Methodology

Based on the taxonomies and other initiatives for classifying land use activities according to sustainability criteria, the aim of this section is to carry out a case study for aligning financial flows with the analyzed initiatives. The idea is to test what happens when applying different classifications to real data on financing for the agriculture sector, in order to understand the sensitivity of using one framework over another. To do this, a specific set of these initiatives is applied to rural credit, the main agriculture policy in Brazil.

The rural credit instrument finances rural producers (individuals or companies) and their cooperatives, under the conditions established annually in the BCB’s MCR. All credit operations are registered in the BCB’s SICOR. This makes it possible to access information on the value of credit operations contracted with financial institutions. The study uses SICOR as a reference for the period from July 2015 to June 2023, in order to capture information for the 2015/16 to 2022/23 agricultural years, considering that rural credit policy is defined for each agricultural year.[1]

This paper develops a methodology to quantify and compare the amount of rural credit that has sustainability components for agriculture and land use, according to different classifications. For this analysis, only taxonomies and other initiatives with specific criteria applicable to rural credit in Brazil were considered:

- BCB Public Consultation no. 82/2021 – sustainability criteria applicable when granting rural credit (BCB 2021a)

- Criteria for crop of the Climate Bonds Taxonomy, based on the CBI-MAPA study, considering only 100% aligned practices (CBI 2022)

- SPAS of the Brazilian Agicultural Plan (MAPA 2022)

- FEBRABAN Green Taxonomy – federal financing lines and programs for sustainable crop (FEBRABAN 2021)

- SPSABC – ABC+ Plan Technologies (MAPA 2023d)

Table 10 presents a detailed list of the criteria used to define which rural credit lines are considered to be aligned with sustainable objectives, according to the definition of each of the five initiatives analyzed. The criteria are divided into the following SICOR fields: Program/Subprogram, Product, Type of Irrigation, Type of Cultivation, Modality, Purpose, Type of Crop, Type of Integration/Consortium, and Variety. The application of each list of criteria in SICOR generates credit amounts in line with the sustainability objectives declared by each initiative in the 2015/2016 to 2022/2023 historical series. These amounts were adjusted by the Extended National Consumer Price Index (Índice Nacional de Preços ao Consumidor Amplo – IPCA), with July 2023 as the reference.

