Countries that continuously improve the integrity of their carbon transactions will boost confidence and expand market opportunities with a wide array of actors. Indonesia can be one of these countries.

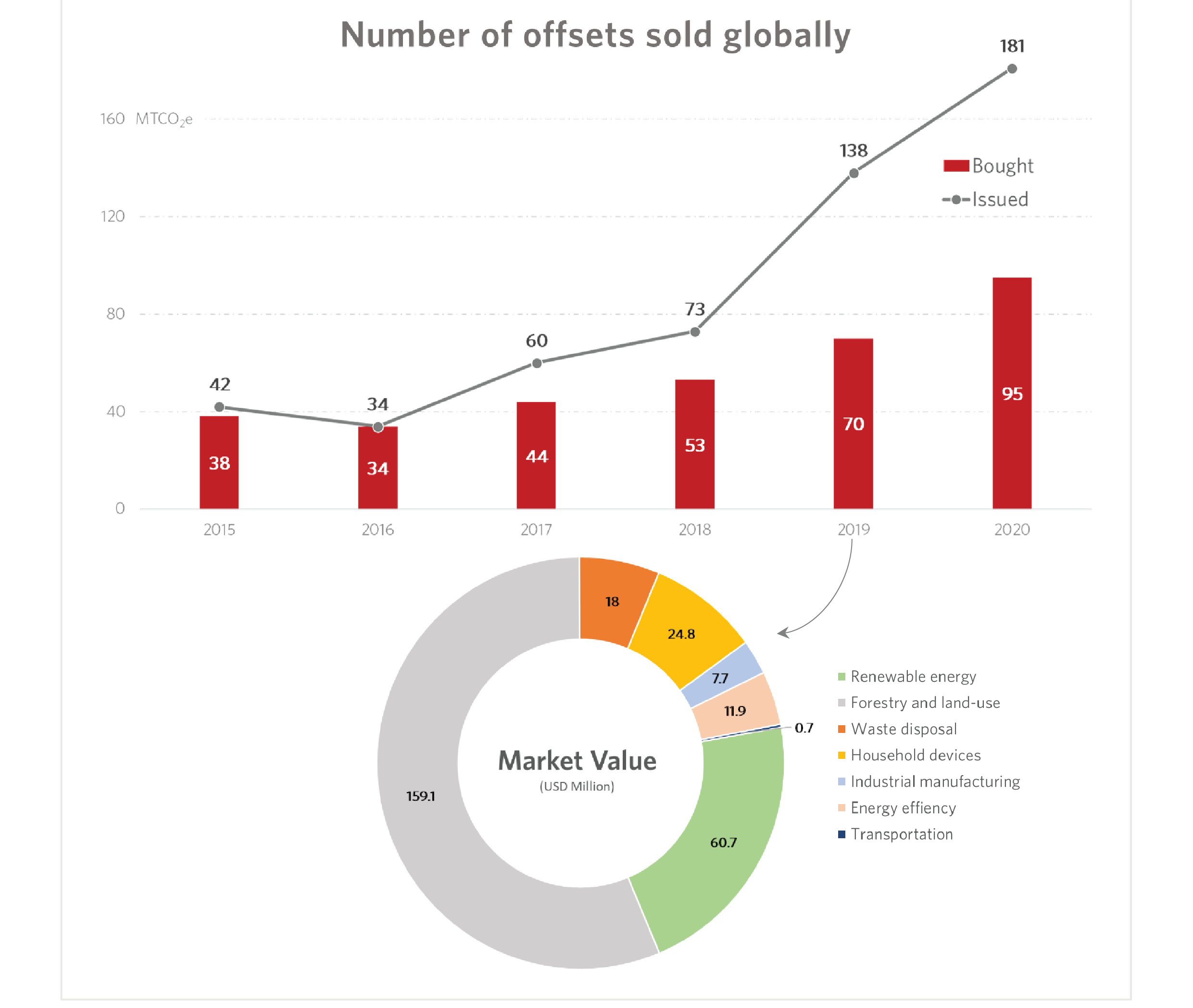

The market size for voluntary carbon offset has been experiencing a sharp growth over the past five years, with the highest valuation currently going to carbon credits produced from the forestry and land-use sector. Responding to this growing market appetite, countries with large tropical forests such as Brazil, the Democratic Republic of Congo (DRC) and Indonesia seemingly stand to gain.

