When asked about last month’s Paris Agreement earlier this week at Davos, UNFCCC executive secretary Christiana Figueres remarked, “The signal is very clear. The signal is toward long-term transformation that is urgent…it is a transformation to decarbonizing the global economy.”

Many of this year’s World Economic Forum (WEF) attendees have already recognized that signal, and after Paris, more have become aware of the opportunities this transformation can bring. Costs of electricity for most renewables — including wind and solar — are now becoming comparable to those of fossil fuels, decreasing drastically over the past five years while costs for coal and natural gas have increased. And now that the Investment Tax Credit (ITC) and Production Tax Credit (PTC) have been extended, the US renewables industry finally has the policy stability it needs to securely finance a pipeline of projects without the risk of the tax benefits going away at the end of the year.

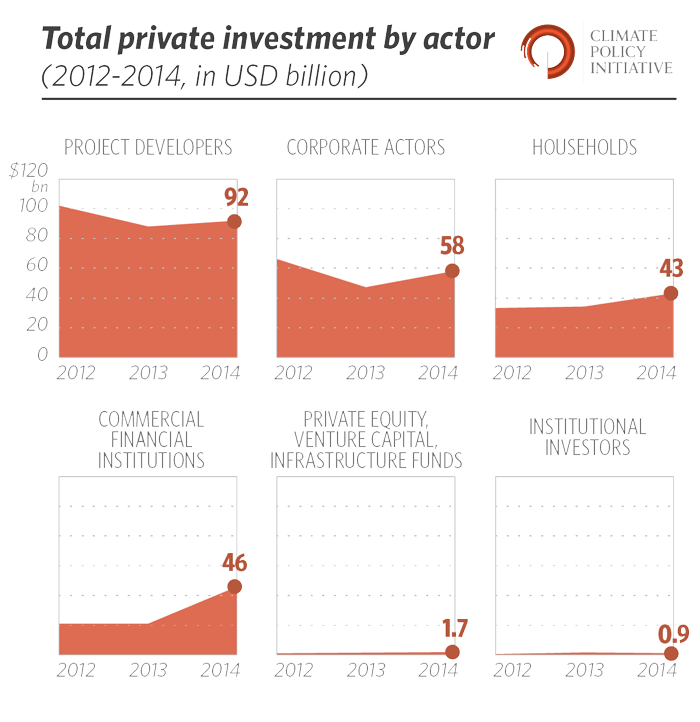

These factors and others have spurred private investors into pouring $243 billion in renewable energy in 2014, up 26 percent from the previous year. As climate exposure begins to pose serious fiduciary and business risks for investors, more and more financial leaders — including Blackrock, Citi, and Bank of America — are recognizing the risks and opportunities surrounding our current energy production and adjusting their portfolios accordingly. Tools, investment vehicles, and other products exist in the market to help businesses realize such exposure and make the necessary decisions to capture them.

Breakdown of total private investment by actor, 2012-2014 in USD billion However, more can and needs to be done to effectively transition to a low-carbon economy. One area of opportunity is in unlocking additional international, cross-border finance. The majority of climate investment (74%) originates and is spent in the same place, illustrating limited cross-border investments. Domestic policy frameworks in many countries, as well as innovative financial interventions can help business scale up overseas investments, and help emerging markets embark on a path of sustainable growth. The Paris Agreement demonstrated the recognition by the global community that action on climate change and economic growth can occur simultaneously, and the business leaders at the WEF this week are instrumental to keeping this momentum. Only by working in tandem can we realize a rapid transformation to a low-carbon economy, and it is evident from Davos that many are already on board.