The previous chapters have highlighted both the scale of the forest agenda and the diversity of challenges across countries. Tropical forests store vast amounts of carbon and offer exceptional potential for large-scale CO2 sequestration through forest restoration. While effective conservation and restoration policies exist—and have delivered results in many contexts—their adoption remains uneven and often vulnerable to political shifts. Establishing a robust, long-term financial architecture is essential to sustain climate ambition and incentivize governments to manage forests accordingly.

In the early 2000s, the inclusion of forests in the Kyoto Protocol’s Clean Development Mechanism (CDM)—the first multilateral carbon pricing mechanism—represented an attempt to recognize that removals generated by the planting of new forests were eligible to generate carbon credits, while forest protection projects were excluded.

In its relatively short years of existence, CDM was able to establish an internationally recognized carbon offset market for restoration activities that relied on the creation of methodological tools to prove additionality generated by projects, internationally approved forms of accounting to address risk of non-permanence, and on UN-led institutional structures.

However, this framework burdened CDM with a regulatory complexity that resulted in a low number of forest-related projects. Barriers that contributed to the underutilization of the mechanism included high transaction and financing costs and the temporary nature of carbon credits from forest activities, which denied fungibility of forest credits in the carbon market, and culminated in constraints on the demand side, including the exclusion of forest credits of the largest demand markets.

Currently, JREDD+ is the main internationally recognized framework for halting deforestation, with a track record in multilateral agreements. More recently, the Tropical Forest Forever Facility (TFFF) was proposed at COP28 to reward the maintenance of standing forests. While still under discussion, TFFF is gaining traction in international forums. Together with other initiatives, these mechanisms address deforestation and forest protection, but they do not prioritize forest restoration, which remains a critical gap.

Also, at COP28, the first Global Stocktake reaffirmed forests as indispensable for meeting the Paris Agreement’s temperature goals. Governments agreed on the urgency of conserving, protecting, and restoring forests and ecosystems to halt and reverse deforestation by 2030. Article 33 states the decision for parties to emphasize “the importance of conserving, protecting and restoring nature and ecosystems towards achieving the Paris Agreement temperature goal, including through enhanced efforts towards halting and reversing deforestation and forest degradation by 2030” (UNFCCC 2024). The decision also stressed the priority in providing enhanced financial, technical, and capacity-building support, and highlighted the non-carbon benefits of forests, including biodiversity conservation, ecosystem resilience, and social safeguards.

In this context, CPI/PUC-RIO proposes the Reversing Deforestation Mechanism (RDM), building on the framework developed by Assunção, Hansen, Munson, and Scheinkman (2025). RDM aims at compensating countries for net carbon removal outcomes—the carbon captured through forest restoration subtracting emissions from deforestation and degradation—at the jurisdictional level.

RDM aims to address the restoration finance gap and complement JREDD+, TFFF, and related mechanisms to form a flexible and scalable strategy that can be adapted to diverse national circumstances. This chapter outlines its core concept design, implementation requirements, and potential to transform tropical forests into high-impact climate assets.

The Mechanism

RDM is a results-based payment system designed to scale up forest restoration through jurisdictional agreements. It aims to create results-based incentives for countries with tropical forests to restore ecosystems and reduce emissions from deforestation and forest degradation.

At its core, the mechanism is structured as a bilateral agreement between a buyer—typically a government, multilateral institution, or private entity—and a jurisdiction (such as a national or subnational government) responsible for forest management. The main objective is to generate carbon removal credits through forest restoration, with credits calculated annually on a net basis. This net metric accounts for the amount of CO2 sequestered through forest regrowth, minus emissions resulting from deforestation, forest degradation, and agricultural land-use activities within the jurisdiction.

The mechanism involves an offtake agreement—the buyer commits to paying a price for each verified ton of net CO2 removed in the jurisdiction. Verified credits trigger disbursements that are directed into a dedicated jurisdictional fund. This fund can be used for activities that reinforce the climate and ecological goals of the mechanism—specifically, preventing deforestation and forest degradation, and scaling up forest restoration efforts, particularly through natural regeneration and sustainable land-use strategies.

By aligning financial incentives with measurable climate outcomes at the jurisdictional level, this mechanism offers a scalable and transparent model for integrating forest restoration into the global climate finance architecture, complementing mechanisms such as JREDD+ and TFFF and filling a gap for tropical forests (Figure 10).

