While global climate finance has steadily increased over the past decade, reaching a high of USD 1.46 trillion in 2022, much more is needed to keep global temperature rises within 1.5°C by the end of this century and avoid the worst impacts of climate change.

Timely and accurate information on climate investment flows and needs is key to creating awareness among public and private investors as well as policymakers and ensuring that climate investments are channeled toward those sectors and countries that display the largest funding gaps.

Since 2021, CPI has been building a collective understanding of the climate finance needed to reach net-zero carbon emissions by 2050. We collect and standardize data on climate finance needs from a wide variety of sources to provide the most comprehensive available overview of the current climate finance gap.

Top-down needs are estimations of the climate finance required across different sectors to keep the average global temperature rise within 1.5°C by the end of this century. These needs are typically calculated using predictive models for different sectors. Climate-compatible scenarios developed by different institutions can differ widely in the data, assumptions, model used, and (geographic or sectoral) scope.

Top-down needs differ from bottom-up needs which are climate finance required by countries to reach their national climate targets, as stated in official documents such as Nationally Determined Contributions (NDCs). CPI’s methodology and data on bottom-up needs are available here.

How much (more) is needed to keep us under 1.5°C?

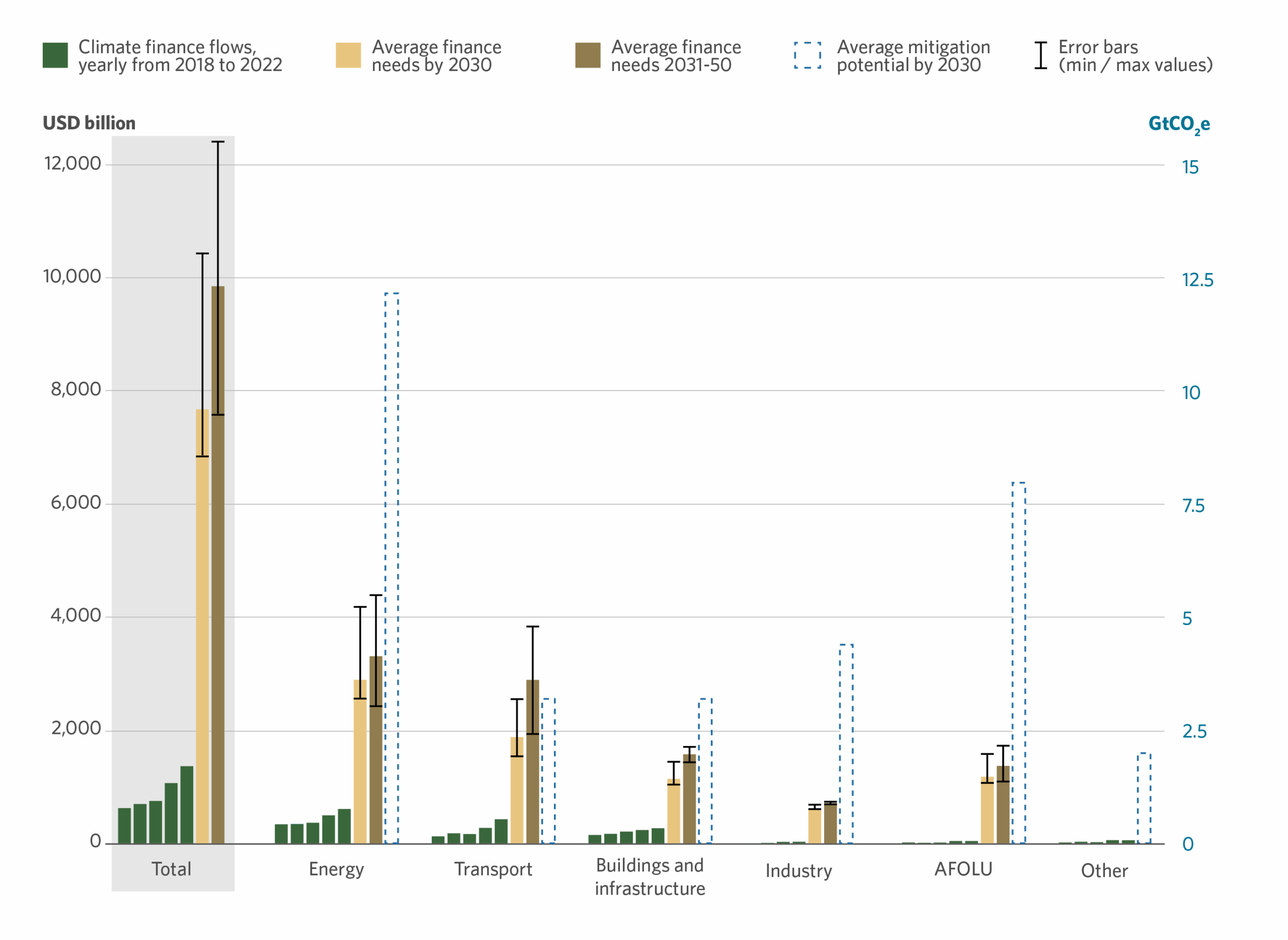

Our compilation of top-down needs assessments shows that, in an average scenario, annual climate finance flows must increase at least fivefold compared to current levels, reaching USD 7.5 trillion per year between now and 2030, and over USD 8.8 trillion per year from 2031 to 2050. Mitigation investments account for 97% of these estimated needs, in part because adaptation finance needs are largely underestimated (see below).

Within mitigation, the largest investment gaps, in absolute terms, are observed in the energy and transport sectors, where an additional USD 2.2 trillion and USD 1.4 trillion per year1 will be required, respectively, between now and 2050. In relative terms, the largest gaps are observed in agriculture, forestry, and other land use (AFOLU) and industry, where funding needs to grow by 30 times and 22 times, respectively, compared to 2022 levels. Increasing funding for AFOLU could be especially impactful, as the sector is estimated to have the second-largest mitigation potential, at an average of 8 GtCO2e by 2030.

Global climate finance flows in key mitigation sectors, finance needs, and mitigation potential

Note: Historical finance flows (2018-2022) are expressed in nominal USD. Climate finance needs by 2030 and 2050 are expressed in constant 2022 USD. Historical finance flows include both mitigation-focused funding and dual-benefit investments (i.e., those supporting projects with combined mitigation and adaptation objectives).

