Within developing economies, there are significant opportunities to increase investment in clean energy, however, risk remains a key barrier to climate investment. Blended finance is a critical tool to help nations meet their climate commitments, while also addressing the risks and barriers faced by investors when pursuing these opportunities.

In one of CPI’s early publications on risk – the 2013 Risk Gaps series – we highlighted how risk can prevent renewable energy projects from finding financial investors by jeopardizing their potential returns. At the time, investors in both developed and developing countries were demanding coverage for policy risk (such as retroactive changes to feed-in-tariff in Spain), while financing risks in developing markets were being driven by immature financial institutions, and not sufficiently addressed by financial instruments.

Today – five years later – even though clean energy costs have come down significantly, risks and barriers are still preventing investment in developing countries.

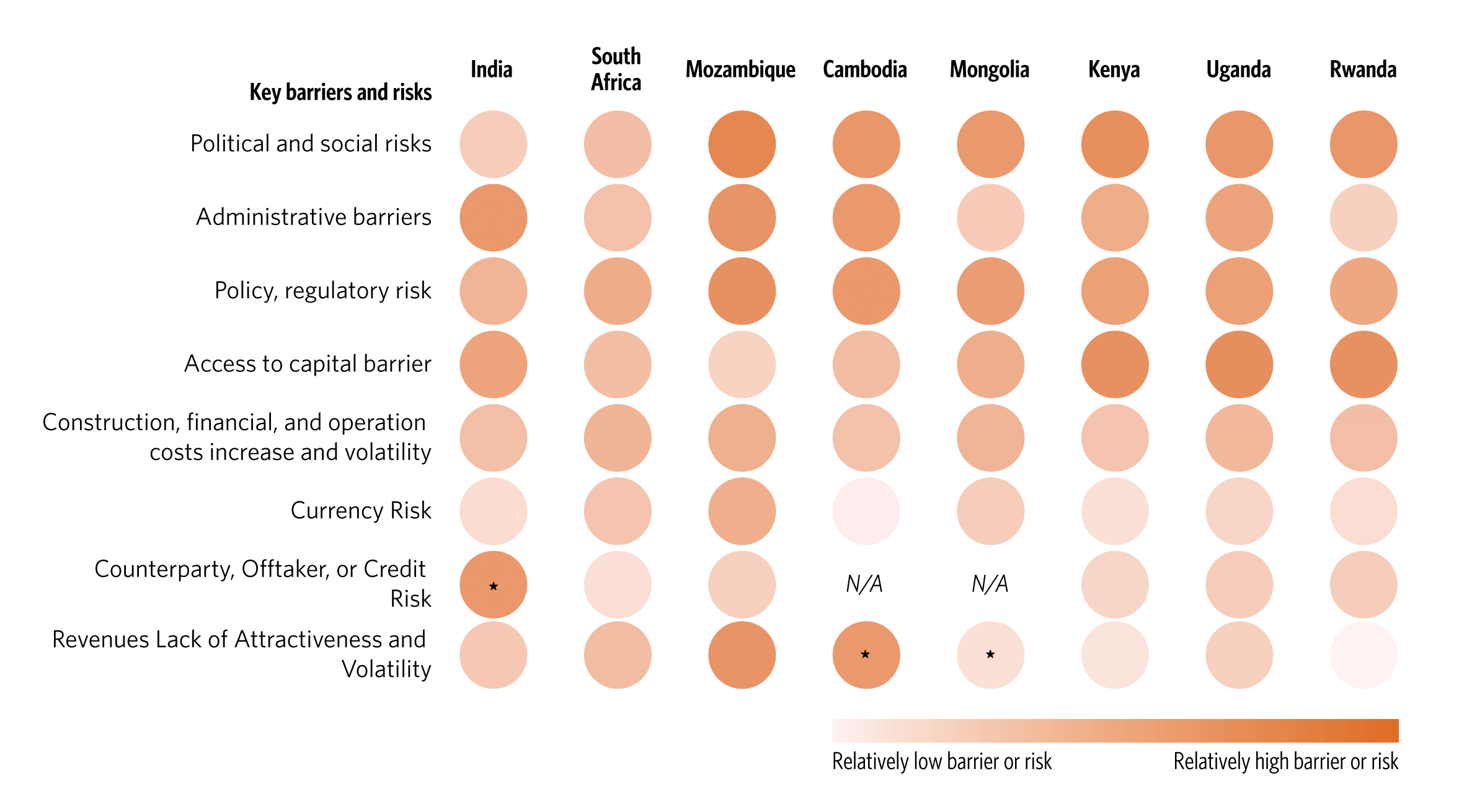

Our recent publication, “Blended Finance in Clean Energy: Experiences and Opportunities” looks at potential markets for high-impact investment opportunities requiring blended finance support – India, South Africa, Mozambique, Cambodia, Mongolia, Uganda, Kenya, and Rwanda – and identifies key barriers to investment using macro-indicators that best define specific risks in the region. Our analysis also evaluates blended finance initiatives in clean energy, diving in-depth into a subset of them, to understand how barriers are currently being addressed and to identity any remaining gaps.