Figure 10. Forest Finance Mechanisms: JREDD+, TFFF, and RDM

Source: CPI/PUC-RIO, 2025

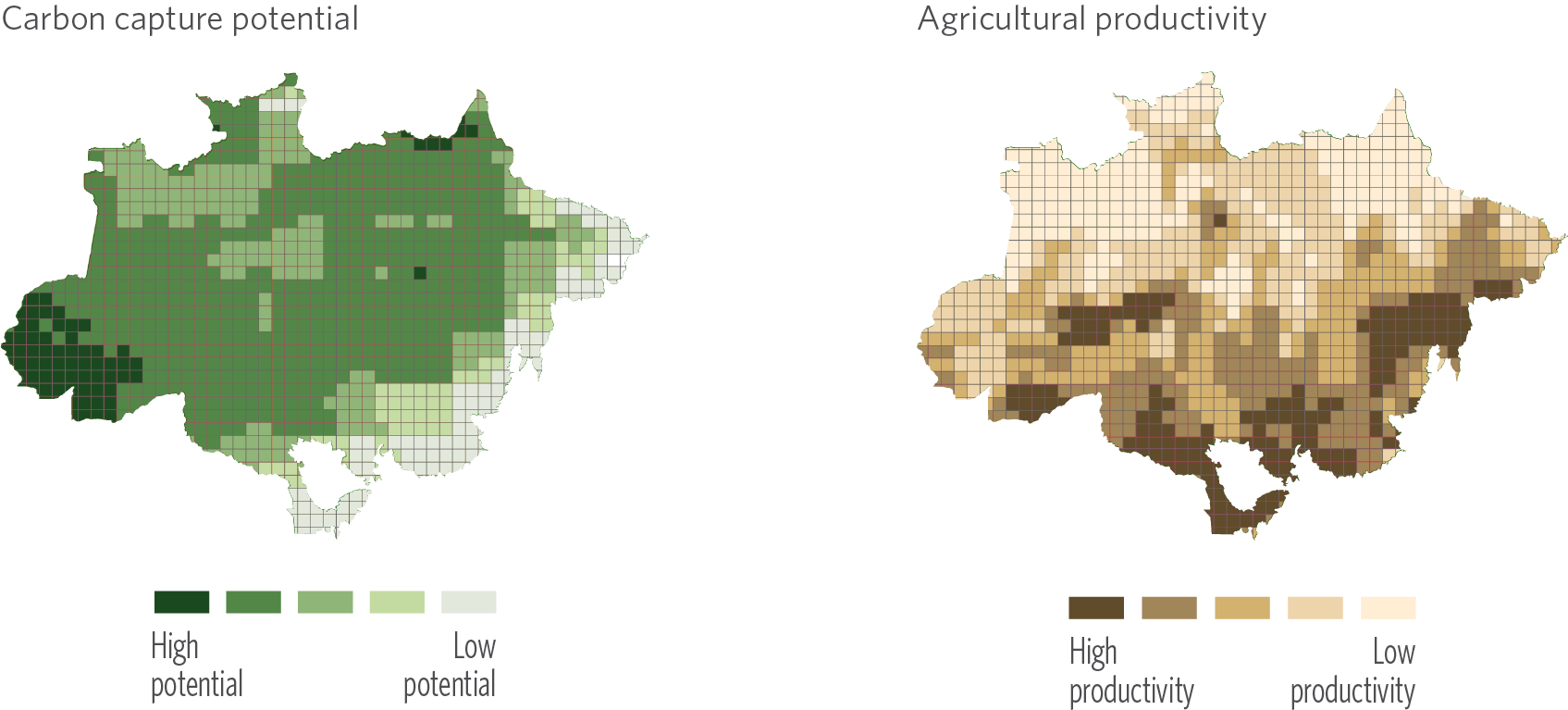

Simulating the Impact of the RDM for the Brazilian Amazon

The Brazilian Amazon offers a powerful illustration of how RDM could deliver both climate and economic benefits. In a recent study, Assunção, Hansen, Munson, and Scheinkman (2025) analyze the implications of implementing such a mechanism in the region. Their analysis leverages rich spatial data on carbon sequestration potential and agricultural revenues across more than 1,000 sites, with a particular focus on cattle ranching—the dominant land use in deforested areas. The Amazon exhibits high levels of heterogeneity: some sites have high carbon capture potential and low agricultural productivity, while others show the opposite pattern (Figure 11). This variation is central to understanding where and how forest restoration can be most effective.

