Agricultural risk management instruments accounted for US$ 1.0 billion/year in climate finance between 2015 and 2020. These instruments constitute Brazil’s primary climate adaptation mechanism, as they increase the resilience of agricultural activities and reduce vulnerability to climate events that cause production losses, such as excessive rains and droughts.[1]

Agricultural risk management, like rural credit, is encouraged by public policies. Currently, the main Brazilian programs in this area are the PSR, the Agricultural Activity Guarantee Program (Programa de Garantia da Atividade Agropecuária – PROAGRO), the Garantia-Safra, and the Minimum Price Guarantee Policy (Política de Garantia de Preços Mínimos – PGPM).[2] These programs operate differently from one another and envisage distinct objectives and target audiences.

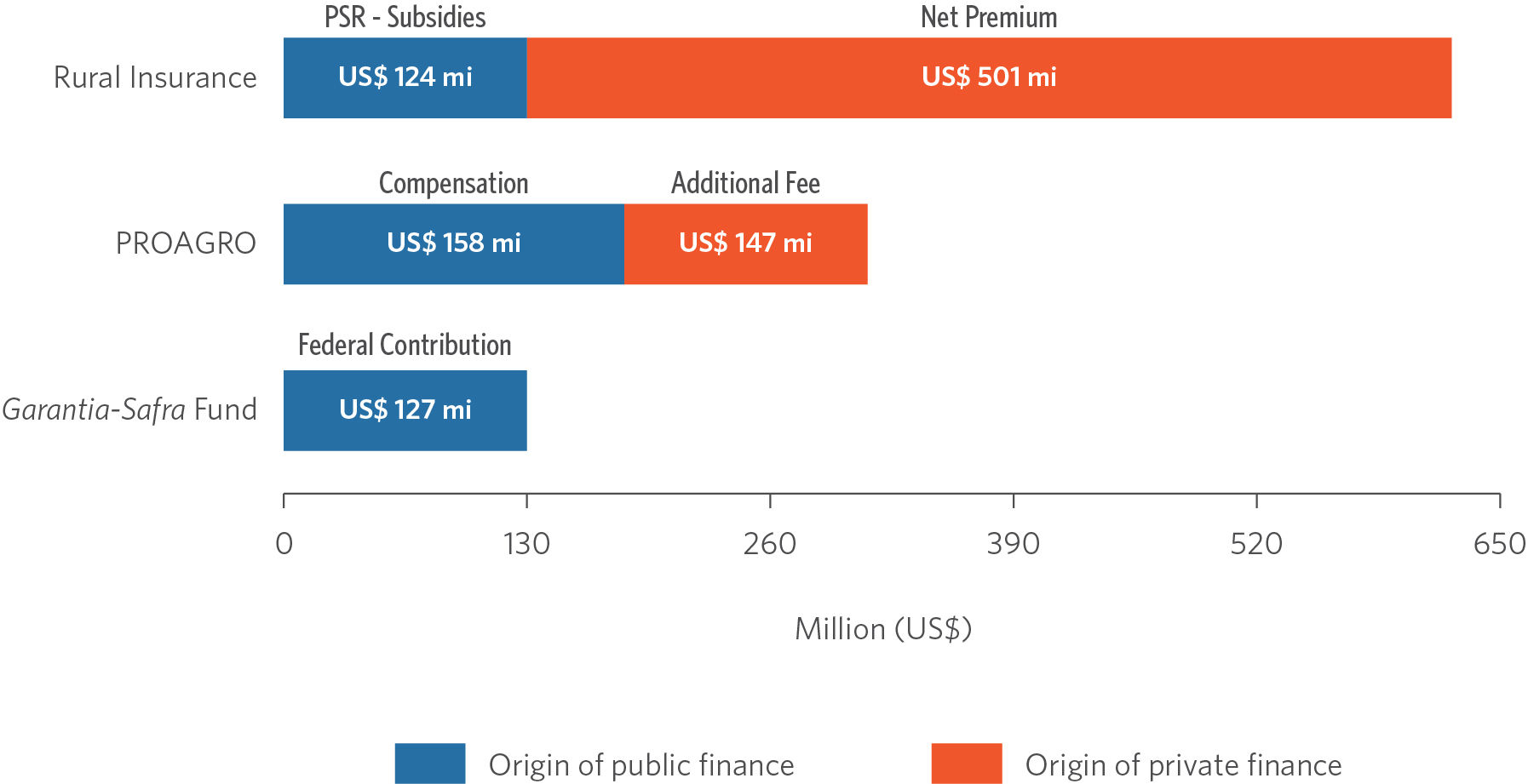

The share of public and private finance sources in risk management instruments considers finance from the different stakeholders in the aforementioned policies. The premium paid by producers for hiring an agricultural risk management instrument is considered a private financial resource. Therefore, private climate finance included both the premium paid by producers for contracting rural insurance (US$ 500 million/year) and the amount for joining PROAGRO (US$ 146 million/year).[3] Thus, approximately US$ 647 million/year of the finance originated from private sources, which corresponds to 60% of climate finance via agricultural risk management instruments in the period.

Public finance for risk management instruments totaled US$ 408 million/year and included federal government expenditures for operating the PSR (US$ 124 million/year),[4] PROAGRO (US$ 157 million/year) and the Garantia-Safra (US$ 126 million/year).

