Cities are on the frontlines of the climate crisis. While the need for urban adaptation is growing, funding remains alarmingly low. Hamza Abdullah and Alastair Mayes from CCFLA reveal why finance isn’t flowing—and what can be done to close the gap.

Climate adaptation in cities remains vastly underfunded, especially in the Global South.

The Cities Climate Finance Leadership Alliance (CCFLA) is a coalition of 80+ public and private institutions working to close the urban climate finance gap. We do this by producing practical knowledge, fostering collaboration, and engaging in policy discussions on key topics such as adaptation finance, project preparation, private capital, and public finance.

Since 2019, CCFLA has delivered over 40 knowledge products—including the flagship State of Cities Climate Finance Report (SCCFR) — and convened more than 120 global events. Our initiatives, such as the Project Preparation Facility Connector (PPF Connector) and quarterly action groups, help members scale urban climate investments and drive real-world solutions.

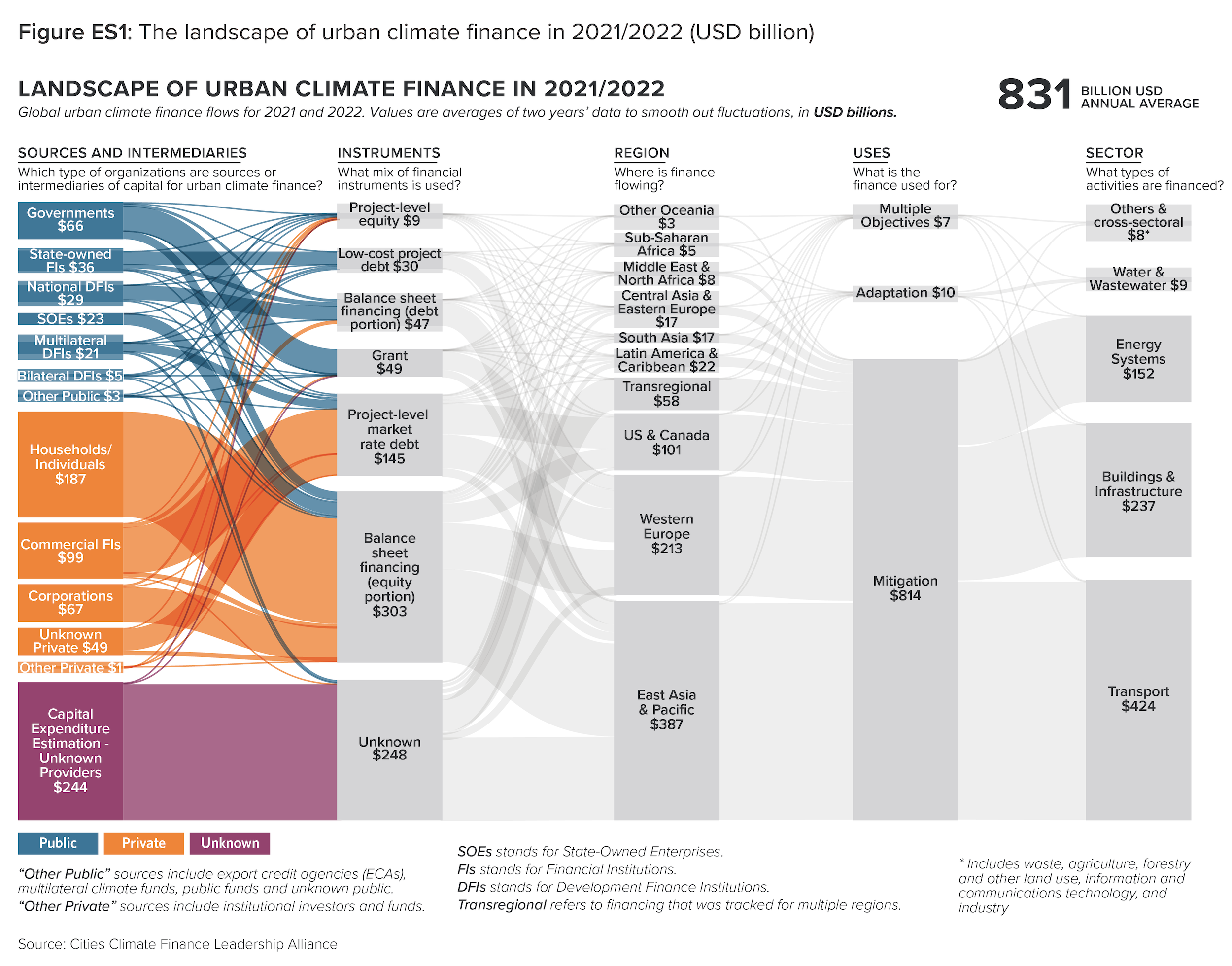

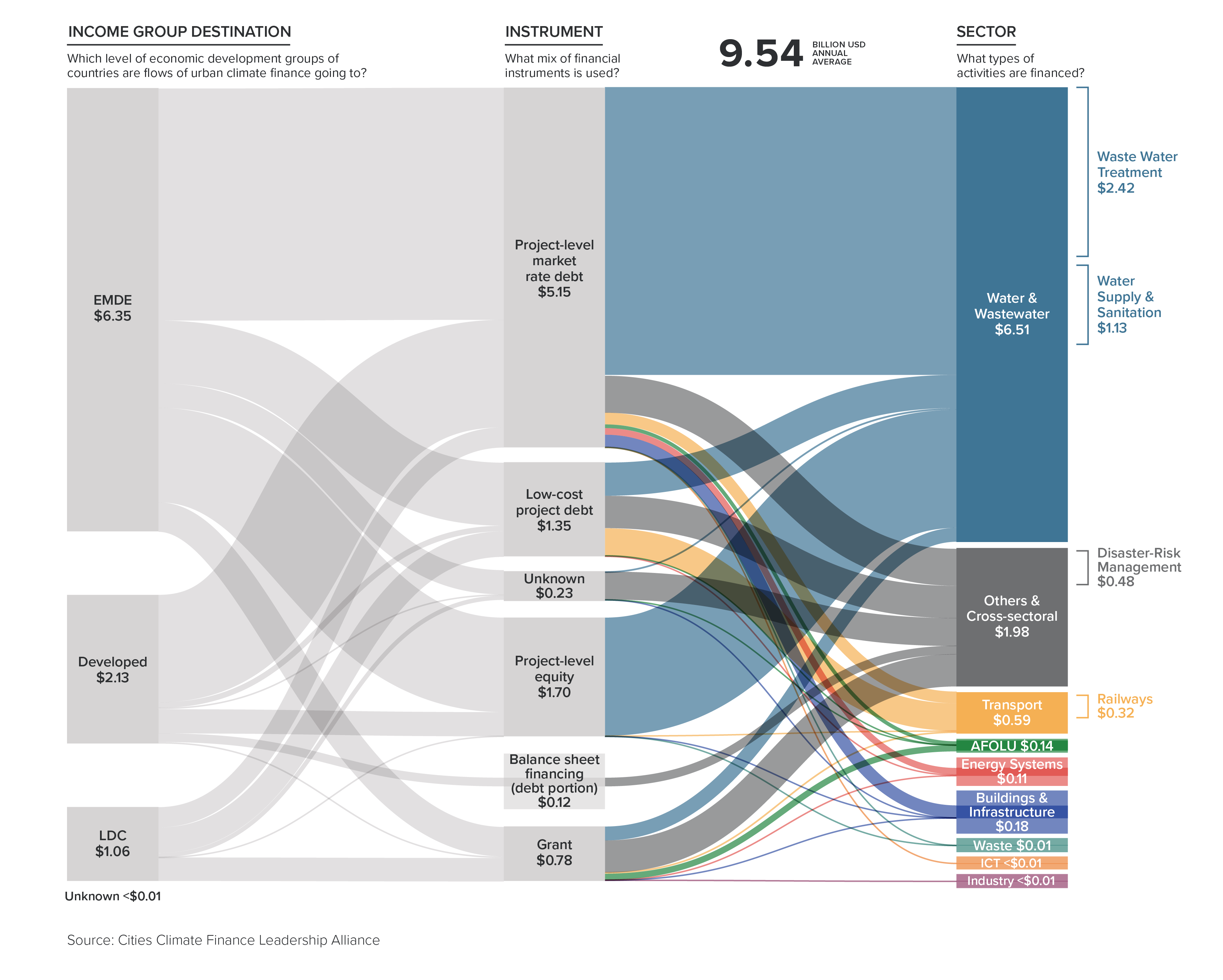

According to the SCCFR, $ 831 billion was directed to urban climate projects in 2021 and 2022. However, adaptation projects received just $ 10 billion, only $ 6 billion of which went to cities in emerging markets and developing economies (EMDEs). Sub-Saharan African and South Asian cities received a mere 8 per cent and 7 per cent, respectively.

Yet, EMDE cities need an estimated $ 147 billion annually for adaptation by 2030—and likely much more, given the persistent data and tracking gaps.