Figure 11. Carbon Sequestration Parameters and Agricultural Productivity Heterogeneity for the Brazilian Amazon

Source: CPI/PUC-RIO with data from Assunção et al. (2025), 2025

The analysis contains two main features:

- Detailed Carbon Dynamics: The study models how carbon is emitted when forests are cleared and how it is sequestered over time through natural regeneration once cattle are removed. Carbon uptake is front-loaded—over 60% of the total potential is captured within the first 30 years, though the forest continues to sequester CO2 for up to a century. This timing aligns well with the urgency of the global climate agenda.

- Robustness to Deep Uncertainty: The model incorporates not only price fluctuations in cattle markets but also ambiguity around key parameters, such as carbon uptake rates and agricultural productivity. This approach ensures that the conclusions are not overly sensitive to any single assumption.

The results are striking. At a modest carbon price, RDM could reverse the Amazon’s carbon trajectory. Instead of emitting approximately 16 GtCO2 over 30 years, the region could capture up to 18 GtCO2 through large-scale natural regeneration. A carbon price of US$ 50 per ton of CO2, which is much lower than the current market rate, would yield around US$ 30 billion annually, making restoration the more profitable land use for vast areas currently dedicated to low-productivity cattle ranching.

This case highlights the two-way nature of the forest-climate nexus: the Amazon can make a major contribution to global climate goals, while climate finance can generate transformative economic opportunities in a region that continues to face development challenges. It also illustrates the scale of the challenge ahead, since realizing this potential depends on high-income countries driving demand for carbon removals, when facing considerably higher mitigation costs.

