With each passing year, extreme weather events and chronic climate-related changes occur more frequently and intensify globally. These changes put enormous pressure on communities worldwide to invest in adapting to climate change. Since 2012, Climate Policy Initiative (CPI) has sought to comprehensively track domestic and international investment in activities that address and respond to climate change through the Global Landscape of Climate Finance (the Landscape). High quality adaptation finance tracking can identify gaps and barriers in financing adaptation and resilience solutions globally, drive leaders and stakeholders to invest in or otherwise support increased finance flows, hold public and private actors accountable, and support government agencies in developing policy guidance.

Despite the critical importance of adaptation finance tracking, significant data and reporting challenges limit our ability to capture the full picture of global adaptation finance flows in the Landscape. Adaptation investment is difficult to track due to a variety of challenges, including the context dependency of adaptation projects, uncertain causality associated with potential adaptation investments, a lack of impact metrics, and confidentiality and reporting requirements.

From an international policy perspective, the need for tracking adaptation finance flows originates from a commitment made by developed countries in 2009 to jointly mobilize USD 100 billion per year in climate finance by 2020 for action in developing countries (UNFCCC, 2009). To support this aim to jointly mobilize climate finance in the hundreds of millions, CPI submitted research, A Snapshot of Global Adaptation Investment and Tracking Methods, to the Global Commission on Adaptation to inform its September 2019 flagship report: Adapt Now: A Global Call for Leadership on Resilience. The submitted research contains a new level of detail on adaptation finance tracked in the Landscape, including breakdowns of adaptation flows by sector and type of finance, a mapping of flows by region in key sectors, and country-level case studies to assess how vulnerability correlates with adaptation finance flows.

Though this paper assesses flows to adaptation finance in 2015 and 2016, the most recent version of the Landscape finds that adaptation flows in 2017 and 2018 remained level at 5% as a percentage of total climate finance flows. A key throughline of the 2015-2018 adaptation finance analysis is that the overall share of finance flowing toward adaptation and resilience continues to fall far short of international needs and targets as specified in the Paris Agreement.

The Commission, in tandem with the release of the Adapt Now report, recently launched a “year of action” to accelerate action on climate adaptation. The year of action involves eight action tracks, including most notably in connection with this paper, the Finance and Investment action track. This action track aims to increase climate risk visibility and actionability, increase public and private adaptation investment, and promote system-level change in financial systems. One of the core initiatives of the Finance and Investment action track is the Coalition for Climate-Resilient Investment, a private sector-led initiative aiming to develop a unified approach to assess and price climate risk in order to shift how infrastructure investment decisions are made.

Through this paper, we hope to inform ongoing efforts to increase adaptation finance flows and improve metrics of progress to achieve improved adaptive outcomes. This year we are planning to build upon the analysis done in the background paper through new upcoming analysis on resilience finance in cities. This focus will inform a 2020 State of Cities Climate Finance report CPI is developing as Secretariat of the Cities Climate Finance Leadership Alliance.

Key findings from this work include:

Commercial debt was the core mechanism employed to finance adaptation in 2015 and 2016, though the finance type most commonly employed varied by sector. In 2015 and 2016, project-level market rate debt was the main mechanism employed to finance adaptation activities, for an average of USD 11 billion per year. Grants and low-cost project debt comprised USD 5 billion each, while equity finance represented only a negligible amount of total flows. The type of instrument deployed varied significantly between sectors; the water and wastewater management sector received predominantly project level market rate debt in 2015-16, while the agriculture, forestry, land use, and natural resource management sector received predominantly low-cost project debt and grants.

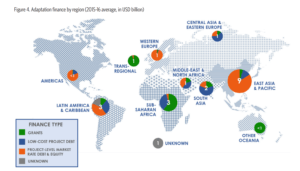

The largest portion of adaptation finance in 2015 and 2016 tracked in the Landscape flowed to the East Asia and Pacific region (USD 9 billion annually). Sub-Saharan Africa and Latin America and the Caribbean followed with USD 3 billion annually in adaptation finance over the same period. Most of the finance tracked flowed to non-OECD countries, likely reflecting both the identification of significant need in those countries as well as the state of data on adaptation finance, which is largely available from international and domestic development finance institutions.

The most common sectors to which finance flows differs between regions, but is largely in alignment with the most vulnerable sector in each region. In Latin America and the Caribbean, investment in disaster risk management aligns with increased tropical storms, hurricanes, and flooding, including at least USD 90 million in damages associated with Hurricane Maria in 2017. In Sub-Saharan Africa, the plurality of finance flowing to agriculture and land use projects aligns with vulnerabilities identified in ND-GAIN, where seven of the top 10 most food vulnerable countries (as measured by projected change of cereal yields, food import dependency, agriculture capacity, among other criteria), are in Sub-Saharan Africa.

In Pakistan, Zambia, and Niger, each country received adaptation finance flows in broad alignment with its most vulnerable sector, but the total annual tracked adaptation finance flowing is insufficient to meet the stated need in each countries’ Nationally Determined Contribution. A detailed understanding of sectoral vulnerabilities and needs can inform on the ground decisions regarding adaptation finance and more work is needed on this front to assess country-level adaptation finance need and to pair evaluations of country or downscaled climate vulnerability with adaptation finance flows.

Ideally, financial flows to adaptation would align with impact metrics, but there are no universally accepted impact metrics. Impact metrics are crucial for a full accounting of adaptation finance because the incremental cost of adaptation is not reflective of the benefit of that investment. For example, a USD 50 million drought-resilient wastewater investment could have vastly different resilience implications in a drought-vulnerable location than in a region with sufficient projected rainfall. Because impact metrics are not yet established for the global tracking of adaptation, the USD 22 billion annual average in 2015-16 towards adaptation that CPI tracked does not capture the resilience value.

For more information, please visit the Global Commission on Adaptation.