This document addresses the effective uses of public financial interventions for low carbon projects. It provides an overview of Climate Policy Initiative’s (CPI’s) approach to determining the most efficient ways in which green banking and other public financial interventions could support the transition to a low-carbon economy. To illustrate, it includes some findings from an application of this approach to the large-scale renewable energy sector in California. These findings are also provided in more detail in our July 2014 report, “Getting the most from your green: A case study for using public money effectively for large-scale renewable energy in California.”

The transition to a low-carbon economy requires substantial up-front capital investment. As a result, the cost of financing this investment plays a significant role in determining the transition’s cost to society. Public funds are increasingly becoming available that could be used to address these costs or other barriers. Institutions dedicated to using public resources to leverage private capital in service of low-carbon objectives have been set up in several states. Connecticut, New York, and Hawaii have all created such institutions, commonly referred to as “green banks”. Due to the current level of interest in these institutions and the mechanisms they may employ, the time is right for rigorous analysis of how these funds can be most cost-effectively and efficiently deployed to accelerate the decarbonization of the economy.

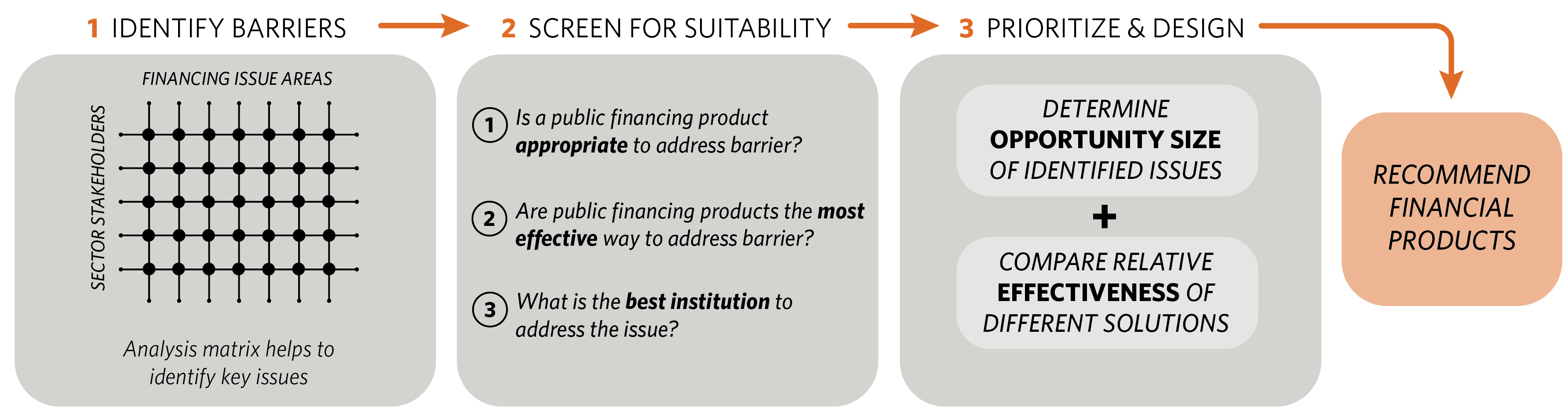

As illustrated by Figure 1, we provide a framework for critically assessing how and when public financial interventions could effectively address these barriers to a low-carbon economy – as well as when such instruments would be less effective than another approach, and when a dedicated implementing institution such as a green bank would be desirable. Our framework addresses three main questions:

- Should public financing and risk-bearing mechanisms be used to address identified financing issues?

- What type of financing or risk-bearing mechanism, if any, would be the best solution for each issue?

- Is a green bank the appropriate institution to implement the identified mechanisms?

This brief focuses on locating the most effective financial mechanisms that a public financing institution could employ. There are many other challenges involved in implementing public financial mechanisms for low-carbon projects. For example, legislation, staffing, and negotiation with existing institutions may be required. Such functions are outside the scope of this document.

This brief follows the sequence laid out in Figure 1. We begin, in section 2, by identifying significant financial barriers to a low-carbon economy. In section 3, we then assess the suitability of public financing interventions to address these barriers and consider whether a green bank or other public financial institution is the most sensible institution to intervene. Finally, we identify the most effective form of policy intervention as outlined in section 4. Appendix 1 provides more detail on the matrix that forms the basis of section 2.

Figure 1: CPI’s analysis framework for evaluating green banking and other financial interventions for low-carbon projects