Simulating RDM’s Potential

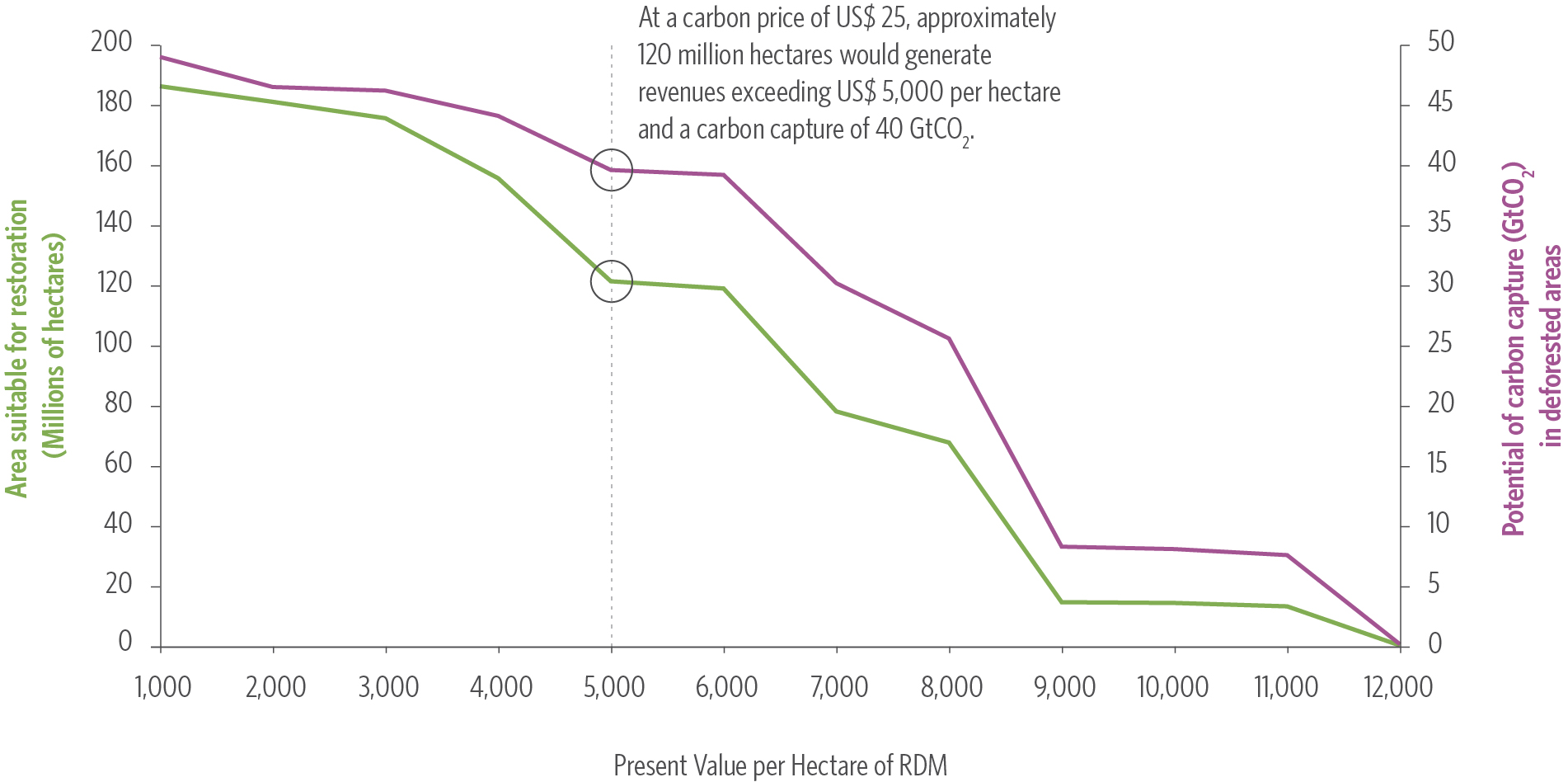

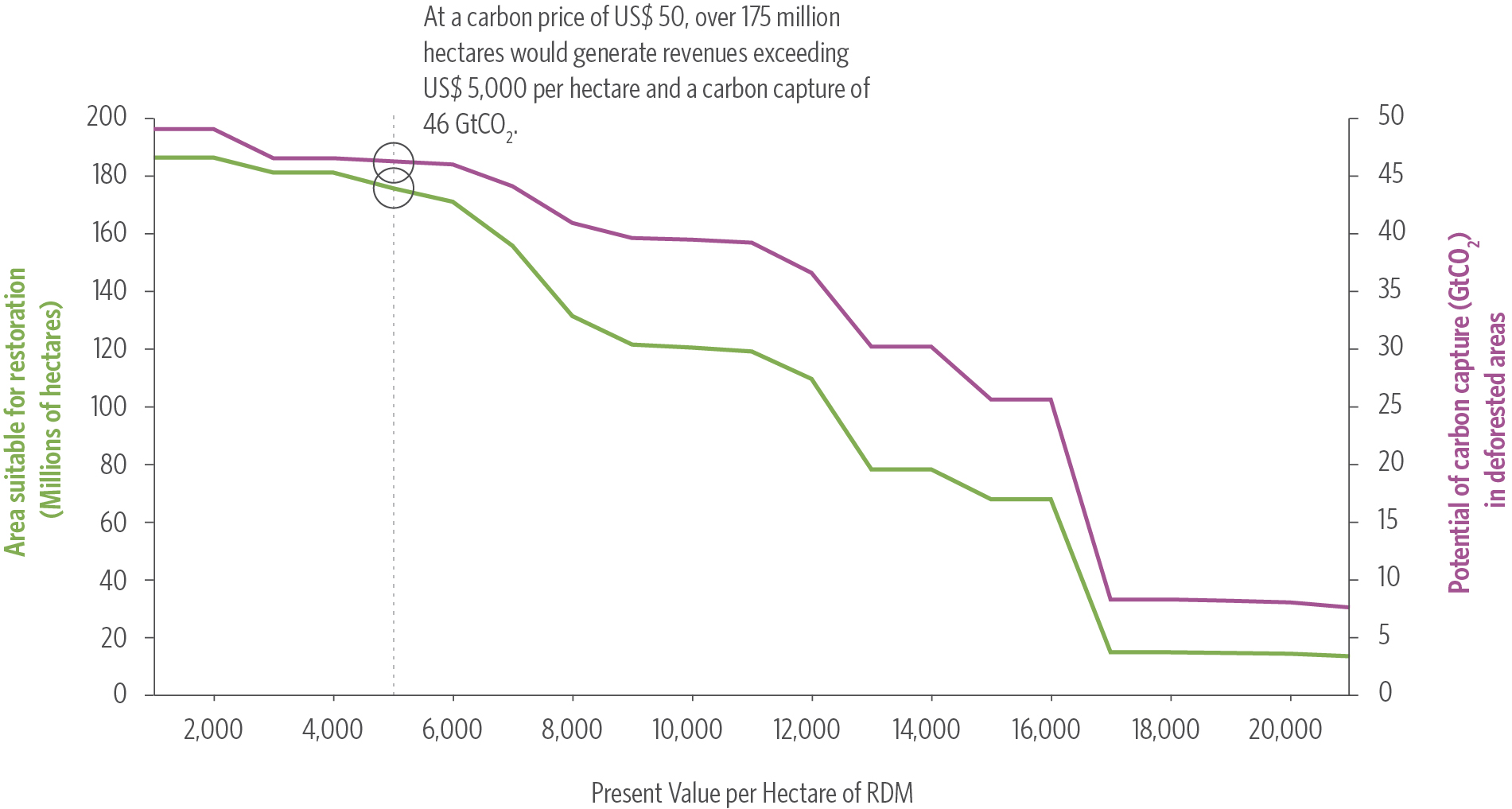

To assess the potential of RDM to deliver large-scale forest restoration and carbon sequestration, CPI/PUC-RIO’s researchers simulate a scenario that places all 180+ million ha of tropical land deforested between 2001 and 2023 under restoration. They then compute the present value (PV) of future income flows under RDM using country-level estimates of carbon removal potential, assuming no additional deforestation occurs. The simulation considers two carbon price scenarios: US$ 25 and US$ 50 per ton of CO2.

The PV metric enables direct comparison with local land prices. For example, Figure 12 shows that under a carbon price of US$ 25, approximately 120 million ha would generate revenues exceeding US$ 5,000 per ha—making RDM financially viable in areas with relatively low land prices. At US$ 50 per ton, the total area for which RDM would create more than US$ 5,000 per ha in revenues expands to over 170 million ha. This illustrates the potential for carbon finance to drive restoration at scale, particularly where opportunity costs are low.

Figure 12. Simulating RDM’s Potential Impacts on Forest Restoration and Carbon Capture Potential

12a. Present Value RDM at US$ 25/tCO2

12b. Present Value RDM at US$ 50/tCO2

Source: CPI/PUC-RIO with data from Hansen et al. (2013), CHIRPS precipitation (2023), and TerraClimate temperature (2020), 2025

To evaluate the timing and climate relevance of these removals, Figure 13 presents projected annual carbon sequestration by country, assuming full restoration begins in 2031, as suggested by the COP28 Global Stocktake. The model assumes all countries start immediately at full pace. Removals decline over time as forest growth—and thus carbon uptake—slows with ecosystem maturation.

Figure 13 demonstrates that in the first five years (2031–2035), restored forests could remove about 2 GtCO2 per year. At US$ 50 per ton of CO2, this represents roughly US$ 100 billion in annual revenues, underscoring both the climate significance and the financial potential of large-scale restoration.

Figure 13. Simulating RDM’s Yearly Carbon Capture Potential

![]() Interactive chart

