starting from scratch. While innovative programs and fit-for-purpose financial instruments are needed, much can be achieved by building on existing urban initiatives and leveraging each other’s platforms. The blueprint for change is in place, beckoning MDBs to seize this opportunity in 2024.