These rainforest-rich countries have responded differently towards voluntary carbon markets. Brazil seems largely indifferent to participating in the REDD+ carbon credit boom, while the DRC is actively advocating for a fair price of forest carbon of $100 per metric ton, about 20 times higher than the current average of $4-6. Meanwhile, Indonesia’s response is rather ambiguous.

Indonesia has listed carbon pricing as one of the key climate finance instruments on its climate policy directions, recognizing the potential value of voluntary carbon markets. It is currently drafting an all-encompassing carbon credit presidential regulation and carbon tax law. However, the country also simultaneously canceled self-declared forest carbon projects to prioritize its nationally determined contributions (NDCs) without any clear and timely guidance for private carbon project developers, adding further uncertainties for carbon credit transactions.

With these mixed signals coming from Indonesia and carbon market regulation subject to many disputes, we wanted to propose how tropical forest-rich countries such as Indonesia can respond positively to the upsurge of voluntary carbon markets.

The voluntary carbon market dilemma

Building a supportive regulatory environment for a carbon market requires a lot of work. For a credit-producing country to benefit from the voluntary carbon market, it must have the needed human and institutional capacities to build integrity across its entire forest carbon value chain.

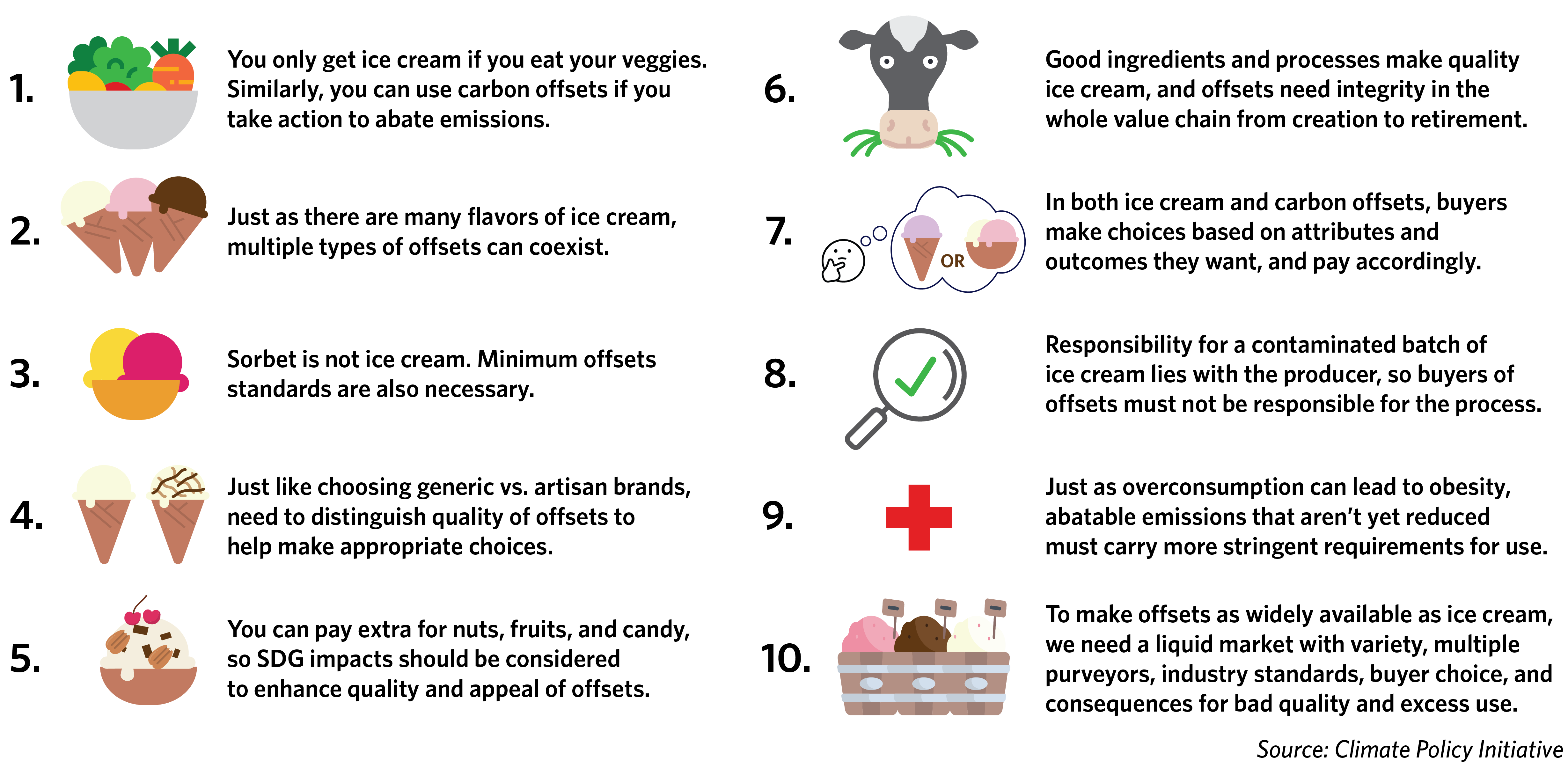

To put it simply, an attractive carbon market should behave like an ice cream shop and policymakers need to ensure that the right conditions for such a market is created. Remember, you only get ice cream if you eat your veggies! Similarly, you can use carbon offsets if you take action to abate emissions.

Creating such an ecosystem might be challenging for countries like Indonesia, which appears to be facing a regulatory dilemma: should it de-prioritize carbon offset projects to ensure emission reductions that achieve its NDC goals first, or should it prioritize revenue streams from carbon credit sales, which risks diverting resources towards pursuing emission reductions? In other words, should Indonesia be “pro-market, pro-revenue” or “pro-NDC, pro-control”?

This debate might be the reason why Indonesia’s stance towards voluntary carbon markets seems ambiguous. No doubt, such mixed signals are bad for the market. Singapore recognized this and responded by eyeing to become the region’s carbon market hub, snatching the first-mover opportunity from credit-producing countries such as Indonesia to respond to the growing market appetite.