Interactive chart

Source: CPI/PUC-RIO with data from Hansen et al. (2013) – v1.11; CHIRPS precipitation (2023); and TerraClimate temperature (2020), 2025

Note: The countries with the highest carbon capture potential are shown individually. The rest was aggregated as “Other countries with tropical forests”.

Given the diverse context of tropical forest countries, it is important to assess the carbon removal potential across countries. Tropical forests differ significantly in biomass density and carbon storage capacity, which directly affects the productivity of restoration efforts under RDM. Some countries are able to sequester substantially more carbon per hectare, making restoration more economically attractive.

Figure 14 presents the PV per ha for countries with the highest carbon capture productivity, under two carbon price scenarios (US$ 25 and US$ 50 per ton of CO2). These PV estimates per ha offer a useful benchmark when compared to local land prices, helping to evaluate the financial viability and attractiveness of the RDM implementation in each national context. As indicated in the initial classification of countries in chapter two, RDM would particularly be impactful for Brazil, Indonesia, and the DRC.

Figure 14. Top 20 Countries with the highest RDM Present Value per Hectare

![]() Interactive chart

Interactive chart

Source: CPI/PUC-RIO with data from Hansen et al. (2013), CHIRPS precipitation (2023), and TerraClimate temperature (2020), 2025

Implementation Requirements

Successful deployment of jurisdictional forest restoration mechanisms requires careful attention to design and operational principles that ensure environmental integrity, scalability, and long-term impact. This section outlines the core elements essential to achieving impact, along with potential implementation pathways.

Jurisdictional Approach

Implementing forest restoration at the jurisdictional level—rather than through isolated projects—offers ecological and operational advantages. Larger, contiguous areas reduce exposure to fire and enhance long-term carbon retention. They also help prevent emission leakages across neighboring lands, which is a common challenge in smaller-scale interventions.