The purpose of the PSR is to support rural producers in mitigating risks associated with agricultural activity and ensuring financial recovery capacity in case of adverse weather events (Souza and Assunção 2020). The PSR is managed by the Ministry of Agriculture and Livestock (Ministério da Agricultura e Pecuária – MAPA) and used by the federal government to subsidize the cost of acquiring rural insurance policies hired by producers from private insurers (Souza, Pereira and Stussi 2022).

PROAGRO, in turn, exonerates producers from having to fulfil financial obligations in rural credit finance operations and indemnifies producers for their out-of-pocket expenses to cover operational production costs in case of losses resulting from weather events. Financial institutions are responsible for the operational part of the program, but the federal government assumes the risks since the program indemnities are paid with public finance (Souza, Pereira and Stussi 2022).[5] Thus, this report counted the indemnities paid by the federal government within the scope of PROAGRO as public finance, which totaled, in average, US$ 157 million/year in the period under analysis.

Figure 6. Climate Finance for Agricultural Risk Management in Brazil by Type and Finance Source, 2015–2020

Note: The values refer to the average amount in Brazilian Real (R$) during the analyzed period, deflated by the IPCA using December 2020 as reference. The values were converted into United States Dollar (US$), according to the average exchange rate for the corresponding year, as provided by the Central Bank of Brazil (Banco Central do Brasil – BCB). The additional fee is similar to a “premium” paid when taking out an insurance policy. In PROAGRO, this rate is calculated as a rate of the total amount to be covered by PROAGRO (BCB 2022).

Source: CPI/PUC-Rio with data from SICOR/BCB, SIOP/MPO, MAPA, and SES/SUSEP, 2023

The Garantia-Safra is a public policy that supports family farming in Brazil’s semi-arid region. It is integrated into the PRONAF rural credit line. Its payment is a conditional benefit for producers residing in municipalities that are proven to have suffered crop losses due to drought events or excessive rainfall.[6] The creation and maintenance of the Garantia-Safra Fund enables payouts to beneficiaries from contributions made by producers – a small membership fee – and from federal contributions set annually by the Fund’s Management Committee. The federal government is the guarantor of the fund and in case there is not enough money in the fund to cover the amount to be paid out to the beneficiaries, the federal government must provide the rest (Souza, Herschmann and Assunção 2020). The federal government’s contributions to the Garantia-Safra Fund totaled US$ 126 million/year from 2015 to 2020.[7]

AGRICULTURAL RISK AND CLIMATE CHANGE

Agriculture is extremely vulnerable to climate change. The sensitivity of crops, cattle, and fisheries to temperature, water availability, and extreme weather events put yields, historical productivity gains, and farmers themselves at risk (Sadler 2016).

Risks tied to agricultural activity have intensified in recent years. Droughts and other increasingly frequent climate events have been causing significant losses in production. The rise in claims also increases the amount of indemnities and, consequently, the expenses borne by the government and insurance companies. Meanwhile, massive production losses can prompt producers to seek more government aid (Souza, Pereira and Stussi 2022; Souza, Stussi and Oliveira 2022).

Agricultural risk management instruments are increasingly important in this context, as they contribute both to increasing the resilience of producers to climate change and to encouraging investment in the adoption of sustainable practices (Chiriac, Naran and Falconer 2020). In fact, inadequate risk management instruments can lead to underinvestment in crops and, consequently, to a loss in production efficiency, causing adverse impacts on land use and increasing the pressure on forest (Souza, Pereira and Stussi 2022). As such, public policies must be effective in increasing productivity and fostering the adoption of new technologies and improved agricultural practices. Finance must also be directed to rural producers in regions more vulnerable to extreme weather events to ensure better risk coverage.

[1] The analysis only includes financial flows for agricultural risk management with coverage exclusively related to climate risks, such as excessive rain, drought, extreme temperature fluctuations, hail, frost, strong winds and cold winds, and diseases and pests, among others. Therefore, only a subset of rural insurance policies is accounted for in the numbers presented here; they do not include, for example, producers’ life insurance modalities. See Appendix II.

[2] The PGPM is a policy focused on correcting price distortions for agricultural products and, therefore, is not directly tied to the occurrence of weather events. As such, this policy was not included in the tracking of climate finance in this report.

[3] Rural insurance private flows indicate the sum of net premiums paid by producers, which were calculated by the total amounts of the policies deducted from the amounts of PSR subsidies. Additionally, the total amount of premiums paid by producers for rural insurance policies without the PSR was also accounted for.

[4] The PSR flows under analysis cover agricultural and forest insurance.

[5] Financial institutions operating rural credit play a central role in providing PROAGRO insurance.

[6] The Garantia-Safra is a conditional benefit to provide a minimum of protection and ensure the survival of the population. To receive the benefit, producers must (i) have a monthly household income of up to 1.5 minimum wage; (ii) grow between 0.6 and 5 hectares of cotton, rice, beans, cassava, corn or other crop activities as defined by the Ministry of Agrarian Development (Ministério do Desenvolvimento Agrário – MDA); (iii) and reside in a municipality either in the area covered by the Superintendence for the Development of the Northeast (Superintendência de Desenvolvimento do Nordeste – SUDENE) or in the state of Espírito Santo, pursuant to Law no. 9,690/1998, and have proven to have lost at least 50% of their set of produced crops due to drought or excessive rainfall.

[7] Municipal and state contributions were not accounted for in the presented flows, the additional data effort was outside the scope of this report.