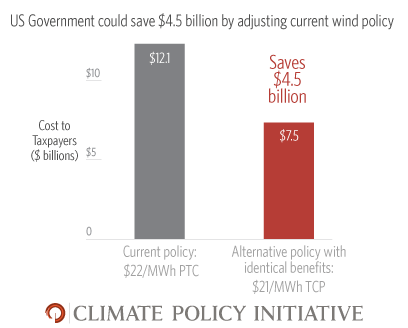

CPI’s recent study, Supporting Renewables While Saving Taxpayers Money, showed that U.S. governments could save a lot of money by adjusting how tax incentives for renewable energy are delivered. In particular, we showed that a $21/MWh taxable cash incentive for production (TCP) for wind could provide the same support to wind projects as the current $22/MWh production tax credit (PTC) and almost halve the cost to federal and state governments.

The PTC is set to expire at the end of this year. The Senate has proposed extending it by one year, but at a cost to government in excess of $12 billion – a heavy lift given budget constraints. Replacing the PTC with a TCP could reduce that cost to $7.5 billion. A similar reduction in cost would apply to any proposal to extend the PTC, including the recent proposal by the American Wind Energy Association to phase-out the PTC over six years.

How does this work?

Well, wind project developers have limited tax liabilities. That means that by themselves, most project developers can’t use federal tax benefits until years after they are received, eroding almost two thirds of the incentive value. In order to get more out of these incentives, project developers bring in outside investors who have greater tax liabilities. This is called tax-equity financing. However, tax equity financing is more expensive and complex than conventional finance, and erodes about a third of the incentive value.

Cash incentives don’t have this problem – cash lets project developers access conventional, cheaper, simpler finance. As a result, the full value of the incentive goes to the project rather than getting used up in complex finance arrangements. This means a smaller cash incentive has the same value to project developers as a larger tax incentive.

Government, therefore, would spend less money for the same results. And taxpayers would pocket the difference.

However, despite dissatisfaction with the inefficiency of current policy, transforming a tax break into a spending program is politically challenging.

Here, we provide three tweaks of the existing PTC that, together, can achieve the same results as a TCP and save the federal government nearly $5 billion:

- Lower the PTC to $21/MWh and make it a refundable tax credit. A refundable tax credit doesn’t require tax liabilities. This avoids the need for expensive tax equity financing and instead delivers the full value of the PTC to renewable project owners.

- Treat the full amount of the PTC as taxable income. By taxing the PTC, the government reduces the cost of the incentive significantly. However, it does so in a way that doesn’t hurt developers. The additional tax liabilities are almost fully offset by accelerated depreciation tax benefits which the wind projects could not otherwise use without expensive tax equity financing.

- Allow the PTC to be claimed by a project company. Clarify that the tax credit can be received by a pass-through entity owned entirely by eligible taxpayers on behalf of its owners. This lowers financing costs further by allowing the full proceeds of the refundable tax credit to be used to increase the amount of cheaper debt used to finance the project. We hope to work with policymakers and other stakeholders to use this mechanism to help sustain the recent boom in wind energy at lower cost to government.