Threats to forest integrity are often linked to edge effects. Forest fragmentation increases the likelihood of fires and other degradation processes. However, larger and contiguous forest areas contribute to the ecosystem’s integrity and long-term carbon retention.

From an enforcement perspective, jurisdictional implementation enables substantial economies of scale. Brazil’s experience with the DETER satellite-based monitoring system illustrates this point: by enabling rapid enforcement actions, DETER helped avoid over 10 GtCO2 emissions at a cost of less than US$ 1 per ton (Assunção, Gandour and Rocha 2023). These outcomes highlight the potential of jurisdictional approaches to deliver high-impact, cost-effective climate results.

Carbon Accounting

A robust and widely accepted carbon accounting system is essential to ensure the credibility and effectiveness of RDM. This system must be capable of tracking carbon flows across entire jurisdictions with a high degree of accuracy and at a reasonable cost. Leveraging remote sensing technologies and satellite data and growing Digital Public Infrastructure (DPI) initiatives are central to achieving this goal, allowing for consistent, low-cost monitoring of vast forested areas.

A defining feature of RDM carbon accounting is its net-based approach. Rather than crediting gross sequestration alone, the mechanism accounts for the net carbon balance within each jurisdiction. This balance is calculated as the carbon sequestered through forest regeneration minus the emissions from deforestation, forest degradation, and agricultural activities. By tying payments to net outcomes, this approach ensures that jurisdictions are rewarded for restoration efforts while also facing a clear disincentive for deforestation. The result is a coherent incentive structure aligned with both climate mitigation and land-use integrity.

Scaling through International Agreements

Scaling forest restoration to meet global climate goals requires large, stable, and predictable financial flows—something voluntary carbon markets are unlikely to deliver at the necessary scale. In contrast, regulated carbon markets offer the depth and reliability required but have, so far, remained largely closed to international credits due to concerns over environmental integrity, delayed domestic mitigation, and fairness.

RDM carbon accounting framework directly addresses many of these concerns. By issuing credits on a net basis—accounting for both carbon sequestration through forest regeneration and emissions from deforestation and land-use activities—RDM ensures that credits reflect real, additional, and verifiable climate benefits. This structure not only rewards forest restoration but also imposes an opportunity cost for deforestation, enhancing both accountability and environmental credibility.

These features make RDM well-suited for integration into international (possibly regulated) markets. Under Article 6 of the Paris Agreement, countries can engage in the transfer of Internationally Transferable Mitigation Outcomes (ITMOs). High-integrity Forest carbon credits generated through jurisdictional RDM programs could meet this standard, unlocking access to demand at scale while maintaining the integrity of national and international climate goals.

Assunção, Hansen, Munson, and Scheinkman (2025) demonstrate the potential efficiency gains: while not directly comparable to removal, the current cost of one allowance (equivalent to one ton of CO2) in the European Union’s Emissions Trading System (EU ETS)—that has recently been trading at an average of about US$ 80 (EU$ 70)—could finance the removal of at least three tons through restoration in the Brazilian Amazon. This illustrates how the use of international credits can lower compliance costs for high-income countries while expanding their mitigation ambition.

For tropical jurisdictions, access to international markets would translate into predictable, results-based finance to support large-scale restoration, strengthen enforcement, and promote inclusive development. Far from being a loophole, high-integrity international credits offer a pathway to do more, faster, and more cost-effectively—while channeling climate finance to the countries best positioned to deliver results.

In the face of tightening climate timelines, excluding credible mitigation opportunities from regulated markets comes at a global cost. RDM can help bridge this gap by aligning robust accounting systems with the financial architecture needed to scale climate solutions.

Permanence

Ensuring the permanence of carbon sequestration is one of the main challenges in forest-based carbon mechanisms. As restored forests mature, the rate of carbon uptake naturally declines, leading to fewer new credits being issued. This dynamic creates a time-consistency problem: jurisdictions that initially commit to restoration may later find it economically attractive to revert to deforestation, especially once payment flows diminish. Beyond these economic pressures, forest fires and illegal deforestation remain persistent threats that can compromise long-term carbon storage and undermine the environmental integrity of the mechanism.

Scheinkman (2024) examines this issue in the context of the Brazilian Amazon, showing that the stream of payments under RDM peaks and then gradually declines as forests reach carbon equilibrium (Scheinkman 2024). While defection is unlikely in the early years, the incentive to abandon restoration becomes positive after roughly four decades, when the net present value of alternative land uses exceeds the value of continued compliance.