Why is Urban Adaptation Finance Falling Short?

Adaptation finance is difficult to access at the city level, especially in the Global South. Here are six reasons why:

- National climate agendas often overlook urban needs. This leaves urban adaptation out of sight and mind when funding priorities are set.

- Multi-level coordination gaps, policy misalignment, and legal and fiscal constraints leave cities without clear authority or incentives to fund and implement adaptation measures, such as flood defences or cooling infrastructure.

- Cities lack the specialised capacities for adaptation, including risk assessment tools and investment frameworks needed to prepare adaptation projects that meet financiers’ criteria.

- City-level adaptation projects are often small-sized, falling outside the standard lending criteria of multilateral/national development financiers.

- Poor municipal creditworthiness, unfavourable market environment and a lack of business models for adaptation projects further sideline investors. This leaves cities relying on scarce own-source revenues and unpredictable transfers or grants.

- Cities rarely utilise insurance to transfer climate risks, due to unaffordable premiums or complicated payout procedures, ultimately deterring financiers from supporting climate-smart investments.

Promising Mechanisms to Finance Urban Adaptation

In spite of these challenges, the perception of adaptation and resilience is changing, with increasing recognition of the opportunities these investments present. Several promising mechanisms are emerging to facilitate private investment in adaptation and resilience. Cities can employ many of these mechanisms to attract finance for their projects.

For instance, de-risking mechanisms are essential to unlock private capital for adaptation and resilience. Among the most promising are blended finance mechanisms that layer public and private finance, such as the 500-million-dollar World Bank partial risk guarantee that unlocked a 910-million-dollar commercial loan for resilient water infrastructure in Luanda, Angola.

Additionally, parametric insurance products are showing promise in unlocking rapid post-disaster financing for cities and, when combined in a pooling system as was done by the Philippines’ City Disaster Insurance Pool. This can spread both costs and risk and facilitate access to additional revenue streams for cities to build resilience.

Many cities in EMDEs struggle to access private investment for urban adaptation and resilience projects due to low creditworthiness and small project sizes. To address these challenges, improving municipal revenues is crucial. Land-value capture, which charges developers for positive increments in land value, can unlock revenues for adaptation initiatives. Further, pooled procurement, through which multiple cities can aggregate demand, can address the challenge of small project sizes and help cities procure products and services at affordable prices. An example is the RAMCC Trust Fund, where 30 Argentinian municipalities purchased climate-smart technologies at lower prices.

Moreover, payments for ecosystem services can incentivise environmental protection. A successful example is Freetown in Sierra Leone, where the Freetown the Treetown project pays residents to maintain trees and sells carbon credits to fund further reforestation.

What Can Cities Do?

Cities can leverage these mechanisms to scale adaptation investments by focusing on four critical enablers set out by CCFLA, as part of its 4Cs agenda to accelerate urban climate finance:

- Commitment: Integrate adaptation targets into local climate plans and advocate for their inclusion in Nationally Determined Contributions (NDCs), National Action Plans (NAPs), and national investment platforms.

- Collaboration: Tag adaptation projects aligned to international taxonomies to signal resilience outcomes to private investors and work with national governments to improve the enabling environment, leveraging CCFLA’s Enabling Framework Conditions tools.

- Capacity: Establish dedicated adaptation departments, share climate risk data with the private sector, leveraging programmes like the Global Risk and Resilience Fellowship and the UrbanShift City Academy; and tap into project preparation facilities (PPFs) using CCFLA’s PPF Connector.

- Capital Mobilisation: Improve creditworthiness using guidance from tools like the City Cred Tool, and engage with development finance institutions, climate funds and PPFs to utilise innovative financial mechanisms discussed above.

The global stocktake of the Paris Agreement highlights a closing window of opportunity to avoid a temperature overshoot. It points to the need for urgent action to increase adaptation finance in urban areas, especially in the rapidly urbanising Global South, where climate change will compound economic risks and human suffering. Closing the urban adaptation financing gap in the Global South is both a matter of equity and smart economics: the latest evidence from the World Resources Institute (WRI) suggests that every dollar invested in adaptation can yield over 10.50 dollars in benefits.

Cities in the Global South must be empowered with the tools and resources they need to adapt to climate change. National and multilateral decision-makers should rapidly scale adaptation financing, reform their mandates to give cities direct access to finance, incentivise private investment and invest in building local capacities. Meanwhile, cities must integrate climate into budgeting and explore innovative financial mechanisms to invest in climate-smart infrastructure to protect their people and economies. The time to act is now.