The productivity and income levels of many of the world’s 450 million smallholder farmers could be improved with better access to finance, modern technologies, and improved farming practices. Smallholder finance is growing in scale, but a USD 150 billion financing gap remains (Dalberg 2016). At the same time, both smallholders and lenders with smallholder lending portfolios, which currently account for about USD 50 billion globally, are highly vulnerable to climate change impacts.

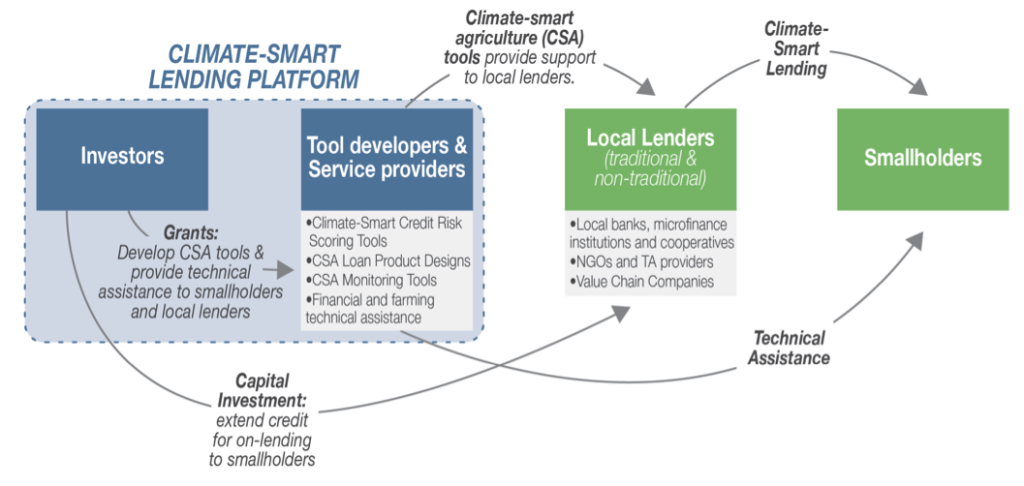

The Climate-Smart Lending Platform will bring together the tools, actors, and finance necessary to reduce climate risk in lending portfolios and scale up climate-smart lending to smallholders globally.

The Climate-smart Lending Platform would help lenders incorporate climate risk in their loan portfolios while incentivizing the adoption of climate-smart farming methods by smallholders. The long-term goal of the Platform is to mainstream Climate-smart Agriculture (CSA) metrics into the credit scoring systems of financial institutions without concessional backing in order to improve agricultural lending portfolio resilience to climate change, and to create strong incentives for farmers to adopt CSA practices and harnessing private finance to do so. This market has a USD 200 billion potential.

Illustrative modelling suggests that farmers who adopt CSA practices could achieve two to four times higher profits under adverse weather conditions, on average, compared to less resilient farmers. Adoption of CSA practices by farmers can also considerably reduce credit providers’ climate-related default exposure due to increased farmer incomes and reduced losses in the event of unexpected climate events.

The Platform could help farmers achieve two to four times higher profits and reduce their exposure to losses due to climate impacts, as well as reduce credit provider’s climate-related default risk.

The Platform will be rolled out in several phases. In Phase 1 (2017-2021), a series of projects will be developed in collaboration with different types of financial institutions and implementing partners in three different geographies and crop contexts (nine projects in total). These projects will produce valuable results to prove the climate-smart lending case. Under each project, grants and concessional loans will be raised, according to local needs, to fund the development of bespoke climate-smart loan products and monitoring tools that would feed in to credit risk scoring tools. Many of the projects will be developed in collaboration with pre-existing lending, climate, and agriculture programs and funds, making use of existing implementing structures to get off the ground. In the second and third phases, which include commercialization and mainstreaming, no concessional financing is envisaged but some first loss guarantee backing for commercial finance providers is included in the proposed financing structure for Phase 2.

The Platform itself will have a relatively small amount of grant funding to facilitate coordination and cooperation across projects, to reduce costs and enhance the effectiveness of individual projects and to help build a strong project pipeline. As such it will help to establish project partnerships and raise funding for new CSA projects. It will also help to share best practices and lessons across projects, acting as a repository of expert knowledge, approaches, loan products, and tools related to CSA lending, supporting investors, local lenders and implementing partners.

The Sophia Foundation (Project Sophia), which has helped to incubate the platform’s proponent F3 Life, will make an initial commitment of an equity investment. FONERWA, the national Rwandan climate fund, has also announced its intention to support a project in Rwanda with IUCN’s support. Support has also come from the Netherlands Foreign Trade and Development Cooperation.

The Climate-Smart Lending Platform has support from the Netherlands, Project Sophia and FONERWA for initial development, and is looking to launch project sites.

DESIGN

The tools and approaches promoted and supported by the Platform include:

- Climate-smart credit products and process designs. The Platform would work with traditional and non-traditional lenders to develop climate-smart loan products for fixed assets, working capital, and social needs of aggregated groups of smallholders (cooperatives and farmer producer groups). Loan terms and conditions would be set to incentivize farmers’ uptake of climate-smart agricultural and land-management practices, and may include preferential loan terms for women.

- A climate-smart credit-scoring tool. While lending and technical assistance are the foundation of the Platform, its key value-add is the development of climate-smart credit risk scoring tools which enable lenders to make more informed decisions on their lending portfolio to reduce default and climate risk. This should help incentivize lenders to increase their lending portfolios to smallholder farmers. Climate-smart credit scoring combines detailed cash flow estimates with climate risk assessments and farm data to more comprehensively calculate the credit worthiness of individual farmers and their portfolios in the context of climate change risk.

- A CSA compliance monitoring tool, using mobile technology, to monitor adoption of climate-smart farming in compliance with loan agreement requirements, which informs the credit-scoring tool.