To address this challenge, RDM incorporates explicit permanence safeguards, creating financial and institutional costs for future governments that might default on conservation commitments. Two complementary approaches can be considered:

Permanence Fund: For every carbon credit issued under RDM, a small fee would be deposited into a dedicated permanence fund. After 40 years—when regular credit payments taper off—the fund would reward jurisdictions through TFFF-type payments, ensuring ongoing incentives for conservation. Scheinkman (2024) estimates that the required fee would be less than US$ 3 per ton of CO2, and the resulting TFFF parameters would be sufficient to deter defection.

Forgivable Loan Structure: As proposed by Harstad (2025), carbon payments could take the form of forgivable loans instead of grants or unconditional payments. Countries could receive upfront financing for restoration but would be required to repay the loan if the restored areas are subsequently deforested. As long as forests remain intact, no repayment is due. This approach leverages sovereign debt frameworks to enforce compliance and ensure long-term permanence. Note that if the mechanism is implemented with a zero interest rate, it does not increase the country’s debt burden—received funds would only be returned in the event of deforestation of the restored areas. Embedding such long-term commitment mechanisms—whether incentive-based (carrot) or sanction-based (stick)—is essential to address both the economic risks of land-use shifts and the physical risks from fires or degradation. These measures are critical to guarantee the durability and credibility of emission reductions over multi-decade horizons.

Long-Term Credit Viability

Jurisdictions participating in RDM will undertake significant shifts in land use—moving away from activities like cattle ranching and crop cultivation toward large-scale forest restoration. These decisions involve irreversible economic costs at the local level, particularly once land is transitioned from productive agriculture to natural regeneration. Reversing course is often difficult and costly, making it essential that jurisdictions receive credible assurances of continued financial support over time.

Ensuring long-term credit viability is therefore a two-sided challenge. On the one hand, it is necessary to mitigate permanence risks, as discussed in the previous section. On the other hand, jurisdictions need confidence that demand for carbon removal credits will remain strong and predictable well into the future—especially after they have already committed land and resources to restoration.

This stresses the importance of anchoring RDM within international carbon markets, which can offer the scale, stability, and institutional backing needed to secure long-term demand. Without such guarantees, the economic and political risks of committing to forest restoration may outweigh the perceived benefits, undermining the effectiveness of the mechanism.

Use of Proceeds

As a results-based mechanism, RDM should provide jurisdictions with flexibility in the allocation of funds, enabling alignment with national priorities and respect for domestic political processes. Proceeds may naturally be used to support a range of forest-related actions, including the creation and maintenance of protected areas, enforcement of environmental regulations, support for indigenous and traditional peoples, and broader conservation programs.

Given the potential scale of revenues in some jurisdictions, funds can be integrated into existing public finance systems and allocated in accordance with local rules and institutional frameworks. In many countries with tropical forests, pressing development needs—such as poverty reduction, improved access to education and healthcare, public safety, and urban infrastructure—compete for scarce resources.

Ensuring that RDM revenues contribute to both environmental protection and socioeconomic development can help build broad-based political support for forest restoration efforts. When forest-based climate finance visibly improves livelihoods, it reinforces the legitimacy of the mechanism and strengthens the long-term commitment to conservation.

Role of the Private Sector

The private sector can play a significant role in forest restoration. Under RDM, carbon revenues can be directed to private actors acting as service providers for restoration activities. In many contexts—especially in degraded or fragmented landscapes—active restoration approaches such as assisted natural regeneration, enrichment planting, or agroforestry systems may be more effective than relying solely on passive forest regrowth. Contracting private entities, cooperatives, or community organizations to deliver these services can enhance implementation capacity, encourage innovation, and accelerate restoration outcomes.

In addition, there is a significant wedge between the cost of forest restoration and prevailing carbon prices in regulated markets. This differential opens opportunities for private sector actors to participate in results-based arrangements or blended finance models that combine RDM payments with revenues from other sources.

Beyond carbon markets, the private sector can also play a role in developing forest-compatible value chains—such as açaí, cacao, Brazil nuts, and other non-timber forest products—that support sustainable livelihoods and reinforce conservation goals. Mobilizing private expertise and capital in these sectors can help align forest restoration with inclusive economic development.