Results

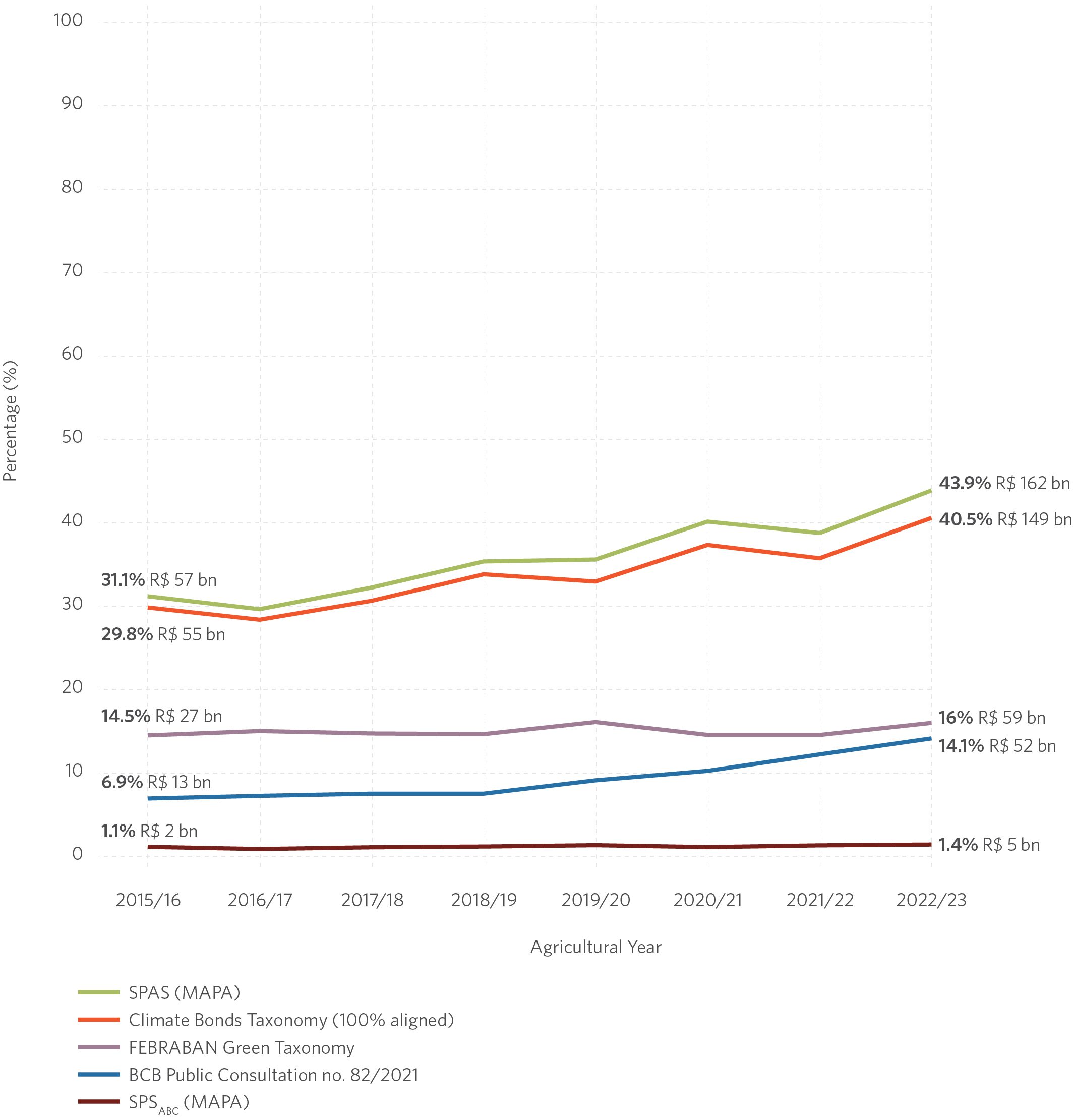

The volume of rural credit in Brazil channeled to sustainable activities depends on the definition of sustainability used and the criteria adopted to classify such activities. Figure 2 shows how much credit released in each agricultural year could be classified as sustainable, according to each of the initiatives listed above. It can be seen that there is a wide variation between each initiative. Based on the most recent agricultural year analyzed (2022/23), the values vary from 1% (considering only the subprograms explicitly associated with the SPSABC) to 44% (considering MAPA’s SPAS).

Figure 2. Proportion of the Amount of Rural Credit Released in Line with Different Definitions of Sustainability in Relation to the Total Amount of Rural Credit Released by Agricultural Year, 2015/16 to 2022/23

Note: Absolute values are in R$ billion at July 2023 prices. With regard to the criteria of the BCB Public Consultation no. 82/2021, the increase observed in the series from 2019/2020 onwards is mainly due to credit operations that started reporting “No-till Farming” in the “Type of Crop” field and “Minimum Cultivation” in the “Type of Cultivation” field in SICOR.

Source: CPI/PUC-Rio with data from BCB (2021a); MAPA (2022); FEBRABAN (2021); CBI (2022) and MAPA (2023d) and data from SICOR/BCB, 2024

Another important fact observed in the graph is the increase in the proportion of operations in activities considered sustainable in the period, according to at least three of the mapped initiatives: MAPA’s SPAS, activities 100% aligned with the Climate Bonds Taxonomy and the BCB Public Consultation no. 82/2021 criteria. This increase has been particularly significant since 2019/20, a period in which there has been a major expansion of rural credit policy in Brazil. Total financing went from R$173.19 billion in the 2018/19 agricultural year to R$ 358.67 billion in the 2022/23 agricultural year. This means an increase of 64% in real terms (discounting inflation for the period). The amounts aligned with MAPA’s SPAS, the Climate Bonds Taxonomy and the BCB Public Consultation no. 82/2021 saw real increases of 103%, 96% and 209% respectively in the period. In other words, they increased more than proportionally in relation to total credit granted.

In the case of the SPAS classification (MAPA 2022), the increase observed in the period is due to contracts classified as sustainable based on products with an affinity to one of the ABC+ Plan’s subprograms. In particular, there was a significant increase in soybean costing contracts in the period. As the SPAS methodology adopts a fixed parameter to consider the percentage of soybean operations associated with no-till farming, the increase in soybean contracts in the period considerably increased the percentage of credit aligned with this definition of sustainability. There was also considerable growth in products such as corn and wheat, as well as equipment and implements such as harvesters, starters, tractors and practices such as intensive soil correction. The CBI’s classification follows criteria very close to those of the SPAS, which explains the similar behavior.[2]

In the case of the BCB’s criteria, the increase observed in the series from 2019/20 onwards is essentially due to the fact that a significant and growing portion of credit operations began to report “No-till Farming” in the “Type of Crop” field in SICOR, in addition to a smaller volume of operations that began to report “Minimum Cultivation” in the “Type of Cultivation” field.

In summary, the exercise shows how the criteria defined by different initiatives can generate very different results, reflecting more or less conservative ways of understanding which financing can be considered sustainable. The most conservative exercise, which only considers programs and subprograms explicitly related to the transition to the use of ABC+ practices, leaves out all the costing contracts that may be adopting such practices, without necessarily having a linked investment contract. On the other hand, the more flexible SPAS exercise makes some strong assumptions about what can be considered sustainable, as is the case with products such as soybeans.

The case of no-till farming exemplifies the need for a careful definition of what will be considered sustainable, or whether this classification will take into account the different stages of implementation, according to the capacity to reduce or remove carbon emissions. Although no-till farming has recognized benefits for the climate issue, the SPD considered by the ABC+ Plan brings together various techniques that need to be implemented simultaneously.

In addition, it is necessary to evaluate possible negative externalities generated by this form of soybean planting on other environmental issues (not necessarily climate), such as the use of glyphosate and possible negative impacts on water quality (Dias, Rocha and Soares 2023). This could violate the DNSH principle mentioned in the Brazilian Sustainable Taxonomy Action Plan.

Table 10. Criteria Used by each Initiative to Align Rural Credit with Sustainability

Source: CPI/PUC-Rio with data from BCB (2021a); MAPA (2022); FEBRABAN (2021); CBI (2022), and MAPA (2023d), 2024

[1] SICOR has contained information since 2013, but the subprogram field wasn’t filled in completely until the 2015/16 harvest. For this reason, the first two agricultural years were not included in the study.

[2] If operations that are 100% aligned with CBI’s taxonomy and operations that are partially aligned are taken into consideration, the figure is very close to that of the SPAS. There remains a small difference explained by two subprograms of the ABC+ Program considered by the SPAS, but not considered by CBI, namely financing with resources from the constitutional funds and financing with resources from rural savings.