In the face of the deepest economic downturn in decades, renewable energy in the U.S. is booming. With financing primarily from the private sector, U.S. workers have built enough solar and wind farms to provide clean electricity to over six million homes since the start of the recession in 2008.

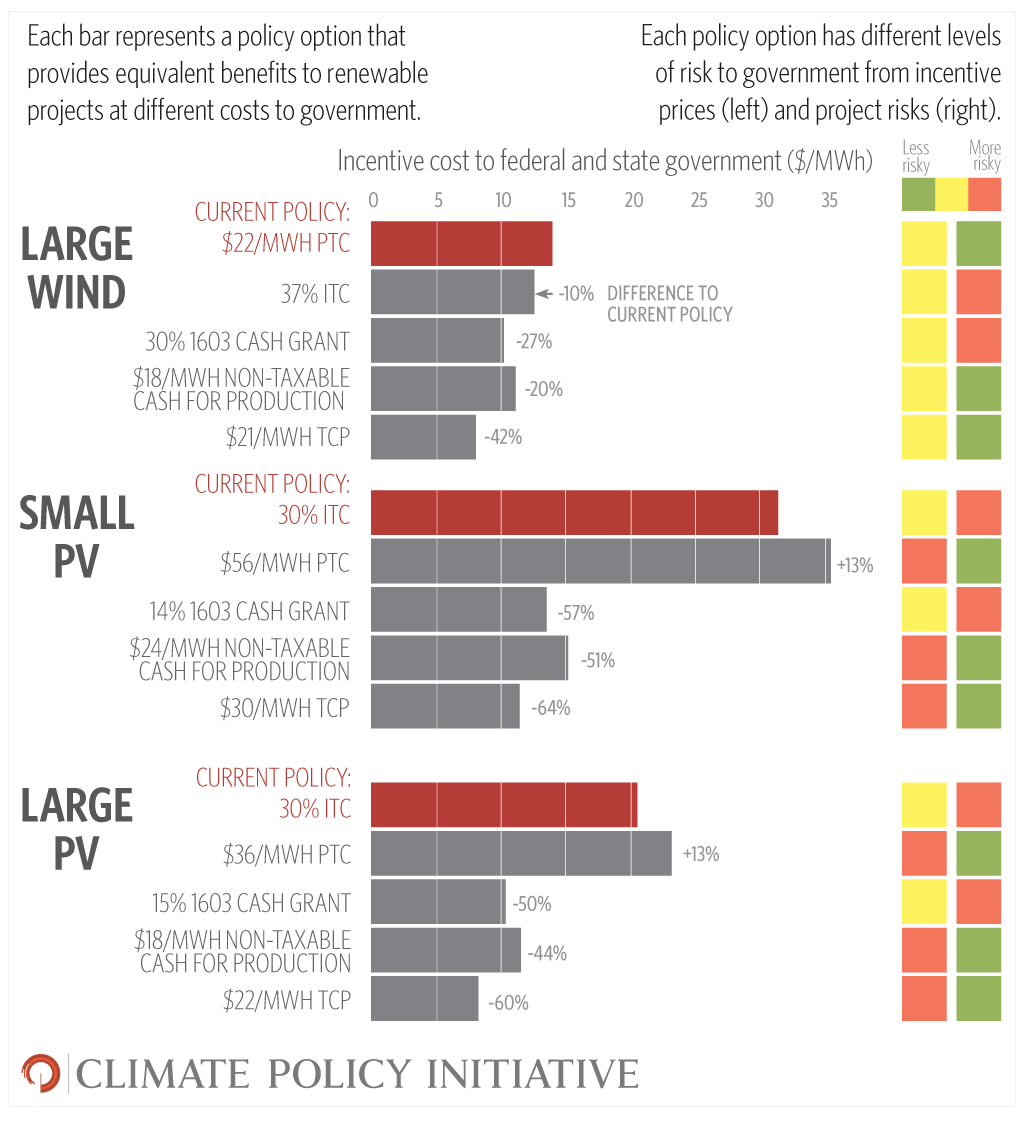

This growth would not have been possible without steady support from state and federal policies like the $22/MWh production tax credit (PTC) for wind. But now, these policies are starting to fade away. A report by US PREF has shown that state policies are likely to drive far lower levels of renewable deployment than we’ve seen in recent years – and the PTC is set to expire at the end of the year.

