Sustainable energy projects in India – including distributed renewable energy (small-scale and off-grid solutions), energy efficiency projects for buildings or in industries, projects for increasing energy access, and projects to encourage sustainable urbanization – are capital intensive, with high capital expenditures and low operating expenditures, and have long project lifetimes. Long-term financing is a key requirement to accelerate the sustainable energy market.

While equity capital has been more forthcoming, there’s been a lack of access to debt capital. There are several sustainable energy companies that are capitalized with equity and have proven that their model works. However, they are not able to raise debt at appropriate terms, which limits their ability to scale.

One main reason why long-term debt investment has been hampered is that the sustainable energy sector is in early stages, with a thin track record of projects. Further, since many sustainable energy projects are small-scale projects, the transaction costs associated with investments in small ticket size projects are higher, which also deters impact investment. Impact investors are in some cases willing to trade lower returns for measurable data on sustainable energy impact measures, and are a good potential source of initial investment to catalyze additional mainstream investors.

However, presently data on impact is being captured in several different ways, leading to differences in interpretation and an additional reporting burden for borrowers. Standardization of impact measures among sustainable energy projects can channel more impact capital, which can catalyze additional private investment.

Sustainable Energy Bonds aim to drive impact investment to sustainable energy in India by offering debt exposure, sufficient returns, and standardized impact measures.

Sustainable Energy Bonds (SEBs) are a class of debt instruments, being floated by cKers Finance, meant for impact investors who are looking for debt exposure in the sustainable energy sector in its initial stages. The SEBs have a defined use of proceeds – financing sustainable energy projects – as well as clear and standardized evidence and benchmarks for project impact assessment, which will serve as a track record in the subsequent stages of development of the sustainable energy market.

In the long run, SEBs will help establish a track record for mainstream debt investors to invest at a later stage, by channelling impact investments and raising the confidence of other classes of investors. Finally, SEBs also provide an aggregation model that can streamline investment into small-scale projects, which will lower transaction costs.

cKers Finance estimates that SEBs can mobilize USD 3 billion in the industrial segments of decentralized renewable energy and energy efficiency, and USD 1 billion in the energy access segment.

INSTRUMENT DESIGN

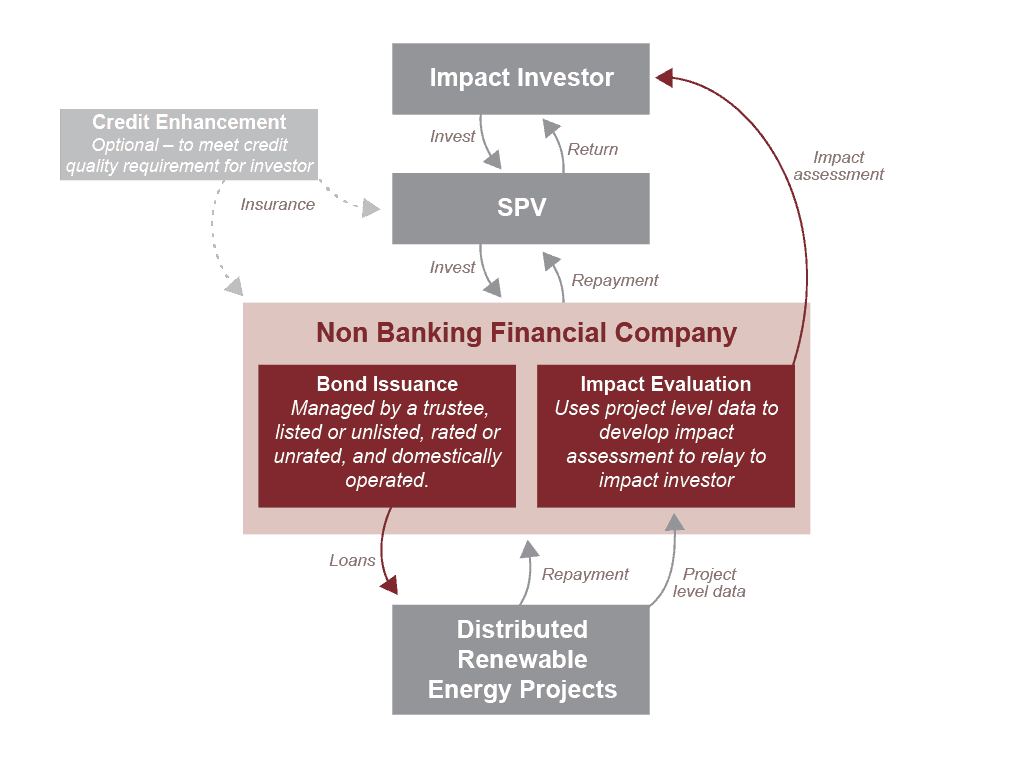

The proposed structure of SEBs consists of SPV, which acts as an investment vehicle/holding company registered in a Double Taxation Avoidance Agreement (DTAA) country to avoid double taxation issues. This SPV invests in a non-banking finance company (NBFC) registered in India, using the Foreign Portfolio Investment (FPI) route. The impact investor will invest in the SPV. The SPV will subscribe to the listed or unlisted SEB which is issued by the local NBFC. The NBFC will then either on lend to sustainable energy projects or will evaluate the existing portfolio and will go for an off-balance sheet funding. These projects will make the principal and interest (coupon) payments to the NBFC that are then passed on to the investor as agreed in the term sheet between the NBFC and the investor. Impact investors get returns though coupon payments on the NCD. The proceeds of the issuance and repayments are managed by a trustee. Impact reporting using pre-decided indictors is done by the NBFC to the investor at a mutually agreed frequency.

The proposed structure provides a tax efficient method of investment as any investment coming from outside India can have issues with double taxation. An SPV in a Double Taxation Avoidance Agreement (DTAA) country can help in countering this.

A key feature of the SEB structure is an impact assessment mechanism that standardizes impact measurement and reporting. The NBFC that issues the SEB does the impact reporting by using data obtained from sustainable investment projects, at predetermined intervals throughout the project lifetime. Some of the indicators used for impact measurement and reporting include: renewable energy capacity installed, increase in hours of electricity available, reductions in emissions and pollution, private investment catalyzed, number of beneficiaries to increased energy access, and number of new jobs created.