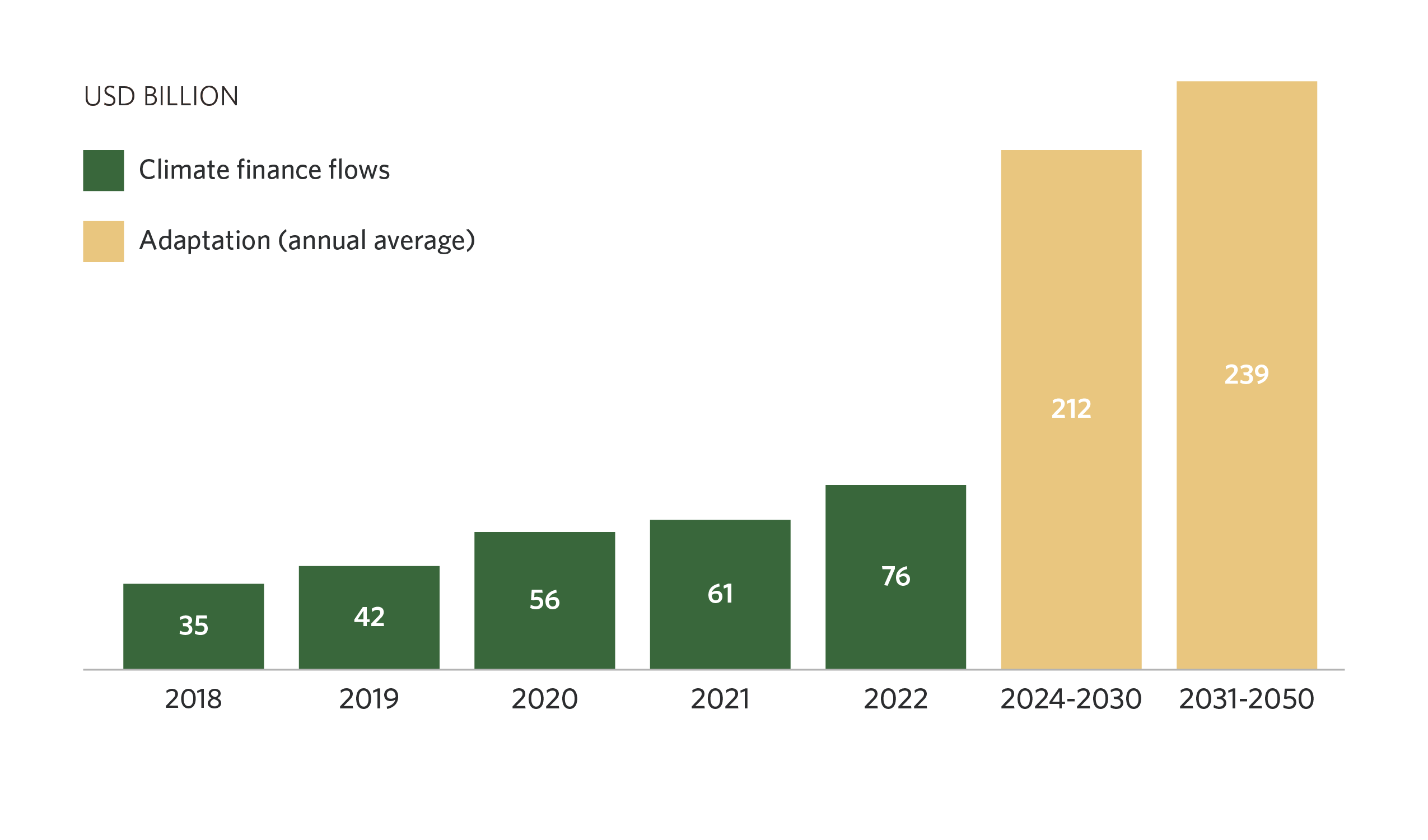

How much do we need to adapt to climate change and build resilient economies?

As the world is currently not on track to keep the average temperature rise within 1.5°C by 2030, losses and damages due to climate change impacts are likely to increase. In this context, adaptation finance will be essential to ensure climate-resilient development and address the growing costs of climate change, especially in emerging markets and developing economies (EMDEs).

In 2021/22, adaptation finance reached USD 69 billion, a 40% increase on 2019/20. Nevertheless, the global adaptation funding gap is widening: CPI analysis indicates that in EMDEs alone, annual adaptation finance will need to reach USD 212 billion by 2030, and USD 239 billion between 2031 and 2050.1

Existing estimates of global adaptation finance needs significantly understate the true scale of investment required to address climate change impacts and build resilient economies. This is because:

- Future adaptation costs are inherently difficult to quantify, as they depend on uncertain, localized, and evolving climate impacts.

- Current estimates focus on adaptation needs in EMDEs only.

- Adaptation needs also depend on mitigation action: each year that we fail to meet mitigation needs and deviate from a 1.5oC pathway, our future adaptation needs increase.

Our approach and how to interpret the data

CPI’s latest top-down needs estimates are compiled and standardized from 17 sources. Our approach is detailed in the methodology document.

Data sources used for CPI top-down needs estimations by sector

Due to data and methodology limitations, caution should be used when interpreting and using CPI’s top-down needs data.

DO…

Use CPI’s top-down needs estimates as a general guideline for the scale of investment required rather than as precise predictions. CPI’s investment needs estimates are derived by aggregating values from multiple sources and scenarios, each based on different—sometimes highly divergent— assumptions and models. As a result, CPI’s average estimates should not be seen as precise figures for achieving 1.5°C alignment but rather as a general indication of the scale of investment required. Presenting a range of values (minimum and maximum estimates) provides a more complete picture, capturing the variability across data sources and scenarios, as well as the uncertainty of future projections.