Simulating Revenues from JREDD+, TFFF and RDM across Countries with Tropical Forests

As a reference, this work seeks to simulate the revenue potential of JREDD+, TFFF, and RDM mechanisms under a common scenario: all lands deforested between 2001 and 2023 are restored, and no further deforestation occurs (Figure 15). In this simulation JREDD+ payments are tied to avoided deforestation, TFFF provides rewards for the conservation of standing forests, and RDM offers compensation for forest restoration. For clarity—and to emphasize the key differences among these mechanisms—potential interactions between them are not considered.

Figure 15. Simulating JREDD+, TFFF, and RDM Revenue Potential across Top 20 Countries with Tropical Forests

Source: CPI/PUC-RIO with data from Hansen et al. (2013) – v1.11, CHIRPS precipitation (2023), and TerraClimate temperature (2020), 2025

Note: Mexico’s forest area figure is sourced from INEGI (2019) and refers to the year 2014. JREDD+ values represent the estimated cumulative amounts countries would have received over the last ten years under a counterfactual of zero deforestation in Tropical & Subtropical Moist Broadleaf Forests. TFFF and RDM figures represent the present value (PV) of all future payments under those instruments.

Considering a reference price of US$ 10 per ton of CO2, the simulation estimates the potential of JREDD+ revenues by linking avoided deforestation to the carbon stored in the tropical forests that were cleared. The baseline for carbon credit is defined as the average annual deforestation of 10 million ha observed between 2013 and 2023, with an associated carbon stock of approximately 375 tons of CO2 per ha. To estimate the maximum potential of JREDD+ for halting deforestation, the exercise assumes an extreme scenario in which all deforestation ceases immediately during the first crediting period—resulting in a one-time payment. An alternative approach would be to model a possible gradual reduction in deforestation, which would imply a schedule of payments over time. However, the PV of such a schedule would necessarily be lower than that of the immediate zero-deforestation scenario.

Multiplying this carbon density by a reference price of US$ 10 per ton of CO2 and by the average annual deforestation yields an estimate of the revenue countries could have earned under JREDD+ by immediately halting forest loss. For all countries combined, this amounts to US$ 32.4 billion. This figure should be understood as a one-time gain, reflecting the immediate halt of deforestation at the 10 million-hectares baseline and the reference price of US$ 10 per ton of CO2.

In contrast with JREDD+, both TFFF and RDM mechanisms necessarily involve payment schedules distributed over time. For TFFF, payments are made annually, while for RDM, the schedule is determined by the natural pace of forest regeneration or tree planting. Given these distinct trajectories, the potential revenues from each mechanism are estimated using the discounted PV of expected payments, applying a 2% discount rate. The potential of TFFF is based on the total tropical forest area of 1.27 billion hectares. Assuming a value of US$ 4 per hectare of standing forest, this translates to approximately US$ 5 billion in annual payments, resulting in a PV of nearly US$ 250 billion.

The simulation of RDM potential assumes that all areas deforested between 2001 and 2023 are placed under regeneration from 2031 onwards. Using a carbon price of US$ 50 per ton of CO2, this yields a PV of roughly US$ 1.7 trillion across tropical forest countries.

This difference across the three mechanisms reflects the distinct objectives of each one: JREDD+ is a mechanism that, in practice, has been primarily used to stop deforestation; TFFF provides standing forest payments, including in areas not under immediate deforestation pressure; and RDM compensates for large-scale carbon removals by incentivizing the restoration of previously forested lands.

The comparative results highlight strong variation across countries. Brazil, with the largest amount of forest cover, highest deforestation and the greatest restoration potential, registers the highest potential revenues under all mechanisms. However, the relative benefits differ significantly elsewhere. Most countries with tropical forests are projected to benefit more from RDM, but countries such as Gabon, and Guyana—where forests are largely intact and deforestation is low—stand to benefit more from TFFF. Note that the values of JREDD+ are significantly lower because, in the best-case scenario, where deforestation is immediately halted, they represent a one-off payment. In contrast, TFFF and RDM provide ongoing flows. These findings reinforce the value of an integrated approach, allowing policy tools to be matched to the specific profiles and needs of each country.

Establishing effective restoration mechanisms that complement existing conservation efforts is critical to unlock the full climate, ecological, and social benefits of tropical forests. Restoration must be designed to work in tandem with conservation incentives, ensuring that gains from forest recovery do not come at the expense of standing forests. The urgency of the climate crisis demands innovative, scalable solutions that respond to diverse national realities and integrate seamlessly with ongoing forest protection efforts. Moving forward, advancing such complementary mechanisms will be essential to maximize the role of tropical forests as pillars of global climate mitigation.