An alternative perspective to the carbon market dilemma is this: instead of focusing on NDC achievement versus offset market revenue, focus on increasing the confidence of investors – who are increasingly willing to invest in high-quality carbon reductions from Indonesia, whether they claim ownership of credits or not. This will signal to the market that Indonesia is a quality destination for climate-focused investments, resulting in a wider, growing appetite to invest in Indonesia’s climate goals in general. By showing that the country is “good for business” for the voluntary carbon market, it can generate a wider trust from Indonesia’s existing partners on climate finance, such as from multilateral and bilateral sources, to invest even more for Indonesia’s NDC achievements.

Ensuring market integrity

So, back to the main question: what should Indonesia do? The short answer is, rather than mimicking Brazil or DRC, it should respond to the trending market by providing ease and ensuring market integrity. There are few key steps to do so.

First, since Indonesia needs financial assistance to finance forest conservation, potential revenues from carbon credit sales should be seen as a promising alternative finance source, instead of inherent competition with NDC goals. While continuously improving its Forest Reference Emission Level (FREL) allocation system for jurisdictional and standalone offset projects and ensuring high-quality forest conservation, Indonesia should also focus on increasing transparency, reducing market barriers; simplifying the permit process, or providing incentives such as tax breaks, or licensing fee discounts for new investments that will generate quality forest carbon credits.

Second, Indonesia should be able to self-diagnose its carbon market’s major pain points. Several common barriers to carbon market integrity are regulatory uncertainty, long lag times between initial investment and eventual sales of credits, scarce financing, inadequate risk management and limited data availability. To do this, Indonesia can leverage its existing national registry system. But the registry still requires significant improvement in the way it takes stock of the non-government projects. They should be able to account carbon projects verified by international standards – in a simple, timely and transparent manner.

Third, Indonesia should focus on improving the integrity of its carbon market. Formalizing the shared principles of carbon credit qualities is a key step, particularly on REDD+ credits where integrity problems can occur at the time of credit creation resulting in distrust over the quality of the emission reduction claims. Aligning Indonesia’s supply-side principles with the ongoing international initiatives is a possible way. In parallel, the country should provide clear policy directions and ensure the engagement of all key stakeholders to ensure credible process and fair distribution of benefits.

While there is no cookie-cutter approach to building a thriving, high-quality pipeline of carbon market offsets that protect a country’s natural resources while generating revenue to address other sustainable development goals, it should be no surprise that integrity, among all things, is the critical ingredient to all the type of solutions.