Key barriers and risks in high-impact countries

Note: (*) indicates that in the absence of a quantitative figure to estimate the barrier or risk, the intensity has been qualitatively determined by combining expert judgement with performance of other risks within the same country. N/A indicates data not available

The main takeaway from our research is that, given the steep declines in clean energy costs, the public sector, when implementing blended finance initiatives, needs to shift its focus from covering the “viability gap” between clean energy and competing fossil fuel technologies, to a focus on targeted investment risks and barriers. Our analysis revealed that off-taker risk, currency risk, policy risk, and liquidity and scale risks are still relevant as early stage projects and clean energy companies face barriers in accessing financing. This has important implications for which financial instruments to deploy looking forward – with risk mitigation instruments, such as guarantees, insurance, and local currency hedging and financing, playing a key role.

More specifically, our research found that:

- Only a few initiatives seem to target commercial risks, including currency risk or off-taker risk, in their design. One example from the Lab, TCX’s Long Term FX Risk Management initiative, which offers long-term risk hedging instruments in countries with underdeveloped capital markets, is an exception, having mobilized EUR 100m of investment with a EUR 30m foreign exchange hedging facility. Another example, GEEREF NeXt, the successor fund to GEEREF, aims to mitigate off-taker risk by engaging early with regulatory bodies in target countries.

- Relatively few initiatives have reported a guarantee element in their design. An analysis of multilateral institutions indicated that guarantees represent only approximately 5% of their commitments, yet generate approximately 45% of their private sector mobilization. Furthermore, previous CPI research found that, even among the already low-risk instrument offerings, only 10% of risk instruments focused on climate related projects. Several administrative barriers prevent the wide use of guarantees as an instrument for private capital mobilization. For example, development finance institutions typically record guarantees in the same way they do loans for the purposes of risk capital allocation, thus discouraging the use of guarantees over loans. Furthermore, guarantees are not counted as official development assistance (ODA) by the OECD, and thus, many financial institutions are not incentivized to use them. In fact, several bilateral institutions are obliged, by law, to offer only ODA-eligible financial products, therefore excluding all guarantees.

- Aggregating individual projects and private company investments into liquid assets (e.g., through securitization), is critical to overcome investment hurdles, including liquidity risk, and to access larger pools of capital, but there is little experience to date in emerging markets. However, some initiatives are currently raising financing successfully, including the Solar Energy Investment Trusts, the IFC’s Rooftop Solar Financing Facility in India, and the Green Receivables Fund in Brazil. For non-project-based financing, supporting energy generation companies, including distributed generation start-ups (via early stage blended risk finance) as well as established utilities (via risk mitigation instruments) to access capital markets financing will also help mainstream clean energy finance.

- There are large gaps in accessing early stage risk financing for project preparation, distributed generation companies, and new technologies.This is particularly true for project preparation during the early stages of mid-to-large scale projects (e.g., over 10 MW). While some grant initiatives, notably the Africa Clean Energy Facility (ACEF) and U.S.- India Clean Energy Finance (USICEF), have focused on addressing gaps at this stage, a financially sustainable solution has not yet been established. However, several initiatives, including Climate Investor One’s Development Fund and a newly endorsed Lab instrument, the Renewable Energy Scale-Up Facility, seek to re-coup some costs by using innovative mechanisms. For technologies involving high upfront commitment combined with significant resource risk, a program developed by IDB combines public loans that are convertible to grants, with private insurance, both aimed at targeting resource risk during the exploration/ drilling phase. New renewable energy technologies, such as energy storage, also face a scarcity of early stage risk finance, including in developed markets. As such, a blended finance initiative in the U.S., the PRIME Coalition, works to deploy philanthropic capital in early stage clean energy technology companies to catalyze private investment, but large gaps remain. Finally, distributed generation also faces scarcity of investment at the earliest stages— including equity and debt—particularly in countries with under-developed financial sectors. ACEF sought to address this barrier as well through grants, while, in India, a group of philanthropies is working to build the India Catalytic Solar Finance Facility, which will use catalytic capital to help non-bank financial companies establish new business lines by co-investing in small and medium sized enterprises that are seeking to scale their clean energy businesses or deploy distributed solar generations.

Many innovators are already building the next generation of blended finance initiatives, increasingly focusing on risk mitigation. CPI’s Climate Finance team remains committed to supporting investors as they improve their understanding of climate risks, and seize the opportunities presented by countries’ transitions to low-carbon and climate-resilient economies.