View needs estimates as investment opportunities in the global transition toward a 1.5°C development pathway rather than as costs. Climate investments not only generate returns for investors but also help develop and strengthen climate-friendly infrastructure, practices, and systems across multiple sectors. This drives long-term economic, health, and social benefits, which are expected to be greater than those under a business-as-usual (BAU) scenario.

DO NOT…

Do not consider investment needed under a 1.5°C pathway as additional to a BAU scenario. Closing the funding gap for 1.5°C alignment is not just about adding new investments—it also requires redirecting capital that would otherwise go toward high-carbon activities in a BAU scenario.

Do not assess progress toward net zero based solely on a single year’s improvement compared to a BAU scenario. Progress should be measured cumulatively over time. Even if investment levels eventually reach the required targets in the future, any shortfall in previous years represents a gap in alignment with the net zero pathway. These missed investments will need to be compensated for later to stay on track.

Do not view investment needs estimates in isolation, but rather as part of the wider context of measures needed to align to a 1.5°C pathway. Top-down (technology-based) models estimating the investment needed for a 1.5°C pathway often focus on capital expenditures (CAPEX) and may overlook key interventions necessary for achieving net zero alignment. For example, policy measures and behavioral changes—e.g., efforts to reduce energy intensity—are frequently underrepresented or entirely unaccounted for in technology-based models, often included as assumptions to build the models but not reflected in the final needs values.

Do not view investments in climate solutions alone as a guarantee that the net zero target will be met. Achieving net zero requires ensuring that these investments drive meaningful transformations. Climate investments will be effective only if (i) they enable physical targets to be reached and (ii) the climate solutions supported are replacing high-carbon activities (aiming for substitution and not addition).

What is needed to improve our global understanding of climate investment needs?

Institutions modeling future climate finance requirements have an important role to play in supporting evidence-based decision-making in this transition. By improving the coverage and granularity of their data, as well as transparency around their underlying methodologies and assumptions, they can ensure that timely and accurate needs estimates are available to decision makers. In particular, action is needed to:

Expand sectoral coverage

While some sectors, such as energy systems and AFOLU, are well covered by existing models, the needs estimates for others are partial or unavailable. More work is required to develop models for sectors, subsectors, and technologies/solutions that are not currently covered (e.g., waste and wastewater, and aviation), as well as improving granularity, where possible, providing data at the technology/solution level.

Develop country and regional models

While current global estimates provide a sense of overall investment requirements, more detailed regional and country-level data could clarify where needs are greatest, significantly improving evidence-based decision-making to close investment gaps. Such data can also help policymakers to set more precise climate goals and strategies (e.g., in each new round of NDCs), enabling them to better assess the investment needed to align with a net-zero pathway.

Develop alternative scenarios to net zero

Developing alternative models alongside 1.5°C scenarios is crucial for understanding the full range of possible futures and can help to inform more effective decision-making. BAU scenarios, in particular, can help quantify the gap between current trajectories and the pathways needed to meet the 1.5°C target, highlighting not just the scale of funding but also shifts in investment required.

Include long-term needs projections

It is essential for all top-down, technology-based models to incorporate long-term trajectories and climate investment requirements through 2050, with milestones for 2030 and 2040 to support shorter-term planning and climate target setting (e.g., in the NDCs).

Improve transparency around scenario assumptions and methodologies

Limited transparency around approaches to build different scenarios makes it difficult to compare needs estimates from different institutions. More clarity is needed around model inputs and assumptions used, exact sectoral scope and alignment with common taxonomies (e.g., the EU Taxonomy), and definitions of investment needs (e.g., whether they include only CAPEX or also financing costs).

1 The gap is based on the comparison between investment needs values presented here and the investment flows for 2022, inventoried by CPI in the Global Landscape of Climate Finance. However, the scope of solutions considered for flows and needs may differ. In particular, for the transport sector, the investments counted for 2022 flows cover climate solutions in aviation, rail and waterway that were not considered for needs due to lack of available estimates. Therefore, if we compared equivalent scopes (i.e., including investment needs for aviation, rail and waterways), we would observe a gap higher than USD 1.4 trillion.