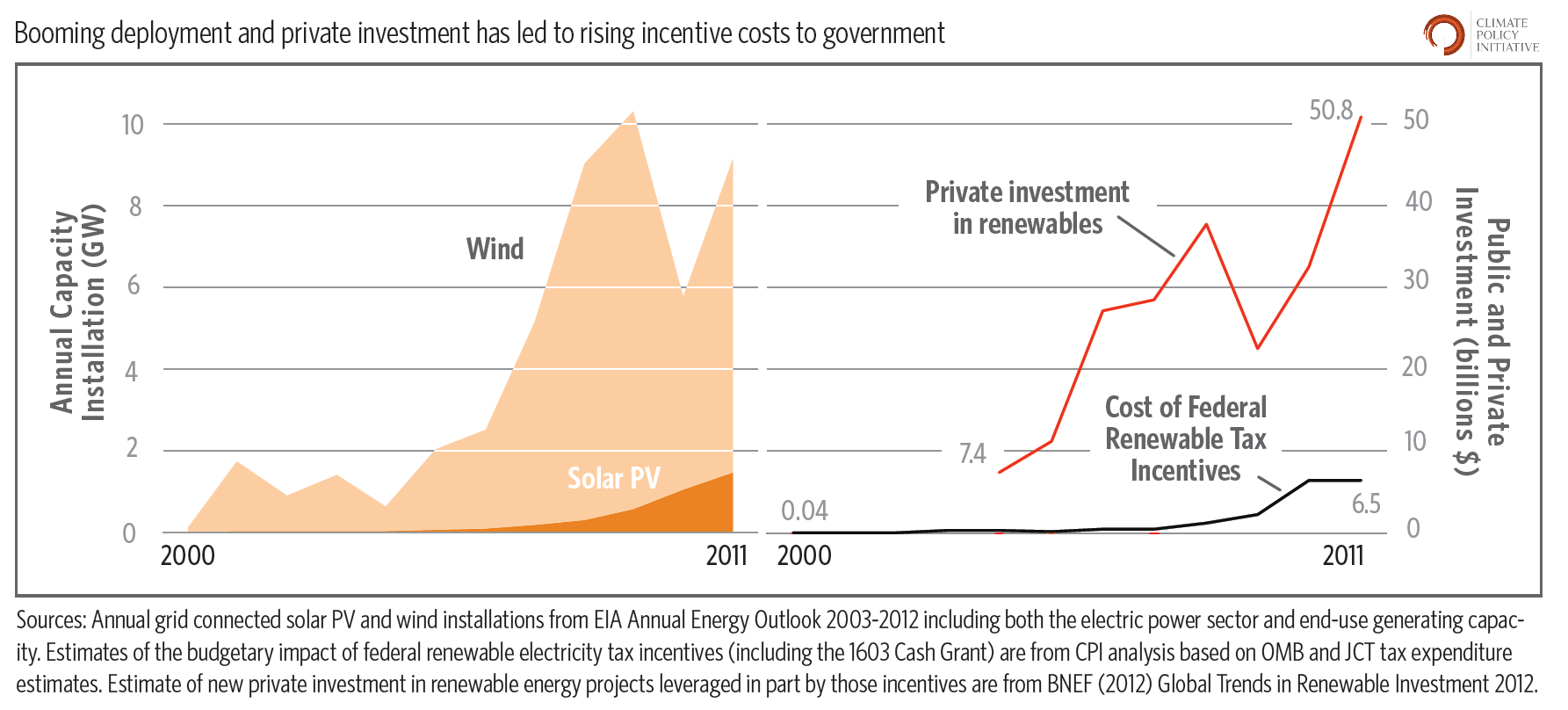

On top of this, while the cost of wind and solar have been falling, rising deployment has led to rising costs to the federal government. With the steep fall in tax revenues and the increase in federal assistance that has come with the deep recession, lawmakers are looking for opportunities to reduce the deficit – and the cost of extending the PTC looms large. Policymakers want to balance support for renewable energy with these fiscal pressures.

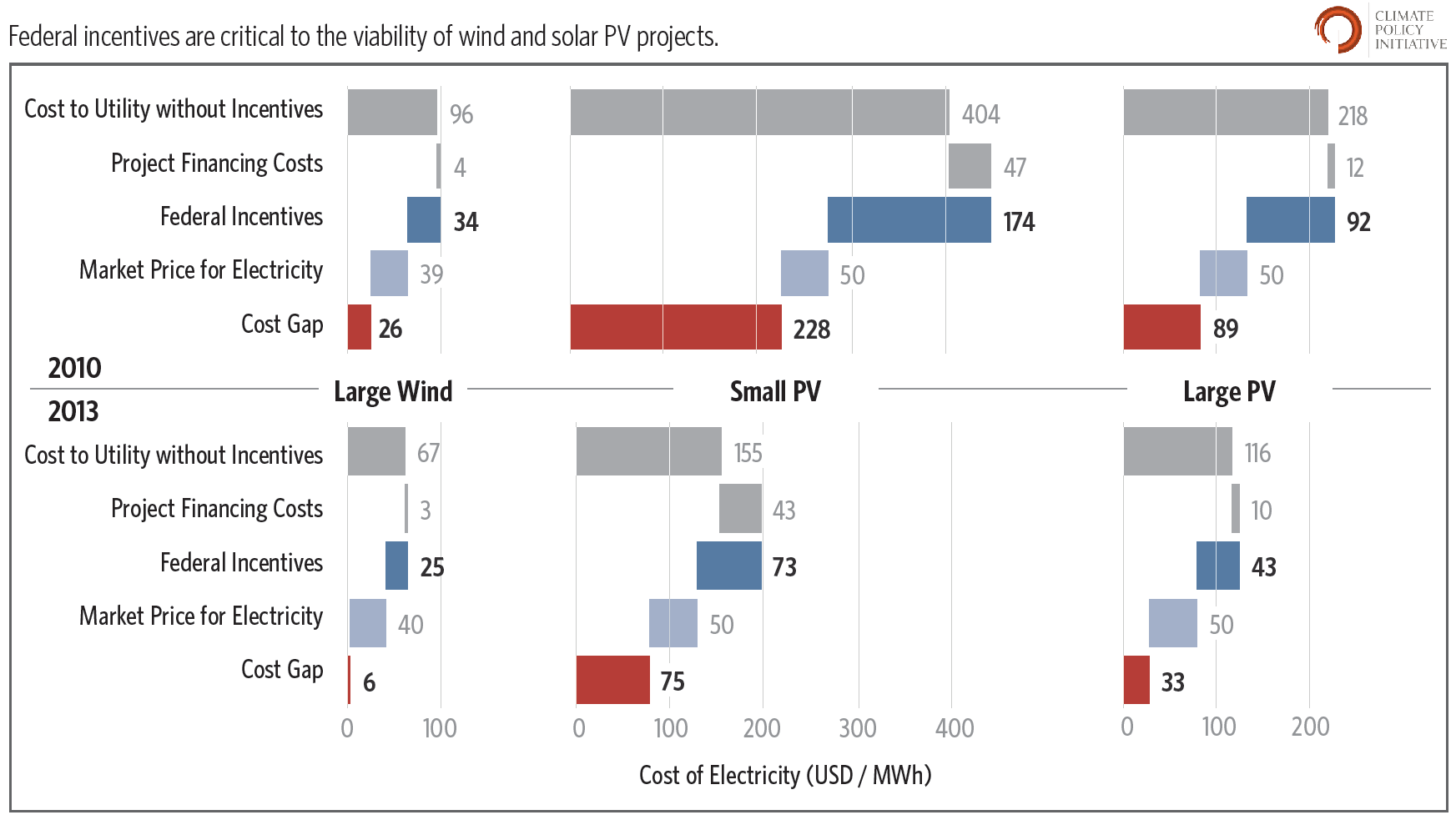

So, we decided to analyze how the federal government can modify existing renewable incentives to save money, while sustaining strong support for U.S. renewable energy deployment. We used project financial modeling of three representative project cases based on actual deployed project cost, financing, and performance data and trends to perform the analysis. We aren’t alone in our interest in this topic; this work started as modeling to support a broader effort to examine ways to scale-up financing for renewable energy in partnership with the Energy Foundation, ACORE, and CalCEF. To start with, we asked if federal incentives are still necessary, given recent solar and wind cost reductions. We found that the bulk of projects built over the last few years would not have made economic sense for investors without federal incentives and state & ratepayer supports. Tight state budgets and even tighter ratepayer budgets due to the ongoing recession make it unlikely that investors could make up for the loss of federal incentives in the near term. However, due to recent cost reductions, by 2013 wind would almost be economically viable with federal incentives alone if the PTC is extended. The gap between solar PV prices and market prices for electricity after federal incentives has also narrowed considerably.